Attorney-Approved Power of Attorney Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in Ohio is a legal document that allows one person to act on behalf of another in financial or health matters. |

| Types | Ohio recognizes several types of POAs, including durable, springing, and limited powers of attorney. |

| Durable Power of Attorney | This type remains effective even if the principal becomes incapacitated, ensuring continuous management of affairs. |

| Springing Power of Attorney | A springing POA only becomes effective under specific conditions, such as the principal's incapacitation. |

| Governing Law | Ohio's Power of Attorney laws are primarily governed by the Ohio Revised Code, specifically sections 1337.01 to 1337.64. |

| Execution Requirements | For a POA to be valid in Ohio, it must be signed by the principal and acknowledged before a notary public. |

| Revocation | The principal can revoke a Power of Attorney at any time, as long as they are mentally competent to do so. |

Dos and Don'ts

When filling out the Ohio Power of Attorney form, it is essential to approach the process with care. Here are some key do's and don'ts to consider:

- Do ensure that you understand the powers you are granting.

- Do choose a trustworthy agent who will act in your best interest.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the signed document for your records.

- Don't leave any blank spaces on the form; this can lead to confusion.

- Don't rush the process; take your time to review the document thoroughly.

- Don't forget to discuss your decisions with your agent before finalizing the form.

Create Popular Power of Attorney Forms for Different States

Printable Power of Attorney Form Texas - Legal advice can be beneficial in creating a Power of Attorney to ensure it meets all requirements.

Having a Durable Power of Attorney is crucial for making sure that your preferences are upheld when you can no longer speak for yourself. This legal tool empowers a chosen representative to handle important decisions regarding your health and finances. To streamline the process, you can utilize resources like Forms Washington, which provide templates and guidance to help you create a thorough document that reflects your intentions.

How to Get Power of Attorney in North Carolina - A legal document allowing one person to make decisions for another.

Common mistakes

-

Not specifying the powers granted. It’s crucial to clearly outline what decisions the agent can make on behalf of the principal.

-

Failing to date the document. A lack of a date can lead to confusion regarding the validity of the Power of Attorney.

-

Not signing in the correct places. Both the principal and the agent must sign the form in designated areas to ensure its legality.

-

Neglecting to have the document notarized. In Ohio, notarization is often necessary to validate the Power of Attorney.

-

Overlooking witness requirements. Depending on the type of Power of Attorney, witnesses may be required for the document to be valid.

-

Using outdated forms. Laws change, and using an old version of the form may result in legal complications.

-

Failing to communicate with the agent. It’s important to discuss the responsibilities and expectations with the chosen agent.

-

Not keeping copies. Retaining copies of the signed document is essential for both the principal and the agent.

-

Ignoring state-specific requirements. Each state has its own rules regarding Power of Attorney forms, and Ohio is no exception.

-

Assuming the Power of Attorney is permanent. It’s important to understand that a Power of Attorney can be revoked or modified at any time by the principal.

Documents used along the form

When creating a Power of Attorney in Ohio, several other forms and documents may be relevant to ensure comprehensive legal coverage. Understanding these documents can help individuals make informed decisions regarding their financial and healthcare matters.

- Living Will: This document outlines an individual's preferences for medical treatment in situations where they are unable to communicate their wishes. It is crucial for end-of-life care decisions.

- Healthcare Power of Attorney: Similar to a standard Power of Attorney, this document specifically designates someone to make healthcare decisions on behalf of an individual if they are incapacitated.

- Durable Power of Attorney: This form remains effective even if the principal becomes incapacitated. It allows the agent to manage financial affairs without interruption.

- Financial Power of Attorney: This document grants authority to an agent to handle financial matters, including banking, real estate transactions, and tax filings.

- Advance Directive: This is a broader term that includes both a Living Will and a Healthcare Power of Attorney. It provides guidance on medical decisions and appoints a decision-maker.

- Will: A legal document that outlines how an individual’s assets should be distributed after their death. It can also name guardians for minor children.

- Trust: A legal arrangement that allows an individual to transfer assets to a trustee, who manages them for the benefit of beneficiaries. It can help avoid probate.

- Firearm Bill of Sale Form: When transferring firearm ownership, utilize the essential firearm bill of sale documentation to ensure compliance with Texas laws.

- HIPAA Authorization: This form allows designated individuals to access a person's medical records and information, ensuring that healthcare providers can share necessary details with the right people.

Incorporating these documents alongside the Power of Attorney can enhance legal protection and ensure that personal wishes are respected. It is advisable to consult with a legal professional to tailor these documents to individual needs and circumstances.

