Attorney-Approved Promissory Note Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specific amount of money to a designated party at a specified time or on demand. |

| Governing Law | The Ohio Promissory Note is governed by the Ohio Revised Code, specifically Section 1303.01 through 1303.77. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be specified in the note. If not, Ohio law allows for a default rate of 8% per annum. |

| Payment Terms | Payment terms must be clear, including the amount due, due date, and any installment arrangements. |

| Enforceability | For the note to be enforceable, it must be signed by the maker and include essential terms such as the amount and payment schedule. |

| Default Consequences | If the borrower defaults, the lender may pursue legal action to recover the owed amount, including potential interest and fees. |

Dos and Don'ts

When filling out the Ohio Promissory Note form, it’s important to follow certain guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate information about the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable, and make sure it complies with Ohio laws.

- Don’t leave any required fields blank; incomplete forms may lead to issues.

- Don’t use white-out or erasers; if you make a mistake, cross it out neatly and initial it.

- Don’t forget to sign and date the form; both parties should do this for it to be valid.

Create Popular Promissory Note Forms for Different States

Promissory Note New York - Borrowers should fully comprehend their obligations before signing to avoid potential misunderstandings.

California Promissory Note Requirements - The form captures essential details such as the purpose of the loan, if applicable.

A prenuptial agreement form in Ohio is a legal document that couples complete before marriage to outline the division of assets and responsibilities in the event of divorce or separation. This agreement helps protect individual interests and provides clarity on financial matters. Understanding the importance of this form, such as obtaining the necessary documentation through Ohio PDF Forms, can lead to a more secure and transparent relationship.

Promissory Note Notarized - It is important to read all terms carefully before signing a promissory note.

Loan Note Template - Understanding each term and condition in the note is critical for both parties involved.

Common mistakes

-

Not including all parties' names: It is crucial to list the names of both the borrower and the lender accurately. Omitting any party can lead to confusion or disputes later on.

-

Incorrect loan amount: Double-check the loan amount written in the form. A mistake here can affect repayment terms and create complications.

-

Missing date: The date of the agreement must be clearly stated. Without it, the validity of the note may be questioned.

-

Failure to specify repayment terms: Clearly outline how and when payments will be made. This includes the frequency of payments and the total repayment period.

-

Not including interest rate: If the loan involves interest, the rate should be specified. Leaving this out can lead to misunderstandings about the total amount due.

-

Neglecting to sign: Both parties must sign the note for it to be legally binding. A missing signature can invalidate the agreement.

Documents used along the form

When engaging in a loan agreement in Ohio, a Promissory Note is often accompanied by various other forms and documents. Each of these documents serves a specific purpose in ensuring clarity and legal protection for both parties involved. Below is a list of commonly used documents alongside the Ohio Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged as security. It details the rights of the lender in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for the debt if the borrowing entity defaults.

- Disclosure Statement: This statement provides essential information about the loan, including fees, terms, and conditions. It ensures transparency and helps the borrower make informed decisions.

- Payment Schedule: A separate document that outlines the timeline for payments, including due dates and amounts. This schedule helps both parties track repayment obligations.

- Amendment Agreement: If any terms of the original loan change, an amendment agreement documents those changes. This ensures that both parties are aware of and agree to the new terms.

- Default Notice: In the event of missed payments, this notice is sent to the borrower. It formally alerts them of the default and outlines the steps that may follow.

- Protection Order Documentation: For individuals in domestic violence situations, it is crucial to consider additional legal paperwork, such as the californiadocsonline.com/california-dv-260-form, to ensure their safety and legal protection through appropriate court measures.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations. It provides proof that the debt has been settled.

- Notarized Affidavit: In some cases, a notarized affidavit may be used to confirm the authenticity of the documents and the identities of the parties involved.

Each of these documents plays a crucial role in the lending process. They help establish clear expectations and protect the interests of both lenders and borrowers. Ensuring that all necessary paperwork is completed accurately can prevent misunderstandings and legal disputes in the future.

Misconceptions

- Misconception 1: A promissory note must be notarized to be valid.

- Misconception 2: Promissory notes are only for loans between individuals.

- Misconception 3: A promissory note does not need to specify repayment terms.

- Misconception 4: Once signed, a promissory note cannot be changed.

