Attorney-Approved Operating Agreement Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Ohio. |

| Governing Law | This agreement is governed by the Ohio Revised Code, specifically Chapter 1705, which covers LLC regulations. |

| Flexibility | Members can customize the agreement to fit their specific needs, allowing for different management styles and profit-sharing arrangements. |

| Importance | Having an Operating Agreement is crucial for protecting members' interests and clarifying roles, even if it is not required by law. |

Dos and Don'ts

When filling out the Ohio Operating Agreement form, it's essential to approach the task with care. Here are some important dos and don’ts to keep in mind:

- Do read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do ensure all member names and addresses are correct. This information is crucial for legal recognition.

- Do specify the management structure clearly. Whether it’s member-managed or manager-managed, clarity is key.

- Do include provisions for profit distribution. This ensures that all members are on the same page regarding financial matters.

- Don’t leave any sections blank. Incomplete forms can lead to delays or complications in processing.

- Don’t use vague language. Be specific in your terms to avoid misunderstandings in the future.

By following these guidelines, you can help ensure that your Ohio Operating Agreement is filled out correctly and serves its intended purpose effectively.

Create Popular Operating Agreement Forms for Different States

Operating Agreement Llc Florida Template - It helps protect the personal assets of the members from business liabilities.

How Much to Start an Llc in Texas - This form provides a framework for decision-making processes.

Filing the Illinois Unclaimed Property Reporting form is vital for businesses wanting to stay compliant with state regulations regarding unclaimed assets. By submitting the UPD601 form, entities can efficiently report any properties that have remained unclaimed for a significant duration, including items such as forgotten bank accounts and unpaid wages. Neglecting this responsibility can lead to penalties, which is why it’s essential to get it right. For more information on the reporting process, you can visit https://formsillinois.com to access detailed guidance and resources.

New Jersey Operating Agreement - Members may attach additional schedules to address specific issues or provisions.

Is an Operating Agreement Required for an Llc - The document lays the groundwork for a sound business relationship among members.

Common mistakes

-

Not including all members: Some people forget to list all members of the LLC. Every member should be named to avoid confusion later.

-

Incorrect member information: Providing wrong details, such as names or addresses, can lead to issues. Double-check all information for accuracy.

-

Missing purpose of the LLC: Failing to state the business purpose can create ambiguity. Clearly outline what the LLC intends to do.

-

Vague management structure: Not specifying how the LLC will be managed can lead to disputes. Define whether it will be member-managed or manager-managed.

-

Ignoring profit distribution: Omitting details about how profits will be shared can cause disagreements. Clearly state how profits and losses will be allocated among members.

-

Not including voting rights: Failing to outline voting procedures can lead to confusion. Specify how decisions will be made and the voting power of each member.

-

Skipping the amendment process: Not including a process for making changes to the agreement can be problematic. Outline how amendments can be made in the future.

-

Neglecting to sign the agreement: Some forget to sign the document. All members must sign to validate the agreement.

-

Failing to date the agreement: Not dating the document can create confusion about when it was enacted. Always include the date of signing.

-

Not keeping a copy: Many people forget to keep a copy of the signed agreement. Always store a copy in a safe place for future reference.

Documents used along the form

When forming a limited liability company (LLC) in Ohio, the Operating Agreement is a crucial document. However, it is often accompanied by other important forms and documents that help establish and govern the LLC's operations. Below is a list of some commonly used documents alongside the Ohio Operating Agreement.

- Articles of Organization: This document is filed with the Ohio Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and the name of the registered agent.

- Member Consent Form: This form is used to document the agreement among members regarding the formation and operation of the LLC. It may outline decisions made prior to the formal establishment of the LLC.

- Employment Verification Form: This form is essential for employers in Washington to confirm the employment status of their workers. It provides vital information when needed, and you can find a useful template at Forms Washington.

- Bylaws: While not required for LLCs, bylaws can provide additional structure. They outline the internal rules and procedures governing the LLC, including how meetings are conducted and how decisions are made.

- Operating Procedures: This document details the specific operational processes of the LLC. It may cover topics such as financial management, member responsibilities, and dispute resolution procedures.

These documents work together to ensure that the LLC operates smoothly and in compliance with state regulations. Having a clear understanding of each document can help members navigate the complexities of running a business effectively.

Misconceptions

-

Misconception 1: The Ohio Operating Agreement is a one-size-fits-all document.

Many people believe that the Ohio Operating Agreement is a standard template that can be used without modification. In reality, this document should be tailored to fit the specific needs and goals of the business and its members. Each business is unique, and the agreement should reflect that individuality.

-

Misconception 2: An Operating Agreement is only necessary for large businesses.

