Attorney-Approved Affidavit of Death Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Affidavit of Death form is used to legally declare the death of an individual. |

| Governing Law | This form is governed by Texas Estates Code, Title 2, Chapter 204. |

| Who Can File | Any interested party, such as a family member or executor, may file the affidavit. |

| Required Information | The form must include the deceased’s full name, date of death, and place of death. |

| Signature Requirement | The affidavit must be signed by the individual filing it, affirming the truth of the information provided. |

| Filing Location | The affidavit should be filed in the county where the deceased resided at the time of death. |

| Notarization | A notary public must witness the signing of the affidavit to ensure its validity. |

| Effect on Estate | Filing this affidavit may help to settle the deceased's estate and facilitate the transfer of assets. |

| Public Record | Once filed, the affidavit becomes part of the public record and can be accessed by interested parties. |

| Deadline | There is no strict deadline for filing the affidavit, but timely filing is recommended to avoid complications. |

Dos and Don'ts

When filling out the Texas Affidavit of Death form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to keep in mind:

- Do: Provide accurate and complete information about the deceased.

- Do: Sign the affidavit in the presence of a notary public.

- Do: Include the date of death and any relevant details.

- Do: Double-check for any spelling errors before submitting.

- Don't: Leave any required fields blank.

- Don't: Use white-out or any correction fluid on the form.

- Don't: Submit the form without a notary's signature and seal.

Create Popular Affidavit of Death Forms for Different States

What Happens When a Joint Tenant Dies in California - The use of the Affidavit of Death is essential for ensuring that personal and family matters are resolved appropriately.

The Ohio Residential Lease Agreement is a legally binding document that outlines the terms and conditions between a landlord and a tenant for renting residential property in Ohio. This form serves as a crucial tool for both parties, ensuring clarity and protection of their rights. For those looking to access the form easily, Ohio PDF Forms provides a convenient online resource, helping to foster a positive rental experience.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out essential details. Ensure that all sections of the form are filled out completely. Missing information can lead to delays in processing.

-

Incorrect Signatures: The affidavit must be signed by the correct individual. If the person who is signing is not the right party, the document may be deemed invalid. Verify that the signature matches the name on the form.

-

Improper Notarization: Failing to have the affidavit properly notarized is another frequent error. A notary public must witness the signing. Without this step, the affidavit may not hold up in legal situations.

-

Wrong Date: Entering the wrong date on the affidavit can cause confusion. Always double-check the date of death and the date of signing to ensure accuracy.

-

Using Incorrect Terminology: Some individuals may use terms that do not align with the legal requirements. Familiarity with the specific language of the affidavit is crucial. Using the correct terminology helps avoid misunderstandings.

-

Failure to Attach Required Documents: Certain supporting documents may need to accompany the affidavit. Not including these can lead to rejection of the form. Always review the requirements to ensure all necessary paperwork is submitted.

Documents used along the form

When dealing with the Texas Affidavit of Death form, several other documents may be needed to support the process. These forms help clarify details and ensure that all necessary legal requirements are met. Below is a list of commonly used documents.

- Death Certificate: This official document confirms the date and cause of death. It is typically issued by the state and serves as a primary proof of death.

- Will: If the deceased left a will, this document outlines their wishes regarding the distribution of assets. It is crucial for probate proceedings.

- Letters Testamentary: Issued by the probate court, this document grants the executor authority to manage the deceased's estate according to the will.

- Affidavit of Heirship: This form is used to establish the heirs of the deceased when there is no will. It helps clarify who inherits the estate.

- Application for Probate: This document initiates the probate process, allowing the court to validate the will and appoint an executor.

- WC-240 Georgia Form: This important document notifies employees about suitable employment offers based on their medical condition, adhering to Georgia’s workers' compensation regulations. More information can be found at georgiaform.com.

- Inventory of Estate: This form lists all assets and liabilities of the deceased's estate. It is often required by the court during probate.

- Notice of Death: This document serves to inform interested parties of the death and any subsequent legal proceedings regarding the estate.

Having these documents ready can streamline the process and help ensure that all legal obligations are fulfilled. Each form plays a vital role in managing the affairs of the deceased effectively and respectfully.

