Valid Single-Member Operating Agreement Form

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to protect the owner's personal assets by establishing the LLC as a separate legal entity. |

| Governing Laws | The governing laws for Single-Member Operating Agreements vary by state. For instance, in Delaware, it is governed by Title 6, Chapter 18 of the Delaware Code. |

| Importance | Having an operating agreement, even for a single-member LLC, is crucial for clarifying the business's operations and can help in resolving disputes. |

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it's important to keep a few key points in mind. Here are some dos and don'ts to guide you:

- Do provide accurate information about your business.

- Do clearly outline your ownership structure.

- Don't leave any sections blank; incomplete forms can lead to issues.

- Don't rush through the process; take your time to ensure everything is correct.

Common mistakes

-

Neglecting to Include Essential Information: Many individuals overlook key details such as the name of the LLC, the registered agent, and the business address. This information is crucial for legal identification and communication purposes.

-

Failing to Specify Management Structure: A common mistake is not clearly defining how the LLC will be managed. Even in a single-member LLC, stating whether the owner will manage the business or if a manager will be appointed is important for clarity.

-

Inadequate Capital Contributions: Some people do not accurately document their initial capital contributions. It’s vital to specify how much money or assets are being invested in the LLC to establish ownership percentages and financial expectations.

-

Omitting a Dissolution Clause: Many forget to include terms for dissolving the LLC. This clause outlines the process for winding up the business, which can prevent confusion or disputes in the future.

Documents used along the form

A Single-Member Operating Agreement is an essential document for a sole proprietorship structured as a limited liability company (LLC). It outlines the management structure and operational procedures for the business. In addition to this agreement, several other forms and documents are commonly used to support the establishment and ongoing operation of the LLC. Below is a list of these documents, each serving a unique purpose.

- Articles of Organization: This document is filed with the state to formally establish the LLC. It includes basic information such as the business name, address, and the names of the members.

- Employer Identification Number (EIN): An EIN is obtained from the IRS and is necessary for tax purposes. It allows the LLC to hire employees and open a business bank account.

- Operating Agreement (Multi-Member): For LLCs with more than one member, this agreement outlines each member's rights, responsibilities, and profit-sharing arrangements.

- Membership Certificate: This document serves as proof of ownership in the LLC. It may be issued to members to signify their stake in the business.

- Operating Agreement Form: To ensure your LLC operates smoothly, utilize the comprehensive Operating Agreement form resources for clear guidelines and legal compliance.

- Bylaws: While not always required, bylaws can provide additional structure to the LLC. They outline the rules for managing the company and conducting meetings.

- State Business Licenses: Depending on the type of business and location, various licenses may be required to legally operate. These can include health permits, zoning permits, and more.

- Meeting Minutes: Keeping a record of meetings can be essential for maintaining transparency and accountability within the LLC. Minutes document decisions made and actions taken during meetings.

- Annual Reports: Many states require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the business and its members.

- Bank Resolution: This document authorizes specific individuals to act on behalf of the LLC in banking matters, such as opening accounts or applying for loans.

Each of these documents plays a crucial role in the formation and management of an LLC. Ensuring that they are properly completed and maintained can help establish a solid foundation for the business and facilitate smooth operations.

Misconceptions

There are several misconceptions about the Single-Member Operating Agreement form that can lead to confusion for business owners. Here are five common misunderstandings:

- It's only necessary for larger businesses. Many believe that only corporations or larger entities require an operating agreement. In reality, even single-member LLCs benefit from having one. It outlines the structure and operations of the business, providing clarity and legal protection.

- It’s a legal requirement in all states. While some states do not mandate a single-member operating agreement, having one is still highly recommended. It helps define ownership and management, which can be crucial for tax purposes and liability protection.

- It needs to be filed with the state. Some people think that the operating agreement must be submitted to state authorities. However, this document is typically kept internal and does not require filing. It serves as a private record of the business's operational guidelines.

- It cannot be modified once created. There is a misconception that once an operating agreement is drafted, it cannot be changed. In fact, it can and should be updated as the business evolves or as circumstances change. Flexibility is key to maintaining relevance.

