Valid Quitclaim Deed Form

State-specific Quitclaim Deed Documents

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any guarantees about the title's validity. |

| Use Cases | Commonly used in situations like transferring property between family members, clearing up title issues, or during divorce settlements. |

| State-Specific Forms | Each state may have its own specific quitclaim deed form. For example, in California, it is governed by California Civil Code Section 1092. |

| Title Guarantee | Unlike warranty deeds, quitclaim deeds do not provide any warranty or guarantee about the property's title, meaning the buyer assumes all risks. |

| Recording | To ensure the transfer is legally recognized, the quitclaim deed should be recorded with the appropriate county office where the property is located. |

| Revocation | Once a quitclaim deed is executed and recorded, it cannot be revoked unilaterally. The grantor cannot reclaim the property without the grantee's consent. |

Dos and Don'ts

When filling out a Quitclaim Deed form, it is important to approach the task with care. Here are four key actions to take and avoid:

- Do: Clearly identify the property being transferred. Include the address and any relevant legal descriptions.

- Do: Ensure that all parties involved are accurately named. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Do: Sign the document in the presence of a notary public. This step is crucial for the deed to be legally valid.

- Do: Keep a copy of the completed deed for your records. This can be helpful for future reference.

- Don't: Leave any sections blank. Every part of the form should be completed to avoid confusion or legal issues.

- Don't: Use vague descriptions of the property. Specificity is key to ensuring the deed is enforceable.

- Don't: Forget to check local laws. Different states may have specific requirements for Quitclaim Deeds.

- Don't: Rush the process. Take your time to review all information before submitting the form.

Create Popular Types of Quitclaim Deed Documents

Deed in Lieu of Foreclosure Meaning - Clear communication about the property's condition is crucial in a Deed in Lieu arrangement.

Free Lady Bird Deed Form - It is a practical approach to keeping family homes within the family line with minimal fuss.

For individuals in California, creating a Durable Power of Attorney form is crucial for ensuring that one's legal and financial decisions are handled by a trusted agent even during times of incapacity. This form not only provides peace of mind but also clarity in matters of authority and intention, making it imperative to understand the implications fully. For more information on how to obtain this vital document, you can visit https://californiadocsonline.com/durable-power-of-attorney-form.

California Corrective Deed - The Corrective Deed can clarify the names of property owners.

Common mistakes

-

Not including a legal description of the property. A quitclaim deed must contain a precise legal description. Failing to provide this can lead to confusion and disputes about what property is being transferred.

-

Incorrectly naming the parties involved. Ensure that all names are spelled correctly and match the names on the original property deed. Any discrepancies can invalidate the document.

-

Not signing the document in the required manner. All parties involved must sign the deed. If the signatures are missing or not properly notarized, the deed may not be legally recognized.

-

Forgetting to include the date of the transfer. The date is important for establishing when the ownership change takes effect. Omitting it can create legal complications later on.

-

Neglecting to check local requirements. Different states and counties may have specific rules regarding quitclaim deeds. Always verify local regulations to ensure compliance.

-

Failing to record the deed. After completing the quitclaim deed, it must be filed with the appropriate county office. Not recording it can leave the transfer unprotected and open to challenges.

Documents used along the form

A Quitclaim Deed is a legal document that transfers ownership of property from one party to another without any warranties. When dealing with property transactions, several other forms and documents may be necessary to ensure a smooth process. Below is a list of common documents that often accompany a Quitclaim Deed.

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. It offers more protection to the buyer compared to a Quitclaim Deed.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes assurances that the property has not been sold to anyone else and is free from encumbrances.

- Title Insurance Policy: This insurance protects the buyer against any future claims or disputes over property ownership. It is often required by lenders during the closing process.

- Property Transfer Tax Form: Many states require this form to be filed when property is transferred. It documents the sale price and calculates any applicable transfer taxes.

- Affidavit of Identity: This document verifies the identity of the parties involved in the transaction. It helps prevent fraud and ensures that the correct individuals are signing the deed.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document outlines all costs associated with the property transfer, including fees, taxes, and the final sale price.

- Power of Attorney: If one party cannot be present for the signing, a power of attorney allows another person to act on their behalf, facilitating the transfer process.

- Notice of Completion: This document is filed after construction or improvements on a property are completed, providing notice to all parties involved and protecting the owner’s rights.