Misconceptions

The Texas Affidavit of Death form is often misunderstood, leading to confusion for those dealing with estate matters. Here are ten common misconceptions about this important legal document:

- It is only for use in Texas. Many believe this form is exclusive to Texas, but it can be recognized in other states under certain conditions, especially if it pertains to property located in Texas.

- It must be notarized. While notarization is recommended for authenticity, it is not a strict requirement for the affidavit to be valid.

- Only family members can file it. Anyone with knowledge of the death can complete and file the affidavit, not just relatives.

- It replaces a death certificate. The affidavit does not replace a death certificate; rather, it serves as a supplementary document to clarify the death in legal matters.

- It is only needed for probate cases. This form is useful in various situations, including transferring property titles or settling debts, not just in probate proceedings.

- There is a specific format that must be followed. While there are guidelines, the affidavit can be customized as long as it contains the necessary information regarding the deceased.

- It can be filed anytime after death. There may be time limits for filing the affidavit, especially when dealing with property transfers or estate claims.

- It can only be used for individuals who died in Texas. The affidavit can be used for individuals who died elsewhere if their estate involves Texas property.

- Once filed, it cannot be amended. The affidavit can be amended if new information comes to light, but this may require additional documentation.

- Legal representation is required to file it. While having a lawyer can be helpful, individuals can file the affidavit on their own if they understand the process.

Understanding these misconceptions can help individuals navigate the complexities of estate matters more effectively. Clarity about the Texas Affidavit of Death form ensures that families can address their legal needs without unnecessary confusion.

