Attorney-Approved Deed in Lieu of Foreclosure Template for the State of Texas

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Purpose | This form allows borrowers to relinquish their property in exchange for the cancellation of their mortgage debt. |

| Governing Law | The process is governed by Texas Property Code, particularly sections related to foreclosure and deed transfers. |

| Eligibility | Borrowers must be facing financial hardship and unable to continue making mortgage payments. |

| Benefits | It can help borrowers avoid the lengthy foreclosure process and reduce the impact on their credit score. |

| Consent Requirement | The lender must agree to accept the deed in lieu of foreclosure; it is not a unilateral decision. |

| Property Condition | The property should be in good condition, as lenders may require repairs before accepting the deed. |

| Tax Implications | Borrowers should consult a tax professional, as there may be tax consequences associated with the cancellation of debt. |

| Process Duration | The process can be quicker than foreclosure, often taking a few weeks to complete once initiated. |

| Alternatives | Other options include loan modification or short sale, which may be more beneficial depending on the situation. |

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it’s important to be careful and thorough. Here’s a list of things you should and shouldn’t do:

- Do ensure all information is accurate and complete.

- Do consult with a legal advisor if you have questions about the process.

- Do keep a copy of the completed form for your records.

- Do sign the document in the presence of a notary public.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank; fill out every required field.

- Don't forget to check for any additional documentation needed.

- Don't ignore the consequences of signing; understand what it means for your mortgage.

Create Popular Deed in Lieu of Foreclosure Forms for Different States

California Pre-foreclosure Property Transfer - This deed can potentially expedite the transition for families facing economic hardship.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Homeowners may use this option to limit the number of foreclosure-related legal actions against them.

When transferring ownership of a vehicle or vessel in California, it’s important to complete the required paperwork accurately, particularly the California Form REG 262. This form, which must be submitted alongside the title or application for a duplicate title, plays a crucial role in ensuring that both the buyer’s and seller’s rights are protected during the transaction. For detailed information and access to the form, you can visit https://californiadocsonline.com/california-fotm-reg-262-form.

Deed in Lieu - Getting a professional appraisal can assist in determining whether the deed is the right choice financially.

Deed in Lieu of Foreclosure Form - In some cases, lenders may offer relocation assistance to homeowners who complete a deed in lieu.

Common mistakes

-

Not including all parties involved: It's essential to list everyone who has an interest in the property. This includes co-owners or spouses. Missing someone can lead to complications later.

-

Incorrect property description: A clear and accurate description of the property is crucial. Ensure you include the correct address and legal description. Errors here can cause delays.

-

Failing to sign the document: All necessary parties must sign the form. A missing signature can render the deed invalid.

-

Not having the document notarized: Many jurisdictions require notarization for the deed to be legally binding. Check if this is necessary in your case.

-

Ignoring the timeline: There are specific timeframes for submitting the deed. Missing these deadlines can complicate the foreclosure process.

-

Not consulting with a professional: It’s wise to seek advice from a lawyer or a real estate professional. They can help avoid common pitfalls and ensure everything is in order.

-

Overlooking tax implications: Transferring property can have tax consequences. Understanding these is vital to avoid unexpected liabilities.

-

Not keeping copies: Always make copies of the completed deed and any related documents. Having records can be helpful for future reference.

-

Failing to communicate with the lender: Keeping the lender informed throughout the process is important. They may have specific requirements or forms that need to be completed.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. When using this form, several other documents may be required to ensure a smooth process. Below is a list of common forms and documents that often accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines changes to the original loan terms. It may be used if the lender agrees to modify the loan instead of proceeding with foreclosure.

- Notice of Default: This is a formal notification sent to the borrower indicating that they have defaulted on their loan payments. It typically precedes any foreclosure action.

- Property Inspection Report: A report detailing the condition of the property. Lenders may require this to assess the property's value before accepting a deed in lieu.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage once the deed is transferred. It protects the homeowner from future claims by the lender.

- Articles of Incorporation: Essential for establishing a corporation in Illinois, this document outlines vital details including the corporation's name and purpose. For those ready to formalize their business, completing the form found at formsillinois.com/ is a crucial step.

- Affidavit of Title: A sworn statement by the homeowner affirming they hold clear title to the property and there are no undisclosed liens or claims against it.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any costs or fees associated with the deed in lieu process.

- Transfer Tax Declaration: A form used to report the transfer of property for tax purposes. It may be required by local governments when a deed is transferred.

- Power of Attorney: If the homeowner cannot be present to sign documents, a power of attorney may authorize another person to act on their behalf during the transaction.

