Attorney-Approved Durable Power of Attorney Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Durable Power of Attorney allows an individual (the principal) to appoint someone else (the agent) to manage their financial and legal affairs, even if the principal becomes incapacitated. |

| Governing Law | The Texas Durable Power of Attorney is governed by Chapter 751 of the Texas Estates Code. |

| Durability | This form remains effective even if the principal becomes mentally or physically incapacitated, ensuring continuous management of their affairs. |

| Agent's Authority | The agent's powers can be broad or limited, depending on the principal's wishes, and can include managing bank accounts, real estate, and other financial matters. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Witness Requirements | In Texas, the form must be signed by the principal in the presence of either a notary public or two witnesses who are not related to the principal or the agent. |

Dos and Don'ts

When filling out the Texas Durable Power of Attorney form, it is essential to follow certain guidelines to ensure the document is valid and effective. Below is a list of things you should and shouldn't do during this process.

- Do read the entire form carefully before starting.

- Do clearly identify the principal and the agent.

- Do specify the powers granted to the agent.

- Do date and sign the form in the presence of a notary.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't use vague language when describing powers.

- Don't forget to consider the needs and wishes of the principal.

- Don't overlook the requirement for witnesses if applicable.

- Don't assume the form is valid without proper execution.

Create Popular Durable Power of Attorney Forms for Different States

How to File for Power of Attorney in Florida - Ensuring that a Durable Power of Attorney is in place can facilitate legal compliance while managing someone's affairs.

To simplify the process of creating this important document, you can reference resources like Forms Washington, which provide templates and guidelines that ensure all necessary information is included in the trailer bill of sale.

Durable Power Printable Power of Attorney Form - This document provides peace of mind, knowing decisions can be made for you.

Ohio Durable Power of Attorney - It can enhance your overall financial security and governance.

Common mistakes

-

Not specifying the powers granted. It's important to clearly outline what decisions the agent can make. Vague language can lead to confusion.

-

Failing to sign and date the form. Without a signature and date, the document may not be considered valid.

-

Not having the form witnessed or notarized. In Texas, a Durable Power of Attorney typically requires either witnesses or a notary to be legally binding.

-

Choosing the wrong agent. Selecting someone who may not act in your best interest can lead to complications later on.

-

Overlooking the need for updates. Life changes, such as a new relationship or a change in health, may require updates to the document.

-

Ignoring state-specific requirements. Each state has its own rules, and it is crucial to follow Texas regulations when completing the form.

-

Not discussing the decision with the chosen agent. It is vital that the agent understands their responsibilities and agrees to take on this role.

Documents used along the form

A Texas Durable Power of Attorney is an important legal document that allows an individual to appoint someone to manage their financial and legal affairs. However, it is often beneficial to have additional documents to ensure comprehensive planning. Below are some other forms and documents commonly used alongside the Durable Power of Attorney in Texas.

- Medical Power of Attorney: This document designates an individual to make healthcare decisions on behalf of another person if they become incapacitated. It ensures that medical preferences are honored when the individual cannot communicate them.

- Advance Directive: Also known as a living will, this document outlines an individual's wishes regarding medical treatment in situations where they are unable to express their preferences. It provides guidance to healthcare providers and loved ones.

- HIPAA Release Form: This form allows an individual to authorize specific people to access their medical records and health information. It ensures that family members or appointed agents can make informed decisions regarding healthcare.

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. It can also designate guardians for minor children and specify funeral arrangements.

- Trust: A trust is a legal arrangement that allows a person to transfer assets to a trustee for the benefit of designated beneficiaries. It can help avoid probate and provide more control over asset distribution.

- Declaration of Guardian: This document allows an individual to designate a guardian for themselves in the event they become incapacitated. It helps ensure that their preferences are respected regarding who will make decisions on their behalf.

Having these documents in place can provide peace of mind and clarity for both the individual and their loved ones. It is important to consider each of these forms carefully to ensure that personal wishes are respected and legal matters are handled appropriately.

