Fill Out a Valid Stock Transfer Ledger Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Stock Transfer Ledger form is used to track the issuance and transfer of shares within a corporation, ensuring accurate record-keeping for ownership changes. |

| Required Information | This form requires details such as the corporation's name, stockholder's name and residence, certificate numbers, and the number of shares issued and transferred. |

| Legal Framework | In the United States, the use of a Stock Transfer Ledger is governed by state corporate laws, which vary by state. For example, in Delaware, the Delaware General Corporation Law outlines requirements for stock records. |

| Importance of Accuracy | Maintaining an accurate Stock Transfer Ledger is crucial for legal compliance and helps prevent disputes over stock ownership, ensuring that all transactions are documented correctly. |

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. Here are ten important do's and don'ts to guide you through the process:

- Do enter the corporation’s name clearly at the top of the form.

- Don't leave any sections blank; all fields must be completed.

- Do provide accurate information about the stockholder’s name and place of residence.

- Don't use abbreviations or nicknames for the stockholder’s name.

- Do list the certificates issued along with their corresponding certificate numbers.

- Don't forget to specify the date when the shares were issued.

- Do indicate from whom the shares were transferred, noting "original issue" if applicable.

- Don't overlook the amount paid for the shares; this information is essential.

- Do include the date of transfer for each transaction.

- Don't forget to surrender the certificates and note their numbers accurately.

Completing the Stock Transfer Ledger form correctly ensures a smooth process for all parties involved. Double-checking your entries can prevent potential issues down the line.

Other PDF Documents

Cg 2010 - This form should be read carefully to understand the endorsements.

Contractor Roof Certification Form - The certification is valid for two years from the inspection date.

The Illinois 45 form, essential for reporting workplace injuries, is a document every employer should be familiar with to maintain compliance with state regulations. Filling out this form accurately is paramount, as it not only provides necessary details about the incident but also supports the injured employee’s claim for workers' compensation benefits. To ensure you adhere to these requirements and protect your workforce, refer to the guidelines available at https://formsillinois.com/ for assistance in completing the form correctly.

Bbb Complaint Form - The company did not resolve my issue satisfactorily.

Common mistakes

-

Neglecting to Enter the Corporation’s Name: One of the most common mistakes is failing to fill in the corporation’s name at the top of the form. This simple oversight can lead to confusion and may invalidate the entire transfer process.

-

Incorrectly Filling Out Stockholder Information: When entering the name and place of residence of the stockholder, accuracy is crucial. Misspellings or incomplete addresses can cause issues in identifying the rightful owner of the shares.

-

Omitting Transfer Details: The form requires specific information about the shares being transferred. People often forget to include the certificate numbers and the number of shares involved. This omission can delay the transfer or lead to disputes about ownership.

-

Failing to Document Payment Information: It’s essential to indicate the amount paid for the shares being transferred. Some individuals overlook this step, which can create ambiguity regarding the transaction and potentially raise legal questions in the future.

Documents used along the form

The Stock Transfer Ledger form is a vital document for any corporation that manages stock issuance and transfers. However, it is often accompanied by several other forms and documents that help streamline the stock transfer process and maintain accurate records. Below is a list of commonly used forms that complement the Stock Transfer Ledger.

- Stock Certificate: This document serves as proof of ownership for shares in a corporation. Each stockholder receives a certificate that details the number of shares owned, the corporation's name, and other relevant information. It is essential for transferring ownership.

- Stock Power Form: This is a legal document that allows a stockholder to transfer shares to another person. The form typically includes the names of both the transferor and the transferee, along with the number of shares being transferred. It must be signed by the current owner.

- Motor Vehicle Bill of Sale: This essential form documents the sale of a vehicle between individuals in Pennsylvania. It details the transaction, including price and date, and serves as proof of ownership transfer. For complete accuracy and legality in your vehicle sale, click here to get the form.

- Corporate Resolution: This document is created by the board of directors to authorize specific actions, such as the transfer of shares. It outlines the decision made by the board and serves as a formal record of the approval process.

