Attorney-Approved Transfer-on-Death Deed Template for the State of Ohio

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the owner, provided the revocation is properly recorded. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded with the county recorder’s office to be valid. |

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it's important to ensure accuracy and compliance with state regulations. Here’s a list of ten things to keep in mind:

- Do ensure that you are eligible to use the Transfer-on-Death Deed by confirming that the property is real estate and not subject to any liens.

- Do clearly identify the property in the deed, including the legal description, to avoid confusion later.

- Do include the names of all beneficiaries who will receive the property upon your passing.

- Do sign the deed in the presence of a notary public to ensure its validity.

- Do file the completed deed with the county recorder’s office where the property is located.

- Don’t forget to review the deed for any errors before submitting it.

- Don’t use vague language when describing the property or beneficiaries; clarity is key.

- Don’t assume that verbal agreements regarding the deed are sufficient; everything must be documented.

- Don’t neglect to inform your beneficiaries about the deed and its implications.

- Don’t wait until the last minute to complete the deed; allow ample time for any necessary corrections or adjustments.

Create Popular Transfer-on-Death Deed Forms for Different States

Problems With Transfer on Death Deeds Ohio - Beneficiaries can benefit from immediate access to the property without the delays typical of probate processes.

The California DV-260 form is a confidential document used in cases of domestic violence. It helps law enforcement and the courts manage restraining orders effectively while keeping sensitive information private. For more information on the DV-260 form and its importance in ensuring protection, visit californiadocsonline.com/california-dv-260-form/. Completing this form is an important step for those seeking protection, ensuring that their information is securely handled and communicated to the necessary authorities.

How to Transfer Deed of House - It can be revoked or amended by the property owner at any time before death.

Transfer on Death - Named beneficiaries should be aware of their rights and responsibilities after the property owner's death.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a clear and accurate description of the property. It’s essential to include details such as the property address and legal description to avoid confusion.

-

Not Naming Beneficiaries: Some individuals forget to name beneficiaries or list them incorrectly. Each beneficiary must be clearly identified to ensure the property is transferred as intended.

-

Omitting Signatures: A Transfer-on-Death Deed must be signed by the property owner. Omitting this crucial step can render the deed invalid, preventing the transfer from occurring.

-

Improper Witnessing or Notarization: Ohio law requires that the deed be signed in the presence of a notary public. Failing to have the deed properly notarized can lead to legal complications.

-

Filing the Deed Late: The deed must be filed with the county recorder before the property owner’s death. Delaying this step can jeopardize the transfer and create additional stress for loved ones.

-

Not Understanding the Implications: Many people do not fully understand the implications of a Transfer-on-Death Deed. It’s important to consider how this choice affects estate planning and taxes.

-

Failing to Update the Deed: Life circumstances change. Failing to update the deed after significant events, such as divorce or the death of a beneficiary, can lead to unintended consequences.

Documents used along the form

The Ohio Transfer-on-Death Deed (TOD) allows property owners to designate beneficiaries who will receive their property upon their death without going through probate. While the TOD deed is a vital document, several other forms and documents are often used in conjunction with it to ensure a smooth transfer of property. Below is a list of these documents, each serving a specific purpose in the estate planning process.

- This document outlines how a person's assets will be distributed after their death. It can include provisions for guardianship of minor children and can complement the TOD deed by addressing other assets not covered by it.

- This form allows an individual to designate someone else to make financial or legal decisions on their behalf while they are alive. It is crucial for managing affairs if the individual becomes incapacitated.

- A living will specifies an individual's wishes regarding medical treatment and end-of-life care. It ensures that healthcare providers and family members understand the person's preferences.

- These forms are used for financial accounts and insurance policies to name beneficiaries who will receive assets directly upon the owner's death, bypassing probate.

- A trust that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. It can help avoid probate and provide privacy.

- Quitclaim Deed: A legal document used in Ohio to transfer ownership of property from one party to another without guaranteeing the title's validity. It’s particularly useful in cases involving family members or acquaintances. To learn more about accessing this form, visit Ohio PDF Forms.

- This document is often used to establish the heirs of a deceased person when there is no will. It can help clarify property ownership and facilitate the transfer of assets.

- A standard property deed is necessary to formally transfer ownership of real estate. It may be needed to document the transfer of property to beneficiaries named in the TOD deed.

- This document informs relevant parties and institutions of an individual's passing. It may be required to initiate the transfer of assets and settle the deceased's estate.

