Valid Promissory Note for a Car Form

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money for the purchase of a vehicle. |

| Parties Involved | The note involves at least two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Interest Rate | The note may include an interest rate, which is the cost of borrowing money, expressed as a percentage. |

| Payment Schedule | Payments are typically made on a monthly basis until the loan is paid off, but terms can vary. |

| Governing Law | The laws governing promissory notes vary by state. For example, California law applies to notes executed in California. |

| Default Consequences | If the borrower defaults, the lender may have the right to repossess the vehicle. |

| Transferability | Promissory notes can often be transferred to another party, allowing the lender to sell the note to another investor. |

| Security Interest | The note may be secured by the vehicle itself, meaning the lender has a claim to the car until the debt is satisfied. |

| Notarization | While not always required, notarizing the promissory note can provide an extra layer of authenticity and legal protection. |

Dos and Don'ts

When filling out a Promissory Note for a Car, it's essential to approach the task with care. This document serves as a legal agreement between the borrower and lender, detailing the terms of the loan. Here are ten important dos and don'ts to consider:

- Do read the entire form thoroughly before filling it out.

- Do provide accurate personal information, including your name, address, and contact details.

- Do specify the loan amount clearly to avoid confusion.

- Do outline the interest rate and payment schedule explicitly.

- Do sign and date the document in the appropriate sections.

- Don't leave any sections blank; ensure all required fields are filled.

- Don't use ambiguous language that could lead to misinterpretation.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to keep a copy of the signed note for your records.

- Don't ignore the importance of understanding the terms before signing.

Create Popular Types of Promissory Note for a Car Documents

Promissory Note Release - Serves as proof that a loan has been satisfied and no further payments are due.

For those looking to create a California Promissory Note form, it is essential to utilize resources that clarify the necessary components of this binding agreement. By understanding the various terms of repayment and relating interest rates, one can establish a solid foundation for secure financial transactions. A great place to start is by visiting formcalifornia.com/, which offers useful templates and guidelines tailored for your needs.

Common mistakes

-

Incorrect Borrower Information: Failing to provide the full legal name, address, or contact information of the borrower can lead to issues in the future.

-

Missing Lender Details: Not including the lender's name and address may create confusion about who is owed the money.

-

Improper Loan Amount: Entering an incorrect loan amount can result in disputes later. Ensure the amount matches the agreed-upon figure.

-

Omitting Interest Rate: Leaving out the interest rate or not specifying whether it is fixed or variable can lead to misunderstandings.

-

Failure to Specify Payment Terms: Not detailing the payment schedule, including due dates and payment frequency, may lead to missed payments.

-

Not Including Late Fees: If applicable, failing to state any late fees or penalties for missed payments can complicate enforcement of the agreement.

-

Signing Without Witnesses: Some states require a witness or notarization. Not adhering to these requirements can invalidate the note.

-

Neglecting to Date the Document: Omitting the date can cause confusion about when the agreement was made.

-

Not Keeping Copies: Failing to make and retain copies of the signed note for both parties can lead to disputes about the terms.

Documents used along the form

When entering into a financing agreement for a car, several important documents often accompany the Promissory Note. These documents help clarify the terms of the agreement and protect the interests of both the buyer and the seller. Below is a list of common forms and documents that you might encounter.

- Bill of Sale: This document serves as proof of the transaction between the buyer and seller. It includes details such as the vehicle's make, model, year, VIN, and the sale price.

- Title Transfer Form: This form is essential for transferring ownership of the vehicle from the seller to the buyer. It typically requires signatures from both parties and may need to be submitted to the Department of Motor Vehicles (DMV).

- Promissory Note: A vital document that establishes the borrower's commitment to repay the loan amount. For resources on customizing this document, visit All New York Forms.

- Loan Application: If financing is involved, a loan application may be required. This document collects personal and financial information to assess the buyer's creditworthiness and ability to repay the loan.

- Credit Report Authorization: This form allows the lender to obtain the buyer's credit report. It helps the lender evaluate the buyer’s credit history and determine loan terms.

- Payment Schedule: A payment schedule outlines the repayment terms, including the amount of each payment, the frequency of payments, and the total number of payments. It helps both parties keep track of the loan repayment process.

- Insurance Verification: Proof of insurance is often required before finalizing the sale. This document confirms that the buyer has obtained the necessary insurance coverage for the vehicle.

- Disclosure Statement: This document may include important information about the vehicle's condition, any existing warranties, and the seller's obligations. It ensures transparency in the transaction.

Understanding these documents can make the car financing process smoother and more transparent. Each form plays a critical role in ensuring that both parties are protected and informed throughout the transaction. Always review each document carefully and seek clarification if needed to ensure a successful purchase experience.