- Shareholder Agreement: This is a contract among shareholders that outlines the rights and responsibilities of each party. It often includes provisions related to the transfer of shares, ensuring that all shareholders are on the same page regarding ownership changes.

- Form 1099-DIV: This tax form is used to report dividends and distributions to shareholders. It is essential for tax purposes and provides stockholders with the information they need to accurately report their income.

- Transfer Agent Agreement: This document outlines the relationship between a corporation and its transfer agent, the entity responsible for managing the transfer of stock. It details the services provided and the fees associated with those services.

These documents play crucial roles in ensuring that stock transfers are conducted smoothly and in compliance with legal requirements. Understanding each form’s purpose can significantly enhance the efficiency of managing stock ownership and transfers.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion. Here are nine common misunderstandings:

- The form is only for large corporations. Many believe that only large companies need a Stock Transfer Ledger. In reality, any corporation, regardless of size, should maintain this record.

- It is not necessary if the corporation has few shareholders. Some think that a small number of shareholders eliminates the need for this form. However, it is still essential to track ownership accurately.

- The form is only relevant during stock transfers. While it is crucial during transfers, the ledger also serves as a historical record of stock issuance and ownership.

- Completing the form is optional. Many assume that filling out this form is not mandatory. In fact, maintaining a Stock Transfer Ledger is often a legal requirement.

- Only the secretary of the corporation can fill it out. There is a belief that only one person is authorized to complete the ledger. In truth, any designated officer can manage this task.

- Once filled out, the ledger does not need to be updated. Some think that the ledger is static. It must be updated regularly to reflect all transfers and issuances.

- It is the same as a stock certificate. People often confuse the Stock Transfer Ledger with stock certificates. They serve different purposes and should not be mixed up.

- The ledger only tracks shares, not financial transactions. There is a misconception that the ledger focuses solely on share ownership. It also records the amounts paid for shares, which is vital for financial tracking.

- It can be maintained informally. Some believe that informal records suffice. However, a formalized ledger is necessary for legal and organizational purposes.

