Valid Owner Financing Contract Form

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract is an agreement where the seller of a property provides financing directly to the buyer, allowing them to make payments over time instead of obtaining a traditional mortgage. |

| Benefits | This type of financing can benefit buyers who may not qualify for conventional loans and can offer sellers a quicker sale and potential tax advantages. |

| Governing Laws | Owner Financing Contracts are governed by state laws, which can vary significantly. For example, in California, the relevant laws include the California Civil Code, while in Texas, it is governed by the Texas Property Code. |

| Key Components | Essential elements of the contract include the purchase price, interest rate, payment schedule, and the consequences of default. |

| Risks | Buyers may face risks such as higher interest rates or the potential for foreclosure if they fail to make payments. Sellers also risk the buyer defaulting on the agreement. |

Dos and Don'ts

When filling out an Owner Financing Contract form, it’s essential to approach the task with care. Here are five important things to do and not do:

- Do read the entire contract thoroughly before filling it out. Understanding the terms is crucial.

- Do provide accurate information. Ensure that all personal and property details are correct to avoid future complications.

- Do consult with a real estate professional if you have questions. Getting expert advice can help clarify any uncertainties.

- Don't rush through the process. Taking your time will help prevent mistakes that could lead to legal issues.

- Don't leave any sections blank. Every part of the contract should be completed to ensure it is legally binding.

By following these guidelines, you can help ensure that your Owner Financing Contract is filled out correctly and serves its intended purpose effectively.

Create Popular Types of Owner Financing Contract Documents

Real Estate Termination Agreement - It serves as a record that the agreement has been terminated, providing legal protection.

When engaging in a real estate transaction in Colorado, it is crucial to familiarize oneself with the Colorado Real Estate Purchase Agreement, a binding document that specifies all essential terms and conditions. For those seeking a reliable source for this form, coloradopdfforms.com/ offers a comprehensive guide that can help buyers and sellers understand their obligations and ensure a smooth transaction.

Purchase Agreement Addendum - This addendum is essential for documenting agreed modifications to the purchase terms.

Common mistakes

-

Not Including Complete Buyer and Seller Information: It’s essential to provide full names, addresses, and contact details for both parties. Missing information can lead to confusion and potential disputes later.

-

Failing to Specify the Purchase Price: Clearly stating the purchase price is crucial. Without it, the contract lacks clarity, which can create misunderstandings about the terms of the sale.

-

Omitting Payment Terms: The contract should detail the payment structure, including the amount, frequency, and duration of payments. Vague terms can lead to disagreements down the line.

-

Not Addressing Interest Rates: If financing includes interest, it should be explicitly stated. Failing to do so may result in unexpected costs for the buyer.

-

Ignoring Default Terms: It’s important to outline what happens in case of default. This section protects both parties and clarifies the consequences of missed payments.

-

Neglecting to Sign and Date the Contract: A contract is not valid without signatures and dates from both parties. This step is critical for enforcing the agreement legally.

Documents used along the form

When entering into an Owner Financing arrangement, several additional forms and documents may be necessary to ensure that all parties are protected and informed. Each document plays a crucial role in the overall transaction, providing clarity and legal backing. Below is a list of commonly used documents that accompany the Owner Financing Contract.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details such as the loan amount, interest rate, payment schedule, and consequences of default.

- Deed of Trust: This legal document secures the loan by transferring the property title to a third party (trustee) until the borrower repays the loan. It provides the lender a way to reclaim the property if the borrower defaults.

- Disclosure Statement: This document provides important information about the terms of the financing arrangement, including any fees, interest rates, and potential risks involved. It ensures transparency between the buyer and seller.

- California Real Estate Purchase Agreement: For those looking to buy or sell property, the detailed California real estate purchase agreement guidelines are essential to ensure all legal terms are understood and agreed upon.

- Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller. It includes details about the property, purchase price, and any contingencies that must be met before closing.

- Loan Application: This form collects information from the borrower regarding their financial status, credit history, and employment. It helps the seller assess the borrower's ability to repay the loan.

- Title Insurance Policy: This policy protects the buyer and lender against any potential issues with the property title, such as liens or ownership disputes. It ensures that the buyer has clear ownership of the property.

- Amortization Schedule: This document outlines the repayment plan for the loan, detailing each payment's principal and interest components over time. It helps both parties understand the financial obligations involved.

