Valid Real Estate Purchase Agreement Form

State-specific Real Estate Purchase Agreement Documents

Real Estate Purchase Agreement Document Categories

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legally binding contract between a buyer and a seller outlining the terms of a property sale. |

| Key Components | This agreement typically includes details such as the purchase price, property description, closing date, and contingencies. |

| State Variations | Each state may have its own version of the agreement, adhering to specific real estate laws. For example, California's agreement follows the California Civil Code. |

| Importance | This document protects both parties by clearly outlining their rights and obligations during the sale process. |

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it’s important to approach the task carefully. Here are some dos and don’ts to consider:

- Do read the entire agreement before filling it out. Understanding the terms is crucial.

- Do provide accurate information. Inaccuracies can lead to complications later.

- Do consult with a real estate agent or attorney if you have questions. Professional guidance can be invaluable.

- Do ensure that all parties involved sign the agreement. A lack of signatures can invalidate the contract.

- Don’t rush through the process. Taking your time can prevent mistakes.

- Don’t leave blank spaces. Fill in all required fields to avoid delays.

- Don’t ignore contingencies. They protect you in case certain conditions aren’t met.

Popular Templates:

Parking Space Rental Agreement Pdf - Includes provisions for renewal or extension of the lease term.

In addition to the essential details outlined, utilizing resources like Forms Washington can further simplify the process of creating a Motorcycle Bill of Sale, ensuring all necessary information is captured accurately for both the buyer and seller.

Army Da 31 - There are no previous editions in use, so all requests must use this latest version.

Common mistakes

-

Incomplete Information: Buyers and sellers often leave sections blank. This can include critical details such as the purchase price, property address, or closing date. Omitting this information can lead to confusion and delays in the transaction process.

-

Incorrect Property Description: A common mistake is failing to provide an accurate description of the property. This can include incorrect lot numbers, missing square footage, or not specifying included fixtures. An unclear property description can create disputes later on.

-

Not Understanding Contingencies: Many people do not fully understand the contingencies included in the agreement. For example, a buyer might not realize that their offer is contingent upon financing or inspections. This misunderstanding can lead to unexpected issues if the contingencies are not met.

-

Ignoring Deadlines: Buyers and sellers sometimes overlook important deadlines outlined in the agreement. This includes dates for inspections, financing approval, or closing. Missing these deadlines can jeopardize the sale and may result in financial penalties.

-

Failure to Seek Professional Help: Some individuals attempt to fill out the agreement without consulting a real estate professional or attorney. This can lead to errors that might have been easily avoided with expert guidance. Professional assistance ensures that the agreement is completed accurately and in compliance with local laws.

Documents used along the form

When navigating the process of buying or selling a home, various forms and documents come into play alongside the Real Estate Purchase Agreement. Understanding these documents can help ensure a smoother transaction and protect your interests. Here’s a brief overview of some of the key forms you might encounter.

- Disclosure Statement: This document provides vital information about the property, including any known issues or defects. Sellers are often required to disclose specific details that could affect the buyer's decision.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is essential. It informs buyers of potential lead hazards and ensures they are aware of the risks associated with lead-based paint.

- Financing Addendum: If the buyer is obtaining a mortgage, this addendum outlines the terms of the financing. It can include details about loan amounts, interest rates, and any conditions tied to the financing.

- Title Report: This document reveals the legal ownership of the property and any liens or encumbrances that may exist. A clear title is crucial for a successful transaction.

- Hold Harmless Agreement: This important document protects one party from liability in real estate transactions, ensuring that risks are properly managed. For more information, visit californiadocsonline.com/hold-harmless-agreement-form/.

- Home Inspection Report: After an inspection, this report details the condition of the property. It highlights any necessary repairs and can influence negotiations between the buyer and seller.

- Appraisal Report: An appraisal determines the fair market value of the property. Lenders typically require this report to ensure the property is worth the loan amount being requested.

- Closing Disclosure: This document outlines the final terms of the mortgage, including the loan amount, interest rate, and closing costs. Buyers must receive this at least three days before closing.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It is recorded with the county to ensure public record of the new ownership.

Being familiar with these documents can empower you throughout the real estate transaction process. Each form plays a unique role in ensuring that both buyers and sellers are protected and informed, ultimately leading to a successful transfer of property ownership.

