Attorney-Approved Gift Deed Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by Texas Property Code, particularly Chapter 5. |

| Requirements | The deed must be in writing, signed by the donor, and must clearly identify the property being gifted. |

| Consideration | No monetary consideration is required for a gift deed, as the transfer is made voluntarily. |

| Recording | It is advisable to record the gift deed with the county clerk's office to provide public notice of the transfer. |

| Tax Implications | Gift tax may apply if the value of the property exceeds the annual exclusion limit set by the IRS. |

| Revocation | A gift deed generally cannot be revoked once executed, unless specific conditions are met. |

Dos and Don'ts

When filling out the Texas Gift Deed form, it's important to be careful and thorough. Here’s a list of things you should and shouldn't do to ensure a smooth process.

- Do provide accurate and complete information about the property being gifted.

- Do include the full names and addresses of both the giver and the recipient.

- Do sign the form in front of a notary public to validate the deed.

- Do ensure that the deed is recorded with the county clerk's office after signing.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague descriptions of the property; be specific.

- Don't forget to check for any local regulations that may apply to your situation.

Following these guidelines will help you avoid common pitfalls and ensure that your gift deed is legally sound.

Create Popular Gift Deed Forms for Different States

Transfer House Title - While no payment is needed, a Gift Deed clarifies property rights for the recipient.

For those navigating the complexities of divorce, understanding the importance of a well-crafted agreement is crucial. Our guide to the Divorce Settlement Agreement process provides valuable insights and resources. To access the necessary documentation, visit this helpful Divorce Settlement Agreement template.

Common mistakes

-

Incomplete Information: One of the most common mistakes occurs when individuals fail to provide all necessary details. This includes not listing the full names of both the donor and the recipient, or neglecting to include the property description. Each piece of information is crucial for the deed to be valid.

-

Incorrect Property Description: It's essential to describe the property accurately. Errors can arise when using vague terms or outdated descriptions. A precise legal description is necessary to avoid confusion and potential disputes in the future.

-

Not Signing the Deed: A gift deed must be signed by the donor. Failing to do so renders the document ineffective. Additionally, if the recipient is required to sign but does not, this could lead to complications down the line.

-

Improper Witnessing: Texas law requires that the deed be witnessed. Many overlook this requirement or fail to have the witnesses sign in the appropriate places. Without proper witnessing, the deed may not hold up in court.

-

Neglecting to Record the Deed: After completing the gift deed, it is vital to record it with the county clerk's office. Some individuals forget this step, which can lead to issues with ownership and the ability to prove the transfer of property.

Documents used along the form

When dealing with a Texas Gift Deed, several other forms and documents may also be necessary to ensure a smooth transfer of property. Understanding these documents can help clarify the process and make it easier for everyone involved.

- Warranty Deed: This document guarantees that the grantor has clear title to the property and has the right to transfer it. It provides assurance to the recipient that there are no undisclosed claims against the property.

- Affidavit of Heirship: This form is often used when property is inherited. It helps establish the rightful heirs of a deceased person's estate and can clarify ownership issues.

- Trailer Bill of Sale: Essential for documenting the transfer of ownership for a trailer in Ohio, this form ensures all parties are protected. For more information, visit Ohio PDF Forms.

- Texas Property Code Section 5.041 Notice: This notice informs the parties involved about the legal implications of the gift deed. It ensures that both parties understand their rights and responsibilities.

- Real Property Transfer Tax Form: This document is used to report any applicable transfer taxes associated with the property gift. It helps ensure compliance with state tax laws.

- Title Insurance Policy: Although not always required, a title insurance policy can protect the recipient against any future claims or disputes regarding the property’s title.

Having these documents prepared and organized can help facilitate the gift deed process. It’s always a good idea to consult with a legal professional if you have any questions or need assistance with these forms.

Misconceptions

Understanding the Texas Gift Deed form can be challenging, and misconceptions often lead to confusion. Here are eight common misunderstandings about this important legal document:

- Gift Deeds Are Only for Family Members: Many believe that gift deeds can only be used to transfer property between family members. In reality, anyone can give a gift deed to anyone else, regardless of their relationship.

- A Gift Deed Requires Payment: Some people think that a gift deed involves a monetary exchange. However, by definition, a gift deed is meant to transfer property without any payment involved.

