Valid Operating Agreement Form

State-specific Operating Agreement Documents

Operating Agreement Document Categories

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a document that outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Purpose | This agreement serves to protect the owners' interests and clarify the roles and responsibilities of each member. |

| State-Specific Requirements | Each state may have specific requirements for an Operating Agreement, and it is essential to comply with these regulations. |

| Governing Law | The Operating Agreement is governed by the laws of the state in which the LLC is formed. For example, in California, it follows the California Corporations Code. |

| Flexibility | Members have the flexibility to customize the terms of the Operating Agreement to suit their specific needs and preferences. |

| Legal Protection | Having a well-drafted Operating Agreement can provide legal protection and help prevent disputes among members. |

| Not Mandatory | While not legally required in all states, it is highly recommended to have an Operating Agreement to ensure clarity and stability within the LLC. |

Dos and Don'ts

When filling out the Operating Agreement form, there are several important things to keep in mind. Here’s a helpful list of dos and don’ts to guide you through the process.

- Do read the entire form carefully before starting.

- Do provide accurate information about all members involved.

- Do clarify the roles and responsibilities of each member.

- Do include provisions for how decisions will be made.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific in your descriptions.

- Don't overlook the importance of signatures; ensure all members sign the document.

By following these guidelines, you can create a clear and effective Operating Agreement that meets the needs of your business.

Popular Templates:

Landlord Statement Letter Example - Must be submitted within specific deadlines for some uses.

Acquiring an Emotional Support Animal Letter can significantly improve the quality of life for those in need, as it not only provides necessary validation of the individual’s mental health requirements but also aids in navigating housing and travel restrictions. To streamline this process, you can easily access the needed templates at Top Document Templates, ensuring you have the proper documentation ready for your emotional support animal.

Dd Form 2656 March 2022 - The DD 2656 outlines eligibility requirements for various types of survivor benefits.

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Every member should be named in the agreement to ensure everyone’s rights and responsibilities are clear.

-

Vague Terms: Using vague or unclear language can lead to misunderstandings. It’s important to be specific about roles, responsibilities, and profit distribution to avoid future disputes.

-

Ignoring State Requirements: Each state has its own rules regarding operating agreements. Not adhering to these requirements can render the agreement ineffective or lead to legal issues down the road.

-

Not Updating the Agreement: As your business grows, changes may occur. Failing to update the operating agreement to reflect these changes can create confusion and potential conflicts among members.

-

Overlooking Dispute Resolution: Many people forget to include a method for resolving disputes. Having a clear process can save time and money if disagreements arise in the future.

Documents used along the form

An Operating Agreement is an essential document for LLCs, outlining the management structure and operational procedures. However, several other forms and documents complement the Operating Agreement to ensure smooth business operations and legal compliance. Here’s a list of commonly used documents alongside the Operating Agreement:

- Articles of Organization: This document is filed with the state to officially create an LLC. It includes basic information such as the LLC's name, address, and the names of its members.

- Bylaws: While primarily used by corporations, bylaws can also be helpful for LLCs. They set forth the rules for managing the business, including meeting protocols and voting rights.

- Member Consent Forms: These forms document decisions made by LLC members outside of formal meetings. They are useful for recording approvals on significant business matters.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Tax Identification Number (TIN) Application: An LLC needs a TIN for tax purposes. This application is submitted to the IRS to obtain the number required for filing taxes.

- Operating Procedures Manual: This document outlines the day-to-day operations of the business. It provides guidance on processes and responsibilities, ensuring consistency in operations.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared among members or with external parties. It ensures confidentiality and prevents misuse of proprietary information.

- Employment Agreements: If the LLC hires employees, these agreements outline the terms of employment, including job responsibilities, compensation, and benefits.

Having these documents in place, alongside the Operating Agreement, can help ensure that your LLC runs smoothly and remains compliant with legal requirements. Each document serves a specific purpose, contributing to the overall governance and management of the business.

Misconceptions

- Misconception 1: An Operating Agreement is only necessary for large businesses.

- Misconception 2: An Operating Agreement is a legally required document.

- Misconception 3: An Operating Agreement is the same as the Articles of Organization.

- Misconception 4: An Operating Agreement cannot be changed once it is created.

- Misconception 5: A verbal agreement among members is sufficient.

- Misconception 6: An Operating Agreement only addresses financial matters.

- Misconception 7: All members must sign the Operating Agreement for it to be valid.

This is not true. All LLCs, regardless of size, benefit from having an Operating Agreement. It provides clarity on management and operational procedures.