Misconceptions

Understanding the Texas Durable Power of Attorney (DPOA) is crucial for making informed decisions. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

- The DPOA is only for financial matters. Many believe that a Durable Power of Attorney only covers financial decisions. In reality, it can also address medical and personal care decisions, depending on how it is drafted.

- Once signed, the DPOA cannot be revoked. Some people think that signing a DPOA is a permanent decision. However, the principal can revoke the DPOA at any time, as long as they are mentally competent.

- The agent has unlimited power. There is a misconception that the agent named in a DPOA can do anything they want. In fact, the agent's authority is limited to what the principal has specified in the document.

- A DPOA is only valid if it is notarized. While notarization is recommended for a DPOA to enhance its validity, it is not strictly required in Texas. Witness signatures may also suffice in certain situations.

- The DPOA remains effective after the principal’s death. Many people mistakenly believe that the DPOA continues to be effective after the principal passes away. This is incorrect; the authority granted in a DPOA ends upon the principal's death.

By clarifying these misconceptions, individuals can better navigate their options and ensure their wishes are respected.

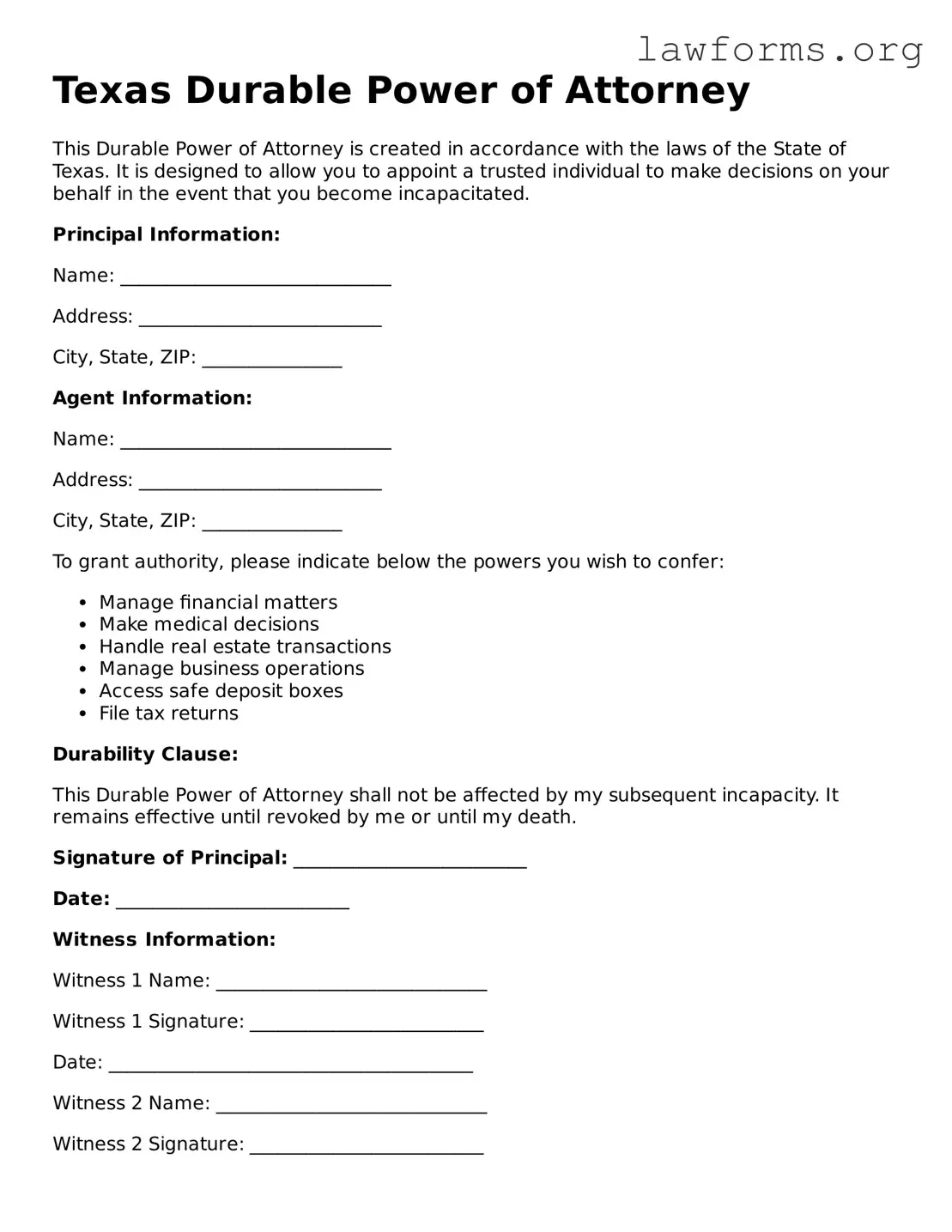

Preview - Texas Durable Power of Attorney Form

Texas Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of Texas. It is designed to allow you to appoint a trusted individual to make decisions on your behalf in the event that you become incapacitated.

Principal Information:

Name: _____________________________

Address: __________________________

City, State, ZIP: _______________

Agent Information:

Name: _____________________________

Address: __________________________

City, State, ZIP: _______________

To grant authority, please indicate below the powers you wish to confer:

- Manage financial matters

- Make medical decisions

- Handle real estate transactions

- Manage business operations

- Access safe deposit boxes

- File tax returns

Durability Clause:

This Durable Power of Attorney shall not be affected by my subsequent incapacity. It remains effective until revoked by me or until my death.

Signature of Principal: _________________________

Date: _________________________

Witness Information:

Witness 1 Name: _____________________________

Witness 1 Signature: _________________________

Date: _______________________________________

Witness 2 Name: _____________________________

Witness 2 Signature: _________________________

Date: _______________________________________

Notary Public (if required):

Name: _____________________________

Commission Expires: ________________

