Valid Promissory Note Form

State-specific Promissory Note Documents

Promissory Note Document Categories

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money at a certain time or on demand. |

| Parties Involved | There are typically two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Interest Rate | The note may include an interest rate, which is the cost of borrowing the money. |

| Governing Law | In the U.S., the Uniform Commercial Code (UCC) governs promissory notes, but state-specific laws may apply. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include essential terms. |

| Payment Terms | Payment terms should clearly outline when and how the payment will be made. |

| Default Consequences | If the maker fails to pay, the payee may take legal action to recover the owed amount. |

| Transferability | Promissory notes can often be transferred to another party, making them negotiable instruments. |

Dos and Don'ts

When filling out a Promissory Note form, it’s important to approach the task with care. Here’s a list of things to do and things to avoid:

- Do: Clearly state the amount of money being borrowed. This ensures that both parties understand the financial obligation.

- Do: Include the names and contact information of all parties involved. This provides clarity and accountability.

- Do: Specify the repayment terms, including the interest rate and payment schedule. This helps to avoid misunderstandings in the future.

- Do: Sign and date the document. This finalizes the agreement and indicates that all parties are in agreement with the terms.

- Don’t: Leave any sections blank. Incomplete information can lead to confusion and potential disputes later on.

- Don’t: Use vague language. Be precise in your wording to ensure that the terms are clear and enforceable.

- Don’t: Forget to keep a copy of the signed Promissory Note. Having a record is essential for future reference.

- Don’t: Ignore legal requirements specific to your state. Always ensure compliance with local laws to avoid complications.

Popular Templates:

Batting Line Up Strategy - Collecting player details promotes understanding of individual responsibilities.

Horse Bill of Sale - The bill of sale can confirm that the horse is free from liens or other claims before the sale.

To ensure clarity in the divorce process, it is advisable to utilize resources such as the Forms Washington, which provides a comprehensive template for drafting a Divorce Settlement Agreement, encompassing key elements like property division and custody arrangements.

Notice of Intent to Lien Florida - This form provides a clear timeline and expectations, helping to keep construction projects on track financially.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to issues later. Ensure that all sections are complete.

-

Incorrect Names: Using the wrong names for the borrower or lender can create confusion. Double-check spelling and titles.

-

Missing Signatures: Not signing the document can render it invalid. Both parties must sign and date the note.

-

Improper Amount: Writing the wrong loan amount can lead to disputes. Verify the amount before finalizing the document.

-

Failure to Specify Terms: Not clearly stating the repayment terms can cause misunderstandings. Include details like interest rates and payment schedules.

-

Ignoring Legal Requirements: Some states have specific requirements for promissory notes. Familiarize yourself with local laws to avoid complications.

-

Not Including a Default Clause: Omitting a clause about what happens if payments are missed can lead to problems. It's important to outline consequences for default.

-

Neglecting to Keep Copies: Failing to make copies for all parties can create issues down the line. Always keep a signed copy for your records.

-

Rushing the Process: Filling out the form quickly can lead to mistakes. Take your time to ensure accuracy and clarity.

Documents used along the form

A Promissory Note is a financial document that outlines the terms of a loan between a borrower and a lender. Along with the Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Below is a list of commonly used documents that often accompany a Promissory Note.

- Loan Agreement: This document details the terms and conditions of the loan, including repayment schedules, interest rates, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets pledged and the rights of the lender in case of default.

- Disclosure Statement: This statement provides important information about the loan, such as the total cost, interest rates, and any fees associated with the loan.

- Personal Guarantee: A personal guarantee may be required from the borrower or a third party, ensuring that the loan will be repaid even if the borrower defaults.

- Payment Schedule: This document outlines the timeline for payments, including due dates and amounts, making it easier for both parties to track obligations.

- Amortization Schedule: An amortization schedule breaks down each payment over the life of the loan, showing how much goes toward principal and interest.

- Default Notice: This notice is issued if the borrower fails to make payments as agreed, outlining the consequences and steps the lender may take.

- Release of Lien: Once the loan is fully repaid, this document confirms that the lender relinquishes any claim to the collateral used for securing the loan.

