Attorney-Approved Employment Verification Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Employment Verification form is used to confirm an individual's employment status and details for various purposes, including loan applications and public assistance programs. |

| Governing Law | This form is governed by Ohio Revised Code Section 4141.29, which outlines the requirements for employment verification. |

| Required Information | Employers must provide specific details, including the employee's name, job title, dates of employment, and salary information. |

| Submission Method | The completed form can be submitted via mail, fax, or electronically, depending on the employer's preference. |

| Confidentiality | Employers are required to handle the information provided on the form confidentially, in compliance with privacy laws. |

| Employee Consent | Typically, the employee's consent is required before their employment information can be disclosed to third parties. |

| Validity Period | Employment verification forms do not have a specific expiration date but should be updated regularly to ensure accuracy. |

| Usage Scenarios | This form is often used in situations involving background checks, rental applications, and financial transactions. |

| Employer Responsibility | It is the employer's responsibility to ensure that the information provided is accurate and up-to-date. |

| State-Specific Variations | While Ohio has its own form, other states may have different requirements and forms for employment verification. |

Dos and Don'ts

When filling out the Ohio Employment Verification form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do provide accurate and complete information. Ensure that all fields are filled out correctly.

- Don't leave any sections blank. Incomplete forms may delay processing.

- Do double-check your spelling. Mistakes can lead to confusion or miscommunication.

- Don't use abbreviations or acronyms unless they are widely recognized. Clarity is key.

- Do sign and date the form where required. An unsigned form may be considered invalid.

- Don't submit the form without reviewing it. Take a moment to ensure everything is correct.

- Do keep a copy of the completed form for your records. This can be helpful in case of future inquiries.

Create Popular Employment Verification Forms for Different States

Employement Verification - Ensures that the applicant has the required work experience.

The process of transferring ownership of a trailer in New York can be straightforward, but it is important to use the correct documentation to avoid any potential issues. By utilizing the New York Trailer Bill of Sale form, both buyers and sellers can ensure that all necessary details are captured accurately. To streamline this process and ensure compliance with regulations, you can find all the required information for the form readily available online.

Verification of Employment/loss of Income - This document helps verify dates of employment and positions held by the employee.

Common mistakes

-

Not providing complete information. Ensure all fields are filled out accurately. Missing details can delay the verification process.

-

Using incorrect dates. Double-check employment start and end dates. Errors can lead to confusion or rejection of the form.

-

Failing to sign the form. A signature is required to validate the information provided. Without it, the form may be considered invalid.

-

Providing outdated contact information. Make sure to list current contact details for the employer or HR department.

-

Not including the correct employer name. Verify the legal name of the company to avoid any discrepancies.

-

Neglecting to check for typos. Simple spelling mistakes can create issues. Review the form carefully before submission.

-

Overlooking additional documentation. Sometimes, supporting documents may be required. Be sure to include anything requested.

-

Ignoring instructions. Read all guidelines thoroughly. Following the instructions can prevent common errors.

-

Not keeping a copy. Always retain a copy of the completed form for your records. This can be helpful for future reference.

-

Submitting the form late. Timeliness is crucial. Ensure you submit the form within the required timeframe to avoid complications.

Documents used along the form

When completing the Ohio Employment Verification form, you may need to gather additional documents to support the verification process. Here is a list of other forms and documents that are commonly used alongside the Employment Verification form.

- W-2 Form: This form reports an employee's annual wages and the amount of taxes withheld. It is often used to verify income for loan applications or other financial purposes.

- Pay Stubs: Recent pay stubs provide proof of current employment and income. They typically show hours worked, pay rates, and deductions.

- Employment Offer Letter: This letter confirms the terms of employment, including job title, salary, and start date. It can serve as proof of employment status.

- Deed in Lieu of Foreclosure: This legal option enables homeowners to voluntarily transfer their property to the lender, as a means to avoid foreclosure. For more details, refer to the Pre-foreclosure Property Transfer.

- Tax Returns: Personal tax returns can provide a comprehensive overview of an individual's income over the past year. They may be required for various verification purposes.

- Social Security Card: This card serves as proof of identity and eligibility to work in the United States. It may be requested during the verification process.