Understanding these documents can help homeowners navigate the deed in lieu process more effectively. Each document serves a specific purpose and contributes to the overall clarity and legality of the transaction.

Misconceptions

Many homeowners facing financial difficulties may consider a Texas Deed in Lieu of Foreclosure as a solution. However, several misconceptions can cloud understanding of this process. Here are seven common misconceptions:

- A Deed in Lieu of Foreclosure eliminates all debt obligations. Many believe that signing over the property means they are free from any remaining mortgage debt. In reality, lenders may still pursue deficiency judgments for any unpaid balance.

- This option is only available to those in foreclosure. Some think that a Deed in Lieu is only an option once foreclosure proceedings have begun. However, homeowners can initiate this process before reaching that point, as long as the lender agrees.

- It automatically improves credit scores. A common belief is that a Deed in Lieu of Foreclosure has a positive effect on credit scores. In fact, it can still negatively impact credit ratings, similar to a foreclosure, as it indicates a failure to meet mortgage obligations.

- Homeowners can choose any date for the transfer. Some individuals think they can dictate when the property transfer occurs. However, the timing is typically determined by the lender and the specific agreement made.

- All lenders accept Deeds in Lieu of Foreclosure. It's a misconception that every lender will agree to this option. Not all financial institutions have policies in place to accept Deeds in Lieu, and some may prefer to proceed with foreclosure.

- Homeowners can remain in the property after signing. Many believe they can continue living in the home after the deed is transferred. However, once the deed is signed, the lender may require the homeowner to vacate the property.

- Legal representation is not necessary. Some homeowners think they can handle the process without legal assistance. However, having legal guidance can help navigate the complexities and ensure that the homeowner's rights are protected.

Understanding these misconceptions can help homeowners make informed decisions regarding their financial situation and the options available to them.

