Attorney-Approved Tractor Bill of Sale Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by the Ohio Revised Code, specifically sections related to the sale of personal property. |

| Required Information | The form typically requires details such as the names and addresses of both parties, the tractor's identification number, and the sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction and confirm the agreement. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed Bill of Sale for their records, as it serves as proof of the transaction. |

Dos and Don'ts

When filling out the Ohio Tractor Bill of Sale form, it is important to adhere to certain guidelines to ensure accuracy and compliance. Below are some dos and don'ts to consider:

- Do provide accurate and complete information about the tractor, including the make, model, year, and Vehicle Identification Number (VIN).

- Do include the sale price clearly to avoid any misunderstandings between the buyer and seller.

- Do ensure both parties sign the document to validate the sale and provide a copy for their records.

- Do check for any additional requirements specific to your county or local jurisdiction regarding the sale of agricultural equipment.

- Don't leave any sections of the form blank, as this may lead to complications or disputes later on.

- Don't use incorrect or outdated information, as this could affect the transfer of ownership.

- Don't forget to date the form, as this establishes the timeline of the sale.

- Don't overlook any state-specific regulations that may apply to the sale of tractors.

Create Popular Tractor Bill of Sale Forms for Different States

Bill of Sale for Tractor - Acts as a formal receipt for the buyer's purchase.

To facilitate a smooth transaction when buying or selling a vehicle, it's essential to utilize the North Carolina Motor Vehicle Bill of Sale, as it records the essential details of the transfer. Before completing the sale, ensure you have all necessary information, including vehicle specifics and agreed purchase terms. For those in need of a convenient option, you can access an editable form download to simplify the process.

Florida Bill of Sale Requirements - Form for confirming the buyer’s rights to a specific tractor.

Does a Tractor Have a Title - Encourages the tracking of performance and maintenance history for the tractor.

Bill of Sale for Tractor - Essential for tax and accounting purposes related to the sale.

Common mistakes

-

Inaccurate Vehicle Information: One common mistake is failing to provide accurate details about the tractor, such as the make, model, year, and Vehicle Identification Number (VIN). Any discrepancies can lead to complications during registration.

-

Incorrect Seller and Buyer Information: It's essential to ensure that both the seller's and buyer's names and addresses are correctly filled out. Errors in this section can result in legal issues later on.

-

Omitting Sale Price: Some individuals forget to include the sale price of the tractor. This figure is crucial for both tax purposes and establishing the value of the transaction.

-

Not Signing the Document: A signature is required from both the buyer and the seller. Failing to sign the document can render it invalid, complicating the transfer of ownership.

-

Neglecting to Date the Bill of Sale: Without a date, the bill of sale lacks a clear timeline for the transaction. This omission can create confusion regarding the effective date of the sale.

-

Not Including Terms of Sale: Some people overlook the importance of outlining any specific terms of the sale, such as warranties or conditions. Clear terms help prevent misunderstandings between the parties involved.

-

Failure to Keep Copies: After filling out the form, individuals often forget to make copies for their records. Retaining a copy is crucial for future reference and potential disputes.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for a bill of sale. Ignoring these can lead to issues when registering the tractor or during any legal proceedings.

Documents used along the form

When buying or selling a tractor in Ohio, the Tractor Bill of Sale form is essential. However, there are several other documents that may also be needed to ensure a smooth transaction. Below is a list of these documents, each serving a specific purpose in the process.

- Title Transfer Form: This document is crucial for transferring ownership of the tractor. It includes details about the vehicle and must be completed by both the seller and buyer.

- Odometer Disclosure Statement: This form verifies the tractor's mileage at the time of sale. It is important for ensuring transparency and preventing fraud.

- Affidavit of Ownership: In cases where the title is lost or unavailable, this affidavit can help establish ownership. It provides a sworn statement from the seller regarding their ownership of the tractor.

- Sales Tax Form: Depending on the sale's specifics, a sales tax form may be required. This document helps ensure that the appropriate taxes are collected and paid to the state.

- Dirt Bike Bill of Sale Form: For those looking to purchase or sell a dirt bike, refer to our important Dirt Bike Bill of Sale documentation to ensure all legal requirements are satisfied.

- Insurance Documentation: Proof of insurance may be necessary before the buyer can legally operate the tractor. This protects both parties in case of accidents or damages.

