Fill Out a Valid Profit And Loss Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form summarizes a business's revenues and expenses over a specific period. |

| Importance | This form helps business owners understand their financial performance and make informed decisions. |

| Components | It typically includes sections for income, cost of goods sold, gross profit, operating expenses, and net profit. |

| Frequency | Businesses often prepare Profit and Loss statements monthly, quarterly, or annually. |

| Tax Reporting | Profit and Loss forms are crucial for tax reporting, as they provide necessary income details to the IRS. |

| State-Specific Forms | Some states require specific forms for reporting profits and losses, governed by local tax laws. |

| Format | Profit and Loss statements can be prepared in various formats, including spreadsheets and accounting software. |

| Comparison | These forms allow for comparison with previous periods, helping identify trends in income and expenses. |

| Stakeholder Use | Investors and lenders often review Profit and Loss statements to assess a business's financial health. |

| Legal Compliance | Maintaining accurate Profit and Loss forms is essential for compliance with financial regulations and audits. |

Dos and Don'ts

When filling out the Profit and Loss form, it’s crucial to be thorough and accurate. Here are five important do's and don'ts to keep in mind:

- Do double-check your entries for accuracy before submitting.

- Do include all sources of income to ensure a complete picture of your finances.

- Do categorize expenses correctly to help with future financial analysis.

- Do keep supporting documents handy in case you need to reference them later.

- Do review the form for any updates or changes in requirements.

- Don't leave any sections blank; if something doesn’t apply, indicate that clearly.

- Don't use vague descriptions for income or expenses; be specific.

- Don't forget to sign and date the form before submission.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't ignore deadlines; submit your form on time to avoid penalties.

Other PDF Documents

Ucc 308 Without Prejudice - It outlines the intention to retain all personal rights.

What Is a 1098 Form - Payment acknowledgment is included to thank you for timely payments received.

Common mistakes

-

Omitting Income Sources: Many individuals fail to include all sources of income. This can lead to an inaccurate representation of financial performance.

-

Incorrect Categorization: Some people misclassify expenses. For example, personal expenses might be listed as business expenses, which can distort the financial picture.

-

Neglecting to Update Regularly: A common mistake is not updating the Profit and Loss form regularly. This can result in outdated information that does not reflect current financial status.

-

Forgetting to Include Non-Cash Expenses: Non-cash expenses, such as depreciation, are often overlooked. These are important for understanding the true cost of doing business.

-

Failing to Reconcile with Bank Statements: Not reconciling the Profit and Loss form with bank statements can lead to discrepancies. Regular reconciliation helps ensure accuracy.

-

Using Estimates Instead of Actual Figures: Some individuals rely on estimates rather than actual figures. This practice can lead to significant inaccuracies in financial reporting.

-

Ignoring Seasonal Variations: Seasonal fluctuations in income and expenses can be significant. Failing to account for these variations may present a misleading financial picture.

-

Not Seeking Professional Help: Many people attempt to fill out the form without professional guidance. This can lead to errors that could have been avoided with expert assistance.

Documents used along the form

When managing a business's financial health, several documents complement the Profit and Loss form. Each of these documents plays a critical role in providing a comprehensive view of a company's financial performance and position. Understanding these forms can help business owners make informed decisions and enhance their financial strategies.

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the company owns and owes, offering insights into its financial stability.

- Cash Flow Statement: This statement outlines the inflows and outflows of cash within a business over a particular period. It highlights how cash is generated and used, which is crucial for assessing liquidity and operational efficiency.

- Budget: A budget is a financial plan that estimates revenue and expenses over a specified period. It serves as a roadmap for managing finances, guiding spending, and setting financial goals.

- Accounts Receivable Aging Report: This report categorizes a company’s outstanding invoices based on how long they have been unpaid. It helps businesses manage their credit policies and collections effectively.

- Accounts Payable Aging Report: Similar to the accounts receivable report, this document tracks outstanding bills and payments owed to suppliers. It aids in managing cash flow and ensuring timely payments to maintain supplier relationships.