Misconceptions

Understanding the Promissory Note for a Car form is essential for both buyers and sellers. However, several misconceptions often arise. Here are four common misunderstandings:

- It is the same as a car loan agreement. Many people think a promissory note is identical to a car loan agreement. While both documents involve borrowing money to purchase a vehicle, a promissory note is a simpler document that outlines the borrower's promise to repay the loan, rather than detailing the terms of the loan itself.

- Only banks can issue promissory notes. Some believe that only financial institutions can create promissory notes. In reality, individuals can also issue them. If a person lends money to a friend or family member for a car purchase, they can use a promissory note to formalize the loan.

- It does not need to be in writing. There is a misconception that a verbal agreement is enough for a promissory note. However, having a written document is crucial. A written note provides clear evidence of the terms agreed upon, which can be important in case of disputes.

- It guarantees the car title transfer. Some people think that signing a promissory note automatically transfers the car title to the borrower. This is not the case. The title transfer usually requires additional paperwork and must be completed separately from the promissory note.

Being aware of these misconceptions can help individuals navigate the process of buying or selling a car more effectively. Understanding the role and limitations of a promissory note is key to making informed financial decisions.

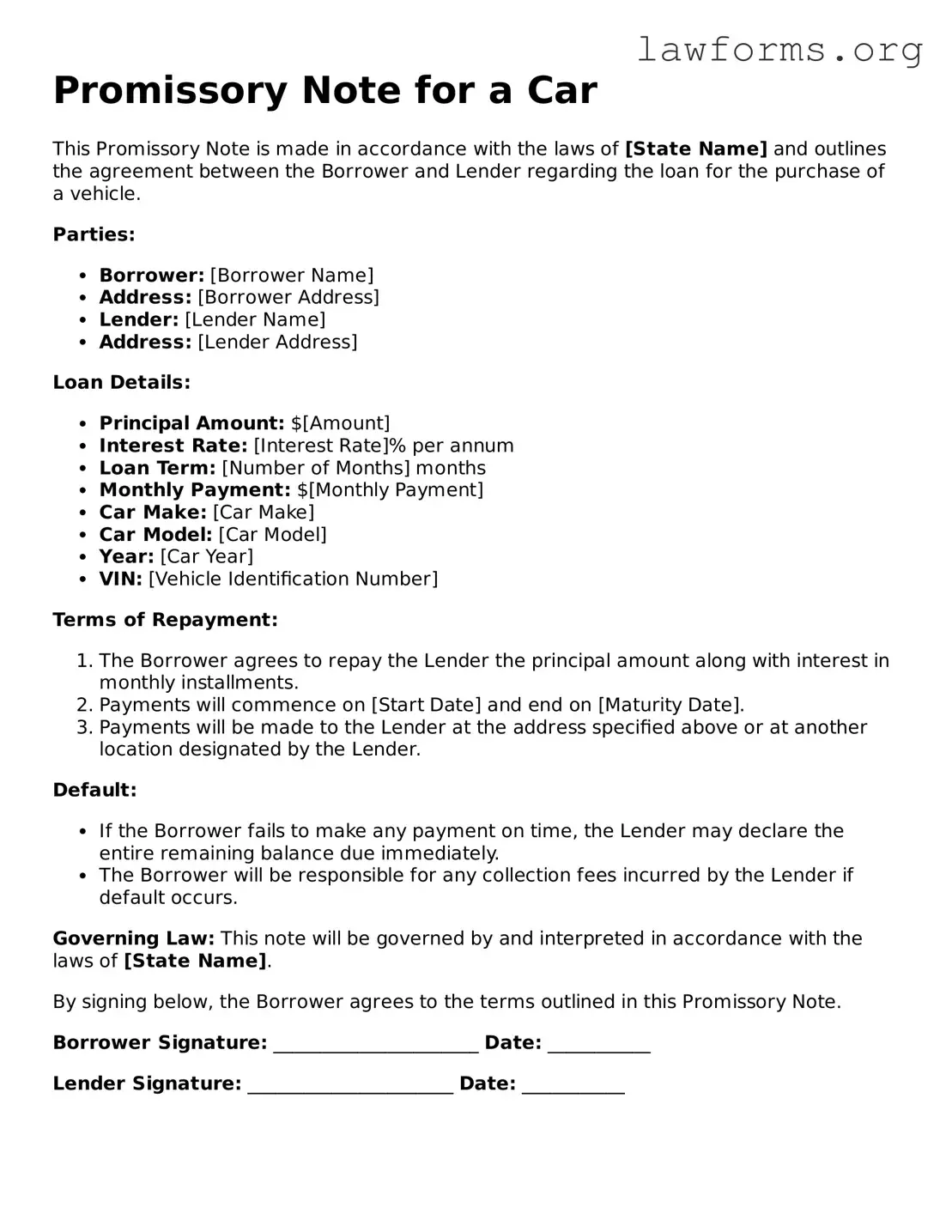

Preview - Promissory Note for a Car Form

Promissory Note for a Car

This Promissory Note is made in accordance with the laws of [State Name] and outlines the agreement between the Borrower and Lender regarding the loan for the purchase of a vehicle.

