Attorney-Approved Bill of Sale Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Bill of Sale form is used to document the transfer of ownership of personal property, such as vehicles, boats, or equipment, from one party to another. |

| Governing Laws | The form is governed by Texas law, specifically under the Texas Business and Commerce Code, which outlines the requirements for the sale of goods. |

| Required Information | Essential details include the names and addresses of both the buyer and seller, a description of the property being sold, and the sale price. |

| Notarization | While notarization is not mandatory for all transactions, it is recommended to provide additional legal protection and verification of the parties' identities. |

Dos and Don'ts

When filling out the Texas Bill of Sale form, it is important to follow specific guidelines to ensure accuracy and legality. Below is a list of things to do and avoid during this process.

- Do: Provide accurate information about the buyer and seller.

- Do: Include a detailed description of the item being sold, including make, model, and VIN if applicable.

- Do: Clearly state the purchase price of the item.

- Do: Ensure both parties sign and date the document.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Don't: Leave any sections of the form blank; incomplete information can lead to issues.

- Don't: Use vague language when describing the item; specificity is crucial.

- Don't: Forget to check for typos or errors before finalizing the document.

- Don't: Assume that verbal agreements are sufficient; a written Bill of Sale is essential.

- Don't: Sign the document without fully understanding all terms and conditions.

By adhering to these guidelines, you can help ensure that the Bill of Sale is valid and serves its intended purpose effectively.

Create Popular Bill of Sale Forms for Different States

How to Transfer Title in Florida - In some states, a Bill of Sale must be notarized for added legal protection.

For a practical approach when dealing with transactions, you may find this crucial resource: a guide on how to utilize a General Bill of Sale effectively to ensure a smooth transfer of ownership.

What Does a Car Bill of Sale Look Like - Good for private sellers to protect themselves in a transaction.

Common mistakes

-

Incomplete Information: Many people forget to fill in all required fields. This can include missing names, addresses, or the date of the sale. Always double-check to ensure everything is complete.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurate. A single digit mistake can lead to confusion or issues with registration. Verify the VIN on the vehicle before writing it down.

-

Not Signing the Document: A Bill of Sale is not valid without signatures from both the buyer and seller. Make sure both parties sign and date the document at the time of the sale.

-

Failure to Include Payment Details: It's important to specify the payment amount and method. Whether it’s cash, check, or another form, clarity helps avoid future disputes.

-

Not Keeping Copies: After filling out the Bill of Sale, both parties should keep a copy for their records. This document serves as proof of the transaction and is essential for future reference.

Documents used along the form

When engaging in a transaction that involves a Texas Bill of Sale, it is often helpful to have additional documents that can support the sale and provide clarity for both parties. Below are some commonly used forms and documents that complement the Bill of Sale.

- Title Transfer Document: This document is essential for transferring ownership of a vehicle or other titled property. It serves as proof that the seller has relinquished ownership and the buyer has accepted it. Proper completion ensures that the new owner can register the item without complications.

- Vehicle History Report: This report provides important information about a vehicle's past, including accidents, repairs, and ownership history. Buyers often request this document to ensure they are making a well-informed purchase.

- Odometer Disclosure Statement: Required by federal law for vehicle sales, this statement confirms the mileage on the vehicle at the time of sale. It helps prevent fraud and ensures that buyers are aware of the vehicle's usage.

- Affidavit of Identity: This document may be used to verify the identities of both the buyer and seller. It can be particularly important in transactions involving large sums of money or valuable items, providing an additional layer of security.

Having these documents ready can streamline the transaction process, ensuring that both parties feel secure and informed. It is always advisable to consult with a legal professional if there are any questions or concerns regarding these forms.

Misconceptions

The Texas Bill of Sale form is a useful document for transferring ownership of personal property, but several misconceptions can lead to confusion. Here are seven common misunderstandings:

-

It is only for vehicle sales.

Many people believe that a Bill of Sale is only necessary for selling cars or trucks. In reality, it can be used for various personal property transactions, including boats, trailers, and even furniture.

-

It is not legally required.