- Misconception 5: Promissory notes do not require a witness.

- Misconception 6: All promissory notes are the same.

While notarization can add a layer of authenticity, it is not a legal requirement for a promissory note to be enforceable in Ohio. As long as the document is signed by the borrower and clearly outlines the terms, it can be valid without a notary's seal.

Many people believe that promissory notes are limited to personal loans. However, they are commonly used in business transactions as well, including loans from banks or other financial institutions to businesses.

Some assume that a promissory note can be vague about repayment. In reality, clear terms regarding the amount, interest rate, and repayment schedule are essential for the note to be enforceable.

People often think that a promissory note is set in stone once signed. In fact, the terms can be modified if both parties agree to the changes, and it is advisable to document any amendments in writing.

While a witness is not legally required for a promissory note in Ohio, having one can provide additional protection. A witness can help verify the authenticity of the signatures if disputes arise later.

Many believe that all promissory notes follow a standard format. In reality, the terms and conditions can vary widely based on the agreement between the parties involved. Customization is often necessary to meet specific needs.

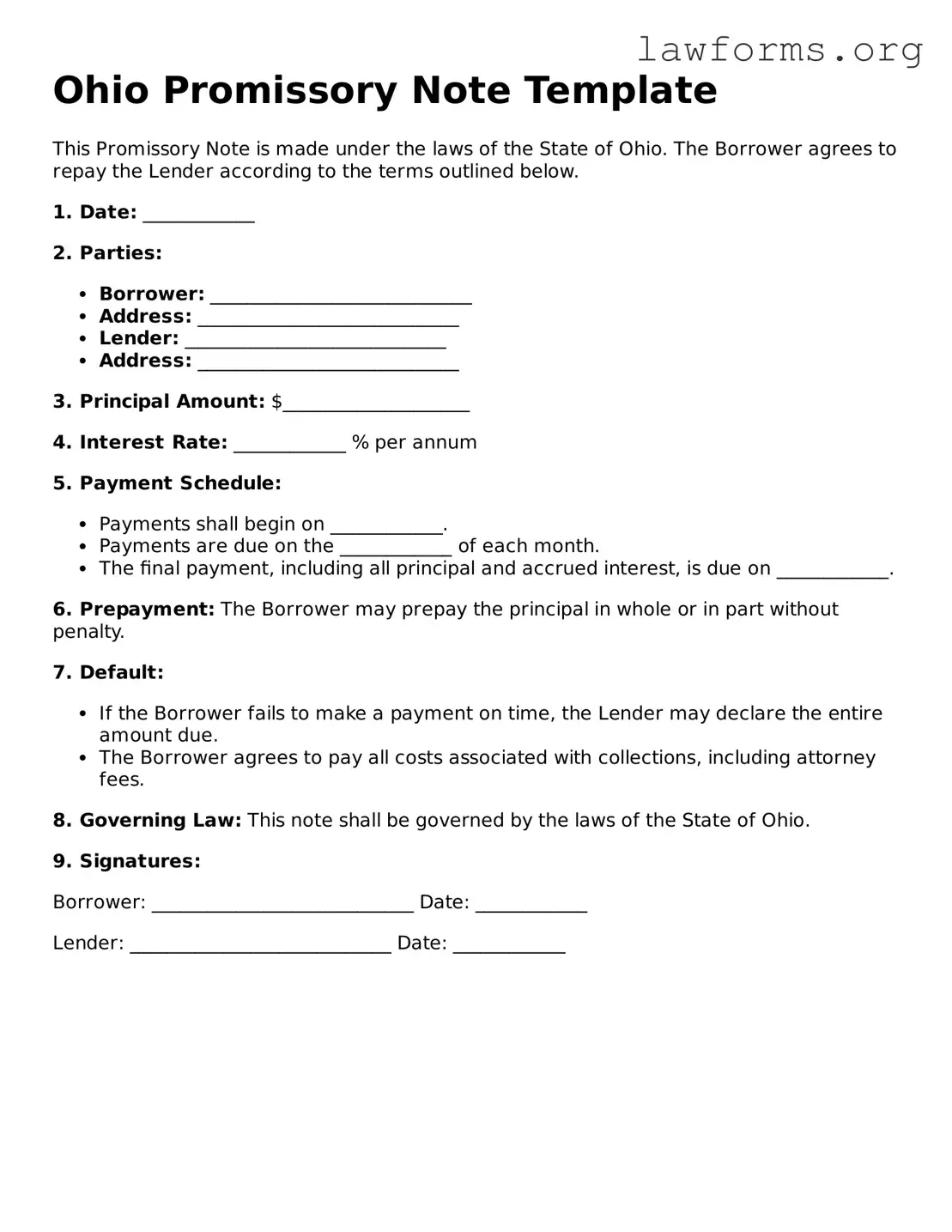

Preview - Ohio Promissory Note Form

Ohio Promissory Note Template

This Promissory Note is made under the laws of the State of Ohio. The Borrower agrees to repay the Lender according to the terms outlined below.

1. Date: ____________

2. Parties:

- Borrower: ____________________________

- Address: ____________________________

- Lender: ____________________________

- Address: ____________________________

3. Principal Amount: $____________________

4. Interest Rate: ____________ % per annum

5. Payment Schedule:

- Payments shall begin on ____________.

- Payments are due on the ____________ of each month.

- The final payment, including all principal and accrued interest, is due on ____________.

6. Prepayment: The Borrower may prepay the principal in whole or in part without penalty.

7. Default:

- If the Borrower fails to make a payment on time, the Lender may declare the entire amount due.

- The Borrower agrees to pay all costs associated with collections, including attorney fees.

8. Governing Law: This note shall be governed by the laws of the State of Ohio.

9. Signatures:

Borrower: ____________________________ Date: ____________

Lender: ____________________________ Date: ____________

Key takeaways

When filling out and using the Ohio Promissory Note form, there are several important considerations to keep in mind. Here are key takeaways that can help ensure proper usage:

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan under specified terms.

- Include Essential Information: The note should clearly state the names of the borrower and lender, the amount borrowed, interest rate, and repayment schedule.

