Attorney-Approved Articles of Incorporation Template for the State of Texas

Form Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The Texas Business Organizations Code governs the Articles of Incorporation in Texas. |

| Purpose | The form is used to officially create a corporation in the state of Texas. |

| Filing Requirement | Filing the Articles of Incorporation with the Texas Secretary of State is mandatory for incorporation. |

| Information Required | The form typically requires the corporation's name, duration, registered agent, and purpose. |

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it is essential to approach the task with care and attention. Here are some important dos and don'ts to keep in mind:

- Do ensure that you have a clear understanding of your business structure before starting the form.

- Do provide accurate and complete information about your corporation's name, purpose, and registered agent.

- Do double-check all entries for typos or errors to avoid delays in processing.

- Do consider consulting with a professional if you are unsure about any section of the form.

- Don't use a name for your corporation that is too similar to an existing business in Texas.

- Don't leave any required fields blank; incomplete forms can lead to rejection.

- Don't forget to include the filing fee when submitting your form to the state.

By following these guidelines, you can help ensure a smoother process for establishing your corporation in Texas. Taking the time to prepare correctly will pave the way for your business's success.

Create Popular Articles of Incorporation Forms for Different States

Starting an Llc in California - Includes basic information about the company, such as its name and address.

A California Hold Harmless Agreement is a legal document designed to protect one party from liability for certain actions or events. This form is commonly used in various situations, such as contracts and rental agreements, where one party agrees to assume the risk and hold another party harmless from any potential claims. Understanding this agreement is essential for anyone looking to navigate liability issues effectively in California, and more information can be found at https://californiadocsonline.com/hold-harmless-agreement-form/.

Incorporating in Nc - The Incorporation process often requires additional documentation.

Florida Corporation - Understanding the content of the Articles is crucial for new business owners.

Document Retrieval Center - Establishes the legal boundaries of corporate activities.

Common mistakes

-

Incorrect Business Name: One common mistake is choosing a business name that is already in use or too similar to another registered name. It’s essential to conduct a thorough name search through the Texas Secretary of State’s website before submitting the form.

-

Missing Registered Agent Information: Failing to provide accurate details for a registered agent can delay the incorporation process. The registered agent must be a resident of Texas or a business entity authorized to conduct business in the state.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly stated. A vague or overly broad description can lead to complications. It’s best to be specific about the business activities.

-

Improper Number of Directors: Some individuals overlook the requirement for a minimum number of directors. Texas law mandates at least one director, but depending on the structure, more may be needed. Ensure compliance with these requirements.

-

Failure to Include Initial Capital Structure: Not specifying the number of shares the corporation is authorized to issue can result in delays. Clearly outline the share structure to avoid confusion.

-

Neglecting to Sign the Document: One of the simplest mistakes is forgetting to sign the Articles of Incorporation. Without a signature, the form is incomplete and will not be processed.

Documents used along the form

When forming a corporation in Texas, the Articles of Incorporation are just the beginning. Several other documents play a crucial role in establishing and operating your business legally. Below is a list of commonly used forms and documents that accompany the Articles of Incorporation.

- Bylaws: These are the internal rules that govern the management of the corporation. Bylaws outline how the corporation will operate, including details about meetings, voting procedures, and the roles of officers and directors.

- Certificate of Formation: This is similar to the Articles of Incorporation but may include additional details specific to the type of corporation being formed. It is filed with the Texas Secretary of State and serves as the official record of the corporation's creation.

- Motorcycle Bill of Sale: This form is essential for recording the sale of a motorcycle in Washington, ensuring a smooth transfer of ownership. It can be obtained from Forms Washington.

- Employer Identification Number (EIN): This number, issued by the IRS, is essential for tax purposes. It is used to identify the corporation for federal tax filings and to open a business bank account.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document typically includes information about the corporation's officers, directors, and registered agent.

- Stock Certificates: If your corporation issues stock, these certificates serve as legal proof of ownership for shareholders. They typically include the corporation's name, the shareholder's name, and the number of shares owned.

- Meeting Minutes: Keeping accurate records of meetings is vital. Minutes document the discussions and decisions made during board meetings or shareholder meetings, ensuring transparency and accountability.

- Registered Agent Consent Form: This form confirms that the registered agent has agreed to accept legal documents on behalf of the corporation. It is often required when filing the Articles of Incorporation.