- Driver's License or State ID: A government-issued identification card helps verify a person's identity and is often requested in conjunction with employment verification.

- Background Check Consent Form: This form allows an employer to conduct a background check. It may be necessary for certain positions or industries.

Gathering these documents can help ensure a smooth verification process. Having everything ready can save time and reduce any potential delays.

Misconceptions

Understanding the Ohio Employment Verification form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Here are six common misconceptions:

-

It is mandatory for all employers to use the Ohio Employment Verification form.

This is not true. While many employers choose to use this form for consistency, it is not legally required. Employers can create their own verification methods as long as they comply with applicable laws.

-

The form can only be used for new hires.

Many believe that the Ohio Employment Verification form is exclusively for new employees. In reality, it can also be used for existing employees, especially when verifying employment for loans, leases, or other purposes.

-

Employees must provide personal information to their employers.

This misconception overlooks the fact that the form is primarily for the employer's use. Employees are not required to provide personal information beyond what is necessary for employment verification.

-

Employers are not liable for errors on the form.

This is misleading. Employers are responsible for ensuring that the information provided on the form is accurate. Errors can lead to legal issues, including potential claims of defamation or discrimination.

-

Only full-time employees can be verified using this form.

This is incorrect. The Ohio Employment Verification form can be used for part-time, temporary, and seasonal employees as well. Employment status does not limit the use of the form.

-

The form is only for specific industries.

This misconception suggests that only certain sectors need to use the form. In truth, any employer in Ohio can utilize the form, regardless of the industry.

By addressing these misconceptions, both employers and employees can better navigate the employment verification process in Ohio.