- Marital Separation Agreement: To legally outline the terms of your separation, consider the comprehensive Marital Separation Agreement options available for ensuring mutual understanding and clarity.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

Each of these documents plays a crucial role in the property transfer process. They help protect the interests of both the buyer and seller, ensuring that the transaction is conducted legally and smoothly. Always consult with a professional to determine which documents are necessary for your specific situation.

Misconceptions

Understanding quitclaim deeds can be tricky. Here are ten common misconceptions about them:

- Quitclaim deeds transfer ownership completely. Many believe that a quitclaim deed transfers full ownership of a property. In reality, it only transfers the interest that the grantor has in the property, which may be none at all.

- Quitclaim deeds are only for divorces. While quitclaim deeds are often used in divorce settlements, they are also used in various situations, such as transferring property between family members or correcting title issues.

- Using a quitclaim deed is always risky. Some think that quitclaim deeds are inherently dangerous. They can be safe when used in appropriate situations, such as transferring property between trusted parties.

- Quitclaim deeds provide warranties. People sometimes assume that quitclaim deeds come with guarantees about the property. However, they do not provide any warranties or guarantees about the title.

- All states treat quitclaim deeds the same. Laws regarding quitclaim deeds can vary by state. It’s important to understand local laws and requirements when using this type of deed.

- A quitclaim deed can resolve all title issues. Some believe that a quitclaim deed can fix any title problem. However, it does not clear liens or other encumbrances on the property.

- Quitclaim deeds are only for real estate. While commonly used for real estate, quitclaim deeds can also be applied to other types of property, such as vehicles or personal property.

- Once a quitclaim deed is signed, it cannot be changed. Many think that a quitclaim deed is final and unchangeable. In some cases, it can be revoked or modified if all parties agree.

- Quitclaim deeds are complicated legal documents. Some people feel intimidated by quitclaim deeds. In fact, they are relatively straightforward and can often be completed without a lawyer, depending on the situation.

- Quitclaim deeds are only for family transfers. While they are frequently used among family members, quitclaim deeds can be used by anyone wishing to transfer property rights to another individual or entity.

By clarifying these misconceptions, individuals can make more informed decisions about using quitclaim deeds in their property transactions.

