Valid Release of Promissory Note Form

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note is a document that formally releases a borrower from their obligation to repay a promissory note. |

| Purpose | This form is used to provide legal confirmation that a debt has been satisfied and that the lender relinquishes any claims against the borrower. |

| Governing Law | Each state has its own laws governing promissory notes, often found in the Uniform Commercial Code (UCC). |

| State-Specific Forms | Some states may require specific wording or formats for the release. Always check local laws. |

| Signatures Required | The release must be signed by the lender to be effective, indicating their agreement to release the borrower. |

| Notarization | In some jurisdictions, notarization of the release may be required to ensure its validity. |

| Record Keeping | Both parties should keep a copy of the release for their records to avoid future disputes. |

| Effect on Credit | Once the release is executed, it can positively impact the borrower’s credit, as it shows the debt is settled. |

Dos and Don'ts

When filling out the Release of Promissory Note form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Below are ten important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Do check for any required witnesses or notarization.

- Don't leave any required fields blank.

- Don't use white-out or erase any mistakes; instead, cross out errors neatly.

- Don't submit the form without reviewing it for accuracy.

- Don't ignore any specific instructions provided with the form.

- Don't rush through the process; take your time to ensure everything is correct.

Following these guidelines will help ensure that your Release of Promissory Note form is completed correctly and processed without delays.

Create Popular Types of Release of Promissory Note Documents

Online Promissory Note - Borrowers may use this note to manage their finances effectively while purchasing a car.

For those interested in securing a loan agreement in Texas, the straightforward Texas Promissory Note form provides a reliable framework to outline your terms for repayment effectively.

Common mistakes

-

Incorrect Names: Failing to use the full legal names of all parties involved can lead to confusion or disputes later. Ensure that names match those on the original promissory note.

-

Missing Signatures: Omitting signatures from all required parties invalidates the release. Every party must sign the form to confirm their agreement.

-

Wrong Date: Entering the wrong date can create complications. Always double-check that the date reflects when the release is being executed.

-

Inaccurate Payment Details: If the payment amount or terms are incorrect, it can lead to misunderstandings. Verify that all financial details match the original agreement.

-

Not Notarizing: Some jurisdictions require notarization for the release to be legally binding. Failing to notarize can render the document ineffective.

-

Improper Formatting: Using an incorrect format can cause delays or rejections. Follow the specified format closely to ensure acceptance.

-

Neglecting to Keep Copies: Not keeping a copy of the signed release can lead to issues in the future. Always retain a copy for your records.

-

Ignoring State-Specific Requirements: Different states may have unique requirements for releasing a promissory note. Research and comply with local laws to avoid problems.

-

Rushing the Process: Filling out the form in haste often leads to mistakes. Take your time to review each section carefully before submitting.

Documents used along the form

The Release of Promissory Note form is an important document that signifies the end of a loan agreement and confirms that the borrower has fulfilled their obligations. However, it often accompanies several other forms and documents that help clarify the terms of the loan, protect the parties involved, and ensure proper record-keeping. Below is a list of related documents that you may encounter in conjunction with the Release of Promissory Note.

- Promissory Note: This is the original document that outlines the borrower's promise to repay a loan. It includes details like the loan amount, interest rate, repayment schedule, and any consequences of default.

- Loan Agreement: This comprehensive document details the terms and conditions of the loan. It covers aspects such as collateral, payment terms, and what happens in case of default, providing a clear framework for both parties.

- Collateral Agreement: If the loan is secured by collateral, this document specifies what assets are being used as security. It protects the lender's interests in case the borrower defaults.

- Release of Lien: This document is used to formally remove any lien placed on the borrower's property as security for the loan. It is essential for clearing the borrower's title after the debt is settled.

- Affidavit of Payment: This sworn statement confirms that the borrower has made all required payments. It serves as additional proof for both parties and can be useful in case of disputes.

- Editable Promissory Note: For those seeking flexibility in their agreements, an editable version of the promissory note can be beneficial. You can find a useful resource for this at newjerseyformspdf.com/editable-promissory-note, allowing borrowers and lenders to customize terms as necessary.