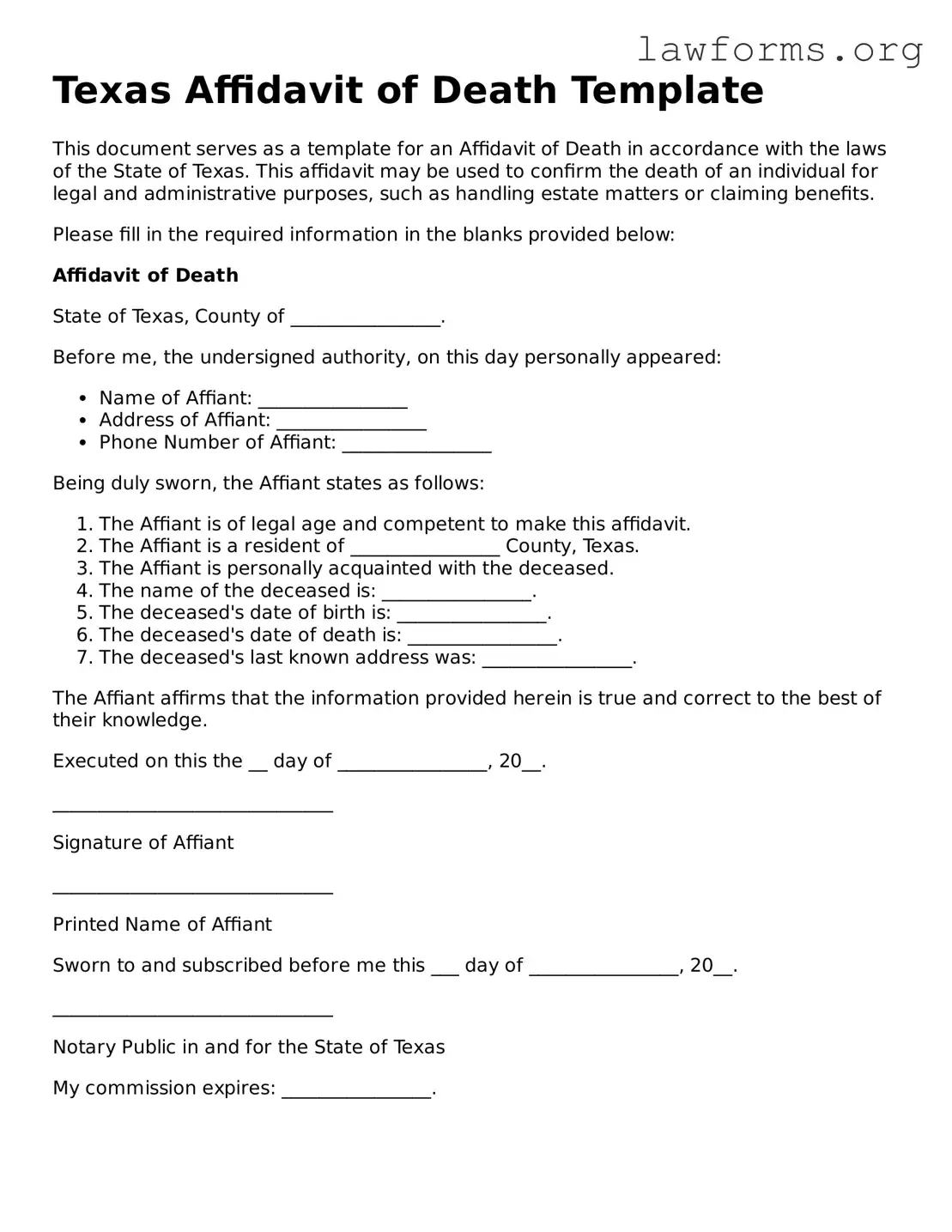

Preview - Texas Affidavit of Death Form

Texas Affidavit of Death Template

This document serves as a template for an Affidavit of Death in accordance with the laws of the State of Texas. This affidavit may be used to confirm the death of an individual for legal and administrative purposes, such as handling estate matters or claiming benefits.

Please fill in the required information in the blanks provided below:

Affidavit of DeathState of Texas, County of ________________.

Before me, the undersigned authority, on this day personally appeared:

- Name of Affiant: ________________

- Address of Affiant: ________________

- Phone Number of Affiant: ________________

Being duly sworn, the Affiant states as follows:

- The Affiant is of legal age and competent to make this affidavit.

- The Affiant is a resident of ________________ County, Texas.

- The Affiant is personally acquainted with the deceased.

- The name of the deceased is: ________________.

- The deceased's date of birth is: ________________.

- The deceased's date of death is: ________________.

- The deceased's last known address was: ________________.

The Affiant affirms that the information provided herein is true and correct to the best of their knowledge.

Executed on this the __ day of ________________, 20__.

______________________________

Signature of Affiant

______________________________

Printed Name of Affiant

Sworn to and subscribed before me this ___ day of ________________, 20__.

______________________________

Notary Public in and for the State of Texas

My commission expires: ________________.

Key takeaways

When dealing with the Texas Affidavit of Death form, it is important to understand its purpose and the steps involved in completing it. Here are six key takeaways:

- The Texas Affidavit of Death is used to officially declare that an individual has passed away.

- Ensure that the form is filled out completely and accurately to avoid delays in processing.

- Typically, the affidavit must be signed in the presence of a notary public to be considered valid.

- Gather necessary information before filling out the form, including the deceased's full name, date of death, and other identifying details.

- This document may be required for settling estates, transferring property, or accessing financial accounts of the deceased.

- Keep copies of the completed affidavit for your records and for any legal or administrative purposes.

Similar forms

- Death Certificate: This official document serves as legal proof of an individual's death. It is often required for settling estates, claiming life insurance, or addressing other legal matters. Like the Affidavit of Death, it confirms the fact of death but is typically issued by a government authority.

- Will: A will outlines how a person's assets and affairs should be handled after their death. While the Affidavit of Death may be used to affirm that the person has passed away, a will specifies the distribution of their property, showcasing the deceased's intentions.

- California Form REG 262: This form is required for the transfer of ownership of a vehicle or vessel in California. Proper completion is essential for compliance with state laws, and more information can be found at californiadocsonline.com/california-fotm-reg-262-form.

- Letter of Administration: This document is issued by a court to appoint an administrator for the estate of a deceased person when no will exists. Similar to the Affidavit of Death, it is a critical part of the probate process, confirming the need to manage the deceased's affairs.

- Trust Document: A trust document details how a person's assets will be managed during their lifetime and after their death. While the Affidavit of Death verifies the death, the trust document provides instructions for asset distribution, highlighting the deceased's wishes.

- Power of Attorney (POA): A POA grants someone the authority to act on behalf of another person in legal or financial matters. Although it is not directly related to death, it can become invalid upon the principal's death, paralleling the Affidavit of Death in terms of authority and representation.

- Beneficiary Designation Forms: These forms specify who will receive assets from accounts like life insurance policies or retirement plans after death. Similar to the Affidavit of Death, they play a crucial role in the transfer of assets, ensuring that the deceased's wishes are honored.