Some individuals think that only larger companies need an Operating Agreement. However, even small businesses and startups benefit from having this document. It helps clarify roles, responsibilities, and procedures, which can prevent misunderstandings and disputes down the line.

-

Misconception 3: The Operating Agreement is not legally binding.

There is a common belief that an Operating Agreement lacks legal weight. This is incorrect. In Ohio, once signed, this agreement is a legally binding contract among the members. It outlines the rules and guidelines for the business, and courts will enforce its terms if disputes arise.

-

Misconception 4: You don’t need an Operating Agreement if you have a written partnership agreement.

Some may think that a partnership agreement is sufficient and that an Operating Agreement is unnecessary. While both documents serve important functions, they are not interchangeable. An Operating Agreement specifically addresses the operations of an LLC, while a partnership agreement pertains to partnerships. Having both can provide comprehensive coverage for your business structure.

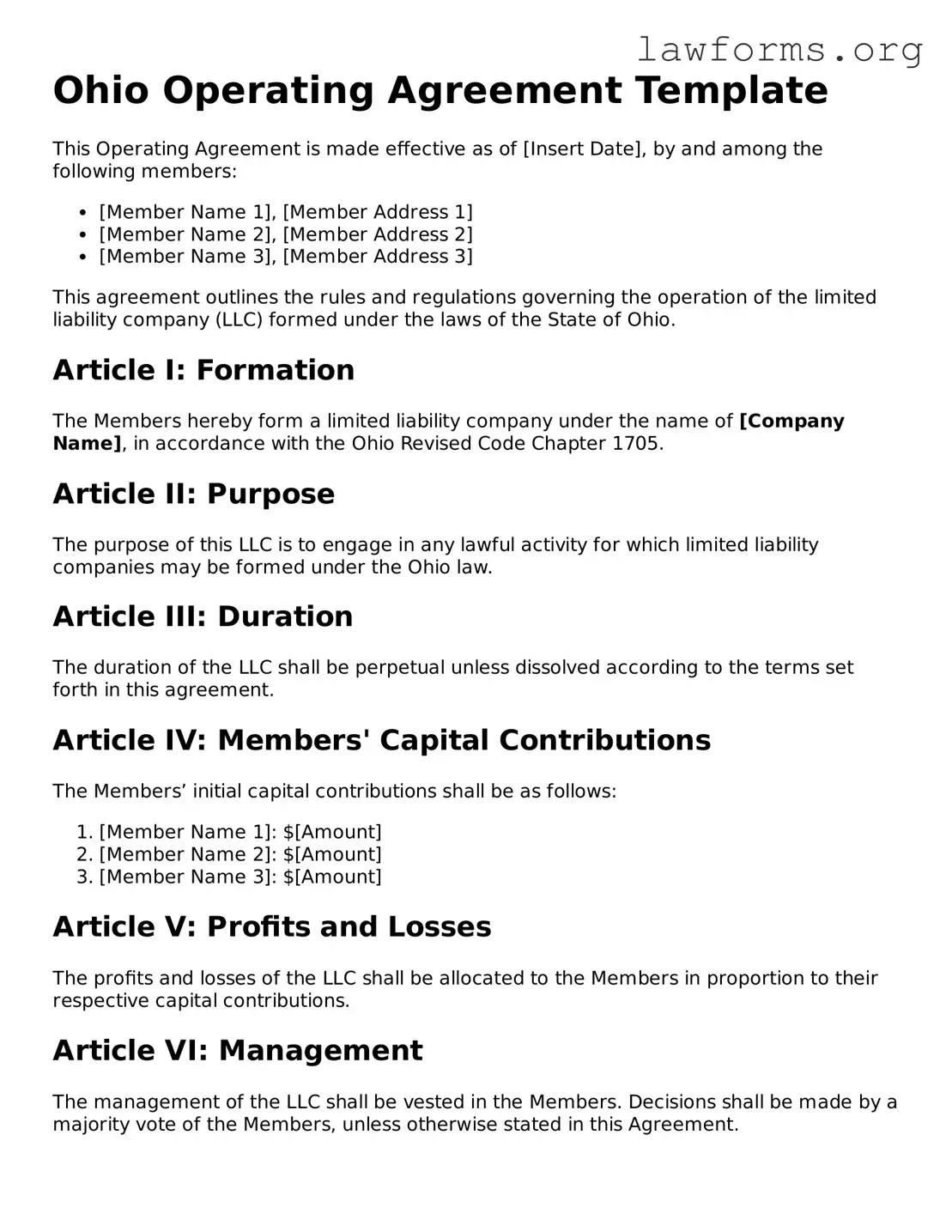

Preview - Ohio Operating Agreement Form

Ohio Operating Agreement Template

This Operating Agreement is made effective as of [Insert Date], by and among the following members:

- [Member Name 1], [Member Address 1]

- [Member Name 2], [Member Address 2]

- [Member Name 3], [Member Address 3]

This agreement outlines the rules and regulations governing the operation of the limited liability company (LLC) formed under the laws of the State of Ohio.