Misconceptions

When dealing with real estate transactions, misunderstandings can lead to costly mistakes. The Real Estate Purchase Agreement (RPA) is a crucial document, yet several misconceptions surround it. Here are four common myths to be aware of:

- Misconception 1: The RPA is just a formality.

- Misconception 2: Once signed, the RPA cannot be changed.

- Misconception 3: The RPA protects both buyers and sellers equally.

- Misconception 4: The RPA guarantees a successful transaction.

Many believe that the RPA is merely a formality, something to be signed without much thought. In reality, this document outlines the terms of the sale, including price, contingencies, and timelines. It’s essential to review it carefully.

Some think that signing the RPA locks both parties into the agreement without any possibility of modification. However, changes can be made if both parties agree to the amendments. Communication is key.

While the RPA serves both parties, it often favors the seller. Buyers should be aware of their rights and may need to negotiate specific terms to ensure their interests are adequately protected.

Signing the RPA does not guarantee that the sale will go through. Various factors, such as financing issues or inspection results, can derail the process. It’s important to remain vigilant and proactive throughout the transaction.

Understanding these misconceptions can help you navigate the real estate landscape more effectively. Always consult with a qualified professional to ensure that your interests are safeguarded.

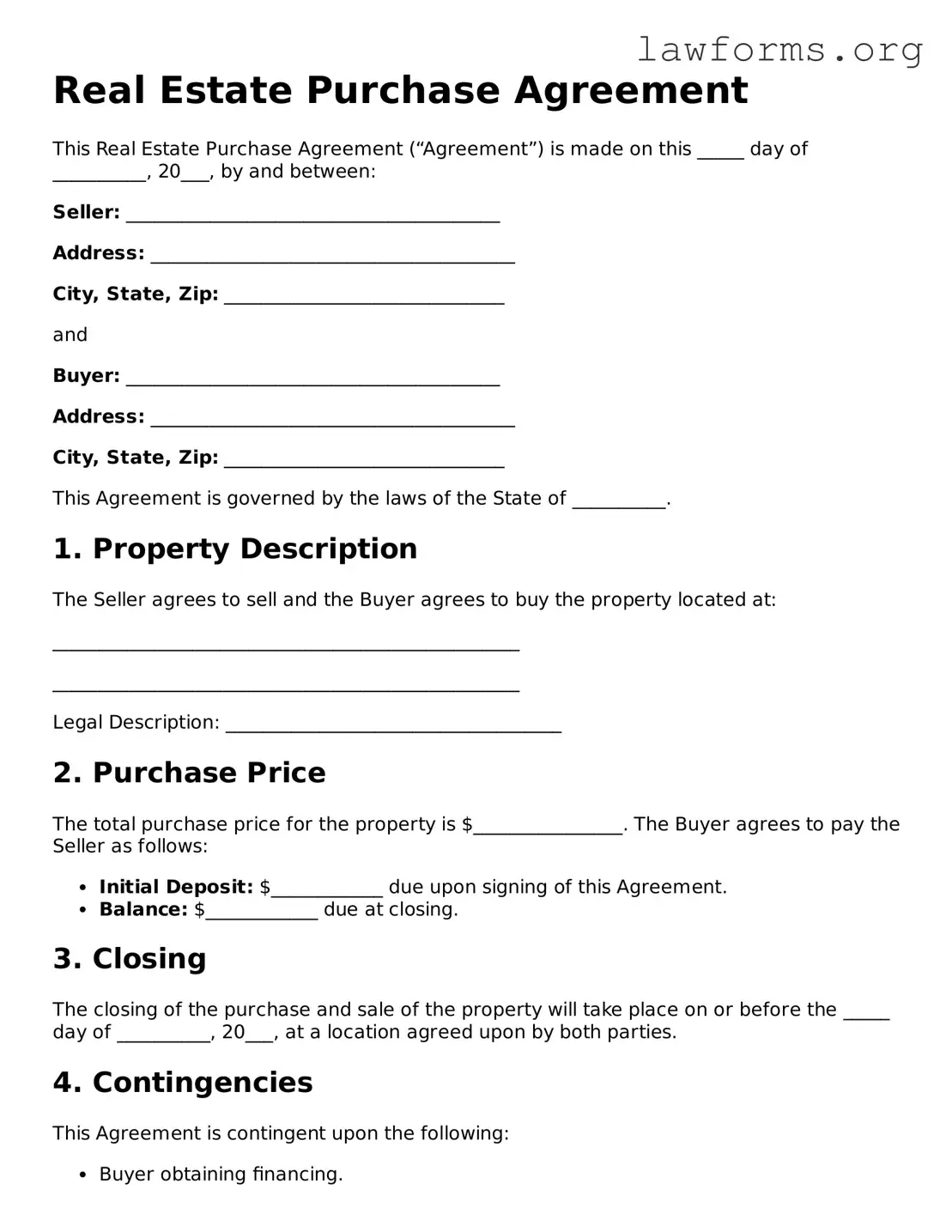

Preview - Real Estate Purchase Agreement Form

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made on this _____ day of __________, 20___, by and between:

