Valid Power of Attorney Form

State-specific Power of Attorney Documents

Power of Attorney Document Categories

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types | There are several types of POA, including General, Durable, and Limited, each serving different purposes. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke a POA at any time as long as they are mentally competent. |

| State-Specific Forms | Each state has its own requirements for POA forms. For example, in California, the governing law is the California Probate Code. |

| Notarization | Most states require the POA to be notarized to be legally valid. |

| Agent's Responsibilities | The agent must act in the best interests of the principal and follow their wishes as outlined in the POA. |

Dos and Don'ts

When filling out a Power of Attorney form, it’s essential to be careful and thorough. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do clearly identify the person you are granting authority to.

- Do specify the powers you are granting in detail.

- Do sign the form in the presence of a notary, if required.

- Don’t leave any sections blank; fill in all required information.

- Don’t use vague language; be specific about your intentions.

- Don’t forget to keep a copy for your records after it’s completed.

Popular Templates:

Closing Date Extension Addendum Form - Essential for managing changes in the closing schedule.

Affidavit of Support - Providing false information on the I-864 can lead to serious consequences.

Partial Lien Waiver Form - This document can serve as leverage in negotiations between property owners and creditors.

Common mistakes

-

Not Specifying the Powers Granted: One common mistake is failing to clearly define the powers that the agent will have. It’s crucial to specify whether the agent can handle financial matters, medical decisions, or both. Ambiguity can lead to confusion and unintended consequences.

-

Choosing the Wrong Agent: Selecting an agent who may not have the best interests of the principal at heart can be detrimental. It’s essential to choose someone trustworthy and capable of making decisions that align with the principal’s values and wishes.

-

Not Updating the Document: Life changes, and so do relationships. Failing to update the Power of Attorney after significant life events—such as marriage, divorce, or the death of a previously designated agent—can lead to complications. Regular reviews of the document are advisable.

-

Overlooking Witnesses and Notarization: Many states require that the Power of Attorney be signed in the presence of witnesses or notarized. Neglecting these requirements can render the document invalid. Always check local laws to ensure compliance.

-

Assuming All Powers are Automatic: Some people mistakenly believe that a Power of Attorney automatically grants all powers to the agent. In reality, specific powers must be explicitly stated. It’s important to outline what the agent can and cannot do to avoid misunderstandings.

Documents used along the form

A Power of Attorney (POA) is a powerful document that allows one person to act on behalf of another in legal or financial matters. When creating or using a POA, several other forms and documents may be necessary to ensure that all aspects of the arrangement are clear and legally binding. Below is a list of commonly used documents that often accompany a Power of Attorney.

- Durable Power of Attorney: This variation remains effective even if the principal becomes incapacitated. It is crucial for long-term planning and ensures that decisions can still be made on behalf of the principal when they are unable to do so.

- Medical Power of Attorney: Specifically designed for healthcare decisions, this document allows the appointed agent to make medical choices for the principal if they are unable to communicate their wishes.

- Living Will: A living will outlines the principal's preferences regarding medical treatment and end-of-life care. It works in conjunction with a Medical Power of Attorney to guide healthcare decisions.

- Advance Healthcare Directive: This document combines a Medical Power of Attorney and a Living Will, providing comprehensive instructions for healthcare decisions and appointing an agent to act on behalf of the principal.

- Financial Power of Attorney: Similar to a standard POA, this document specifically grants authority to manage financial matters, such as banking, investments, and real estate transactions.

- Employment Application PDF: This standardized form is essential for job seekers to provide their personal information and relevant experience effectively. Check out Top Document Templates for a convenient template to get started.

- Revocation of Power of Attorney: If the principal wishes to terminate the authority granted to an agent, this document serves to formally revoke the previous Power of Attorney, ensuring clarity and preventing misuse.

- Certification of Trust: This document verifies the existence of a trust and outlines the powers of the trustee. It can be essential when a Power of Attorney is used in conjunction with trust management.

Understanding these additional documents can enhance the effectiveness of a Power of Attorney and provide peace of mind. Each document serves a specific purpose, ensuring that the principal's wishes are respected and that their affairs are managed appropriately in various situations.