- It’s just a formality. Some may view the operating agreement as a mere formality that holds little significance. On the contrary, it plays a vital role in defining the business’s structure and can help prevent disputes down the line. It’s an important tool for clarity and protection.

Understanding these misconceptions can help single-member LLC owners make informed decisions about their operating agreements and ensure their businesses are well-structured and protected.

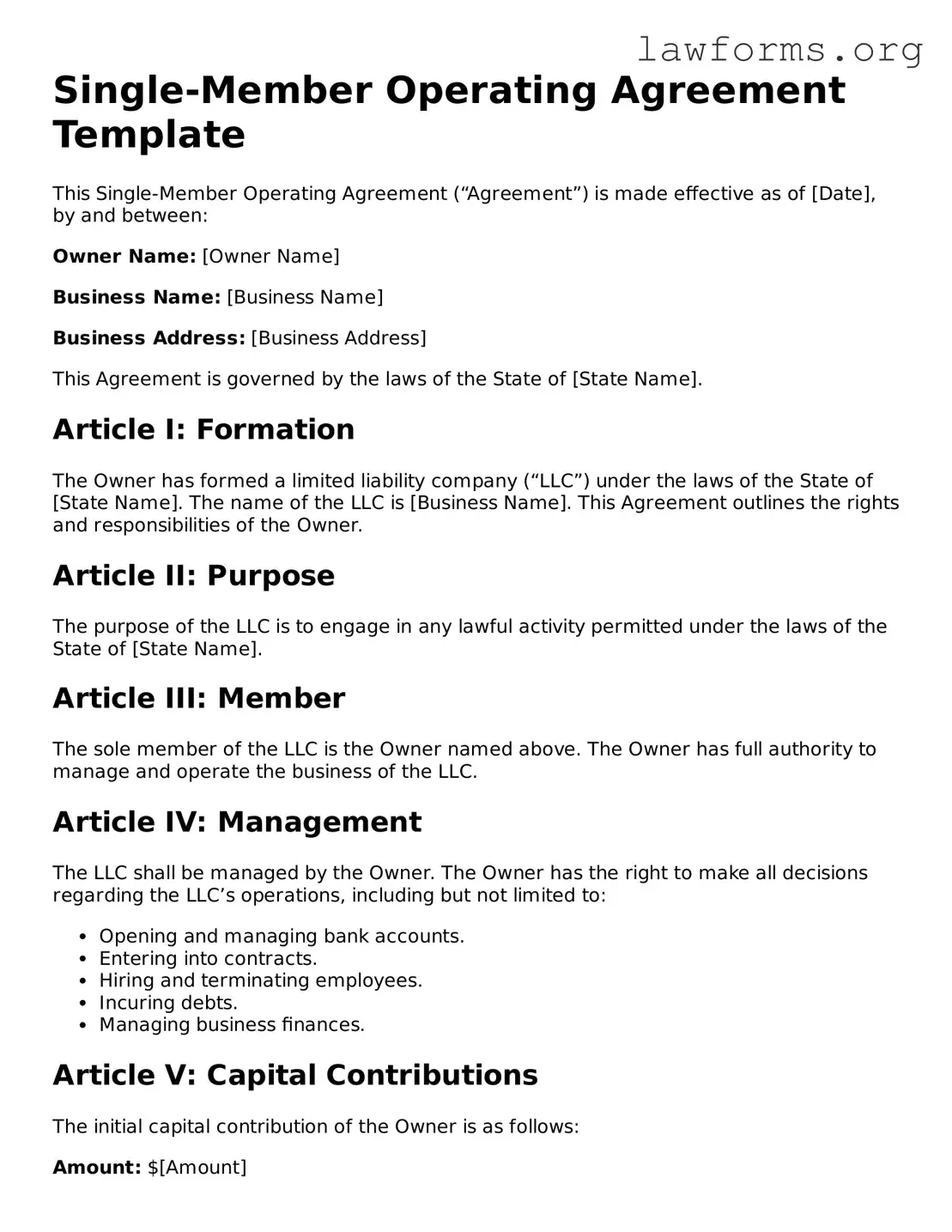

Preview - Single-Member Operating Agreement Form

Single-Member Operating Agreement Template

This Single-Member Operating Agreement (“Agreement”) is made effective as of [Date], by and between:

Owner Name: [Owner Name]

Business Name: [Business Name]

Business Address: [Business Address]

This Agreement is governed by the laws of the State of [State Name].