- Notice of Default: If a borrower fails to meet their obligations, this document notifies them of their default status. It outlines the steps needed to remedy the situation and is often a precursor to further legal action.

Understanding these documents can help both borrowers and lenders navigate the complexities of loan agreements. Each plays a vital role in ensuring that the terms are clear and that all parties are protected throughout the lending process.

Misconceptions

Understanding the Release of Promissory Note form is crucial for anyone involved in lending or borrowing. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- The form is only necessary for large loans. Many believe that the Release of Promissory Note form is only required for significant amounts. In reality, it is important for any loan, regardless of size, to document the release of the borrower's obligation.

- Once a promissory note is signed, it cannot be changed. Some think that a signed promissory note is set in stone. However, modifications can be made if both parties agree and document the changes properly.

- The form is only for personal loans. It is a common misconception that this form applies solely to personal loans. In truth, it is relevant for business loans and other financial agreements as well.

- Filing the form is unnecessary if the loan is paid off. Some borrowers believe that simply paying off the loan negates the need for a release. However, without the formal release, the lender may still hold a claim on the debt.

- The form is complicated and requires legal assistance. Many fear that completing the form requires a lawyer. While legal advice can be helpful, the form is generally straightforward and can often be completed by the parties involved.

By addressing these misconceptions, individuals can better navigate the process of releasing a promissory note and ensure their financial agreements are clear and legally binding.