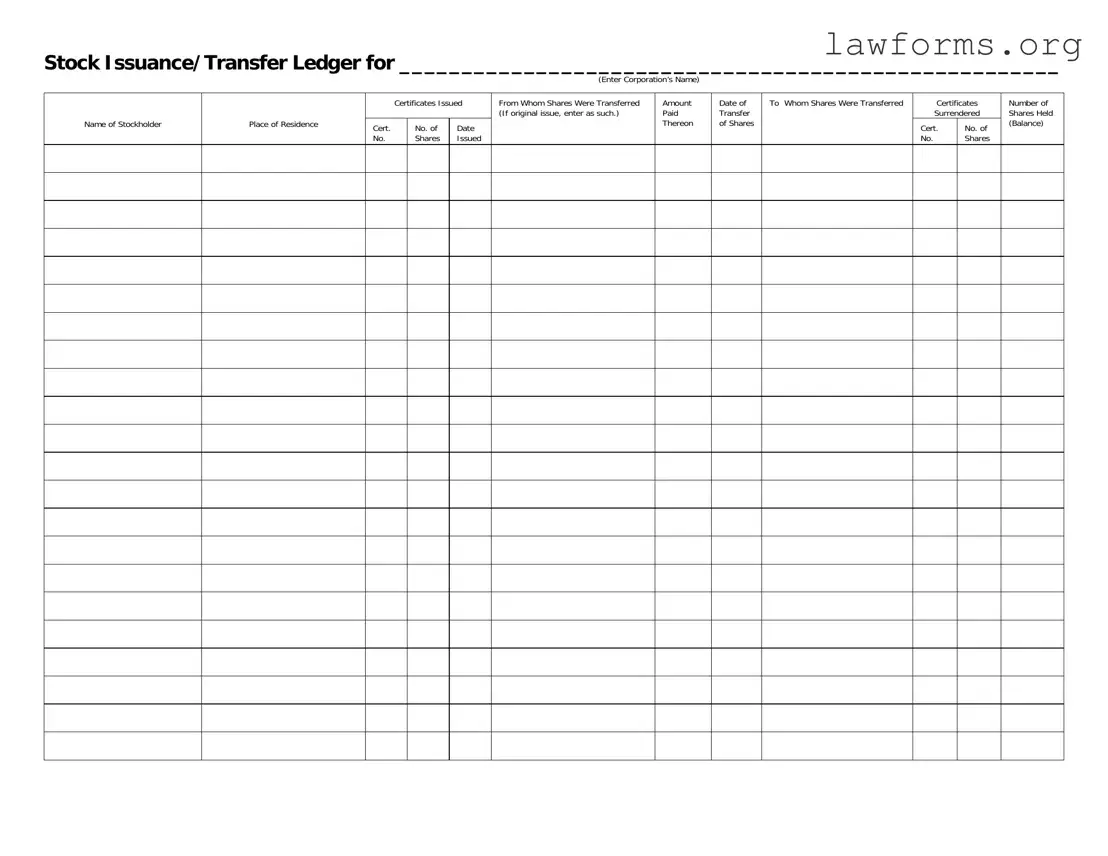

Preview - Stock Transfer Ledger Form

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Key takeaways

When filling out the Stock Transfer Ledger form, it is essential to keep several key points in mind. Here are some important takeaways to ensure accuracy and compliance:

- Complete Corporation Name: Always enter the full name of the corporation at the top of the form. This helps identify the entity associated with the stock transfer.

- Accurate Stockholder Information: Provide the full name and place of residence of the stockholder. This information is crucial for record-keeping.

- Certificate Details: Record the certificate numbers and the date of issuance accurately. This information links the shares to the stockholder.

- Transfer Details: Clearly indicate from whom the shares were transferred. If it is the original issue, specify that to avoid confusion.

- Payment Information: Document the amount paid for the shares. This ensures transparency in financial transactions.

- Date of Transfer: Always include the date when the transfer occurred. This establishes a timeline for ownership changes.

- Recipient Information: Specify to whom the shares were transferred. This is important for updating ownership records.

- Certificates Surrendered: If applicable, note the certificate numbers of any shares that were surrendered during the transfer process.

By following these guidelines, you can effectively manage stock transfers and maintain accurate records within the Stock Transfer Ledger.

Similar forms

The Stock Transfer Ledger form is an important document used to track the issuance and transfer of shares within a corporation. Several other documents serve similar purposes in managing stock transactions and shareholder information. Below is a list of eight documents that share similarities with the Stock Transfer Ledger form:

- Stock Certificate: This document serves as proof of ownership of shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the corporation's name, similar to how the Stock Transfer Ledger records ownership and transfers.

- Shareholder Agreement: This document outlines the rights and responsibilities of shareholders. It often includes provisions regarding the transfer of shares, much like the Stock Transfer Ledger tracks share transfers and ownership changes.

- Corporate Bylaws: These are the rules governing the internal management of a corporation. They typically include guidelines for issuing and transferring shares, paralleling the purpose of the Stock Transfer Ledger.

- Cease and Desist Letter: This legal document is essential for formally requesting that a party stop certain harmful actions. Understanding its proper use can be crucial for protecting one's rights and interests, as demonstrated by templates available from Forms Washington.

- Stock Option Agreement: This document grants employees the right to purchase shares at a set price. It contains details about the shares, similar to how the Stock Transfer Ledger records share issuance and ownership.

- Dividend Distribution Record: This document tracks the distribution of dividends to shareholders. It relates to the Stock Transfer Ledger as both involve managing shareholder equity and ownership records.

- Form 1099-DIV: This tax form reports dividends and distributions to shareholders. It connects to the Stock Transfer Ledger by providing financial information about shares held and transferred.

- Annual Shareholder Meeting Minutes: These minutes document decisions made during shareholder meetings, including share transfers. They complement the Stock Transfer Ledger by providing context for ownership changes.

- Transfer Agent Records: Transfer agents maintain records of stock ownership and transfer. Their records align with the Stock Transfer Ledger by tracking who owns shares and any changes in ownership.