Fill Out a Valid Payroll Check Template

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Payroll Check form is used to issue payments to employees for work performed. |

| Components | The form typically includes employee name, pay period, hours worked, and total wages. |

| State Variations | Each state may have specific requirements for payroll checks, including additional information. |

| Governing Laws | Payroll checks are governed by federal laws, such as the Fair Labor Standards Act (FLSA), and state laws. |

| Tax Deductions | Employers must withhold federal, state, and local taxes from employee wages as required by law. |

| Record Keeping | Employers are required to keep payroll records for a minimum of three years, as per federal law. |

| Electronic Payments | Many employers now offer electronic payroll options, which must comply with state laws regarding consent. |

| Employee Access | Employees have the right to access their payroll information and request corrections if necessary. |

Dos and Don'ts

When filling out the Payroll Check form, it's important to be careful and accurate. Here are some things to keep in mind:

- Do double-check all personal information for accuracy.

- Do ensure that the payment amount is correct before submitting.

- Do sign the form in the designated area.

- Do keep a copy for your records.

- Don't leave any required fields blank.

- Don't use incorrect or outdated forms.

Other PDF Documents

Final Waiver of Lien Chicago Title - The waiver helps to create a clean title for the property, which is vital for future sales or financing needs.

For entrepreneurs looking to secure their business operations, a strategic Non-compete Agreement is vital, ensuring that key employees do not adversely affect company interests post-employment. To download a detailed Non-compete Agreement for your needs, visit this helpful resource on Non-compete Agreement templates.

Proper Hazmat Bill of Lading Example - Details about the nature of hazardous materials are included in the form.

Common mistakes

-

Incorrect Employee Information: Many people forget to double-check the employee's name, address, and Social Security number. A simple typo can lead to delays in processing.

-

Wrong Pay Period Dates: It's common to mix up the start and end dates of the pay period. This can result in employees being underpaid or overpaid.

-

Missing Signatures: Failing to sign the form can halt the payroll process. Always ensure that all required signatures are present before submission.

-

Inaccurate Hours Worked: Some individuals miscalculate the total hours worked. This mistake can lead to payroll discrepancies and employee dissatisfaction.

Documents used along the form

When managing payroll, several important forms and documents complement the Payroll Check form. Each of these documents serves a unique purpose in ensuring that payroll processes are accurate, compliant, and efficient. Below is a list of common forms used alongside the Payroll Check form.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- W-2 Form: At the end of the year, employers provide this form to employees. It summarizes the total earnings and taxes withheld for the year, which employees need for their tax returns.

- Direct Deposit Authorization Form: Employees fill out this form to authorize their employer to deposit their paychecks directly into their bank accounts, streamlining the payment process.

- Motorcycle Bill of Sale Form: This essential document ensures the legal transfer of motorcycle ownership in Illinois and can be filled out by visiting formsillinois.com.

- Time Sheet: This document records the hours worked by employees. It is essential for calculating pay, especially for hourly workers, and ensures accurate payroll processing.

- Payroll Register: This internal document tracks all payroll transactions for a specific pay period. It includes details such as employee names, hours worked, gross pay, deductions, and net pay.

- Employee Handbook: While not a payroll-specific document, it outlines company policies, including payroll practices, benefits, and employee rights, providing essential information to staff.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state taxes. Employees may need to complete it to ensure proper state income tax withholding.

- Employment Agreement: This document outlines the terms of employment, including salary, benefits, and job responsibilities. It serves as a reference for both the employer and employee regarding payroll expectations.

Understanding these forms and documents is crucial for any business managing payroll. Each piece plays a vital role in ensuring compliance with tax laws, maintaining accurate records, and fostering clear communication between employers and employees.

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions often cloud this important document. Below is a list of common misunderstandings, along with clarifications to help demystify the Payroll Check form.

- All payroll checks are the same. This is not true. Payroll checks can vary significantly based on the employer's policies, the employee's status, and the specific terms of employment.

- Payroll checks are only issued bi-weekly. While many companies do follow a bi-weekly schedule, others may choose to pay weekly, monthly, or semi-monthly. The frequency of pay depends on the employer's practices.

- Employees do not need to keep payroll checks. On the contrary, it is advisable for employees to retain their payroll checks or stubs. These documents serve as proof of income and can be vital for tax purposes or loan applications.

- Payroll checks include all deductions. Some may believe that all deductions are clearly listed on the check. In reality, certain deductions, such as retirement contributions or health insurance premiums, may require additional documentation to fully understand.