Misconceptions

When it comes to Power of Attorney (POA) forms, there are many misunderstandings that can lead to confusion and missteps. Here’s a look at some common misconceptions:

- All Power of Attorney forms are the same. Each state has its own rules and requirements for POA forms. It's essential to use the correct form for your state to ensure it is valid.

- A Power of Attorney gives unlimited power. This is not true. A POA can be limited to specific tasks or decisions, depending on how it is drafted. You can specify what powers you want to grant.

- Once a Power of Attorney is signed, it cannot be revoked. In fact, you can revoke a POA at any time as long as you are mentally competent. Just be sure to notify the agent and any institutions involved.

- Only lawyers can create a Power of Attorney. While it's wise to consult a lawyer, many states allow individuals to create their own POA forms. Just ensure you follow your state’s guidelines.

- Power of Attorney is only for financial matters. A POA can also be designated for healthcare decisions, allowing someone to make medical choices on your behalf if you are unable to do so.

- My agent can do whatever they want with my Power of Attorney. Agents must act in your best interest and follow the guidelines laid out in the POA. They cannot use the authority for personal gain.

- A Power of Attorney is only needed for the elderly. People of all ages can benefit from a POA, especially in situations where they may be incapacitated or unable to make decisions.

- Once I create a Power of Attorney, I don’t need to think about it again. It's crucial to review your POA regularly, especially after major life changes like marriage, divorce, or the birth of a child.

- Power of Attorney is the same as a will. A POA is used while you are alive to manage your affairs, while a will takes effect after your death to distribute your assets.

- My agent has to be a family member. While many choose family, you can appoint anyone you trust, including friends or professionals, as your agent.

Understanding these misconceptions can help you make informed decisions about your Power of Attorney and ensure that your wishes are respected in times of need.