Understanding these documents and their roles can significantly enhance the effectiveness of estate planning. Each serves a unique function, and together they help ensure that your wishes are honored and your beneficiaries are protected.

Misconceptions

Understanding the Ohio Transfer-on-Death Deed can be confusing. Here are eight common misconceptions about this legal tool:

- It only applies to real estate. Many believe the Transfer-on-Death Deed can only be used for real property. In fact, it specifically allows for the transfer of real estate upon death, but does not apply to personal property or bank accounts.

- It avoids probate entirely. While a Transfer-on-Death Deed can help avoid probate for the property it covers, it does not eliminate probate for other assets that do not have a designated beneficiary.

- It is the same as a will. A Transfer-on-Death Deed is not a will. A will distributes all assets upon death, while the Transfer-on-Death Deed only transfers specific real estate to named beneficiaries.

- Beneficiaries have immediate rights to the property. Beneficiaries do not have rights to the property until the owner passes away. Until then, the owner retains full control and can sell or mortgage the property.

- It requires a lawyer to complete. While it is advisable to seek legal advice, individuals can fill out and file the Transfer-on-Death Deed on their own. The form is designed to be user-friendly.

- It can be revoked easily. Although a Transfer-on-Death Deed can be revoked, it requires a formal process. Simply changing your mind does not invalidate the deed without following the correct steps.

- All property can be transferred using this deed. Not all types of property are eligible for transfer via a Transfer-on-Death Deed. Properties with liens or those held in certain types of trusts may not qualify.

- It is only beneficial for wealthy individuals. This deed can be advantageous for anyone who wants to simplify the transfer of their home or property to loved ones, regardless of their financial situation.

Being aware of these misconceptions can help individuals make informed decisions about estate planning in Ohio.