- Specify the Terms: Clearly define the repayment terms, including due dates, late fees, and any penalties for missed payments.

- Signatures Matter: Both parties must sign the document to make it legally binding. Ensure that signatures are dated and witnessed if required.

- Keep Copies: After completing the form, both the borrower and lender should retain copies for their records to avoid future disputes.

- Consult a Professional: If there are uncertainties about the terms or legal implications, consider seeking advice from a legal professional.

Similar forms

A Promissory Note is a financial instrument that outlines a promise to pay a specified amount of money at a particular time. While it stands out in its own right, it shares similarities with several other documents. Below are eight documents that exhibit characteristics akin to a Promissory Note:

- Loan Agreement: Like a Promissory Note, a loan agreement details the terms of borrowing money, including the amount, interest rate, and repayment schedule. However, it often includes additional clauses regarding the rights and responsibilities of both parties.

- Mortgage: A mortgage is a specific type of loan agreement where the property serves as collateral. Both documents involve a promise to repay, but a mortgage also includes provisions for foreclosure in case of default.

- Dirt Bike Bill of Sale Form: For those looking to document their transactions, the essential Dirt Bike Bill of Sale details ensure that every sale is legally recorded.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt, similar to a Promissory Note. However, it typically lacks the formal structure and detailed terms found in a Promissory Note.

- Bond: A bond represents a loan made by an investor to a borrower, typically a corporation or government. Both bonds and Promissory Notes involve a promise to repay, but bonds are often issued in larger amounts and traded on markets.

- Lease Agreement: While primarily used for renting property, a lease agreement can include payment terms similar to those in a Promissory Note. It outlines the obligations of the lessee to pay rent over a specified period.

- Letter of Credit: This financial document guarantees payment to a seller from a bank, provided certain conditions are met. It shares the concept of a payment promise but is typically used in international trade transactions.

- Security Agreement: A security agreement establishes a secured party's rights over collateral in the event of default. It often accompanies a Promissory Note, providing additional assurance for the lender.

- Personal Guarantee: This document involves a promise by an individual to repay a debt if the primary borrower defaults. Like a Promissory Note, it signifies a commitment to pay, but it often involves personal liability.

Understanding these documents can provide valuable insights into financial agreements and obligations, highlighting the nuances that differentiate them while also emphasizing their commonalities.