Attorney-Approved Deed Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose of the Texas Deed | The Texas Deed is used to transfer ownership of real property from one party to another. |

| Governing Law | This deed is governed by the Texas Property Code, specifically Title 1, Chapter 5. |

| Types of Deeds | Common types include General Warranty Deed, Special Warranty Deed, and Quitclaim Deed. |

| Execution Requirements | The deed must be signed by the grantor and may require notarization for it to be valid. |

| Recording the Deed | Once executed, the deed should be recorded in the county where the property is located to protect the new owner's rights. |

Dos and Don'ts

When filling out the Texas Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are five things to do and five things to avoid.

Things to Do:

- Provide accurate property details, including the legal description.

- Include the names of all parties involved in the transaction.

- Sign the deed in the presence of a notary public.

- Ensure that the date of the transaction is clearly stated.

- File the completed deed with the appropriate county clerk's office.

Things to Avoid:

- Do not leave any required fields blank.

- Avoid using abbreviations that may cause confusion.

- Do not forget to check for any local requirements or additional forms.

- Refrain from signing the document before it is notarized.

- Do not submit the deed without reviewing it for errors.

Create Popular Deed Forms for Different States

Warranty Deed Form Ohio - Multiple parties can be named on a deed, indicating joint ownership.

To ensure compliance with state regulations, it is crucial for employers to accurately complete the IL-941 form, which is required for reporting withheld income tax. For a streamlined process, you can find helpful resources and access the form at https://formsillinois.com, making it easier to stay on top of your tax obligations.

Florida Deed Form - Facilitates a clear understanding of the rights and obligations of the new owner.

Common mistakes

-

Incorrect Names: People often misspell names or use nicknames instead of legal names. Ensure that the names match the identification documents.

-

Missing Signatures: All required parties must sign the deed. Failing to obtain a signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. An unnotarized deed may not be accepted by the county clerk.

-

Incorrect Property Description: A vague or inaccurate description of the property can lead to disputes. Use the legal description found in previous deeds or property records.

-

Omitting the Consideration: The deed should state the consideration, or payment, involved in the transfer. Leaving this blank can raise questions about the validity of the transaction.

-

Failure to Record: After completing the deed, it must be recorded with the county clerk. Not doing so can result in loss of ownership rights.

-

Using the Wrong Form: Different types of deeds exist, such as warranty deeds and quitclaim deeds. Using the wrong form can lead to unintended legal consequences.

-

Ignoring Local Laws: Each county may have specific requirements for deeds. Ignoring these can result in delays or rejection of the filing.

Documents used along the form

When transferring property in Texas, several forms and documents accompany the Texas Deed form to ensure a smooth transaction. Each document serves a specific purpose in the process of property transfer, providing necessary information and legal backing.

- Title Commitment: This document outlines the terms under which a title company will issue a title insurance policy. It details any liens or claims against the property, ensuring the buyer is aware of any potential issues.

- Survey: A property survey provides a detailed map of the property boundaries. It helps identify the exact dimensions and location of the property, which is crucial for both buyers and lenders.

- Property Disclosure Statement: Sellers must provide this document, which discloses known issues with the property. This transparency helps buyers make informed decisions and can protect sellers from future liability.

- California LLC-1 Form: Essential for filing Articles of Organization for a Limited Liability Company in California, this form can be found at https://californiadocsonline.com/california-llc-1-form/ and is necessary for efficient processing with the Secretary of State's office.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document itemizes all the costs associated with the property transaction. It outlines what the buyer and seller are responsible for financially at closing.

- Bill of Sale: This document transfers ownership of personal property associated with the real estate, such as appliances or furniture. It is important for ensuring that all agreed-upon items are included in the sale.

- Affidavit of Heirship: In cases where property is inherited, this affidavit establishes the heirs of a deceased owner. It can help clarify ownership and facilitate the transfer of property rights.

- Power of Attorney: If a party cannot attend the closing, a power of attorney allows someone else to sign documents on their behalf. This legal document must be prepared and executed properly to be valid.

- Loan Documents: If the buyer is financing the property, various loan documents will be required. These include the mortgage agreement and promissory note, which outline the terms of the loan.

Understanding these documents can significantly impact the property transfer process. Each plays a vital role in ensuring that the transaction is legally sound and that all parties are protected. Being informed about these forms can help facilitate a smoother closing experience.

