Attorney-Approved Last Will and Testament Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Ohio Last Will and Testament is governed by Ohio Revised Code Section 2107. |

| Requirements | For a will to be valid in Ohio, it must be in writing, signed by the testator, and witnessed by at least two individuals. |

| Holographic Wills | Ohio recognizes holographic wills, which are handwritten and do not require witnesses if the signature and material provisions are in the testator's handwriting. |

| Revocation | A will can be revoked in Ohio by a subsequent will, a written declaration, or by physically destroying the original document. |

| Executor Appointment | The testator can appoint an executor in the will, who will be responsible for administering the estate according to the will's terms. |

Dos and Don'ts

When preparing your Last Will and Testament in Ohio, it is important to approach the process with care and attention. Below are some guidelines to help ensure that your will is valid and reflects your intentions.

- Do: Clearly identify yourself and state that this document is your Last Will and Testament.

- Do: List your beneficiaries and specify what each person will receive.

- Do: Appoint an executor who will be responsible for carrying out your wishes.

- Do: Sign the document in the presence of two witnesses, who should also sign it.

- Do: Keep the original will in a safe place and inform your executor of its location.

- Don't: Use vague language that could lead to confusion about your intentions.

- Don't: Forget to date the will, as this establishes when it was created.

Following these guidelines can help ensure that your Last Will and Testament is clear, effective, and legally binding. It is wise to consult with a legal professional if you have any questions or concerns about the process.

Create Popular Last Will and Testament Forms for Different States

New Jersey Will Template - Can address specific bequests, detailing items given to named individuals.

Where to Make a Will - Complete your estate plan by including your Last Will and Testament.

Last Will and Testament Sample - Involves careful consideration of family dynamics and relationships.

The California Dog Bill of Sale form is not only essential for transferring ownership of a dog but also serves to clarify any potential ambiguities regarding the transaction. By providing detailed information about the dog, such as its breed, age, and health status, both sellers and buyers can ensure a smooth transition of ownership. For further guidance on this important document, you can visit californiadocsonline.com/dog-bill-of-sale-form/ to understand its significance in establishing accountability.

Simple Will Florida - Can include provisions for trusts to manage your assets over time.

Common mistakes

-

Not Clearly Identifying the Testator: It's crucial to clearly state who is creating the will. Omitting your full name or not including a statement that identifies you as the testator can lead to confusion and potential legal challenges.

-

Failing to Specify Beneficiaries: Leaving out the names of beneficiaries or being vague about who receives what can create disputes among heirs. Always list full names and, if possible, their relationship to you.

-

Overlooking Witness Requirements: In Ohio, a will must be signed in the presence of at least two witnesses. Forgetting to have witnesses present or not having them sign the document can invalidate the will.

-

Not Updating the Will: Life changes, such as marriage, divorce, or the birth of children, necessitate updates to your will. Failing to revise it can lead to unintended distributions of your assets.

-

Using Ambiguous Language: Clarity is key when drafting a will. Using vague terms or phrases can lead to misinterpretation. Be specific about your wishes to avoid confusion.

-

Neglecting to Sign and Date the Will: A will must be signed and dated by the testator to be valid. Forgetting this crucial step can render the document ineffective.

Documents used along the form

When preparing an estate plan, the Ohio Last Will and Testament form is just one piece of the puzzle. Several other documents can complement your will, ensuring your wishes are honored and your estate is managed effectively. Here’s a list of essential forms and documents to consider.

- Living Will: This document outlines your preferences for medical treatment in case you become incapacitated. It specifies what life-sustaining measures you do or do not want.

- Durable Power of Attorney: This form allows you to appoint someone to manage your financial affairs if you are unable to do so yourself. It remains effective even if you become incapacitated.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this document designates someone to make healthcare decisions on your behalf if you cannot communicate your wishes.

- Revocable Living Trust: This trust holds your assets during your lifetime and allows for easier transfer of those assets upon your death, avoiding probate.

- Beneficiary Designations: These forms specify who will receive assets from accounts like life insurance policies or retirement accounts, bypassing the will.

- Letter of Intent: While not legally binding, this document can provide guidance to your executor and family regarding your wishes for your estate and funeral arrangements.

- Pet Trust: This specialized trust ensures your pets are cared for according to your wishes after your passing.

- Funeral Planning Document: This form outlines your preferences for funeral arrangements, including burial or cremation, and any specific requests you may have.

- Employment Verification Form: This form is crucial for employers to confirm the employment status of their workers, ensuring accurate information is provided when needed. A helpful resource for this is Forms Washington.

