Attorney-Approved Employment Verification Template for the State of Texas

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Texas Employment Verification form is used to confirm an individual's employment status and income for various purposes, such as loan applications or public assistance. |

| Governing Law | This form is governed by Texas Labor Code, Section 61.003, which outlines the requirements for employment verification. |

| Who Uses It | Employers and employees often use this form to provide necessary documentation for employment-related inquiries. |

| Required Information | The form typically requires the employee's name, job title, dates of employment, and salary information. |

| Confidentiality | Employers must handle the information on this form with care to protect the employee's privacy and comply with applicable privacy laws. |

| Submission Method | The completed form can be submitted electronically or in hard copy, depending on the employer's policies. |

| Validity Period | There is no specific expiration date for the form; however, it is advisable to use the most recent information available. |

| Signature Requirement | A signature from both the employer and employee is usually required to validate the information provided. |

| Common Uses | This form is commonly used for mortgage applications, rental agreements, and government assistance programs. |

Dos and Don'ts

When filling out the Texas Employment Verification form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some do's and don'ts to keep in mind:

- Do provide accurate and complete information.

- Do double-check all entries for spelling and numerical errors.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations that might confuse the reader.

- Don't forget to provide the correct contact information for verification.

By adhering to these guidelines, you can help ensure that the employment verification process goes smoothly.

Create Popular Employment Verification Forms for Different States

Ohio Certification Verification - Employers may reach out to confirm information provided.

In the context of preparing for future eventualities, the Georgia Power of Attorney form serves as a vital tool, empowering a designated individual to handle important decisions on behalf of the principal. For those seeking a comprehensive understanding of this legal document and its implications, further information is available at https://georgiaform.com/, which provides valuable insights into its use and benefits.

Verification of Employment/loss of Income - It may include details such as job title and departmental responsibilities.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required fields. Missing details can delay the verification process and may lead to unnecessary complications.

-

Incorrect Dates: Many individuals mistakenly enter wrong employment dates. This can create confusion and may raise questions about the accuracy of the information provided.

-

Misunderstanding the Purpose: Some applicants do not grasp the significance of the Employment Verification form. It is essential to understand that this document serves as proof of employment, and inaccuracies can have serious implications.

-

Failing to Sign: A crucial step often overlooked is the signature. Without a signature, the form is incomplete and cannot be processed. This oversight can lead to delays in employment verification.

-

Providing Outdated Information: Individuals sometimes submit information that is no longer accurate. Regularly updating details ensures that the form reflects the current employment status.

-

Neglecting to Review: Before submitting the form, it is vital to review all entries. Errors can easily go unnoticed, leading to potential issues down the line. Taking a moment to double-check can save time and prevent frustration.

Documents used along the form

When completing employment verification processes in Texas, several forms and documents may accompany the Texas Employment Verification form. Each of these documents plays a crucial role in ensuring that the verification process is thorough and accurate. Below is a list of commonly used forms and documents.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld from their paycheck. Employers provide it to employees and the IRS, making it essential for verifying income and employment history.

- Pay Stubs: These documents provide a detailed breakdown of an employee's earnings for a specific pay period. They often include information on hours worked, deductions, and net pay, which can help confirm employment status and income.

- Offer Letter: This document outlines the terms of employment, including job title, salary, and start date. It serves as proof of employment and can help clarify the employee's role within the organization.

- California Civil Form: The California Civil form, specifically the Civil Case Cover Sheet (CM-010), is a document required for initiating civil cases in California. This form helps the court categorize and manage cases effectively by gathering essential information about the nature of the case. Completing this form accurately is crucial, as it can impact case management and judicial resources. For more information, visit https://californiadocsonline.com/california-civil-form/.

- Employment Contract: A legally binding document that details the terms and conditions of employment. It includes information about job responsibilities, compensation, and benefits, providing a comprehensive view of the employment arrangement.

- Tax Returns: Personal tax returns, such as the 1040 form, can provide additional verification of income over a longer period. They are often used in conjunction with other documents to assess an individual’s financial history.

Utilizing these documents alongside the Texas Employment Verification form can streamline the verification process, ensuring that all necessary information is available for review. Each form contributes to a clearer understanding of an individual's employment status and history, ultimately aiding in decision-making for potential employers or agencies.