Parties:

- Borrower: [Borrower Name]

- Address: [Borrower Address]

- Lender: [Lender Name]

- Address: [Lender Address]

Loan Details:

- Principal Amount: $[Amount]

- Interest Rate: [Interest Rate]% per annum

- Loan Term: [Number of Months] months

- Monthly Payment: $[Monthly Payment]

- Car Make: [Car Make]

- Car Model: [Car Model]

- Year: [Car Year]

- VIN: [Vehicle Identification Number]

Terms of Repayment:

- The Borrower agrees to repay the Lender the principal amount along with interest in monthly installments.

- Payments will commence on [Start Date] and end on [Maturity Date].

- Payments will be made to the Lender at the address specified above or at another location designated by the Lender.

Default:

- If the Borrower fails to make any payment on time, the Lender may declare the entire remaining balance due immediately.

- The Borrower will be responsible for any collection fees incurred by the Lender if default occurs.

Governing Law: This note will be governed by and interpreted in accordance with the laws of [State Name].

By signing below, the Borrower agrees to the terms outlined in this Promissory Note.

Borrower Signature: ______________________ Date: ___________

Lender Signature: ______________________ Date: ___________

Key takeaways

When filling out and using the Promissory Note for a Car form, there are several important points to keep in mind. Here are some key takeaways:

- Understand the Purpose: A promissory note is a legal document that outlines the terms of a loan for purchasing a vehicle. It serves as a written promise to repay the borrowed amount.

- Include Accurate Information: Make sure to provide correct details about the borrower, lender, vehicle, and loan amount. Any inaccuracies can lead to complications later.

- Specify the Terms: Clearly outline the repayment terms, including interest rates, payment schedule, and due dates. This helps avoid misunderstandings between parties.

- Consider Interest Rates: Be aware of the interest rate being charged. It should be fair and compliant with state laws to avoid any legal issues.

- Signatures Matter: Both the borrower and lender must sign the document. This signifies that both parties agree to the terms laid out in the note.

- Keep Copies: After signing, make sure to keep copies of the signed promissory note. This provides a record of the agreement for both parties.

- Know Your Rights: Understand your rights and responsibilities under the promissory note. This knowledge can protect you in case of disputes.

- Consult a Professional: If you have any doubts or questions, consider consulting a legal or financial professional. They can provide guidance tailored to your situation.

By keeping these points in mind, you can ensure a smoother process when using the Promissory Note for a Car form.

Similar forms

- Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms under which money is borrowed and repaid. It specifies the loan amount, interest rate, repayment schedule, and consequences of default.

- Mortgage: A mortgage is a specific type of loan agreement used to purchase real estate. It involves collateral in the form of the property itself, similar to how a car may serve as collateral in a promissory note.

- Editable Promissory Note: For those looking to create a customized agreement, the option for an Editable Promissory Note provides flexibility. This format allows borrowers and lenders to define specific terms including interest rates and repayment schedules, as found on https://newjerseyformspdf.com/editable-promissory-note/, ensuring that the document meets their unique needs.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for payment. Like a promissory note, it outlines payment terms and responsibilities of both parties.

- Installment Sale Agreement: This document details the sale of an item, typically a vehicle, where the buyer pays in installments over time. It functions similarly to a promissory note by establishing payment terms and ownership transfer.

- Personal Loan Agreement: This agreement is used when borrowing money from a friend or family member. It includes repayment terms and conditions, much like a promissory note, but typically lacks formalities.

- Credit Agreement: A credit agreement sets the terms for borrowing from a credit provider. It includes interest rates and repayment terms, paralleling the structure of a promissory note.

- Sales Contract: A sales contract outlines the terms of a sale, including payment details. It shares similarities with a promissory note in that it specifies what is owed and when.

- Secured Loan Agreement: This type of agreement involves a loan backed by collateral. Like a promissory note for a car, it details the terms of repayment and the consequences of default.

- Debt Acknowledgment: A debt acknowledgment is a simple document that confirms the existence of a debt. It may not be as detailed as a promissory note but serves a similar purpose in recognizing what is owed.