While many states do not mandate an Operating Agreement, having one is highly recommended. It helps prevent misunderstandings among members.

The two documents serve different purposes. The Articles of Organization establish the LLC, while the Operating Agreement outlines its internal management structure.

This is incorrect. Members can amend the Operating Agreement as needed, provided they follow the procedures outlined within the document itself.

Verbal agreements can lead to disputes and confusion. A written Operating Agreement provides a clear reference point for all members.

While financial arrangements are included, the Operating Agreement also covers management roles, decision-making processes, and member responsibilities.

While it is advisable for all members to sign, some states allow for the agreement to be valid even if not all members have signed, depending on the circumstances.

Preview - Operating Agreement Form

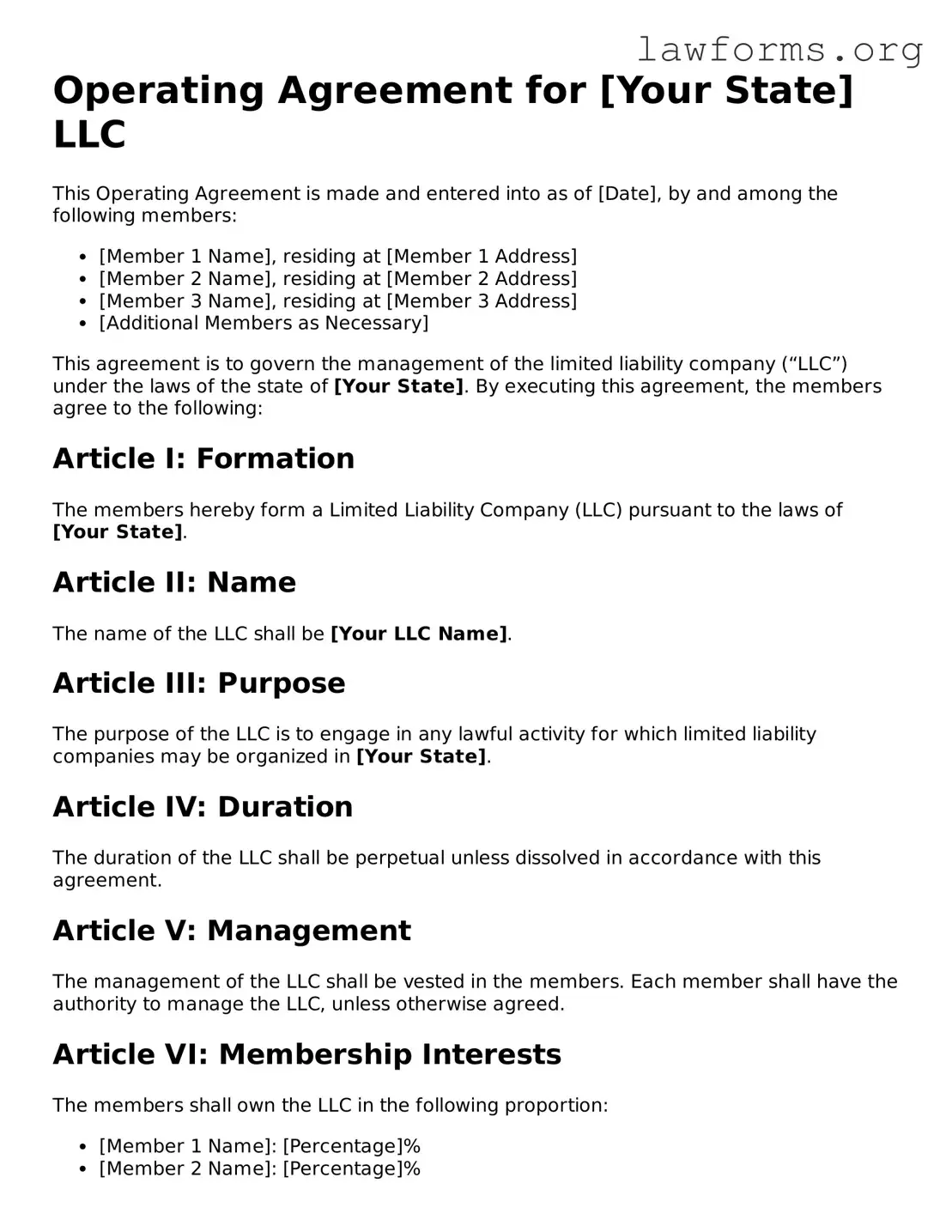

Operating Agreement for [Your State] LLC

This Operating Agreement is made and entered into as of [Date], by and among the following members:

- [Member 1 Name], residing at [Member 1 Address]

- [Member 2 Name], residing at [Member 2 Address]

- [Member 3 Name], residing at [Member 3 Address]

- [Additional Members as Necessary]

This agreement is to govern the management of the limited liability company (“LLC”) under the laws of the state of [Your State]. By executing this agreement, the members agree to the following:

Article I: Formation

The members hereby form a Limited Liability Company (LLC) pursuant to the laws of [Your State].