- Annual Franchise Tax Report: Texas corporations must file this report each year to maintain their good standing. It includes financial information and confirms that the corporation is still active.

Understanding these documents is essential for successfully navigating the incorporation process in Texas. Each one serves a specific purpose and helps ensure that your corporation operates smoothly and in compliance with state laws.

Misconceptions

Understanding the Texas Articles of Incorporation form is essential for anyone looking to establish a corporation in Texas. However, several misconceptions can lead to confusion. Here are ten common misconceptions explained:

- All businesses must file Articles of Incorporation. Not all businesses need to incorporate. Sole proprietorships and partnerships do not require this form.

- The process is quick and easy. While filing is straightforward, preparing the necessary information can take time. Ensure you have everything ready before submission.

- Once filed, the corporation cannot change its purpose. A corporation can amend its Articles of Incorporation to change its purpose if needed.

- Filing Articles of Incorporation guarantees business success. Incorporation does not ensure success. Business planning and management are crucial.

- Only large businesses can incorporate. Any business, regardless of size, can file Articles of Incorporation.

- Incorporation protects personal assets automatically. While it provides some protection, proper business practices must be followed to maintain that protection.

- You don’t need a registered agent. A registered agent is required for receiving legal documents on behalf of the corporation.

- All states have the same requirements for incorporation. Each state has its own rules and forms. Texas has specific requirements that differ from other states.

- Filing is a one-time task. Corporations must file annual reports and maintain compliance with state laws to stay in good standing.

- Articles of Incorporation are the only documents needed. Other documents, such as bylaws and organizational minutes, are also necessary for proper governance.

Being aware of these misconceptions can help you navigate the incorporation process more effectively. If you have any questions, consider seeking guidance from a professional who can provide clarity.