This document may need to be filed with your financial and medical institutions. It is advisable to review the document periodically to ensure it reflects your current wishes.

Key takeaways

When filling out and using the Texas Durable Power of Attorney form, keep these key takeaways in mind:

- Choose a trustworthy agent: Select someone who understands your wishes and can act in your best interest.

- Specify powers clearly: Clearly outline the powers you grant to your agent to avoid confusion later.

- Consider legal advice: Consulting with a legal professional can help ensure the document meets all necessary requirements.

- Keep it updated: Review and update the document periodically to reflect any changes in your circumstances or preferences.

Similar forms

- General Power of Attorney: This document allows an individual to appoint someone to manage their affairs, similar to a Durable Power of Attorney. However, it typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This form specifically grants authority to make medical decisions on behalf of an individual if they are unable to do so themselves. It focuses on health-related matters rather than financial ones.

- Living Will: While not a power of attorney, a living will outlines an individual’s preferences regarding medical treatment in end-of-life situations. It complements a Healthcare Power of Attorney by providing guidance to the appointed agent.

- Revocable Trust: A revocable trust allows a person to manage their assets during their lifetime and specify how they should be distributed after death. Like a Durable Power of Attorney, it can help avoid court intervention if the individual becomes incapacitated.

- Financial Power of Attorney: This document grants someone authority to handle financial matters on behalf of another person. It can be durable or non-durable, with the former remaining effective during incapacity.

- Advance Directive: This term encompasses both a living will and a Healthcare Power of Attorney. It provides instructions about medical care preferences and designates someone to make decisions when necessary.

- Guardian Appointment: In situations where an individual is unable to care for themselves, a guardian may be appointed by the court. This process is more formal than a Durable Power of Attorney and requires judicial oversight.

- Will: A will is a legal document that outlines how a person's assets will be distributed after their death. While it does not grant authority during life, it is essential for estate planning and can work alongside a Durable Power of Attorney.

- Beneficiary Designation: This document allows individuals to name beneficiaries for certain assets, such as life insurance or retirement accounts. It operates independently of a Durable Power of Attorney but is crucial for estate planning.