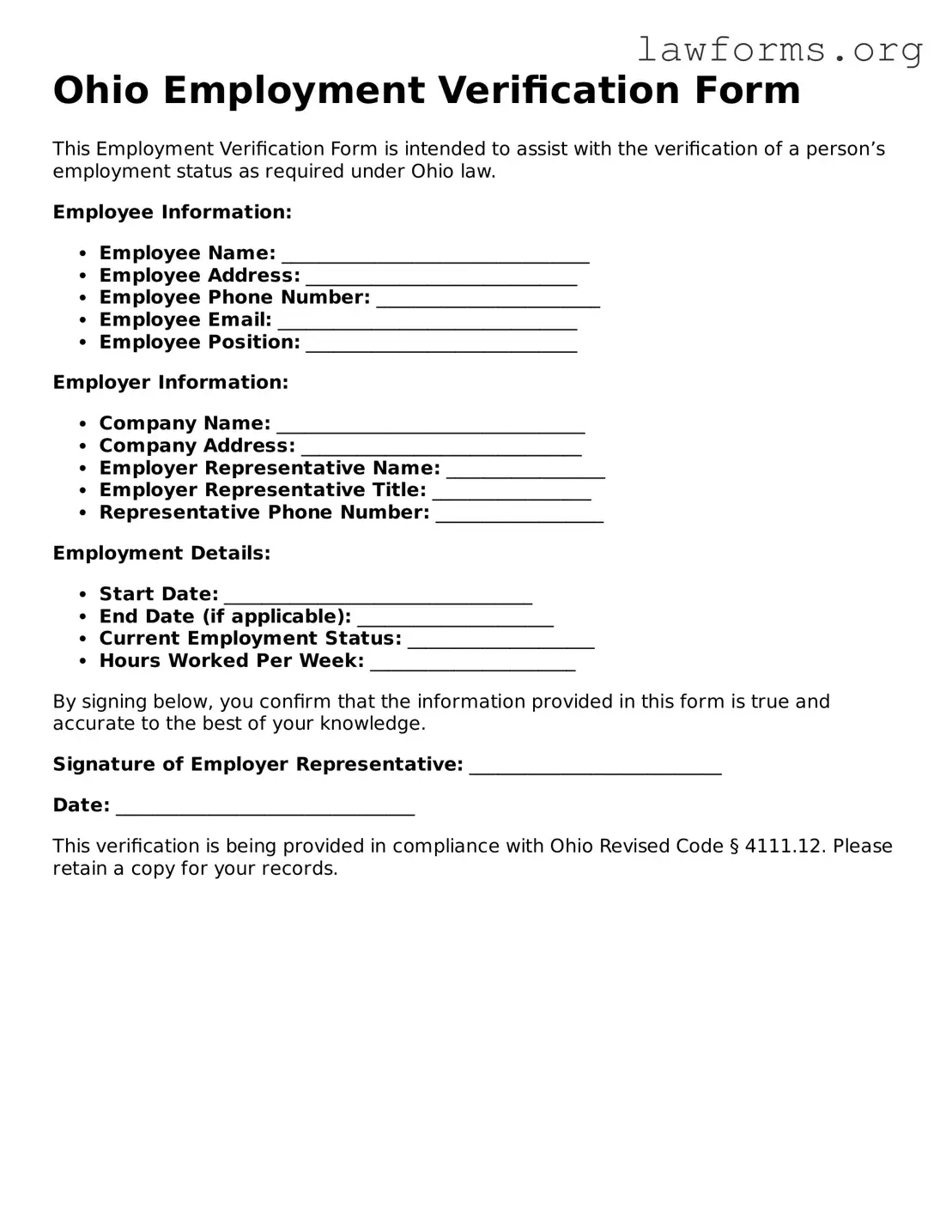

Preview - Ohio Employment Verification Form

Ohio Employment Verification Form

This Employment Verification Form is intended to assist with the verification of a person’s employment status as required under Ohio law.

Employee Information:

- Employee Name: _________________________________

- Employee Address: _____________________________

- Employee Phone Number: ________________________

- Employee Email: ________________________________

- Employee Position: _____________________________

Employer Information:

- Company Name: _________________________________

- Company Address: ______________________________

- Employer Representative Name: _________________

- Employer Representative Title: _________________

- Representative Phone Number: __________________

Employment Details:

- Start Date: _________________________________

- End Date (if applicable): _____________________

- Current Employment Status: ____________________

- Hours Worked Per Week: ______________________

By signing below, you confirm that the information provided in this form is true and accurate to the best of your knowledge.

Signature of Employer Representative: ___________________________

Date: ________________________________

This verification is being provided in compliance with Ohio Revised Code § 4111.12. Please retain a copy for your records.

Key takeaways

When filling out and using the Ohio Employment Verification form, it is essential to keep several key points in mind. Here are some important takeaways:

- Understand the Purpose: The form is used to verify an individual's employment status, which may be required for various reasons, including loan applications or public assistance.

- Accurate Information: Ensure that all information provided is accurate and up-to-date. Incorrect details can lead to delays or complications.

- Employer's Role: The employer must complete their section of the form, confirming the employee's job title, dates of employment, and salary information.

- Signature Requirement: A signature from an authorized representative of the employer is necessary to validate the form.

- Submission Process: After completion, the form should be submitted according to the specific instructions provided for its intended use.

- Keep Copies: It is advisable to keep a copy of the completed form for your records. This can be helpful in case of future inquiries.

- Privacy Considerations: Be mindful of the sensitive nature of the information shared. Ensure it is handled securely and shared only with authorized parties.

Similar forms

-

W-2 Form: The W-2 form is used by employers to report wages paid to employees and the taxes withheld from them. Similar to the Employment Verification form, it serves as proof of employment and income, providing essential information for loan applications or tax purposes.

-

Pay Stubs: Pay stubs detail the earnings of an employee over a specific period, including deductions and net pay. Like the Employment Verification form, they confirm employment status and income, often required for financial transactions such as renting an apartment or applying for credit.

- WC-1 Georgia Form: The WC-1 Georgia form is crucial for reporting workplace injuries in Georgia, facilitating claims for compensation. For further details on this essential document, visit georgiaform.com.

-

Offer Letter: An offer letter outlines the terms of employment, including job title, salary, and start date. This document, similar to the Employment Verification form, verifies an individual's employment status and can be used in various situations, such as verifying eligibility for benefits or loans.

-

Reference Letter: A reference letter, often provided by a previous employer or colleague, speaks to an individual's skills and character. While it focuses more on personal attributes, it still serves to verify employment history, much like the Employment Verification form, when applying for new positions or opportunities.