- Sales Tax Report: This report summarizes the sales tax collected during a specific period. It is essential for compliance with tax regulations and for preparing accurate tax returns.

- Inventory Report: This document provides details about the quantity and value of inventory on hand. It is vital for managing stock levels and understanding the cost of goods sold.

- Financial Projections: These are estimates of future financial outcomes based on historical data and market trends. They help businesses plan for growth and assess potential risks.

- Expense Report: This document records business expenses incurred by employees or the organization itself. It is crucial for tracking spending and ensuring that expenses align with the budget.

Utilizing these documents alongside the Profit and Loss form creates a robust framework for financial analysis. Together, they provide a clearer picture of a company's financial health, enabling informed decision-making and strategic planning.

Misconceptions

Understanding the Profit and Loss (P&L) form is crucial for anyone involved in managing finances. However, several misconceptions can cloud this understanding. Here are seven common misconceptions about the Profit and Loss form:

-

The P&L form is only for large businesses.

This is not true. Small businesses and freelancers also benefit from using a P&L form to track income and expenses.

-

A P&L form shows cash flow.

While the P&L provides information on revenues and expenses, it does not detail cash flow. A separate cash flow statement is needed for that purpose.

-

All expenses are deductible.

Not all expenses listed on the P&L are deductible for tax purposes. Only ordinary and necessary business expenses qualify.

-

The P&L form is static.

The P&L form is dynamic and should be updated regularly to reflect the most current financial situation of the business.

-

Profit means cash in hand.

Profit does not equal cash on hand. A business can be profitable on paper but still face cash flow issues.

-

The P&L form is only for accountants.

Anyone can use a P&L form. Business owners, managers, and even employees can benefit from understanding this document.

-

Profit and Loss forms are the same as balance sheets.

These are different financial statements. The P&L focuses on income and expenses over a period, while the balance sheet shows assets, liabilities, and equity at a specific point in time.

By clearing up these misconceptions, individuals can better utilize the Profit and Loss form to make informed financial decisions.