- Only full-time employees receive payroll checks. This is a misconception. Part-time employees, interns, and even freelancers can receive payroll checks, depending on their employment agreements.

- Payroll checks are automatically correct. Mistakes can happen. It is crucial for employees to review their payroll checks for accuracy, including hours worked and deductions taken.

- Direct deposit eliminates the need for payroll checks. While direct deposit is increasingly popular, many employees still receive paper checks. Employers may offer both options to accommodate different preferences.

- Payroll checks do not affect taxes. In reality, payroll checks are subject to various tax withholdings. Understanding these withholdings is essential for employees to manage their tax liabilities effectively.

By addressing these misconceptions, individuals can better navigate the complexities of payroll and ensure they are informed about their rights and responsibilities regarding compensation.

Preview - Payroll Check Form

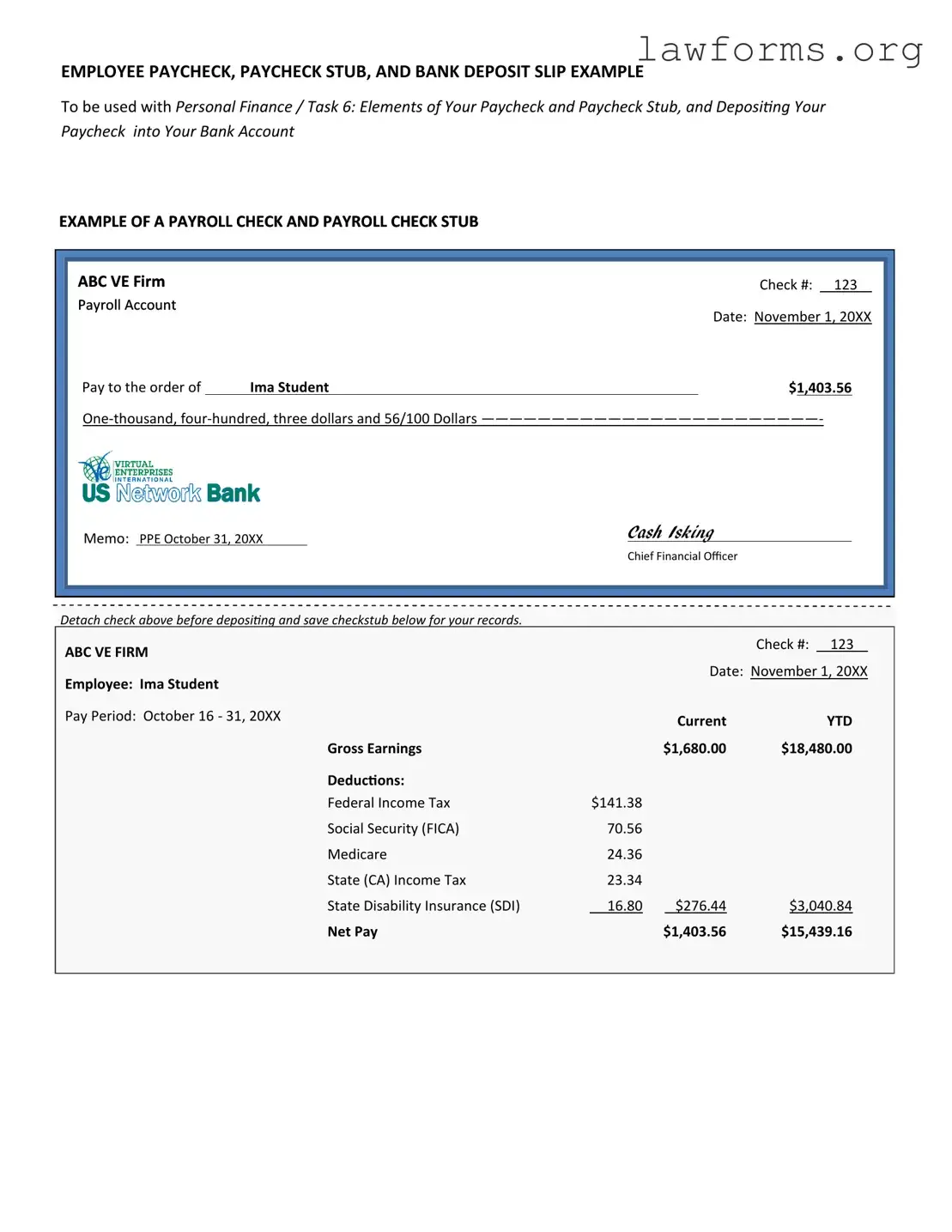

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

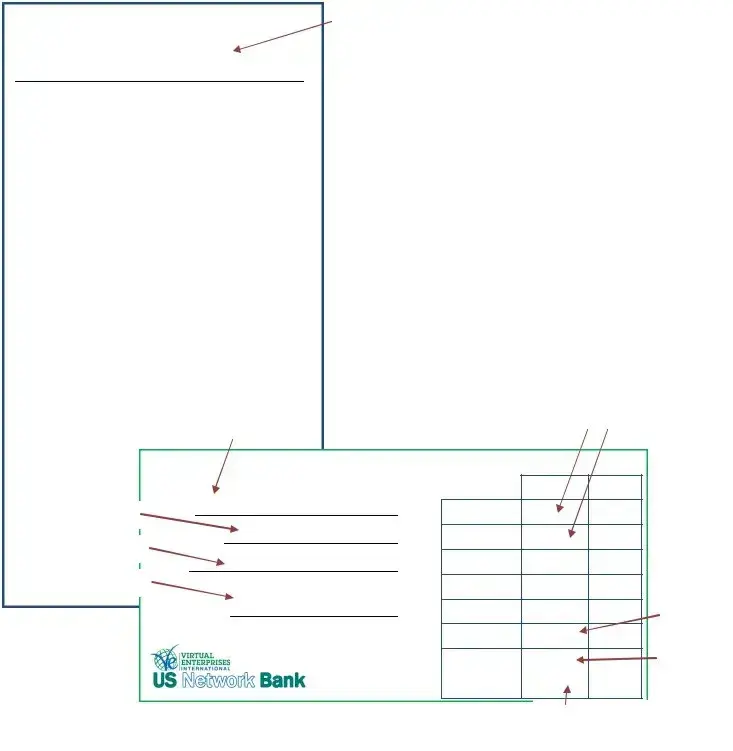

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Key takeaways

When filling out and using the Payroll Check form, several important points should be kept in mind to ensure accuracy and compliance. Here are key takeaways to consider:

- Complete Information: Ensure that all required fields are filled out completely. Missing information can delay processing.

- Accurate Amounts: Double-check the amounts entered. Errors in payment can lead to employee dissatisfaction and potential disputes.

- Employee Identification: Use the correct employee identification number. This helps in accurately tracking payroll records.

- Signature Requirement: Ensure that the form is signed by an authorized person. This adds a layer of accountability to the payroll process.

- Timely Submission: Submit the form on time to avoid delays in payroll processing. Late submissions can disrupt employee payments.

- Record Keeping: Keep a copy of the completed Payroll Check form for your records. This can be useful for future reference and audits.

- Compliance with Laws: Stay informed about federal and state payroll regulations. Compliance is essential to avoid penalties.