- California LLC 12 Form: Essential for all California limited liability companies, this form must be submitted within 90 days of registration and every two years thereafter. For more information, visit https://californiadocsonline.com/california-llc-12-form/.

- Assignment of Rights: If the lender decides to transfer the loan to another party, this document outlines the rights and obligations being assigned.

These documents serve to protect both the borrower and the lender, ensuring that all terms are clear and legally enforceable. It is essential to have all relevant paperwork in order to avoid misunderstandings and disputes in the future.

Misconceptions

Understanding the Promissory Note form can be tricky. Many people hold misconceptions about what it is and how it works. Here are six common misunderstandings:

- It’s just a simple IOU. Many think a promissory note is merely an informal IOU. In reality, it is a formal legal document that outlines the terms of a loan, including repayment schedules and interest rates.

- Only banks use promissory notes. While banks often use them, individuals and businesses can also create promissory notes for personal loans or transactions between parties.

- Promissory notes don’t need to be in writing. Some believe verbal agreements are sufficient. However, a written document is essential for clarity and enforceability.

- All promissory notes are the same. There is a misconception that all promissory notes have identical terms. In fact, they can vary widely based on the agreement between the borrower and lender.

- Signing a promissory note means you can’t change it. Many think that once signed, the terms are set in stone. However, parties can agree to modify the terms if both sides consent.

- Promissory notes are not legally binding. Some believe these notes hold no legal weight. In truth, they are enforceable contracts, and failing to adhere to the terms can lead to legal consequences.

By clarifying these misconceptions, individuals can better understand the importance and function of promissory notes in financial transactions.