Misconceptions

Understanding the Texas Employment Verification form is crucial for both employers and employees. However, several misconceptions often arise regarding its purpose and use. Below is a list of seven common misconceptions, along with clarifications to help clear up any confusion.

- Misconception 1: The form is only required for new hires.

- Misconception 2: The form guarantees employment verification.

- Misconception 3: Only employers can fill out the form.

- Misconception 4: There is a standard format for the form.

- Misconception 5: The form contains sensitive personal information.

- Misconception 6: The form must be submitted to the state.

- Misconception 7: Completing the form is optional for employers.

This is not true. While the form is commonly used during the hiring process, it can also be requested for existing employees in certain situations, such as loan applications or background checks.

Filling out the form does not guarantee that employment will be verified. Employers have the discretion to choose whether to provide the requested information.

Employees can initiate the process by requesting their employers to complete the form. This can help facilitate the verification process.

While there are common elements, the Texas Employment Verification form does not have a universally mandated format. Employers may customize it according to their needs.

The form typically requires basic employment information, such as job title and dates of employment. It does not usually request sensitive personal data like Social Security numbers.

There is no requirement to submit the Employment Verification form to any state agency. It is usually kept between the employer and the employee or the requesting party.

While employers are not legally obligated to fill out the form, they should consider the potential benefits of providing verification for their employees, as it can enhance trust and transparency.