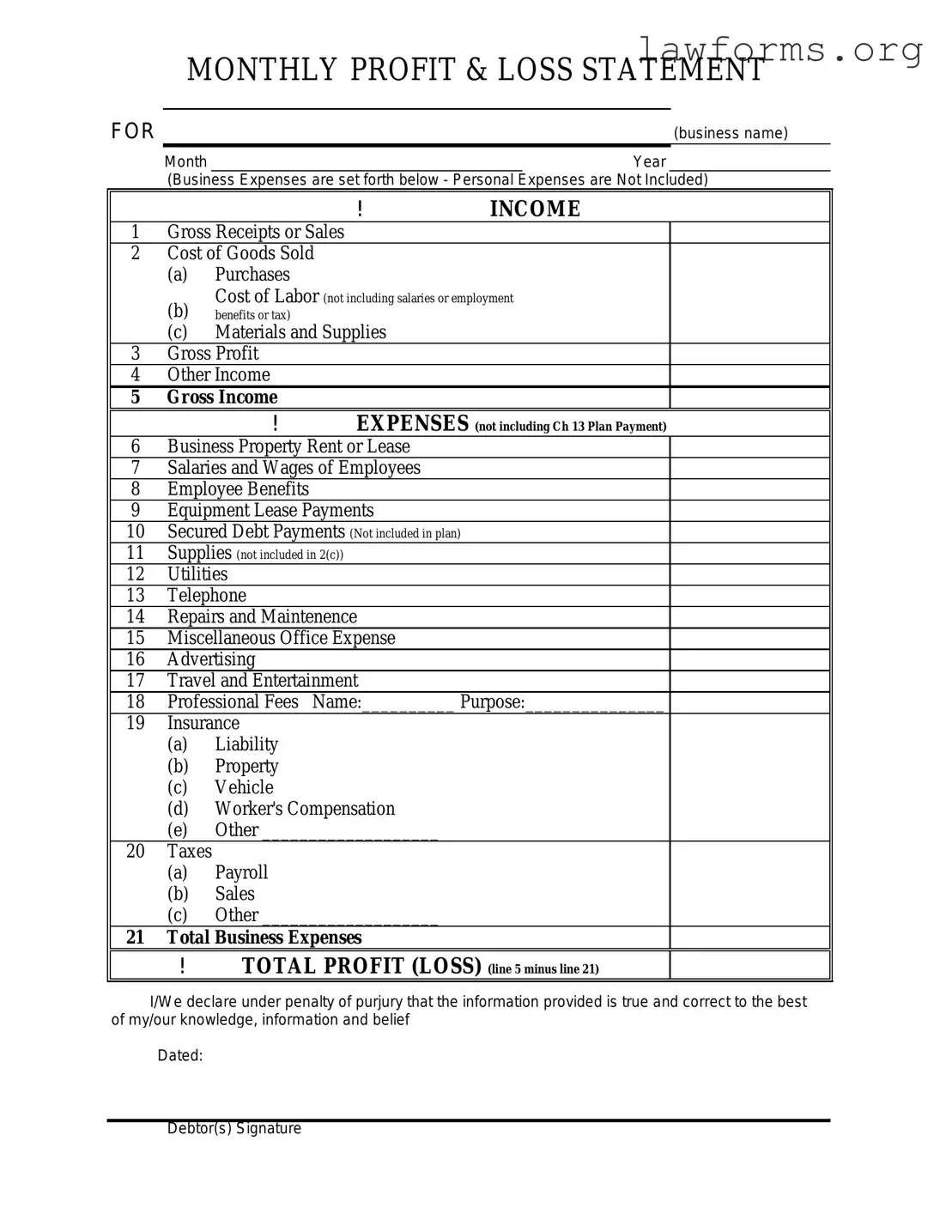

Preview - Profit And Loss Form

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Key takeaways

Here are six key takeaways about filling out and using the Profit and Loss form:

- Understand the Purpose: The Profit and Loss form summarizes income and expenses over a specific period, helping to assess financial performance.

- Accurate Data Entry: Ensure all income and expense figures are entered correctly to reflect true financial status.

- Consistent Time Periods: Use the same time frame for each report to allow for accurate comparisons over time.

- Review Regularly: Regularly review the Profit and Loss form to track financial trends and make informed business decisions.

- Use for Budgeting: Utilize the information from the form to create budgets and set financial goals for the future.

- Consult Professionals: If unsure about any figures or categories, consult with an accountant for guidance.

Similar forms

Balance Sheet: This document provides a snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and equity. While the Profit and Loss form summarizes revenues and expenses over a period, the Balance Sheet captures what the company owns and owes at a moment's glance.

Cash Flow Statement: The Cash Flow Statement tracks the flow of cash in and out of a business during a specific period. Similar to the Profit and Loss form, it reflects financial performance, but focuses on liquidity rather than profitability.

- Articles of Incorporation: This foundational document establishes a corporation legally and outlines its purpose, similar to how the Formaid Org provides resources for creating this essential paperwork.

Income Statement: Often used interchangeably with the Profit and Loss form, the Income Statement details revenues and expenses to show net income over a period. Both documents serve to analyze profitability but may vary in format and terminology.

Budget Report: A Budget Report outlines projected revenues and expenses for a future period. Like the Profit and Loss form, it helps assess financial performance, but focuses on planned financial outcomes rather than historical data.

Sales Report: This document details sales performance over a period, providing insight into revenue generation. While the Profit and Loss form includes sales as a component, the Sales Report hones in specifically on sales figures and trends.

Expense Report: An Expense Report itemizes expenditures incurred by a business, providing clarity on spending. The Profit and Loss form aggregates these expenses to show overall financial performance, but the Expense Report focuses on individual costs.