Article I: Formation

The Members hereby form a limited liability company under the name of [Company Name], in accordance with the Ohio Revised Code Chapter 1705.

Article II: Purpose

The purpose of this LLC is to engage in any lawful activity for which limited liability companies may be formed under the Ohio law.

Article III: Duration

The duration of the LLC shall be perpetual unless dissolved according to the terms set forth in this agreement.

Article IV: Members' Capital Contributions

The Members’ initial capital contributions shall be as follows:

- [Member Name 1]: $[Amount]

- [Member Name 2]: $[Amount]

- [Member Name 3]: $[Amount]

Article V: Profits and Losses

The profits and losses of the LLC shall be allocated to the Members in proportion to their respective capital contributions.

Article VI: Management

The management of the LLC shall be vested in the Members. Decisions shall be made by a majority vote of the Members, unless otherwise stated in this Agreement.

Article VII: Indemnification

The LLC shall indemnify its Members against any loss or damage incurred in connection with the LLC, except in cases of willful misconduct or gross negligence.

Article VIII: Amendments

This Operating Agreement may be amended only with the consent of all Members, provided that such consent is evidenced in writing.

Article IX: Miscellaneous

In the event of any dispute arising from this agreement, the Members agree to resolve the matter through mediation before seeking legal remedies.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first written above.

[Member Name 1] ___________________________

[Member Name 2] ___________________________

[Member Name 3] ___________________________

Key takeaways

When filling out and utilizing the Ohio Operating Agreement form, there are several important considerations to keep in mind. Below are key takeaways that can guide you through the process.

- Understand the purpose of the Operating Agreement. It outlines the management structure and operational procedures of your LLC.

- Gather necessary information about all members of the LLC before starting the form. This includes names, addresses, and ownership percentages.

- Clearly define the roles and responsibilities of each member. This helps prevent conflicts and ensures smooth operations.

- Include provisions for adding new members or handling the departure of existing members. This prepares your LLC for future changes.

- Address how profits and losses will be distributed among members. This is crucial for financial transparency.

- Establish procedures for decision-making. Specify whether decisions require a majority vote or unanimous consent.

- Incorporate a dispute resolution mechanism. This can save time and resources if disagreements arise among members.

- Consider including a buy-sell agreement. This outlines how ownership interests can be transferred or sold.

- Review the document regularly. As your business evolves, your Operating Agreement may need updates to reflect new circumstances.

- Consult with legal professionals if needed. They can provide guidance tailored to your specific situation and ensure compliance with state laws.

By keeping these points in mind, you can effectively fill out and implement the Ohio Operating Agreement form, ensuring that your LLC operates smoothly and efficiently.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for managing a corporation. They define the roles of directors and officers, meetings, and voting procedures.

- Partnership Agreement: This document governs the relationships and responsibilities among partners in a partnership. It addresses profit sharing, decision-making, and dispute resolution, much like an Operating Agreement does for LLC members.

- Shareholder Agreement: This agreement is used by corporations to manage the relationship between shareholders. It includes provisions on share transfers, voting rights, and management structure, paralleling the governance aspects found in an Operating Agreement.

- Joint Venture Agreement: This document outlines the terms of a partnership between two or more parties for a specific project. It specifies contributions, profit-sharing, and management roles, similar to the collaborative framework of an Operating Agreement.

- Franchise Agreement: This agreement governs the relationship between a franchisor and a franchisee. It includes operational guidelines and responsibilities, akin to how an Operating Agreement outlines member duties in an LLC.

- Employment Agreement: While primarily focused on the employer-employee relationship, it can include terms on confidentiality and non-compete clauses, reflecting the protective measures often found in Operating Agreements.

- Real Estate Partnership Agreement: This document is tailored for partnerships involved in real estate ventures. It details ownership shares, responsibilities, and profit distribution, similar to the member roles defined in an Operating Agreement.

- Horse Bill of Sale Form: For those wishing to document horse ownership transfers, utilize the essential Horse Bill of Sale documentation resources for clear and legal transactions.

- Confidentiality Agreement (NDA): While focused on protecting sensitive information, it can also define how parties will collaborate, similar to the operational guidelines set forth in an Operating Agreement.

- Buy-Sell Agreement: This agreement is crucial for business continuity. It outlines how ownership interests can be bought or sold among partners, resembling the transfer provisions in an Operating Agreement.

- Membership Certificate: This document serves as proof of membership in an LLC. While it does not govern operations, it complements the Operating Agreement by establishing ownership and rights within the entity.