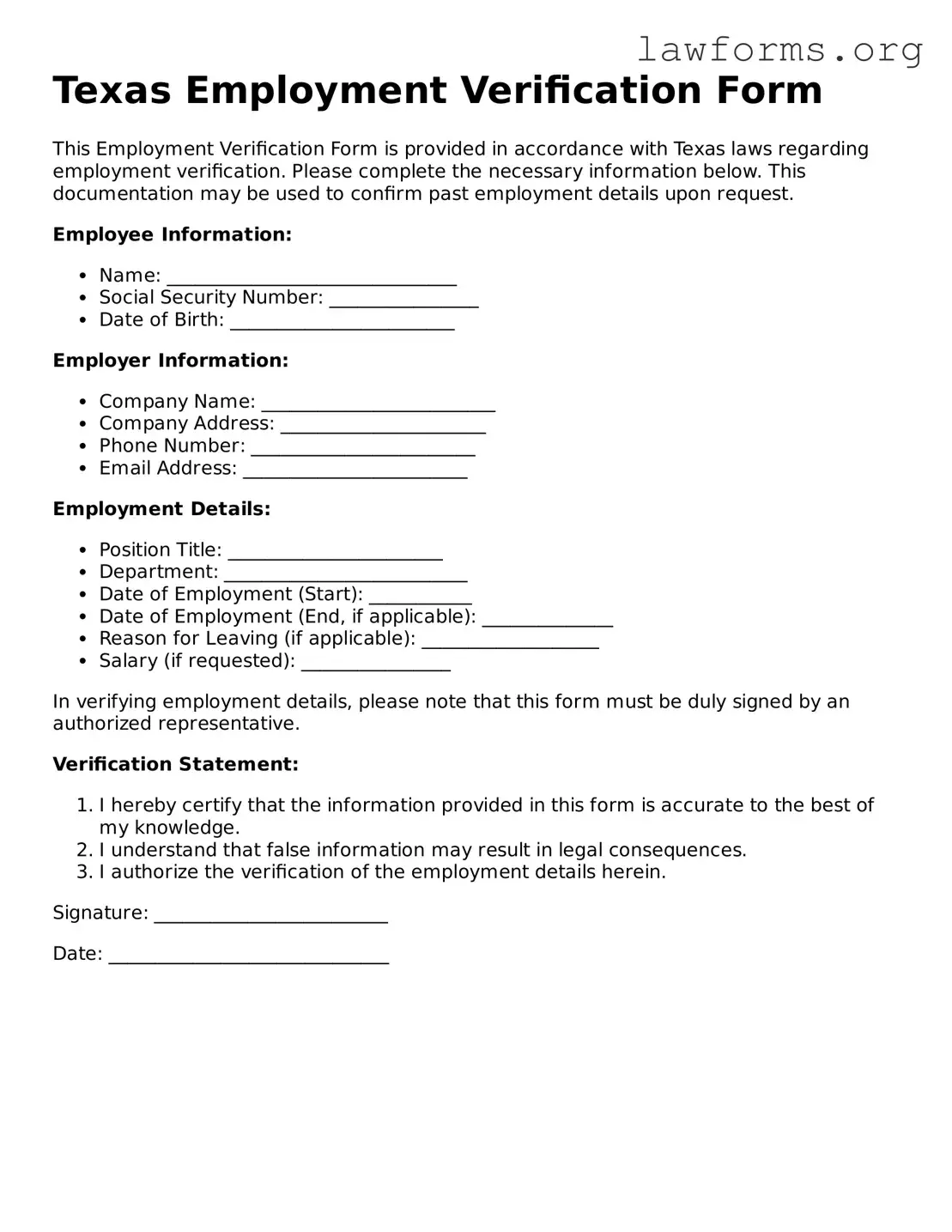

Preview - Texas Employment Verification Form

Texas Employment Verification Form

This Employment Verification Form is provided in accordance with Texas laws regarding employment verification. Please complete the necessary information below. This documentation may be used to confirm past employment details upon request.

Employee Information:- Name: _______________________________

- Social Security Number: ________________

- Date of Birth: ________________________

- Company Name: _________________________

- Company Address: ______________________

- Phone Number: ________________________

- Email Address: ________________________

- Position Title: _______________________

- Department: __________________________

- Date of Employment (Start): ___________

- Date of Employment (End, if applicable): ______________

- Reason for Leaving (if applicable): ___________________

- Salary (if requested): ________________

In verifying employment details, please note that this form must be duly signed by an authorized representative.

Verification Statement:

- I hereby certify that the information provided in this form is accurate to the best of my knowledge.

- I understand that false information may result in legal consequences.

- I authorize the verification of the employment details herein.

Signature: _________________________

Date: ______________________________

Key takeaways

Filling out and using the Texas Employment Verification form is an important process for both employers and employees. Here are key takeaways to keep in mind:

- Understand the Purpose: The form is primarily used to verify an individual's employment status, which can be crucial for background checks, loan applications, or other verification needs.

- Gather Necessary Information: Before starting, collect all relevant details such as employee name, job title, and dates of employment.

- Complete All Sections: Ensure that every section of the form is filled out completely to avoid delays in processing.

- Use Accurate Dates: Double-check employment dates. Inaccurate information can lead to complications.

- Include Contact Information: Provide a reliable contact number and email for follow-up questions or clarifications.

- Signature Requirement: Remember that the form must be signed by an authorized representative of the company, which confirms the validity of the information provided.

- Keep Copies: Make copies of the completed form for your records. This can be useful for future reference.

- Know the Submission Process: Understand how and where to submit the form, whether electronically or by mail, to ensure it reaches the right department.

- Follow Up: If you do not receive confirmation of receipt, it’s advisable to follow up to ensure the form has been processed.

- Stay Informed: Be aware of any changes to the form or the process, as regulations and requirements can evolve.

By adhering to these guidelines, individuals can ensure that the Texas Employment Verification form is completed accurately and efficiently, facilitating a smooth verification process.

Similar forms

- W-2 Form: This document provides a summary of an employee's annual wages and the taxes withheld from their paycheck. Like the Employment Verification form, it serves as proof of employment and income for various purposes, including loan applications and tax filings.

- Pay Stub: A pay stub is issued by an employer with each paycheck, detailing the employee's earnings, deductions, and net pay. It verifies employment status and income, similar to the Employment Verification form.

- Offer Letter: An offer letter outlines the terms of employment, including job title, salary, and start date. It confirms the individual's employment status and is often used in conjunction with the Employment Verification form during background checks.

- Operating Agreement: The Operating Agreement is essential for LLCs, outlining governance and operational details. For those looking to create one, resources such as Ohio PDF Forms are invaluable.

- Employment Contract: This legally binding document details the terms of employment, including duties, compensation, and duration. It verifies employment and can be referenced alongside the Employment Verification form to confirm job specifics.

- Reference Letter: A reference letter from a previous employer can provide insight into an individual’s work history and character. While it serves a different purpose, it can supplement the Employment Verification form by confirming employment duration and responsibilities.

- Social Security Administration (SSA) Earnings Record: This record shows an individual's earnings history as reported to the SSA. It can be used to verify employment and income, much like the Employment Verification form, particularly for government-related applications.