While a Bill of Sale is not mandatory for every transaction, having one provides legal protection for both the buyer and seller. It serves as proof of the transaction and can help resolve disputes.

-

It must be notarized.

Some think that a Bill of Sale must be notarized to be valid. In Texas, notarization is not a requirement, although it can add an extra layer of authenticity.

-

It only protects the seller.

This misconception overlooks the fact that a Bill of Sale benefits both parties. It protects the seller by documenting the transfer and protects the buyer by proving ownership.

-

It can be verbal.

While verbal agreements can be made, they are often difficult to enforce. A written Bill of Sale is much clearer and provides a record of the transaction.

-

All Bills of Sale are the same.

People may assume that any Bill of Sale template will suffice. However, different transactions may require specific details, so it's essential to use a form that fits your situation.

-

It is only for private sales.

Some believe that a Bill of Sale is only necessary for transactions between individuals. In fact, businesses may also use this document when selling goods to consumers.

Understanding these misconceptions can help ensure that your transactions are smooth and legally sound. Always consider using a Bill of Sale to protect your interests, regardless of the type of property involved.

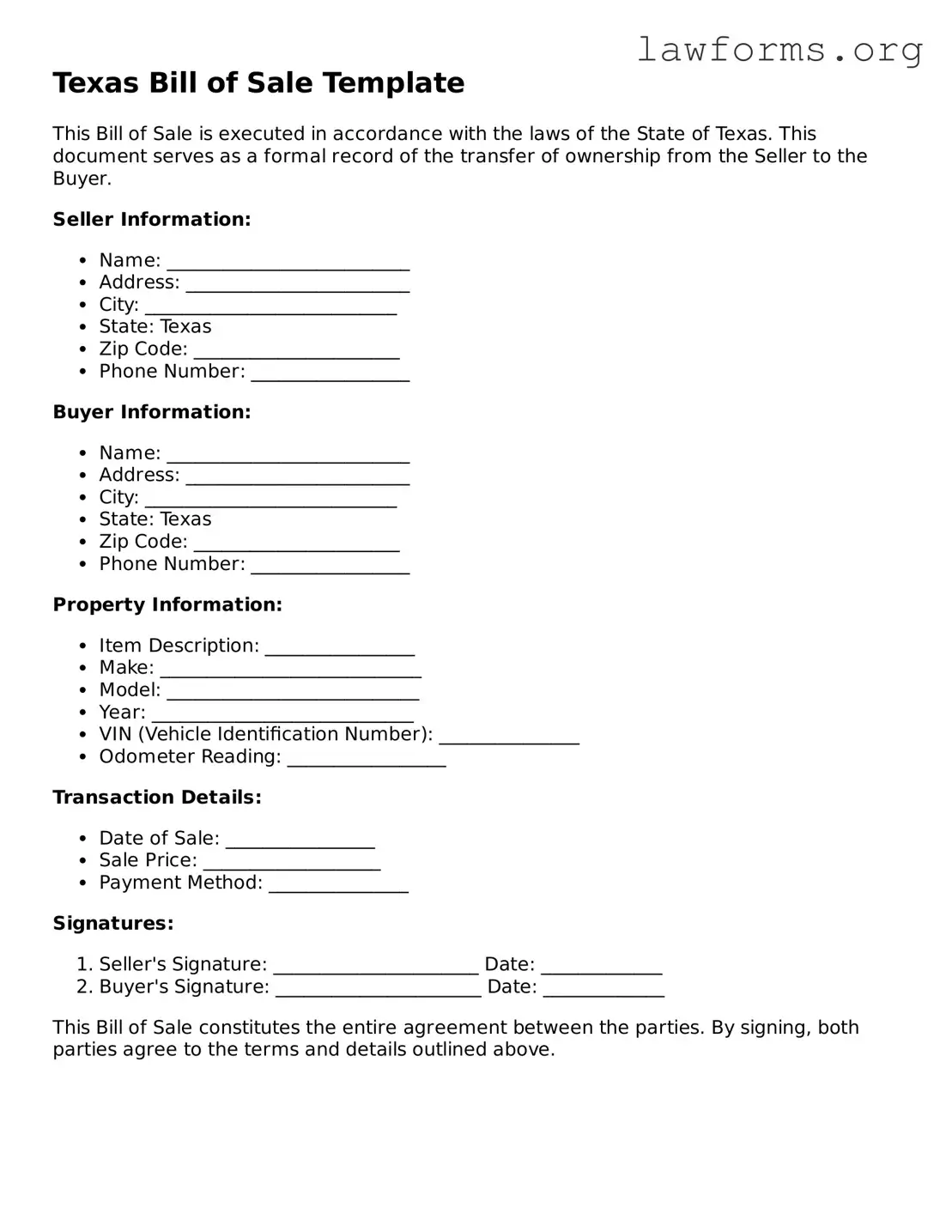

Preview - Texas Bill of Sale Form

Texas Bill of Sale Template

This Bill of Sale is executed in accordance with the laws of the State of Texas. This document serves as a formal record of the transfer of ownership from the Seller to the Buyer.

Seller Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Texas

- Zip Code: ______________________

- Phone Number: _________________

Buyer Information:

- Name: __________________________

- Address: ________________________

- City: ___________________________

- State: Texas

- Zip Code: ______________________

- Phone Number: _________________

Property Information:

- Item Description: ________________

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): _______________

- Odometer Reading: _________________

Transaction Details:

- Date of Sale: ________________

- Sale Price: ___________________

- Payment Method: _______________

Signatures:

- Seller's Signature: ______________________ Date: _____________

- Buyer's Signature: ______________________ Date: _____________

This Bill of Sale constitutes the entire agreement between the parties. By signing, both parties agree to the terms and details outlined above.

Key takeaways

When filling out and using the Texas Bill of Sale form, it is essential to keep several key points in mind to ensure a smooth transaction.

- Accuracy is crucial: Make sure all information is filled out correctly, including names, addresses, and descriptions of the item being sold.