- All Gifts Require a Gift Deed: Not every gift of property necessitates a formal gift deed. Small gifts or personal items may not require any legal documentation, while larger or more valuable gifts often do.

- Gift Deeds Are Irrevocable: There is a belief that once a gift deed is executed, it cannot be undone. While it is true that gift deeds are generally permanent, there are specific circumstances under which they can be revoked.

- Only Real Estate Can Be Transferred: Many assume that gift deeds are limited to real estate transactions. In fact, they can also be used to transfer personal property, such as vehicles or valuable collectibles.

- A Notary Public Is Not Necessary: Some individuals think that a gift deed does not need to be notarized. In Texas, having the deed notarized is essential for it to be legally binding and recognized.

- Gift Deeds Are Automatically Recorded: There is a misconception that once a gift deed is signed, it is automatically recorded with the county. In reality, the responsibility for recording the deed falls on the donor or recipient.

- Gift Deeds Are Only for Property Transfers: Lastly, many people believe that gift deeds can only be used for transferring ownership of property. However, they can also be used to convey other rights, such as interests in a trust.

By dispelling these misconceptions, individuals can better understand the Texas Gift Deed form and its implications. Knowledge empowers people to make informed decisions about property transfers.

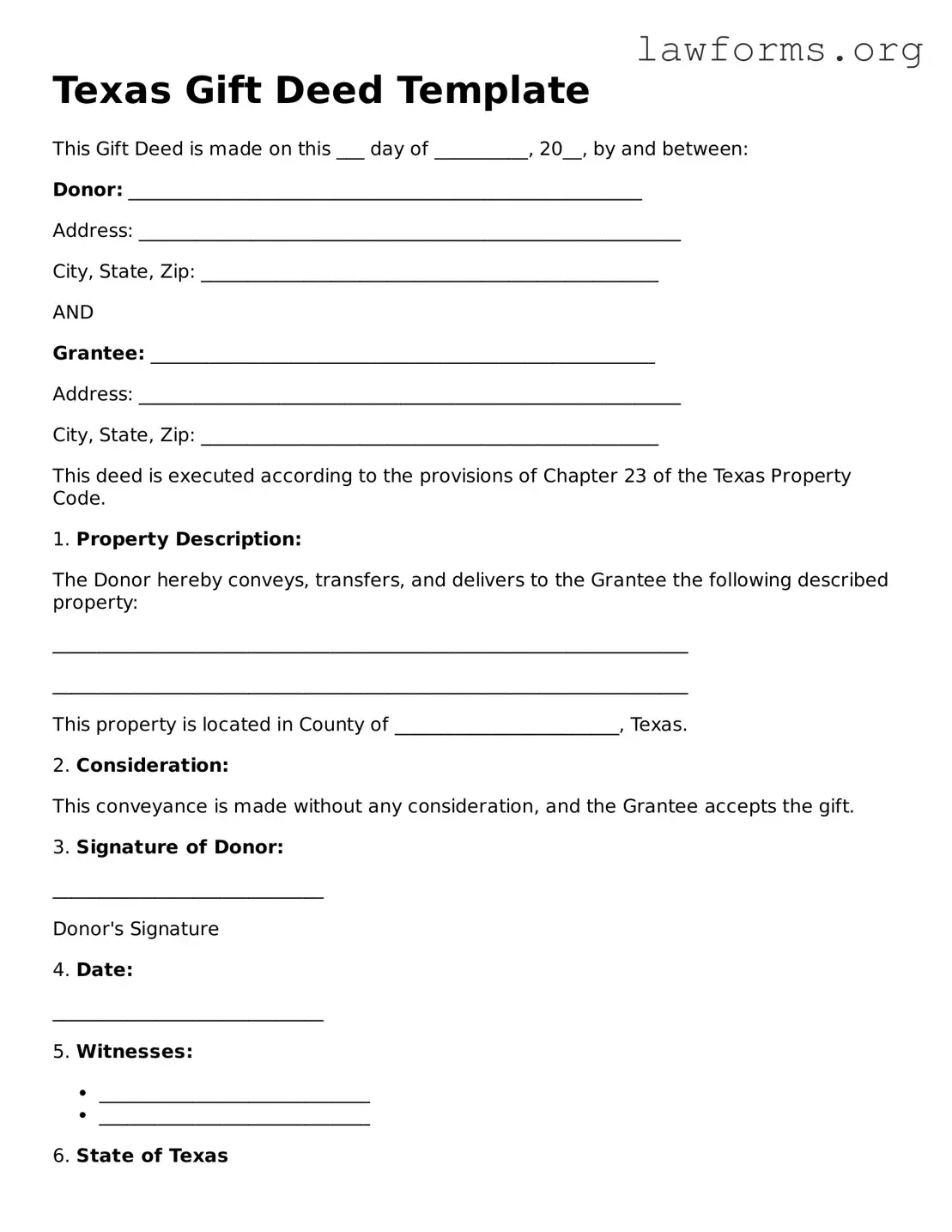

Preview - Texas Gift Deed Form

Texas Gift Deed Template

This Gift Deed is made on this ___ day of __________, 20__, by and between:

Donor: _______________________________________________________

Address: __________________________________________________________

City, State, Zip: _________________________________________________

AND

Grantee: ______________________________________________________

Address: __________________________________________________________

City, State, Zip: _________________________________________________

This deed is executed according to the provisions of Chapter 23 of the Texas Property Code.

1. Property Description:

The Donor hereby conveys, transfers, and delivers to the Grantee the following described property:

____________________________________________________________________

____________________________________________________________________

This property is located in County of ________________________, Texas.

2. Consideration:

This conveyance is made without any consideration, and the Grantee accepts the gift.

3. Signature of Donor:

_____________________________

Donor's Signature

4. Date:

_____________________________

5. Witnesses:

- _____________________________

- _____________________________

6. State of Texas

Before me, the undersigned authority, on this ___ day of __________, 20__, personally appeared the above-named Donor, who acknowledged the execution of this Gift Deed.

Notary Public in and for the State of Texas

My Commission Expires: ________________

Key takeaways