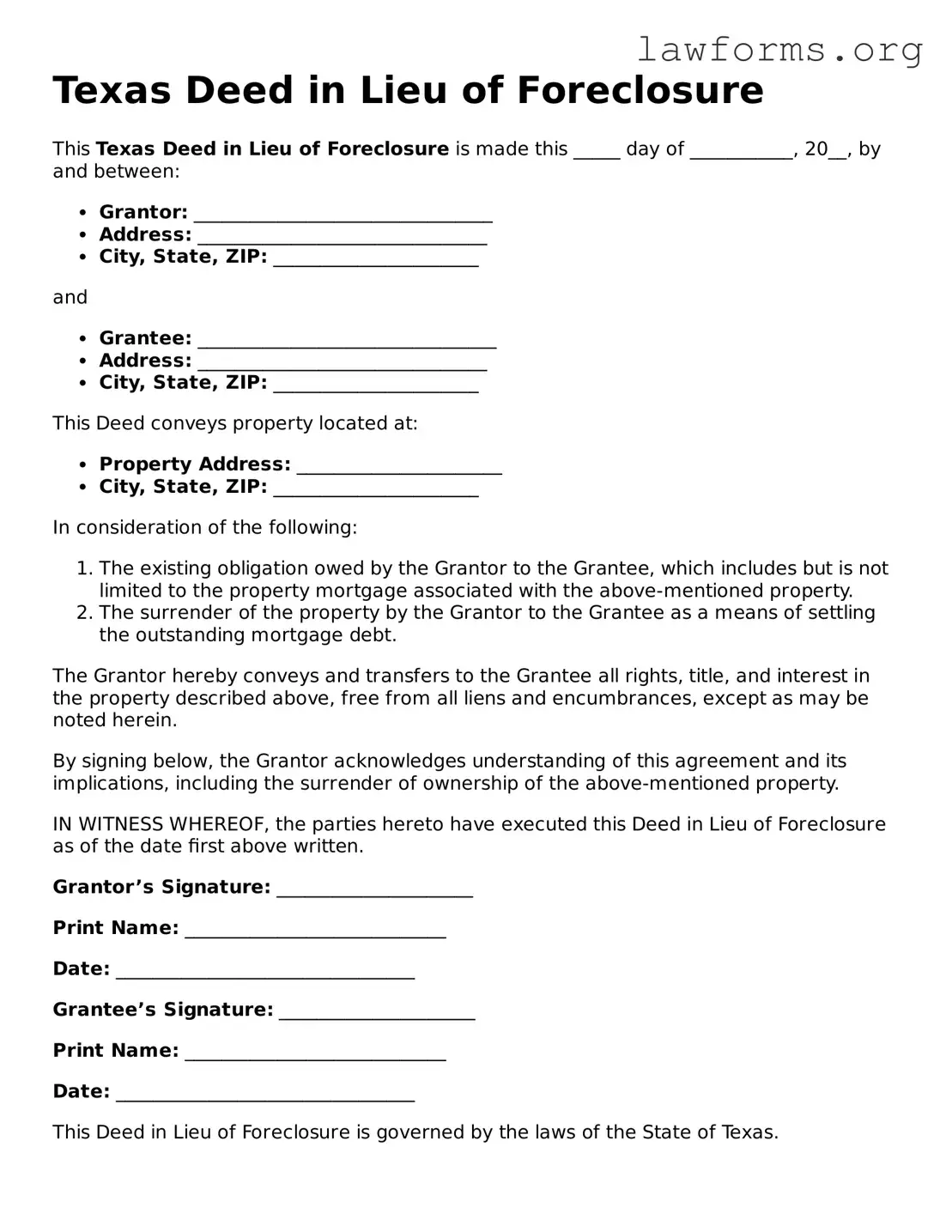

Preview - Texas Deed in Lieu of Foreclosure Form

Texas Deed in Lieu of Foreclosure

This Texas Deed in Lieu of Foreclosure is made this _____ day of ___________, 20__, by and between:

- Grantor: ________________________________

- Address: _______________________________

- City, State, ZIP: ______________________

and

- Grantee: ________________________________

- Address: _______________________________

- City, State, ZIP: ______________________

This Deed conveys property located at:

- Property Address: ______________________

- City, State, ZIP: ______________________

In consideration of the following:

- The existing obligation owed by the Grantor to the Grantee, which includes but is not limited to the property mortgage associated with the above-mentioned property.

- The surrender of the property by the Grantor to the Grantee as a means of settling the outstanding mortgage debt.

The Grantor hereby conveys and transfers to the Grantee all rights, title, and interest in the property described above, free from all liens and encumbrances, except as may be noted herein.

By signing below, the Grantor acknowledges understanding of this agreement and its implications, including the surrender of ownership of the above-mentioned property.

IN WITNESS WHEREOF, the parties hereto have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor’s Signature: _____________________

Print Name: ____________________________

Date: ________________________________

Grantee’s Signature: _____________________

Print Name: ____________________________

Date: ________________________________

This Deed in Lieu of Foreclosure is governed by the laws of the State of Texas.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Texas, it is essential to understand the implications and requirements of this legal document. Here are some key takeaways to keep in mind:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender. This can help avoid the lengthy and often stressful foreclosure process.

- Eligibility Criteria: Not all homeowners qualify for a Deed in Lieu of Foreclosure. Lenders typically require that the property is free of other liens and that the homeowner is experiencing financial hardship.

- Documentation is Key: Proper documentation is crucial. Homeowners must provide financial information and any relevant details about the property to the lender. This transparency can facilitate a smoother process.

- Impact on Credit: While a Deed in Lieu of Foreclosure may be less damaging than a foreclosure, it can still negatively impact a homeowner’s credit score. Understanding this consequence is vital for future financial planning.

- Legal Advice is Recommended: Consulting with a legal professional before proceeding can help homeowners navigate the complexities of the Deed in Lieu of Foreclosure process. This guidance can ensure that their rights are protected.

Taking these factors into account can provide clarity and assist in making informed decisions during a challenging time.

Similar forms

- Short Sale Agreement: A short sale agreement allows a homeowner to sell their property for less than the amount owed on the mortgage. Similar to a deed in lieu of foreclosure, it helps the homeowner avoid foreclosure and mitigate financial losses.

- Residential Lease Agreement: The Ohio PDF Forms is essential for landlords and tenants to ensure a clear understanding of rental terms, protecting the rights of both parties and fostering a positive rental experience.

- Mortgage Modification Agreement: This document changes the terms of an existing mortgage to make it more affordable for the borrower. Like a deed in lieu of foreclosure, it aims to help the homeowner retain their property while addressing financial difficulties.

- Forbearance Agreement: A forbearance agreement temporarily suspends or reduces mortgage payments. This option is similar to a deed in lieu of foreclosure as it provides the homeowner with relief from immediate payment obligations, allowing time to recover financially.

- Repayment Plan: A repayment plan outlines a schedule for the borrower to catch up on missed payments. This document shares similarities with a deed in lieu of foreclosure in that both seek to resolve the homeowner's financial issues without proceeding to foreclosure.

- Loan Assumption Agreement: A loan assumption agreement allows a buyer to take over the existing mortgage from the seller. Like a deed in lieu of foreclosure, it provides a way to transfer responsibility for the mortgage, potentially avoiding foreclosure for the seller.