Misconceptions

Understanding the Texas Deed form is essential for anyone involved in real estate transactions in Texas. However, several misconceptions can lead to confusion and potential legal issues. Below are nine common misconceptions about the Texas Deed form, along with clarifications.

- All Deeds Are the Same: Many believe that all deed forms are interchangeable. In reality, different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds.

- Notarization Is Optional: Some individuals think that notarization of a deed is not necessary. In Texas, a deed must be signed in the presence of a notary public to be valid.

- Verbal Agreements Are Sufficient: There is a misconception that a verbal agreement can suffice for transferring property. However, Texas law requires a written deed for property transfers to be legally binding.

- Only Lawyers Can Prepare Deeds: While it is advisable to consult a lawyer, anyone can prepare a Texas Deed form as long as they follow the legal requirements.

- Deeds Do Not Require a Legal Description: Some people think that a simple address is enough. In fact, a precise legal description of the property is necessary for the deed to be valid.

- Once Filed, Deeds Cannot Be Changed: There is a belief that once a deed is recorded, it cannot be altered. However, it can be amended or corrected through a new deed under certain circumstances.

- All Deeds Are Recorded: Some assume that all deeds must be recorded to be valid. While recording is not required, it is highly recommended to protect the interests of the parties involved.

- Only the Grantor Signs the Deed: A common misconception is that only the seller (grantor) needs to sign the deed. In reality, both the grantor and the grantee should sign to ensure the transfer is valid.

- Deeds Are Only Relevant at Closing: Many believe that deeds only matter during the closing process. However, understanding and managing deeds is crucial throughout the entire property ownership period.

Awareness of these misconceptions can help individuals navigate the complexities of real estate transactions more effectively. Proper understanding of the Texas Deed form can prevent legal complications and ensure smoother property transfers.