- Estate Inventory: This document lists all your assets and debts, providing a clear picture of your estate for your executor and beneficiaries.

Reviewing these documents can help ensure that your estate plan is comprehensive and reflects your wishes. Consult with a legal professional to determine which documents are best suited for your situation.

Misconceptions

When it comes to creating a Last Will and Testament in Ohio, several misconceptions often arise. Understanding these can help ensure that your will accurately reflects your wishes and is legally valid.

- Myth 1: A handwritten will is not valid in Ohio.

- Myth 2: You need an attorney to create a will in Ohio.

- Myth 3: Once a will is created, it cannot be changed.

- Myth 4: All assets must be included in the will.

- Myth 5: A will takes effect immediately after it is signed.

- Myth 6: If you die without a will, your assets will automatically go to the state.

- Myth 7: Witnesses can be anyone, even beneficiaries.

This is not true. Ohio recognizes handwritten wills, also known as holographic wills, as valid if they are signed and dated by the testator. However, it is advisable to follow formal requirements for clarity and to avoid disputes.

While having an attorney can be helpful, it is not a legal requirement. Individuals can create their own will using templates or forms, as long as they comply with Ohio laws.

This is a common misunderstanding. Wills can be amended or revoked at any time, as long as the testator is of sound mind. This can be done through a codicil or by creating a new will.

Not all assets need to be listed in a will. For example, assets held in joint tenancy or those with designated beneficiaries, like life insurance policies, do not pass through a will.

A will does not take effect until the testator passes away. Until that time, the testator can alter or revoke the will as they see fit.

This is misleading. In Ohio, if someone dies without a will, their assets are distributed according to state intestacy laws, which typically favor relatives. However, the state may claim assets if no relatives can be found.

In Ohio, witnesses must be disinterested parties, meaning they should not stand to gain from the will. Having beneficiaries as witnesses can lead to complications or invalidate portions of the will.