When filling out and using the Texas Gift Deed form, there are several important points to keep in mind. Understanding these can help ensure a smooth process.

- Clear Intent: The gift deed must clearly state the donor's intention to give the property as a gift. This helps avoid any confusion later.

- Property Description: Provide a detailed description of the property being gifted. This includes the address and any relevant legal descriptions.

- Signatures Required: Both the donor and the recipient must sign the deed. This confirms that both parties agree to the terms of the gift.

- Notarization: The deed must be notarized. This step adds an extra layer of authenticity and helps prevent disputes.

- Filing the Deed: After completion, the gift deed should be filed with the county clerk’s office where the property is located. This makes the gift official.

- Tax Implications: Be aware of potential tax implications for both the donor and recipient. Consulting a tax professional can provide clarity on this matter.

By following these key takeaways, individuals can navigate the Texas Gift Deed process more effectively.

Similar forms

A Gift Deed is a specific legal document used to transfer ownership of property or assets from one person to another without any exchange of money. However, there are several other documents that serve similar purposes in different contexts. Here’s a breakdown of seven documents that share similarities with a Gift Deed:

- Will: A Will outlines how a person's assets will be distributed upon their death. Like a Gift Deed, it can transfer property to beneficiaries without monetary exchange, but it takes effect only after death.

- Trust Agreement: This document creates a trust to manage and distribute assets. Similar to a Gift Deed, it can facilitate the transfer of property to beneficiaries, often with specific conditions attached.

- Quitclaim Deed: A Quitclaim Deed transfers ownership rights in property without guaranteeing that the title is clear. It is similar to a Gift Deed in that it can transfer property without monetary compensation.

- Transfer on Death Deed: This deed allows property owners to transfer their property to beneficiaries upon death, bypassing probate. Like a Gift Deed, it does not involve payment at the time of transfer.

- Sales Agreement: While typically involving a monetary transaction, a Sales Agreement can also document the transfer of property. It is similar in that it outlines the terms of the transfer, though it usually requires payment.

- California Judicial Council Form: This form is essential for individuals navigating legal processes in California. For more information, please visit https://californiadocsonline.com/california-judicial-council-form, which provides insights into its use and importance.

- Deed of Gift: This is essentially another name for a Gift Deed. It serves the same purpose of transferring property without compensation and includes details about the donor and recipient.

- Beneficiary Designation Form: This form allows individuals to designate beneficiaries for certain assets, like bank accounts or insurance policies. Similar to a Gift Deed, it facilitates the transfer of assets without a monetary exchange upon the owner's death.