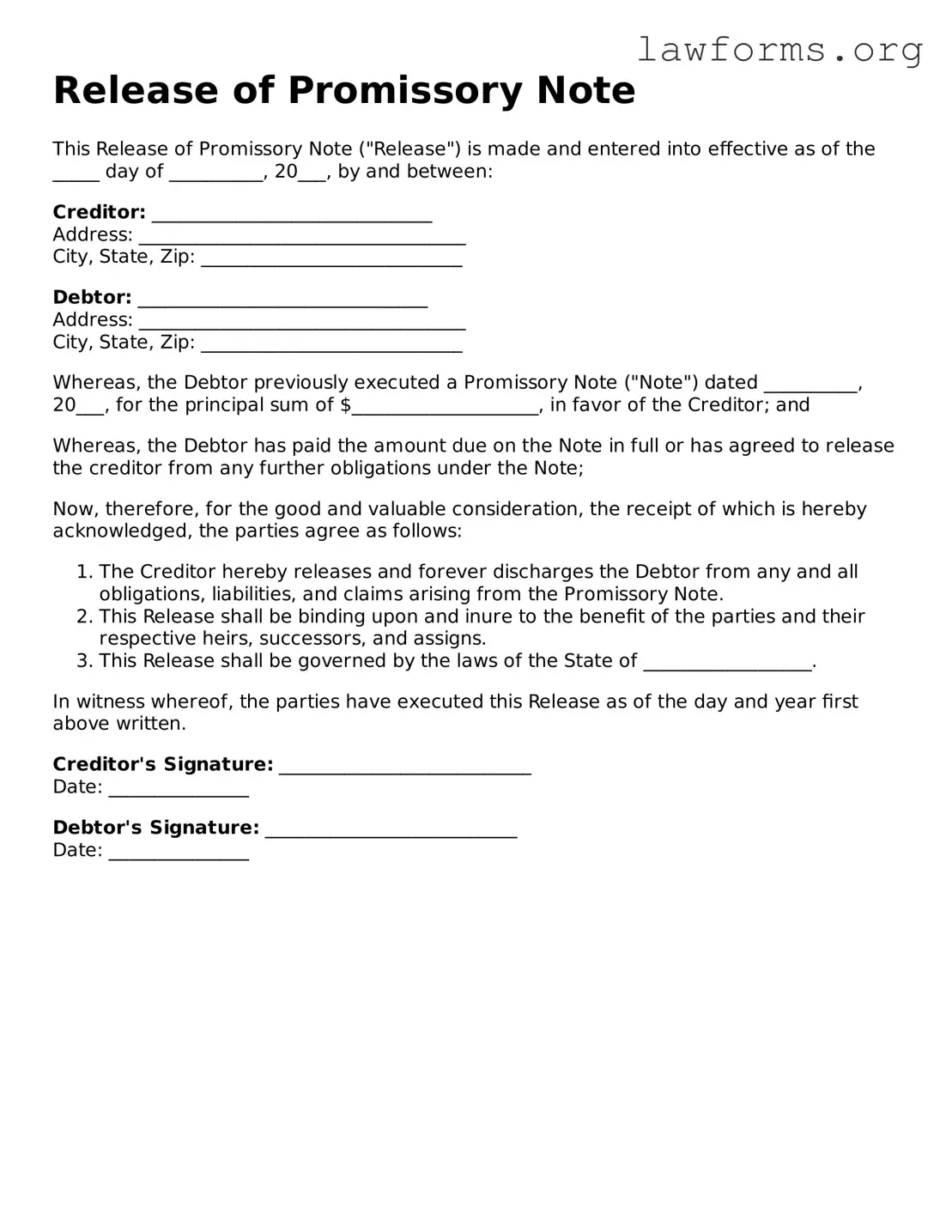

Preview - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note ("Release") is made and entered into effective as of the _____ day of __________, 20___, by and between:

Creditor: ______________________________

Address: ___________________________________

City, State, Zip: ____________________________

Debtor: _______________________________

Address: ___________________________________

City, State, Zip: ____________________________

Whereas, the Debtor previously executed a Promissory Note ("Note") dated __________, 20___, for the principal sum of $____________________, in favor of the Creditor; and

Whereas, the Debtor has paid the amount due on the Note in full or has agreed to release the creditor from any further obligations under the Note;

Now, therefore, for the good and valuable consideration, the receipt of which is hereby acknowledged, the parties agree as follows:

- The Creditor hereby releases and forever discharges the Debtor from any and all obligations, liabilities, and claims arising from the Promissory Note.

- This Release shall be binding upon and inure to the benefit of the parties and their respective heirs, successors, and assigns.

- This Release shall be governed by the laws of the State of __________________.

In witness whereof, the parties have executed this Release as of the day and year first above written.

Creditor's Signature: ___________________________

Date: _______________

Debtor's Signature: ___________________________

Date: _______________

Key takeaways

When filling out and using the Release of Promissory Note form, it is essential to understand the following key points:

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This information is crucial for legal clarity.

- Specify the Note Details: Include the original promissory note's date, amount, and any relevant identifiers. This ensures that the release is tied to the correct document.

- Provide Clear Release Language: The form should contain explicit language indicating that the promissory note is being released. This helps prevent future disputes.

- Signatures Are Essential: Both parties must sign the form. Without signatures, the release may not be considered valid.

- Keep Copies: After completing the form, retain copies for your records. This documentation is important for future reference.

Understanding these aspects will help ensure that the Release of Promissory Note form is filled out correctly and used effectively.

Similar forms

The Release of Promissory Note form serves a specific purpose in financial transactions, particularly in releasing a borrower from the obligation of a promissory note. Several other documents share similarities with this form, each playing a role in confirming the release of obligations or rights. Below are four documents that are similar to the Release of Promissory Note form:

- Release of Mortgage: This document is used to release a borrower from the obligations of a mortgage. Just as the Release of Promissory Note frees the borrower from the note, the Release of Mortgage indicates that the borrower has fulfilled their obligations, and the lender relinquishes their claim to the property.

- Promissory Note: Essential for establishing loan terms in Florida, this document details the repayment plan and can be customized using resources from All Florida Forms.

- Settlement Agreement: A settlement agreement resolves disputes between parties, often involving the release of claims. Similar to the Release of Promissory Note, it signifies that one party is no longer liable for certain obligations, thus providing closure to the involved parties.

- Debt Satisfaction Letter: This letter confirms that a debt has been paid in full. Like the Release of Promissory Note, it provides evidence that the borrower has met their financial obligations, effectively releasing them from further claims regarding that debt.

- Discharge of Liability: This document releases an individual or entity from any future claims or obligations related to a specific matter. It functions similarly to the Release of Promissory Note by ensuring that the party is no longer held accountable for the obligations outlined in the original agreement.