Seller: ________________________________________

Address: _______________________________________

City, State, Zip: ______________________________

and

Buyer: ________________________________________

Address: _______________________________________

City, State, Zip: ______________________________

This Agreement is governed by the laws of the State of __________.

1. Property Description

The Seller agrees to sell and the Buyer agrees to buy the property located at:

__________________________________________________

__________________________________________________

Legal Description: ____________________________________

2. Purchase Price

The total purchase price for the property is $________________. The Buyer agrees to pay the Seller as follows:

- Initial Deposit: $____________ due upon signing of this Agreement.

- Balance: $____________ due at closing.

3. Closing

The closing of the purchase and sale of the property will take place on or before the _____ day of __________, 20___, at a location agreed upon by both parties.

4. Contingencies

This Agreement is contingent upon the following:

- Buyer obtaining financing.

- Property appraisal satisfactory to the Buyer.

- Inspection of the property.

5. Additional Terms

Any additional terms or conditions can be added here:

__________________________________________________

6. Signatures

The parties hereby agree to the terms outlined in this Agreement.

_____________________________ Seller's Signature

_____________________________ Date

_____________________________ Buyer's Signature

_____________________________ Date

Key takeaways

When filling out and using the Real Estate Purchase Agreement form, it is essential to keep several key points in mind to ensure a smooth transaction.

- Understand the purpose of the agreement; it outlines the terms and conditions of the sale.

- Accurate details about the property, including the address and legal description, are crucial.

- Both the buyer and seller must provide their full legal names and contact information.

- Include the purchase price and any earnest money deposits to demonstrate commitment.

- Clarify the closing date and any contingencies, such as financing or inspections.

- Review any additional terms, such as repairs or personal property included in the sale.

- Both parties should sign and date the agreement to make it legally binding.

- Keep a copy of the signed agreement for your records and future reference.

- Consult with a real estate agent or attorney if any questions arise during the process.

Similar forms

The Real Estate Purchase Agreement (REPA) is a critical document in the home buying process, but it shares similarities with several other important documents. Each of these documents serves a unique purpose while also playing a role in the real estate transaction. Here are eight documents that are similar to the REPA:

- Lease Agreement: This document outlines the terms under which a tenant can occupy a rental property. Like the REPA, it specifies the rights and responsibilities of both parties, including payment terms and duration of the agreement.

- Purchase and Sale Agreement: Often used interchangeably with the REPA, this document details the terms of a property sale. It includes information about the purchase price, closing date, and any contingencies, similar to the REPA.

- Notary Acknowledgement: Essential for verifying signatures, the Texas Notary Acknowledgement form is vital for ensuring authenticity and legal validity in document transactions.

- Option to Purchase Agreement: This document grants a potential buyer the exclusive right to purchase a property within a specified time frame. It shares the REPA's focus on the buyer’s rights and outlines conditions under which the purchase may occur.

- Real Estate Listing Agreement: This agreement is between a property owner and a real estate agent. It establishes the agent's authority to market the property, similar to how the REPA formalizes the buyer-seller relationship.

- Escrow Agreement: This document defines the terms under which an impartial third party holds funds or documents until certain conditions are met. Like the REPA, it ensures that both parties fulfill their obligations before the transaction is completed.

- Title Insurance Policy: This document protects against potential disputes over property ownership. It complements the REPA by ensuring that the buyer receives clear title to the property, thus safeguarding their investment.

- Disclosure Statement: Sellers often provide this document to inform buyers of any known issues with the property. It aligns with the REPA's emphasis on transparency and informed decision-making in real estate transactions.

- Closing Statement: This document summarizes the financial details of the transaction at closing. It includes the final costs and credits, much like the REPA, which outlines the agreed-upon price and terms of sale.

Understanding these documents can help buyers and sellers navigate the complexities of real estate transactions with greater confidence.