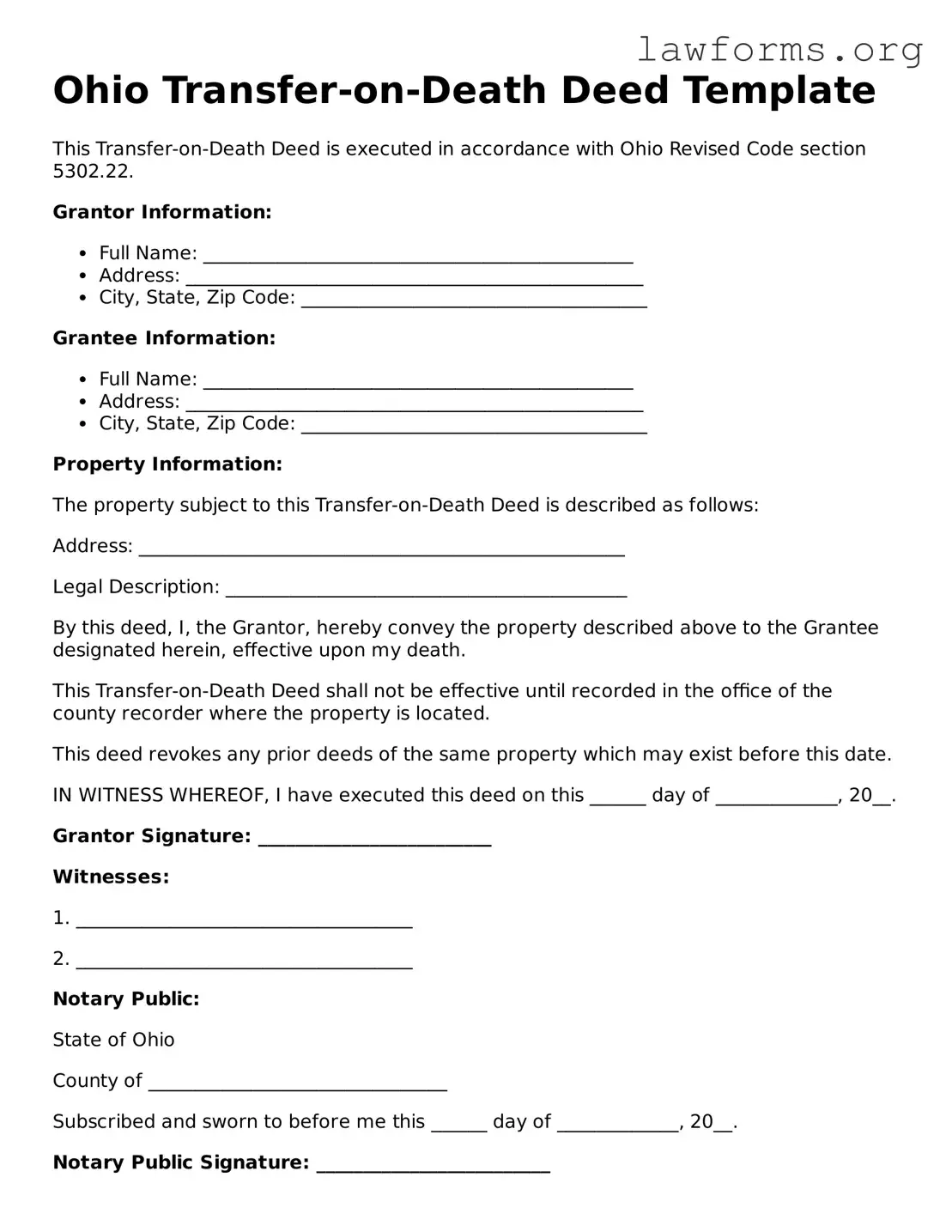

Preview - Ohio Transfer-on-Death Deed Form

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Ohio Revised Code section 5302.22.

Grantor Information:

- Full Name: ______________________________________________

- Address: _________________________________________________

- City, State, Zip Code: _____________________________________

Grantee Information:

- Full Name: ______________________________________________

- Address: _________________________________________________

- City, State, Zip Code: _____________________________________

Property Information:

The property subject to this Transfer-on-Death Deed is described as follows:

Address: ____________________________________________________

Legal Description: ___________________________________________

By this deed, I, the Grantor, hereby convey the property described above to the Grantee designated herein, effective upon my death.

This Transfer-on-Death Deed shall not be effective until recorded in the office of the county recorder where the property is located.

This deed revokes any prior deeds of the same property which may exist before this date.

IN WITNESS WHEREOF, I have executed this deed on this ______ day of _____________, 20__.

Grantor Signature: _________________________

Witnesses:

1. ____________________________________

2. ____________________________________

Notary Public:

State of Ohio

County of ________________________________

Subscribed and sworn to before me this ______ day of _____________, 20__.

Notary Public Signature: _________________________

My Commission Expires: _________________________

Key takeaways

When filling out and using the Ohio Transfer-on-Death Deed form, keep these key points in mind:

- Eligibility: Only real property can be transferred using this deed. Ensure the property is eligible for transfer-on-death designation.

- Signature Requirements: The deed must be signed by the property owner in front of a notary public. This step is crucial for the deed's validity.

- Effective Date: The transfer does not take effect until the owner's death. Until then, the owner retains full control over the property.

- Revocation: The owner can revoke the deed at any time before death. This can be done by filing a new deed or a revocation form.

Similar forms

- Last Will and Testament: A document that outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries, but it requires probate to validate the distribution.

- Living Trust: This legal arrangement holds a person's assets during their lifetime and specifies how those assets should be managed or distributed after death. Unlike a Transfer-on-Death Deed, a living trust can help avoid probate, providing a smoother transition of assets.

- Beneficiary Designation Forms: Commonly used for financial accounts, these forms allow individuals to name beneficiaries who will receive assets upon their death. Similar to a Transfer-on-Death Deed, they bypass probate, directly transferring assets to the designated individuals.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows two or more people to hold title to property together. When one owner dies, their share automatically passes to the surviving owner(s), mirroring the transfer mechanism of a Transfer-on-Death Deed.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate beneficiaries who will receive the funds upon their death. Like a Transfer-on-Death Deed, POD accounts facilitate direct transfer of assets without going through probate.

- Trailer Bill of Sale: This crucial document formalizes the sale of a trailer in Georgia, ensuring all transaction details are recorded, serving as a reliable proof of ownership transfer and facilitating the registration process for the buyer. For more information, visit https://georgiaform.com.

- Transfer-on-Death (TOD) Registration for Securities: This allows individuals to designate beneficiaries for their securities, such as stocks and bonds. Similar to a Transfer-on-Death Deed, it ensures that the designated beneficiaries receive the assets directly upon the owner's death.

- Life Insurance Policies: These policies typically allow the policyholder to name beneficiaries who will receive the death benefit upon the policyholder's passing. Much like a Transfer-on-Death Deed, the proceeds are transferred directly to the beneficiaries, avoiding probate.