Understanding these documents is essential for anyone involved in an Owner Financing transaction. Each plays a vital role in ensuring that both the buyer and seller are protected and that the terms of the financing are clear and enforceable. Having all necessary documentation in order can help facilitate a smoother transaction and prevent potential disputes in the future.

Misconceptions

Owner financing can be a great option for buyers and sellers, but several misconceptions often cloud understanding. Here are six common myths about the Owner Financing Contract form:

- Owner financing is only for buyers with bad credit. Many people believe that owner financing is solely a last resort for those who cannot secure traditional loans. In reality, it can be a strategic choice for buyers looking for flexibility or those who want to avoid lengthy bank processes.

- All owner financing agreements are the same. This is not true. Each owner financing agreement can be tailored to fit the needs of both the buyer and the seller. Terms, interest rates, and repayment schedules can vary significantly.

- Owner financing is illegal or not recognized by banks. Owner financing is legal in all states and is a recognized method of real estate transaction. Banks may not be involved, but that does not invalidate the agreement.

- Buyers have no protections in an owner financing deal. Buyers actually have rights and protections, similar to traditional financing. These can include the right to receive a clear title and the right to inspect the property before finalizing the deal.

- Only experienced investors can use owner financing. This is a misconception. Owner financing is accessible to anyone, including first-time homebuyers. With proper guidance, anyone can navigate the process.

- Owner financing eliminates the need for legal documents. Even though owner financing may seem straightforward, legal documents are essential. A well-drafted Owner Financing Contract is crucial to protect both parties' interests.

Understanding these misconceptions can help buyers and sellers make informed decisions about owner financing. Clarity and preparation are key to a successful transaction.