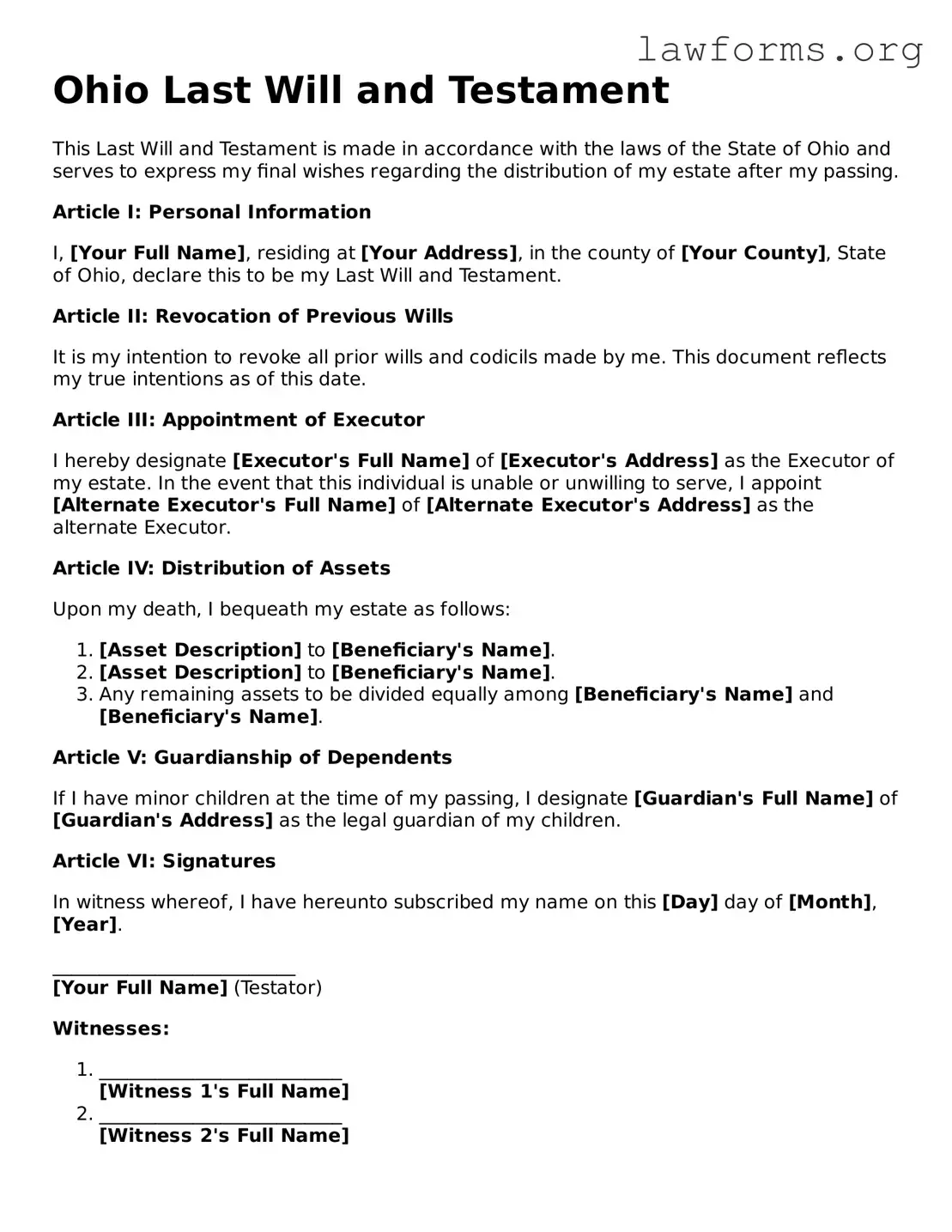

Preview - Ohio Last Will and Testament Form

Ohio Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of Ohio and serves to express my final wishes regarding the distribution of my estate after my passing.

Article I: Personal Information

I, [Your Full Name], residing at [Your Address], in the county of [Your County], State of Ohio, declare this to be my Last Will and Testament.

Article II: Revocation of Previous Wills

It is my intention to revoke all prior wills and codicils made by me. This document reflects my true intentions as of this date.

Article III: Appointment of Executor

I hereby designate [Executor's Full Name] of [Executor's Address] as the Executor of my estate. In the event that this individual is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] of [Alternate Executor's Address] as the alternate Executor.

Article IV: Distribution of Assets

Upon my death, I bequeath my estate as follows:

- [Asset Description] to [Beneficiary's Name].

- [Asset Description] to [Beneficiary's Name].

- Any remaining assets to be divided equally among [Beneficiary's Name] and [Beneficiary's Name].

Article V: Guardianship of Dependents

If I have minor children at the time of my passing, I designate [Guardian's Full Name] of [Guardian's Address] as the legal guardian of my children.

Article VI: Signatures

In witness whereof, I have hereunto subscribed my name on this [Day] day of [Month], [Year].

__________________________

[Your Full Name] (Testator)

Witnesses:

- __________________________

[Witness 1's Full Name] - __________________________

[Witness 2's Full Name]

We, the undersigned witnesses, hereby affirm that the above-named Testator signed this document in our presence on the date above written.

Key takeaways

When filling out and using the Ohio Last Will and Testament form, keep these key takeaways in mind:

- Ensure you are of legal age and mentally competent when creating your will.

- Clearly identify your beneficiaries and the specific assets you wish to leave them.

- Have your will signed in the presence of at least two witnesses, who should also sign the document.

- Store your will in a safe place and inform your loved ones where it can be found.

Similar forms

- Living Will: This document outlines a person's wishes regarding medical treatment in case they become unable to communicate. Like a Last Will, it reflects personal choices and preferences.

- Durable Power of Attorney: This allows someone to make financial or legal decisions on behalf of another person. Both documents grant authority to act, but a Durable Power of Attorney is effective while the person is alive.

- Trust: A trust holds assets for beneficiaries. It can specify how and when assets are distributed, similar to how a Last Will dictates the distribution of an estate.

- Health Care Proxy: This designates someone to make health care decisions if a person cannot do so. It shares the intent of ensuring that personal wishes are respected, like a Last Will.

- Illinois VSD 190 Form: Essential for residents and businesses, the Illinois VSD 190 form is necessary for requesting dealer and remitter forms from the Secretary of State’s office, ensuring compliance and prompt service. For more information and to access the form, visit https://formsillinois.com.

- Letter of Intent: This is a non-legally binding document that expresses wishes regarding the distribution of assets or care for dependents. It complements a Last Will by providing additional guidance.

- Beneficiary Designation: Commonly used for life insurance and retirement accounts, this document specifies who receives assets upon death. It works alongside a Last Will to ensure all assets are addressed.

- Codicil: A codicil is an amendment to an existing Last Will. It allows changes to be made without creating a new will, similar to how a Last Will can be updated to reflect new wishes.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It serves a similar purpose to a Last Will by clarifying who inherits property.

- Guardianship Designation: This document appoints someone to care for minor children if both parents pass away. It is similar to a Last Will in ensuring that personal wishes regarding dependents are followed.

- Estate Inventory: An estate inventory lists all assets and liabilities of a deceased person. While it does not dictate distribution, it supports the process initiated by a Last Will.