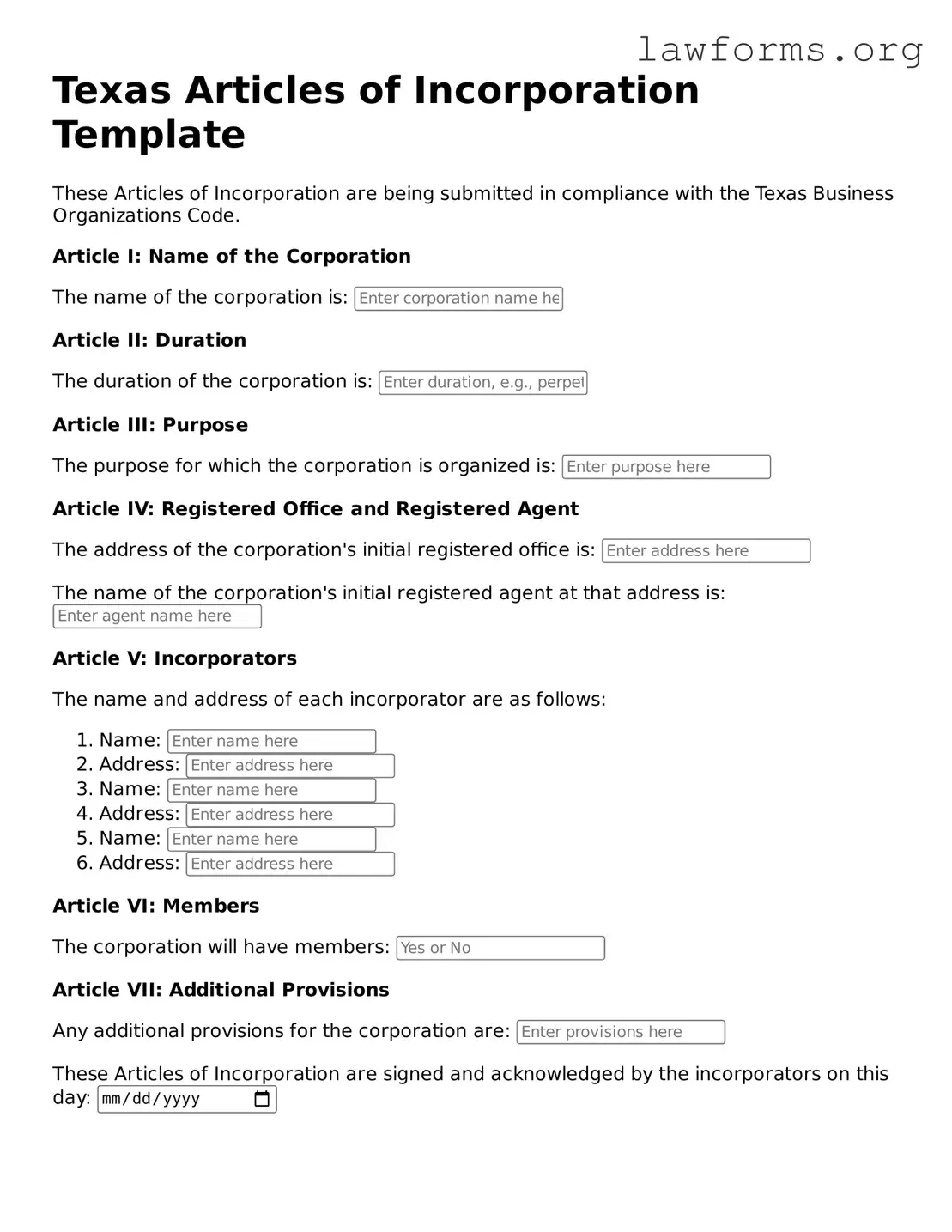

Preview - Texas Articles of Incorporation Form

Texas Articles of Incorporation Template

These Articles of Incorporation are being submitted in compliance with the Texas Business Organizations Code.

Article I: Name of the Corporation

The name of the corporation is:

Article II: Duration

The duration of the corporation is:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Registered Office and Registered Agent

The address of the corporation's initial registered office is:

The name of the corporation's initial registered agent at that address is:

Article V: Incorporators

The name and address of each incorporator are as follows:

- Name:

- Address:

- Name:

- Address:

- Name:

- Address:

Article VI: Members

The corporation will have members:

Article VII: Additional Provisions

Any additional provisions for the corporation are:

These Articles of Incorporation are signed and acknowledged by the incorporators on this day:

Key takeaways

Filling out the Texas Articles of Incorporation form is an important step in establishing your business. Here are some key takeaways to keep in mind:

- Provide Accurate Information: Ensure that all details, such as the name of your corporation and its registered agent, are correct. Mistakes can lead to delays or complications.

- Choose the Right Business Structure: Decide whether you want to form a non-profit, for-profit, or professional corporation. Each type has different requirements and implications.

- Understand Filing Fees: Be aware of the fees associated with filing the Articles of Incorporation. These can vary based on the type of corporation and the services you choose.

- Include Necessary Provisions: Some sections of the form require specific provisions. Make sure to include any necessary information about the purpose of your corporation and its management structure.

- Follow Up After Submission: After submitting your Articles of Incorporation, keep an eye out for confirmation from the state. This will ensure that your corporation is officially recognized.

Similar forms

The Articles of Incorporation is a key document for establishing a corporation, but it's not the only one. Here are nine other documents that share similarities with the Articles of Incorporation:

- Bylaws: These outline the internal rules and procedures for managing the corporation, similar to how the Articles define its structure and purpose.

- Operating Agreement: Used by LLCs, this document details the management and operational procedures, akin to the Articles for corporations.

- Certificate of Formation: This is often required for LLCs and serves a similar purpose as the Articles by officially creating the entity.

- Partnership Agreement: This document defines the roles and responsibilities of partners, paralleling how the Articles define the corporation's structure.

- Notice to Quit Form: This form is crucial for landlords looking to initiate eviction proceedings. It serves as an official notice to tenants regarding violations and includes a clear directive to vacate the premises. For those interested in learning more about this process, detailed forms can be found at formsillinois.com.

- Business License: While not a formation document, it grants permission to operate, similar to how the Articles establish legal recognition.

- Annual Report: This document provides updates on the corporation's status and activities, much like the Articles provide initial information about the business.

- Shareholder Agreement: This governs the relationship between shareholders, similar to how the Articles outline the rights and responsibilities of the corporation.

- Tax Registration Forms: These are necessary for tax identification and compliance, akin to how the Articles establish the corporation’s legal identity.

- Certificate of Good Standing: This confirms that a corporation is compliant with state regulations, similar to how the Articles show that the corporation was legally formed.