- Include all necessary details: The bill of sale should specify the item’s make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Signatures are required: Both the seller and buyer must sign the document to validate the transaction.

- Consider notarization: While not mandatory, having the bill of sale notarized can provide additional legal protection.

- Keep copies: Both parties should retain a copy of the signed bill of sale for their records.

- Use clear language: Avoid ambiguity by using straightforward language that clearly outlines the terms of the sale.

- Verify payment: Ensure that payment has been received before transferring ownership of the item.

- Check local requirements: Different counties may have specific rules regarding bill of sale forms, so it’s wise to verify local regulations.

By following these guidelines, you can facilitate a successful transaction and protect the interests of both parties involved.

Similar forms

Purchase Agreement: This document outlines the terms and conditions of a sale between a buyer and a seller. Like a Bill of Sale, it serves as proof of the transaction and includes details such as the item being sold, the purchase price, and the parties involved.

Lease Agreement: A lease agreement is similar in that it establishes the terms under which one party can use property owned by another. It typically includes information about the duration of the lease, payment terms, and responsibilities of both parties.

Title Transfer Document: This document is crucial when transferring ownership of vehicles or real estate. It provides evidence that the seller has relinquished ownership and that the buyer has received it, similar to how a Bill of Sale confirms the sale of personal property.

Sales Receipt: A sales receipt serves as proof of purchase for a buyer. It details the transaction, including the items purchased and the total amount paid, much like a Bill of Sale, but is often simpler and used for smaller transactions.

Gift Deed: A gift deed is used when property is transferred as a gift rather than a sale. While it does not involve payment, it shares similarities with a Bill of Sale in that it documents the transfer of ownership and identifies the parties involved.

ADP Pay Stub Form: Essential for tracking earnings and deductions, this document is crucial for employees. For templates related to this, visit Document Templates Hub.

Warranty Deed: This document is used in real estate transactions to guarantee that the seller has the right to sell the property and that it is free of liens. Like a Bill of Sale, it provides assurance to the buyer regarding the ownership of the property.

Affidavit of Ownership: This document is often used to declare ownership of an item, especially in cases where a formal title does not exist. It serves a similar purpose to a Bill of Sale by affirming the seller's ownership and the buyer's right to the item.