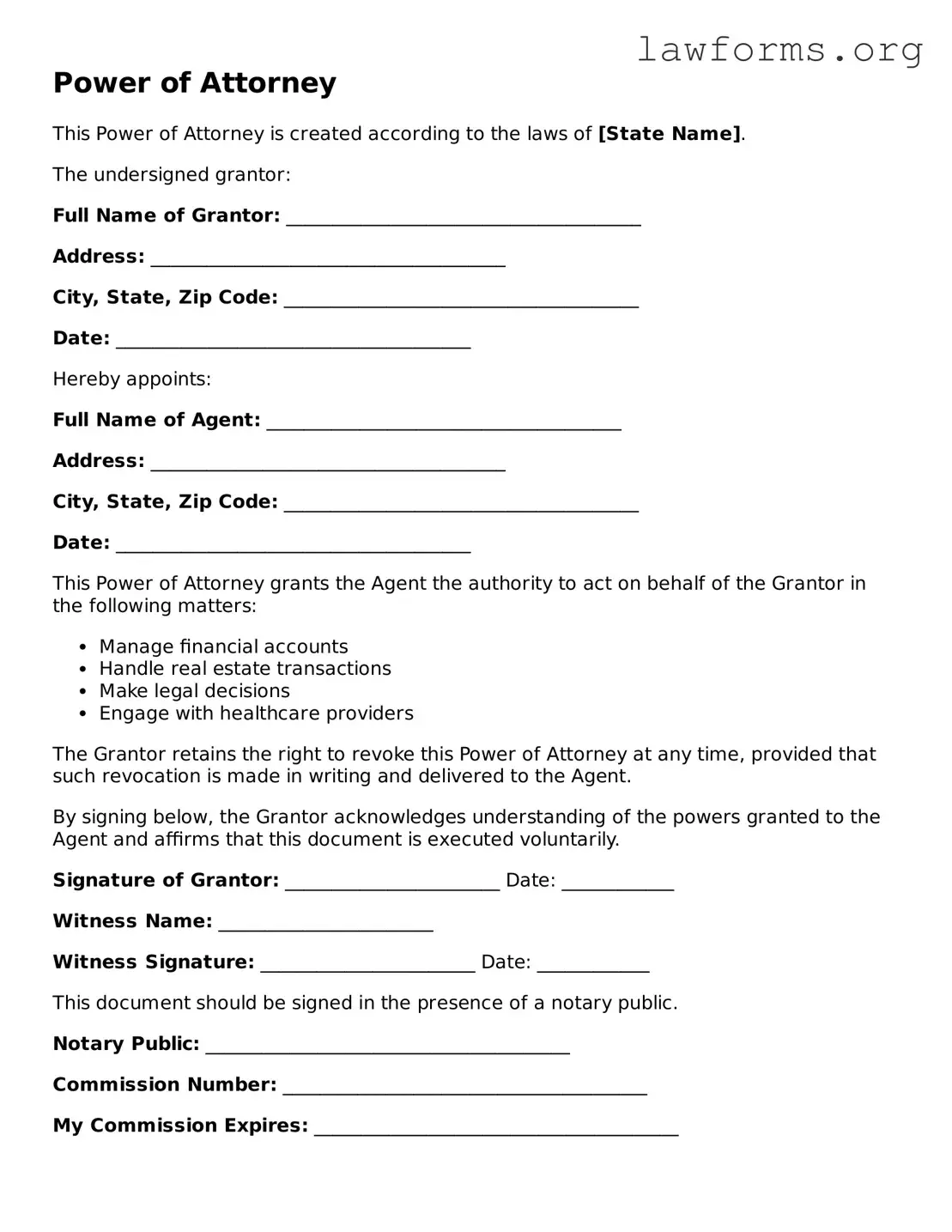

Preview - Power of Attorney Form

Power of Attorney

This Power of Attorney is created according to the laws of [State Name].

The undersigned grantor:

Full Name of Grantor: ______________________________________

Address: ______________________________________

City, State, Zip Code: ______________________________________

Date: ______________________________________

Hereby appoints:

Full Name of Agent: ______________________________________

Address: ______________________________________

City, State, Zip Code: ______________________________________

Date: ______________________________________

This Power of Attorney grants the Agent the authority to act on behalf of the Grantor in the following matters:

- Manage financial accounts

- Handle real estate transactions

- Make legal decisions

- Engage with healthcare providers

The Grantor retains the right to revoke this Power of Attorney at any time, provided that such revocation is made in writing and delivered to the Agent.

By signing below, the Grantor acknowledges understanding of the powers granted to the Agent and affirms that this document is executed voluntarily.

Signature of Grantor: _______________________ Date: ____________

Witness Name: _______________________

Witness Signature: _______________________ Date: ____________

This document should be signed in the presence of a notary public.

Notary Public: _______________________________________

Commission Number: _______________________________________

My Commission Expires: _______________________________________

Key takeaways

When it comes to filling out and using a Power of Attorney (POA) form, understanding its significance is crucial. Here are some key takeaways to keep in mind:

- Choose the Right Type of POA: There are different types of Power of Attorney forms, such as durable, medical, and financial. Select the one that best fits your needs.

- Clearly Define Powers: Be specific about the powers you are granting. This clarity helps avoid confusion and ensures your agent knows their responsibilities.

- Choose Your Agent Wisely: The person you designate as your agent should be trustworthy and capable of making decisions in your best interest.

- Review Regularly: Life circumstances change. Regularly reviewing and updating your Power of Attorney ensures it remains aligned with your current wishes.

Filling out a Power of Attorney form is an important step in planning for the future. Taking the time to understand these key points can lead to better decision-making and peace of mind.

Similar forms

- Living Will: This document outlines your medical preferences in case you become unable to communicate. Like a Power of Attorney, it allows you to express your wishes regarding healthcare decisions.

- Health Care Proxy: Similar to a Power of Attorney, this document designates someone to make medical decisions on your behalf if you are incapacitated. It focuses specifically on health care matters.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if you become incapacitated. It allows your agent to handle financial and legal matters without interruption.

- Financial Power of Attorney: This document grants someone authority to manage your financial affairs. It is similar to a general Power of Attorney but specifically focuses on financial transactions.

- Trust Agreement: A trust allows you to transfer assets to a trustee for the benefit of a beneficiary. Like a Power of Attorney, it involves delegating authority, but it is typically more focused on asset management.

- Will: A will outlines how your assets should be distributed after your death. While it does not grant authority during your lifetime, it is similar in that it involves planning for future decisions regarding your estate.

- Advance Directive: This document combines elements of a living will and health care proxy. It allows you to specify your medical treatment preferences and appoint someone to make decisions for you, similar to a Power of Attorney.