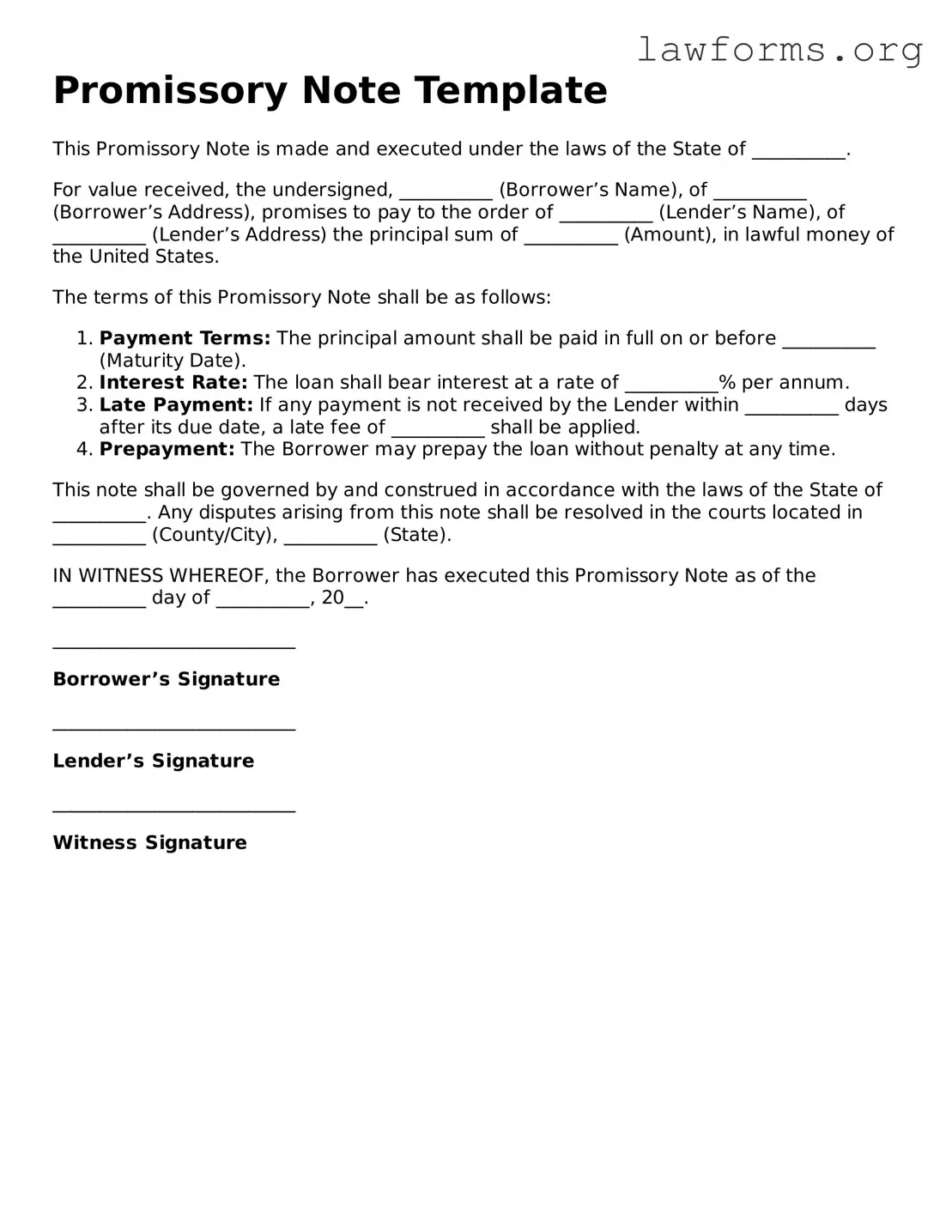

Preview - Promissory Note Form

Promissory Note Template

This Promissory Note is made and executed under the laws of the State of __________.

For value received, the undersigned, __________ (Borrower’s Name), of __________ (Borrower’s Address), promises to pay to the order of __________ (Lender’s Name), of __________ (Lender’s Address) the principal sum of __________ (Amount), in lawful money of the United States.

The terms of this Promissory Note shall be as follows:

- Payment Terms: The principal amount shall be paid in full on or before __________ (Maturity Date).

- Interest Rate: The loan shall bear interest at a rate of __________% per annum.

- Late Payment: If any payment is not received by the Lender within __________ days after its due date, a late fee of __________ shall be applied.

- Prepayment: The Borrower may prepay the loan without penalty at any time.

This note shall be governed by and construed in accordance with the laws of the State of __________. Any disputes arising from this note shall be resolved in the courts located in __________ (County/City), __________ (State).

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the __________ day of __________, 20__.

__________________________

Borrower’s Signature

__________________________

Lender’s Signature

__________________________

Witness Signature

Key takeaways

When filling out and using a Promissory Note form, keep these key takeaways in mind:

- Understand the Purpose: A Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed.

- Outline the Interest Rate: Include the interest rate, whether it’s fixed or variable, and how it will be calculated.

- Set a Repayment Schedule: Detail when payments are due, the frequency of payments, and the total duration of the loan.

- Include Late Fees: Specify any penalties for late payments to encourage timely repayment.

- State the Purpose of the Loan: Mention what the loan will be used for, if applicable, to clarify the agreement.

- Include Signatures: Both parties must sign and date the document to make it legally binding.

- Keep Copies: Make sure both parties retain a copy of the signed Promissory Note for their records.

- Consult Legal Advice: If unsure about any terms, seek legal advice to ensure the document meets all legal requirements.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. It serves as a contract between the borrower and the lender.

- Mortgage: A mortgage is a specific type of loan secured by real property. It includes similar elements to a promissory note, such as the borrower's promise to repay the loan, but also details the collateral involved.

- Personal Guarantee: This document involves a promise by an individual to repay a debt if the primary borrower defaults. It shares the basic principle of obligation found in a promissory note.

- Employee Handbook: To ensure that employees understand their rights and responsibilities, refer to our comprehensive Employee Handbook guidelines for clarity on workplace policies.

- Installment Agreement: An installment agreement lays out a plan for repayment over time, similar to a promissory note. It specifies the amounts and timing of payments.

- Credit Agreement: This document details the terms of credit extended to a borrower. Like a promissory note, it includes repayment terms and conditions, but often encompasses more complex arrangements.

- Security Agreement: A security agreement provides the lender with rights to specific collateral if the borrower defaults. It parallels a promissory note in terms of establishing obligations and rights.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It reflects the same intent to fulfill a financial obligation as a promissory note.