Article I: Formation

The Owner has formed a limited liability company (“LLC”) under the laws of the State of [State Name]. The name of the LLC is [Business Name]. This Agreement outlines the rights and responsibilities of the Owner.

Article II: Purpose

The purpose of the LLC is to engage in any lawful activity permitted under the laws of the State of [State Name].

Article III: Member

The sole member of the LLC is the Owner named above. The Owner has full authority to manage and operate the business of the LLC.

Article IV: Management

The LLC shall be managed by the Owner. The Owner has the right to make all decisions regarding the LLC’s operations, including but not limited to:

- Opening and managing bank accounts.

- Entering into contracts.

- Hiring and terminating employees.

- Incuring debts.

- Managing business finances.

Article V: Capital Contributions

The initial capital contribution of the Owner is as follows:

Amount: $[Amount]

Article VI: Profits and Losses

All profits and losses shall be allocated solely to the Owner. Distributions shall be made at the discretion of the Owner.

Article VII: Indemnification

The LLC will indemnify the Owner to the fullest extent permitted by law from any losses, liabilities, or expenses incurred in the course of the business operations.

Article VIII: Amendments

This Agreement may be amended only in writing and must be signed by the Owner.

Article IX: Miscellaneous

- This Agreement binds and benefits the Owner and their successors, representatives, and assigns.

- If any part of this Agreement is found to be invalid, the remaining sections will remain in full force.

- This Agreement constitutes the entire understanding between the Owner and the LLC.

IN WITNESS WHEREOF, the undersigned has executed this Single-Member Operating Agreement as of the day and year first above written.

Owner Signature: ___________________________

Date: _____________________

Key takeaways

When filling out and using the Single-Member Operating Agreement form, consider the following key takeaways:

- Understand the Purpose: This agreement outlines the structure and rules for your single-member LLC. It serves as a formal document that can help protect your personal assets.

- Detail Your Business Operations: Clearly define how your business will operate. Include information about management, decision-making processes, and financial arrangements.

- Maintain Compliance: Keep this agreement updated to reflect any changes in your business. This will ensure compliance with state laws and regulations.

- Use It as a Reference: The agreement can serve as a reference for you and any potential investors or lenders. It demonstrates professionalism and organization.

Similar forms

- Partnership Agreement: Similar to a Single-Member Operating Agreement, this document outlines the roles, responsibilities, and profit-sharing arrangements between partners in a business. It defines how decisions are made and how disputes are resolved.

- Bylaws: Bylaws govern the internal management of a corporation. Like an Operating Agreement, they detail the structure of the organization, including the roles of officers and procedures for meetings.

- Articles of Incorporation: This document establishes a corporation's existence. While an Operating Agreement is used for LLCs, Articles of Incorporation serve a similar purpose for corporations by outlining the structure and purpose of the business.

- Operating Agreement: As a pivotal document for New York-based LLCs, an Formaid Org ensures clarity in operational procedures, financial decisions, and member responsibilities, making it essential for avoiding conflicts among members.

- Shareholder Agreement: This document is used by corporations with multiple shareholders. It specifies the rights and obligations of shareholders, much like an Operating Agreement defines the rights of a single member in an LLC.

- Joint Venture Agreement: This agreement outlines the terms of a partnership between two or more parties. It shares similarities with an Operating Agreement by detailing the management structure and profit distribution for the joint venture.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can complement an Operating Agreement by protecting sensitive information shared within the business. Both documents establish clear guidelines for business operations.

- Business Plan: A business plan outlines the goals, strategies, and financial projections for a business. Like an Operating Agreement, it serves as a roadmap for the business's future, detailing how it will operate and grow.

- Employment Agreement: This document outlines the terms of employment for individuals within the company. Similar to an Operating Agreement, it specifies roles, responsibilities, and expectations for employees.

- Franchise Agreement: This agreement governs the relationship between a franchisor and franchisee. Like an Operating Agreement, it establishes the terms of operation, including fees, obligations, and rights of both parties.