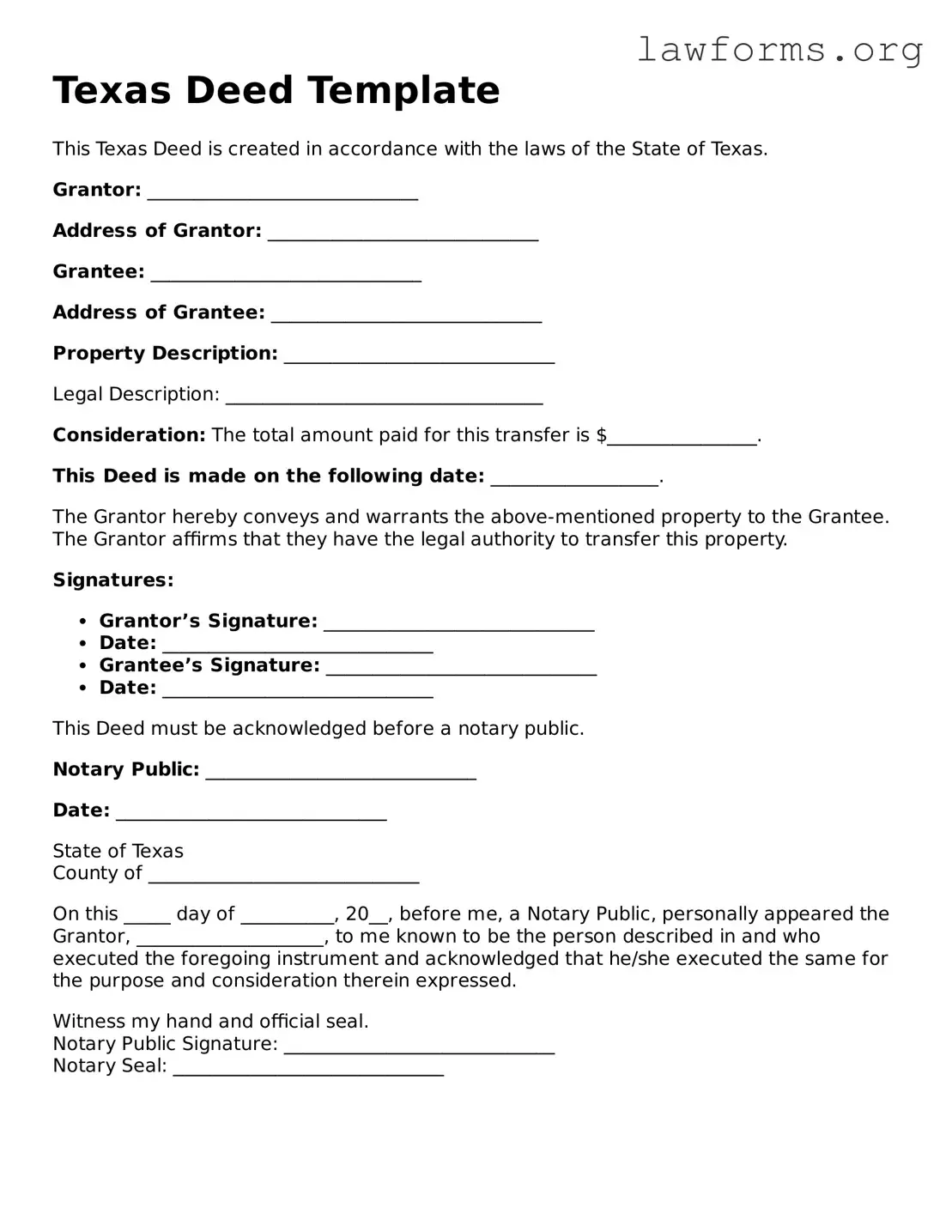

Preview - Texas Deed Form

Texas Deed Template

This Texas Deed is created in accordance with the laws of the State of Texas.

Grantor: _____________________________

Address of Grantor: _____________________________

Grantee: _____________________________

Address of Grantee: _____________________________

Property Description: _____________________________

Legal Description: __________________________________

Consideration: The total amount paid for this transfer is $________________.

This Deed is made on the following date: __________________.

The Grantor hereby conveys and warrants the above-mentioned property to the Grantee. The Grantor affirms that they have the legal authority to transfer this property.

Signatures:

- Grantor’s Signature: _____________________________

- Date: _____________________________

- Grantee’s Signature: _____________________________

- Date: _____________________________

This Deed must be acknowledged before a notary public.

Notary Public: _____________________________

Date: _____________________________

State of Texas

County of _____________________________

On this _____ day of __________, 20__, before me, a Notary Public, personally appeared the Grantor, ____________________, to me known to be the person described in and who executed the foregoing instrument and acknowledged that he/she executed the same for the purpose and consideration therein expressed.

Witness my hand and official seal.

Notary Public Signature: _____________________________

Notary Seal: _____________________________

Key takeaways

When filling out and using the Texas Deed form, it is essential to keep several key points in mind to ensure the process is smooth and legally sound.

- Understand the Types of Deeds: Familiarize yourself with different types of deeds, such as warranty deeds and quitclaim deeds, to choose the right one for your situation.

- Identify the Parties: Clearly identify the grantor (seller) and grantee (buyer) in the deed. Include full names and addresses to avoid confusion.

- Describe the Property: Provide a complete and accurate description of the property being transferred. This includes the legal description, which can be found in previous deeds or property records.

- Consider the Consideration: State the amount of money or value exchanged for the property. This is often referred to as "consideration" and must be included in the deed.

- Signatures Required: Ensure that all parties involved in the transaction sign the deed. In Texas, the grantor's signature must be notarized.

- Filing the Deed: After completing the deed, file it with the county clerk's office in the county where the property is located. This makes the transfer official and public.

- Review Local Laws: Check for any specific local laws or requirements that may affect the deed process. Different counties may have unique regulations.

- Keep Copies: After filing, retain copies of the deed for your records. This is important for future reference and to prove ownership.

Similar forms

The Deed form is an important legal document, but it's not the only one that plays a significant role in property transactions. Here are four other documents that share similarities with the Deed form:

- Title Insurance Policy: This document provides protection against losses due to defects in the title of the property. Like a Deed, it establishes ownership and ensures that the buyer has clear rights to the property.

- Purchase Agreement: A Purchase Agreement outlines the terms and conditions of the sale. Similar to a Deed, it signifies the transfer of property ownership, but it is more focused on the details of the sale rather than the legal transfer itself.

- Bill of Sale: This document is used to transfer ownership of personal property. While a Deed typically pertains to real estate, both documents serve the purpose of formally transferring ownership from one party to another.

Bill of Sale: A bill of sale is used when transferring ownership of personal property. It serves a similar purpose to a deed but is specific to movable assets rather than real estate. For creating a bill of sale, you might consider using templates available at Forms Washington.

- Mortgage Agreement: A Mortgage Agreement details the terms of a loan used to purchase property. Like a Deed, it involves the transfer of rights, but it also includes the borrower's promise to repay the loan, creating a lien on the property.