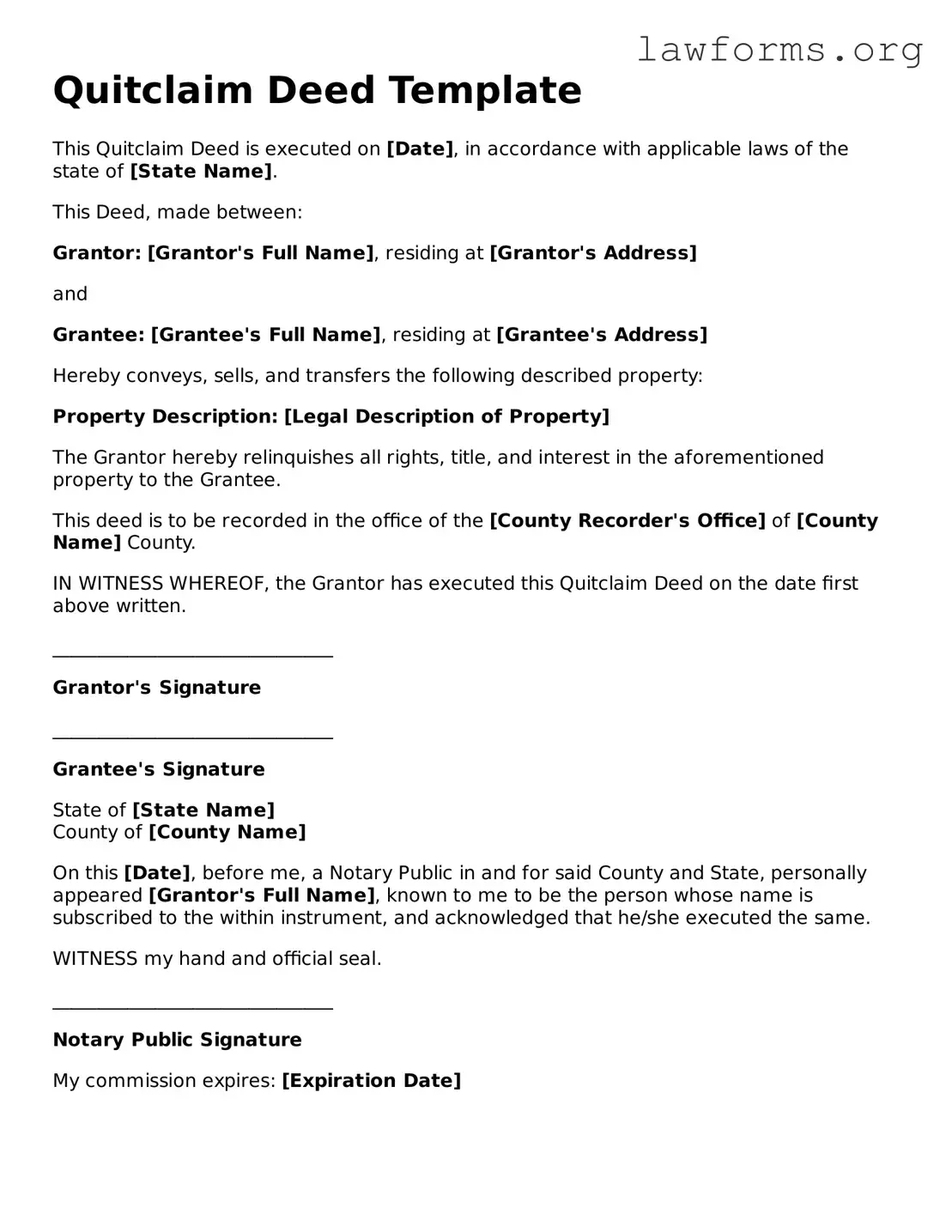

Preview - Quitclaim Deed Form

Quitclaim Deed Template

This Quitclaim Deed is executed on [Date], in accordance with applicable laws of the state of [State Name].

This Deed, made between:

Grantor: [Grantor's Full Name], residing at [Grantor's Address]

and

Grantee: [Grantee's Full Name], residing at [Grantee's Address]

Hereby conveys, sells, and transfers the following described property:

Property Description: [Legal Description of Property]

The Grantor hereby relinquishes all rights, title, and interest in the aforementioned property to the Grantee.

This deed is to be recorded in the office of the [County Recorder's Office] of [County Name] County.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the date first above written.

______________________________

Grantor's Signature

______________________________

Grantee's Signature

State of [State Name]

County of [County Name]

On this [Date], before me, a Notary Public in and for said County and State, personally appeared [Grantor's Full Name], known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

WITNESS my hand and official seal.

______________________________

Notary Public Signature

My commission expires: [Expiration Date]

Key takeaways

When filling out and using a Quitclaim Deed form, there are several important points to consider. Here are key takeaways to keep in mind:

- Understand the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without guaranteeing that the title is clear.

- Gather Necessary Information: Before filling out the form, collect details such as the legal description of the property, the names of the grantor and grantee, and the date of transfer.

- Complete the Form Accurately: Ensure that all fields are filled out correctly. Mistakes can lead to complications in the transfer process.

- Signatures Required: Both the grantor and the grantee must sign the Quitclaim Deed for it to be valid.

- Notarization May Be Necessary: Some states require the deed to be notarized. Check local regulations to ensure compliance.

- File with the Appropriate Office: After completing the form, submit it to the county recorder’s office where the property is located.

- Keep Copies for Your Records: Always retain a copy of the completed Quitclaim Deed for your personal records.

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and will defend against any claims. Unlike a quitclaim deed, it provides more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes assurances that the property is free from liens and encumbrances. It offers more security than a quitclaim deed.

- Special Warranty Deed: This type of deed provides limited warranties, covering only the period during which the seller owned the property. It is less comprehensive than a warranty deed but more protective than a quitclaim deed.

- Deed of Trust: Used in real estate transactions to secure a loan, this document involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose, it also transfers an interest in the property.

- Lease Agreement: This document allows a tenant to use a property for a specified time in exchange for rent. Although it doesn’t transfer ownership, it grants rights to use the property, similar to the transfer of interest in a quitclaim deed.

- Affidavit of Title: This document is a sworn statement confirming the seller's ownership and the absence of liens or claims. It provides assurance to the buyer, similar to the assurances found in a warranty deed.

- Bill of Sale: This document transfers ownership of personal property. While it differs from real estate transactions, it similarly conveys an interest in an asset.

-

Hold Harmless Agreement: This agreement is essential for protecting participants from liability during activities. For further details, refer to Forms Washington, which provides valuable templates and information regarding this type of legal document.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can be used in conjunction with a quitclaim deed to facilitate the transfer process.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it does not transfer ownership by itself, it lays the groundwork for the transfer, similar to the role of a quitclaim deed in finalizing ownership changes.