- Review Before Finalizing: Always review the form before finalizing it. A second look can help catch mistakes you might have missed initially.

Similar forms

- Pay Stub: This document provides employees with a detailed breakdown of their earnings, deductions, and net pay for a specific pay period. Like a Payroll Check, it serves to inform employees of their compensation.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their wages directly into their bank account. It is similar to the Payroll Check in that it pertains to the payment of wages.

- W-2 Form: Issued at the end of the year, this form summarizes an employee's total earnings and taxes withheld. Both documents relate to income and taxation.

- 1099 Form: This document is used to report income received by independent contractors. Like the Payroll Check, it reflects payment for services rendered.

- Payroll Register: A summary of all payroll transactions for a specific period, this document includes details about each employee's pay. It is similar in that it tracks payments made to employees.

- Time Sheet: This record tracks the hours worked by an employee, which directly affects their Payroll Check. Both documents are essential for accurate compensation.

- Employment Contract: This agreement outlines the terms of employment, including salary and payment schedule. It relates to the Payroll Check as it establishes the basis for payment.

-

Employment Verification Form: Often required for background checks, the Employment Verification form is crucial for confirming a candidate's employment history and eligibility. For more information, visit https://californiadocsonline.com/employment-verification-form/.

- Bonus Check: Similar to a Payroll Check, this document represents additional compensation awarded to an employee, often based on performance or company profits.

- Expense Reimbursement Form: Employees use this form to request repayment for work-related expenses. Like a Payroll Check, it involves the transfer of funds from employer to employee.

- Commission Statement: This document details the commissions earned by sales employees. It is similar to a Payroll Check in that it represents payment for work performed.