Misconceptions

Understanding the Ohio Power of Attorney form is crucial for anyone considering its use. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- It only applies to financial matters. Many believe that a Power of Attorney is limited to financial decisions. In reality, it can also cover healthcare and other personal matters, depending on how it is drafted.

- It becomes effective only when the principal is incapacitated. Some think a Power of Attorney only kicks in when the principal can no longer make decisions. However, it can be set up to take effect immediately upon signing, unless specified otherwise.

- It automatically expires after a certain period. There is a misconception that all Powers of Attorney have a built-in expiration date. In fact, they remain valid until revoked by the principal or until the principal passes away, unless otherwise stated.

- Any adult can be a Power of Attorney. While it is true that most adults can serve as an agent, some individuals may not be suitable due to conflicts of interest, such as being a beneficiary in the principal's will.

- It can be used to make decisions about my estate after I die. A Power of Attorney ceases to be effective upon the principal's death. After that point, estate planning documents, like wills, take precedence.

- It must be notarized to be valid. While notarization is recommended for a Power of Attorney in Ohio, it is not always required. Some situations may allow for a simple signature without a notary.

- Once signed, I cannot change it. Many believe that a Power of Attorney is set in stone once executed. In fact, the principal has the right to revoke or modify the document at any time, as long as they are competent.

- It gives the agent unlimited power. This is a common fear, but a Power of Attorney can be tailored to limit the agent's authority. The principal can specify what powers are granted and what decisions the agent can make.

Being informed about these misconceptions can help individuals make better decisions regarding their Power of Attorney needs in Ohio.