Article II: Name

The name of the LLC shall be [Your LLC Name].

Article III: Purpose

The purpose of the LLC is to engage in any lawful activity for which limited liability companies may be organized in [Your State].

Article IV: Duration

The duration of the LLC shall be perpetual unless dissolved in accordance with this agreement.

Article V: Management

The management of the LLC shall be vested in the members. Each member shall have the authority to manage the LLC, unless otherwise agreed.

Article VI: Membership Interests

The members shall own the LLC in the following proportion:

- [Member 1 Name]: [Percentage]%

- [Member 2 Name]: [Percentage]%

- [Member 3 Name]: [Percentage]%

- [Additional Members as Necessary]

Article VII: Distributions

Distributions shall be made to the members in proportion to their membership interests unless otherwise agreed upon.

Article VIII: Meetings

Regular meetings shall be held at least once annually, at a time and place determined by the members.

Article IX: Amendments

This Operating Agreement may be amended only by a written agreement signed by all members.

Article X: Dissolution

The LLC may be dissolved upon agreement of all members, or as required by law. Upon dissolution, assets shall be distributed in accordance with membership interests.

This Operating Agreement has been executed as of the date first above written.

Signature of Members:

- ____________________________ - [Member 1 Name]

- ____________________________ - [Member 2 Name]

- ____________________________ - [Member 3 Name]

- ____________________________ - [Additional Members as Necessary]

Key takeaways

When filling out and using an Operating Agreement form, keep these key takeaways in mind:

- Understand the Purpose: The Operating Agreement outlines the management structure and operational procedures of your business. It serves as a foundational document.

- Identify Members: Clearly list all members of the LLC. This includes their names, addresses, and ownership percentages.

- Define Roles and Responsibilities: Specify the roles of each member. This helps prevent misunderstandings about who is responsible for what.

- Outline Decision-Making Processes: Detail how decisions will be made within the LLC. Include voting rights and procedures for major decisions.

- Include Profit and Loss Distribution: Describe how profits and losses will be shared among members. This should align with ownership percentages unless otherwise agreed.

- Address Changes in Membership: Establish procedures for adding or removing members. This ensures clarity if the structure of the LLC changes.

- Plan for Dissolution: Outline the process for dissolving the LLC if necessary. Include how assets will be distributed upon dissolution.

- Ensure Compliance: Make sure the agreement complies with state laws. Each state has specific requirements for LLC Operating Agreements.

- Review and Update Regularly: Revisit the Operating Agreement periodically. Changes in membership or business operations may require updates.

Using the Operating Agreement effectively can help avoid disputes and clarify expectations among members.

Similar forms

- Partnership Agreement: This document outlines the terms and conditions under which two or more individuals agree to operate a business together. Like an Operating Agreement, it details the roles, responsibilities, and profit-sharing arrangements of each partner.

- Bylaws: Typically used by corporations, bylaws govern the internal management of the company. Similar to an Operating Agreement, they establish the rules for decision-making, meetings, and the duties of officers and directors.

- Shareholder Agreement: This document is essential for corporations with multiple shareholders. It defines the rights and obligations of shareholders, akin to how an Operating Agreement clarifies the relationships among LLC members.

- Joint Venture Agreement: When two or more parties collaborate on a specific project, this agreement outlines their contributions and responsibilities. It resembles an Operating Agreement in that it specifies how profits and losses will be shared.

- LLC Membership Agreement: While similar to an Operating Agreement, this document may focus more on the admission of new members and the terms of their membership in the LLC, providing clarity on ownership stakes and voting rights.

- Franchise Agreement: This contract details the rights and obligations between a franchisor and a franchisee. Like an Operating Agreement, it sets forth the operational framework and standards that must be adhered to by the parties involved.

- Independent Contractor Agreement: This document governs the relationship between a business and an independent contractor. It shares similarities with an Operating Agreement in that it defines the scope of work, compensation, and responsibilities of the contractor.

- Confidentiality Agreement (NDA): Often used in business arrangements to protect sensitive information, this agreement is similar to an Operating Agreement as it can include clauses that safeguard the interests of the parties involved.