- Inspection Report: If the tractor requires inspection before sale, this report will detail its condition. It provides assurance to the buyer regarding the tractor's functionality and safety.

Having these documents ready can simplify the buying or selling process. It ensures that both parties are protected and that the transaction complies with Ohio laws. Always consider consulting with a legal expert to navigate any complexities that may arise.

Misconceptions

- Misconception 1: The Ohio Tractor Bill of Sale is not legally binding.

- Misconception 2: A bill of sale is only necessary for new tractors.

- Misconception 3: Only the seller needs to sign the bill of sale.

- Misconception 4: The bill of sale does not need to be notarized.

- Misconception 5: The bill of sale does not need to include a description of the tractor.

- Misconception 6: The Ohio Tractor Bill of Sale form is the same as a generic bill of sale.

- Misconception 7: A bill of sale is not necessary if the buyer pays in cash.

This form is a legally binding document once both parties have signed it. It serves as proof of the sale and transfer of ownership.

A bill of sale is required for both new and used tractors. It documents the transaction regardless of the condition of the equipment.

Both the buyer and the seller must sign the bill of sale to validate the transaction. This protects the interests of both parties.

While notarization is not always required, having the document notarized can provide additional legal protection and verification of the identities of the parties involved.

A detailed description of the tractor, including the make, model, and VIN, is essential. This information helps avoid disputes over the item sold.

The Ohio Tractor Bill of Sale is specifically designed for the sale of tractors and may include unique requirements or sections relevant to Ohio law.

Regardless of the payment method, a bill of sale is important for documenting the transaction. It provides evidence of the sale and protects both parties.