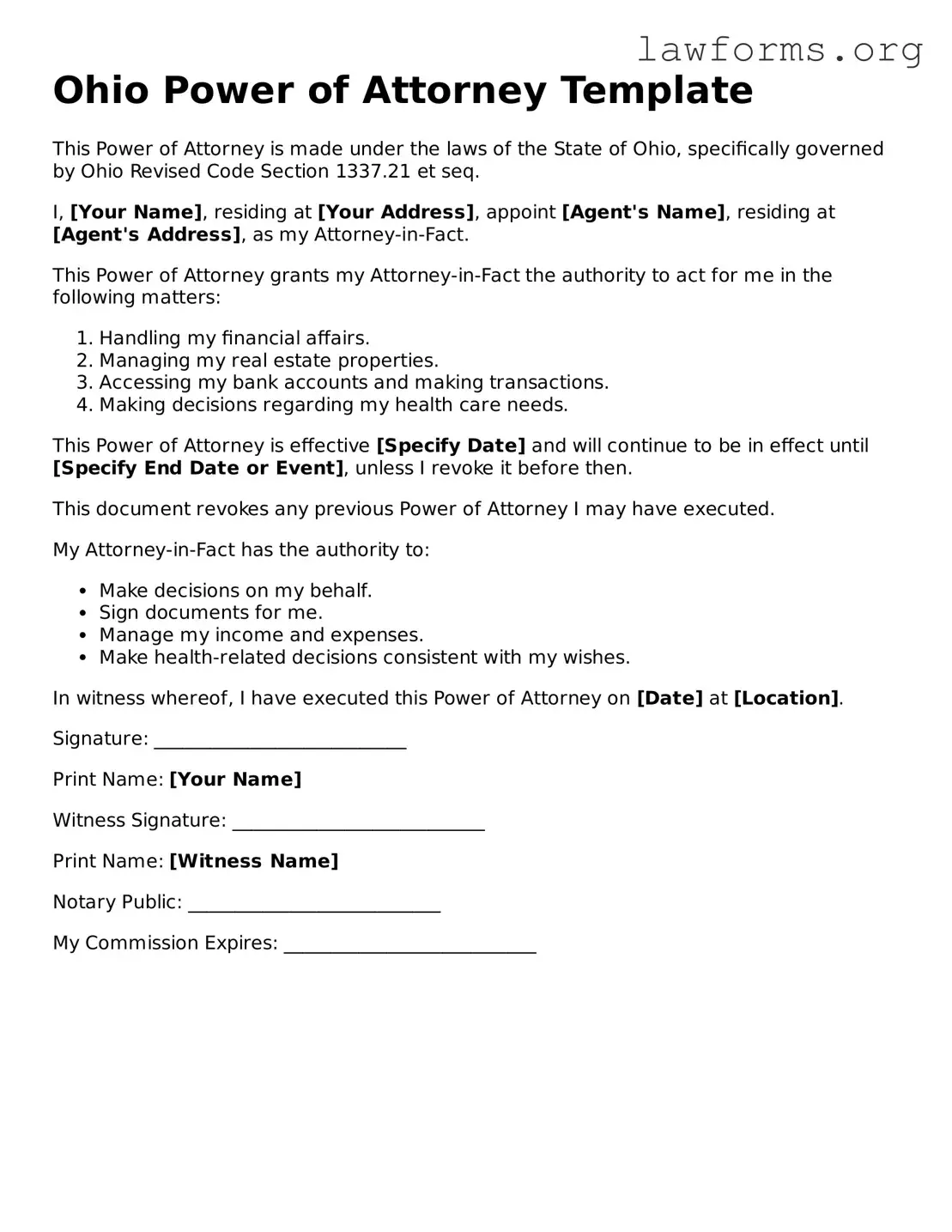

Preview - Ohio Power of Attorney Form

Ohio Power of Attorney Template

This Power of Attorney is made under the laws of the State of Ohio, specifically governed by Ohio Revised Code Section 1337.21 et seq.

I, [Your Name], residing at [Your Address], appoint [Agent's Name], residing at [Agent's Address], as my Attorney-in-Fact.

This Power of Attorney grants my Attorney-in-Fact the authority to act for me in the following matters:

- Handling my financial affairs.

- Managing my real estate properties.

- Accessing my bank accounts and making transactions.

- Making decisions regarding my health care needs.

This Power of Attorney is effective [Specify Date] and will continue to be in effect until [Specify End Date or Event], unless I revoke it before then.

This document revokes any previous Power of Attorney I may have executed.

My Attorney-in-Fact has the authority to:

- Make decisions on my behalf.

- Sign documents for me.

- Manage my income and expenses.

- Make health-related decisions consistent with my wishes.

In witness whereof, I have executed this Power of Attorney on [Date] at [Location].

Signature: ___________________________

Print Name: [Your Name]

Witness Signature: ___________________________

Print Name: [Witness Name]

Notary Public: ___________________________

My Commission Expires: ___________________________

Key takeaways

When filling out and using the Ohio Power of Attorney form, consider the following key takeaways:

- Understand the Purpose: A Power of Attorney allows you to designate someone to make decisions on your behalf.

- Choose Your Agent Wisely: Select a trustworthy person who understands your wishes and can act in your best interest.

- Specify Powers Clearly: Clearly outline the powers you are granting. This can include financial, medical, or legal decisions.

- Consider Limitations: You can limit the powers granted to your agent, specifying what they can and cannot do.

- Sign in Front of a Notary: The form must be signed in front of a notary public to be legally valid.

- Keep Copies: After completing the form, make copies for your agent and any relevant institutions.

- Review Regularly: Periodically review your Power of Attorney to ensure it still reflects your wishes and circumstances.

- Revocation is Possible: You can revoke the Power of Attorney at any time, as long as you are mentally competent.

- Understand State Laws: Familiarize yourself with Ohio laws regarding Powers of Attorney to ensure compliance.

Similar forms

The Power of Attorney (POA) form allows one person to act on behalf of another in legal or financial matters. Several other documents serve similar purposes. Here’s a list of seven documents that share characteristics with a Power of Attorney:

- Living Will: This document outlines a person's wishes regarding medical treatment in case they become unable to communicate. Like a POA, it grants authority to make decisions, but it focuses specifically on healthcare.

- Healthcare Proxy: Similar to a POA, a healthcare proxy designates someone to make medical decisions on behalf of another person. It is specifically for health-related matters.

- Durable Power of Attorney: This is a specific type of POA that remains effective even if the principal becomes incapacitated. It ensures that decisions can still be made when the individual can no longer make them.

- Financial Power of Attorney: This document allows someone to manage financial affairs on behalf of another. It is a more focused version of a general POA, specifically targeting financial matters.

- Trust Document: A trust allows a person to transfer assets to a trustee who manages them for the benefit of another. While it involves asset management, it operates differently than a POA but can include similar delegation of authority.

- Will: A will outlines how a person’s assets should be distributed after their death. Although it does not grant authority during a person’s lifetime, it does reflect the individual’s wishes regarding their estate.

- Dog Bill of Sale: This form is essential for the transfer of dog ownership, ensuring both parties have a clear record of the transaction, including details about the dog's breed and health. For more information, visit californiadocsonline.com/dog-bill-of-sale-form/.

- Assignment of Benefits: This document allows a person to assign their benefits or insurance claims to another party. It shares the delegation aspect of a POA but is usually limited to specific benefits.