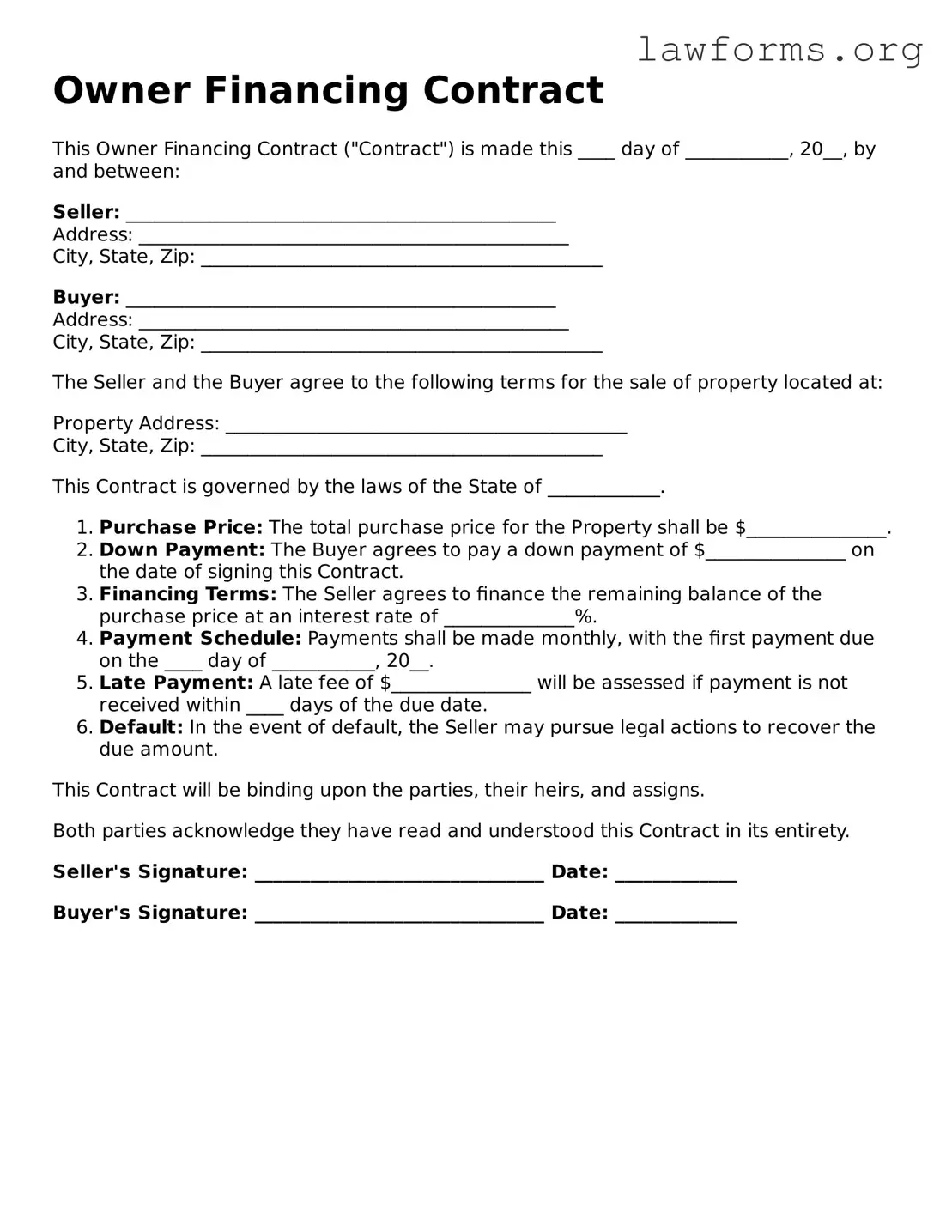

Preview - Owner Financing Contract Form

Owner Financing Contract

This Owner Financing Contract ("Contract") is made this ____ day of ___________, 20__, by and between:

Seller: ______________________________________________

Address: ______________________________________________

City, State, Zip: ___________________________________________

Buyer: ______________________________________________

Address: ______________________________________________

City, State, Zip: ___________________________________________

The Seller and the Buyer agree to the following terms for the sale of property located at:

Property Address: ___________________________________________

City, State, Zip: ___________________________________________

This Contract is governed by the laws of the State of ____________.

- Purchase Price: The total purchase price for the Property shall be $_______________.

- Down Payment: The Buyer agrees to pay a down payment of $_______________ on the date of signing this Contract.

- Financing Terms: The Seller agrees to finance the remaining balance of the purchase price at an interest rate of ______________%.

- Payment Schedule: Payments shall be made monthly, with the first payment due on the ____ day of ___________, 20__.

- Late Payment: A late fee of $_______________ will be assessed if payment is not received within ____ days of the due date.

- Default: In the event of default, the Seller may pursue legal actions to recover the due amount.

This Contract will be binding upon the parties, their heirs, and assigns.

Both parties acknowledge they have read and understood this Contract in its entirety.

Seller's Signature: _______________________________ Date: _____________

Buyer's Signature: _______________________________ Date: _____________

Key takeaways

When considering an Owner Financing Contract, several key points can guide you through the process. Understanding these takeaways can help ensure that the contract serves its intended purpose effectively.

- Clear Terms: Define the terms of the financing arrangement clearly. This includes the purchase price, interest rate, payment schedule, and any penalties for late payments.

- Legal Compliance: Ensure that the contract complies with local and state laws. This may involve consulting with a legal expert to avoid potential issues.

- Disclosure Requirements: Both parties should disclose any relevant information that could affect the agreement. Transparency is crucial for building trust.

- Default Clauses: Include provisions that outline what happens in the event of a default. This can protect both the seller and the buyer in case of missed payments.

- Documentation: Keep thorough records of all communications and transactions related to the contract. This documentation can be vital if disputes arise in the future.

By focusing on these key takeaways, individuals can navigate the complexities of owner financing more effectively.

Similar forms

- Purchase Agreement: This document outlines the terms and conditions for buying a property. Like the Owner Financing Contract, it details the sale price and payment terms.

- Lease Purchase Agreement: This combines a lease with an option to buy. It shares similarities with owner financing by allowing the buyer to secure the property while paying rent.

- Promissory Note: This is a written promise to pay a specified amount. It is similar to the Owner Financing Contract as it includes payment details and obligations of the borrower.

- Mortgage Agreement: This document secures a loan with the property as collateral. It mirrors owner financing by outlining repayment terms and conditions.

- Texas Real Estate Purchase Agreement: This legally binding document details the terms and conditions of property transactions in Texas, covering aspects like purchase price and financing options, making it essential for transferring ownership, as found in Formaid Org.

- Deed of Trust: This document involves three parties: the borrower, lender, and trustee. It functions similarly to owner financing by securing the loan against the property.

- Installment Sale Agreement: This allows the buyer to pay for the property over time. It is similar to owner financing as both involve gradual payments instead of a lump sum.

- Real Estate Option Agreement: This gives a buyer the right to purchase a property within a specified time. Like owner financing, it outlines the purchase price and terms.

- Seller Financing Addendum: This is an additional document to a purchase agreement that outlines seller financing terms. It closely resembles the Owner Financing Contract in its purpose and content.