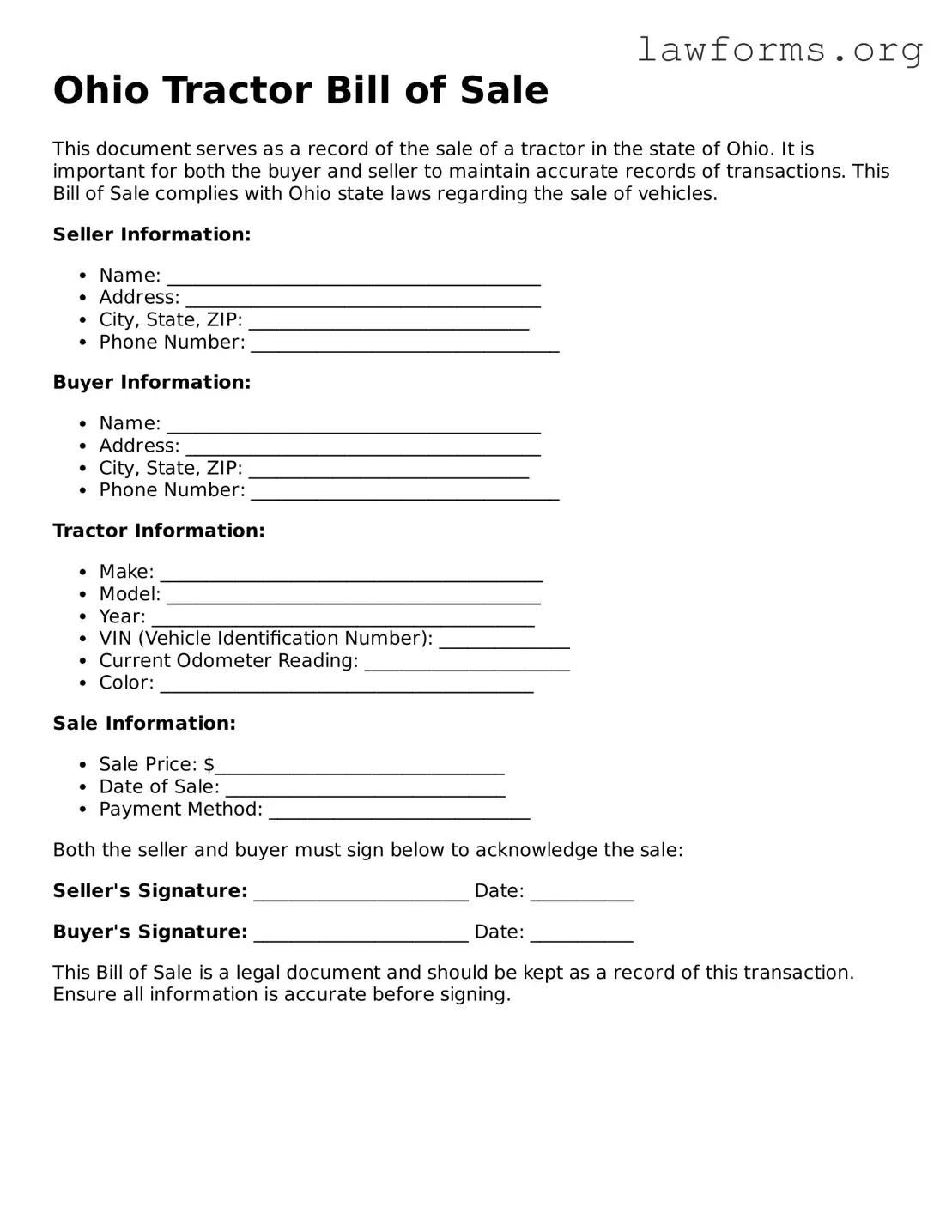

Preview - Ohio Tractor Bill of Sale Form

Ohio Tractor Bill of Sale

This document serves as a record of the sale of a tractor in the state of Ohio. It is important for both the buyer and seller to maintain accurate records of transactions. This Bill of Sale complies with Ohio state laws regarding the sale of vehicles.

Seller Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, ZIP: ______________________________

- Phone Number: _________________________________

Buyer Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, ZIP: ______________________________

- Phone Number: _________________________________

Tractor Information:

- Make: _________________________________________

- Model: ________________________________________

- Year: _________________________________________

- VIN (Vehicle Identification Number): ______________

- Current Odometer Reading: ______________________

- Color: ________________________________________

Sale Information:

- Sale Price: $_______________________________

- Date of Sale: ______________________________

- Payment Method: ____________________________

Both the seller and buyer must sign below to acknowledge the sale:

Seller's Signature: _______________________ Date: ___________

Buyer's Signature: _______________________ Date: ___________

This Bill of Sale is a legal document and should be kept as a record of this transaction. Ensure all information is accurate before signing.

Key takeaways

When filling out and using the Ohio Tractor Bill of Sale form, keep these key takeaways in mind:

- Accurate Information: Ensure all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are correct.

- Seller and Buyer Details: Clearly provide the names and addresses of both the seller and the buyer. This establishes a clear record of the transaction.

- Purchase Price: State the agreed purchase price. This is essential for tax purposes and future reference.

- Signatures Required: Both parties must sign the form to validate the sale. Without signatures, the document may not be legally binding.

- Keep Copies: After filling out the form, make copies for both the buyer and seller. This helps prevent disputes and serves as proof of the transaction.

- Check Local Regulations: Verify if there are any additional requirements or regulations in your local area regarding the sale of tractors.

Similar forms

- Vehicle Bill of Sale: Similar to the Tractor Bill of Sale, this document transfers ownership of a vehicle from one party to another. It includes details about the vehicle, such as make, model, and VIN.

- Boat Bill of Sale: This document serves a similar purpose for boats. It records the sale and includes information about the boat's specifications and the parties involved.

- Divorce Settlement Agreement: A crucial document in the divorce process that outlines the terms agreed upon by both parties, including asset distribution and child custody arrangements, and can be found at Marital Settlement Agreement.

- Motorcycle Bill of Sale: Like the Tractor Bill of Sale, this form is used to document the sale of a motorcycle. It includes pertinent details about the motorcycle and the seller and buyer.

- ATV Bill of Sale: This document is used for all-terrain vehicles. It captures the sale details and ensures a clear transfer of ownership.

- Snowmobile Bill of Sale: This form is specific to snowmobiles. It documents the transaction and includes essential information about the snowmobile.

- Trailer Bill of Sale: Similar to the Tractor Bill of Sale, this document is for trailers. It details the sale and includes the trailer's specifications.

- Farm Equipment Bill of Sale: This document is used for the sale of various types of farm equipment. It includes details about the equipment and the terms of the sale.

- Personal Property Bill of Sale: This general form can be used for various personal items, providing a record of the sale and ownership transfer.

- Real Estate Purchase Agreement: Although focused on real property, it serves a similar function in transferring ownership and outlines the terms of the sale.

- Lease Agreement: While primarily for rental situations, it also establishes terms and conditions for the use of property, similar to how a bill of sale outlines ownership transfer.