Attorney-Approved Golf Cart Bill of Sale Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Golf Cart Bill of Sale form is used to document the sale of a golf cart between a buyer and a seller. |

| Governing Law | The sale of golf carts in Texas is governed by state law, specifically under the Texas Transportation Code. |

| Identification | The form requires the identification details of both the buyer and the seller, including names and addresses. |

| Vehicle Information | Details about the golf cart, such as make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Sale Price | The agreed sale price of the golf cart needs to be clearly stated on the form. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Date of Sale | The date when the sale takes place should be recorded on the form. |

| Record Keeping | It is important for both parties to keep a copy of the completed Bill of Sale for their records. |

Dos and Don'ts

When filling out the Texas Golf Cart Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Provide accurate information about the golf cart, including make, model, and VIN.

- Do: Include the full names and addresses of both the buyer and seller.

- Do: Sign and date the form to validate the transaction.

- Do: Keep a copy of the completed bill of sale for your records.

- Don't: Leave any fields blank; incomplete forms may cause issues later.

- Don't: Use outdated or incorrect information; double-check all details.

- Don't: Forget to mention any liens or encumbrances on the golf cart.

- Don't: Rush the process; take your time to ensure everything is filled out correctly.

Create Popular Golf Cart Bill of Sale Forms for Different States

Do Golf Carts Have a Title - Allows parties to keep track of their commitments outlined in the sale.

Filing the Florida Articles of Incorporation form is an essential process for anyone looking to establish a corporation in the state. This legal document not only outlines the corporation's name and purpose but also includes critical information about its initial directors. To facilitate this process, you can access the necessary form at https://floridadocuments.net/fillable-articles-of-incorporation-form, ensuring you have all required details for a smooth incorporation.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to complications. Ensure that both the buyer and seller's names, addresses, and contact information are fully filled out.

-

Incorrect Vehicle Identification Number (VIN): Double-check the VIN for accuracy. An incorrect VIN can cause issues with registration and ownership verification.

-

Missing Signatures: Both parties must sign the document. Without signatures, the sale may not be legally binding.

-

Failure to Date the Document: Not including the date of the sale can create confusion. Make sure to write the date clearly to establish when the transaction took place.

-

Not Keeping Copies: After completing the form, both parties should retain a copy. This serves as proof of the transaction and can be important for future reference.

Documents used along the form

When completing a transaction involving a golf cart in Texas, several forms and documents may be necessary to ensure a smooth and legally compliant process. Below is a list of commonly used documents that accompany the Texas Golf Cart Bill of Sale form.

- Texas Vehicle Registration Application: This form is required to register the golf cart with the Texas Department of Motor Vehicles. It includes information about the owner and the vehicle.

- Certificate of Title: This document serves as proof of ownership. It must be transferred from the seller to the buyer at the time of sale.

- Odometer Disclosure Statement: This statement is necessary for vehicles less than ten years old. It confirms the mileage at the time of sale to prevent fraud.

- Affidavit of Motor Vehicle Gift Transfer: If the golf cart is being given as a gift, this form may be needed to exempt the buyer from sales tax.

- Sales Tax Exemption Certificate: This certificate is used when the buyer qualifies for a sales tax exemption, such as for certain non-profit organizations.

- Insurance Information: Proof of insurance may be required to demonstrate that the golf cart is covered under a valid policy before registration can occur.

- California Judicial Council Form: This standardized document is vital for ensuring clarity and organization in legal proceedings. For more information, visit https://californiadocsonline.com/california-judicial-council-form/.

- Bill of Sale for Personal Property: In some cases, a more general bill of sale may be used to document the transaction, especially if it includes additional items.

- Release of Liability Form: This form protects the seller from future claims or liabilities after the sale of the golf cart is completed.

Using these documents in conjunction with the Texas Golf Cart Bill of Sale form can help ensure that the sale is properly documented and compliant with state regulations. It is advisable to keep copies of all forms for personal records.

Misconceptions

Understanding the Texas Golf Cart Bill of Sale form is essential for anyone involved in buying or selling a golf cart. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- Golf carts do not need a bill of sale. Many people believe that a bill of sale is unnecessary for golf carts. In Texas, a bill of sale is crucial for documenting the transaction and providing proof of ownership.

- All golf carts are considered vehicles. Some assume that all golf carts are treated like standard vehicles. However, golf carts are classified differently and have specific regulations regarding their use on public roads.

- A bill of sale is only for new golf carts. This is false. A bill of sale is important whether the golf cart is new or used. It protects both the buyer and seller, regardless of the cart's age.

- Verbal agreements are sufficient. Many think that a verbal agreement suffices. In reality, a written bill of sale is necessary to avoid disputes and misunderstandings later on.

- The seller must provide a warranty. Some buyers expect a warranty on used golf carts. However, unless explicitly stated in the bill of sale, the sale is typically "as-is," meaning no warranty is provided.

- Only licensed dealers can sell golf carts. This misconception suggests that only licensed dealers can sell golf carts. In Texas, private individuals can also sell golf carts, provided they complete the necessary documentation.

- Registration is not required for golf carts. While golf carts do not require registration like traditional vehicles, they must comply with local regulations, which may include registration in some areas.

- All golf carts are street legal. Not all golf carts can be driven on public roads. Only those that meet specific criteria set by local laws can be considered street legal.

- A bill of sale is only needed for tax purposes. While taxes are a consideration, the primary purpose of a bill of sale is to document the transaction and protect both parties involved.

- Once signed, a bill of sale cannot be changed. Some believe that a bill of sale is final once signed. However, amendments can be made if both parties agree, as long as they are documented properly.

Understanding these misconceptions can help ensure a smooth transaction when buying or selling a golf cart in Texas. Always consult with a knowledgeable source if uncertain about any aspect of the process.

Preview - Texas Golf Cart Bill of Sale Form

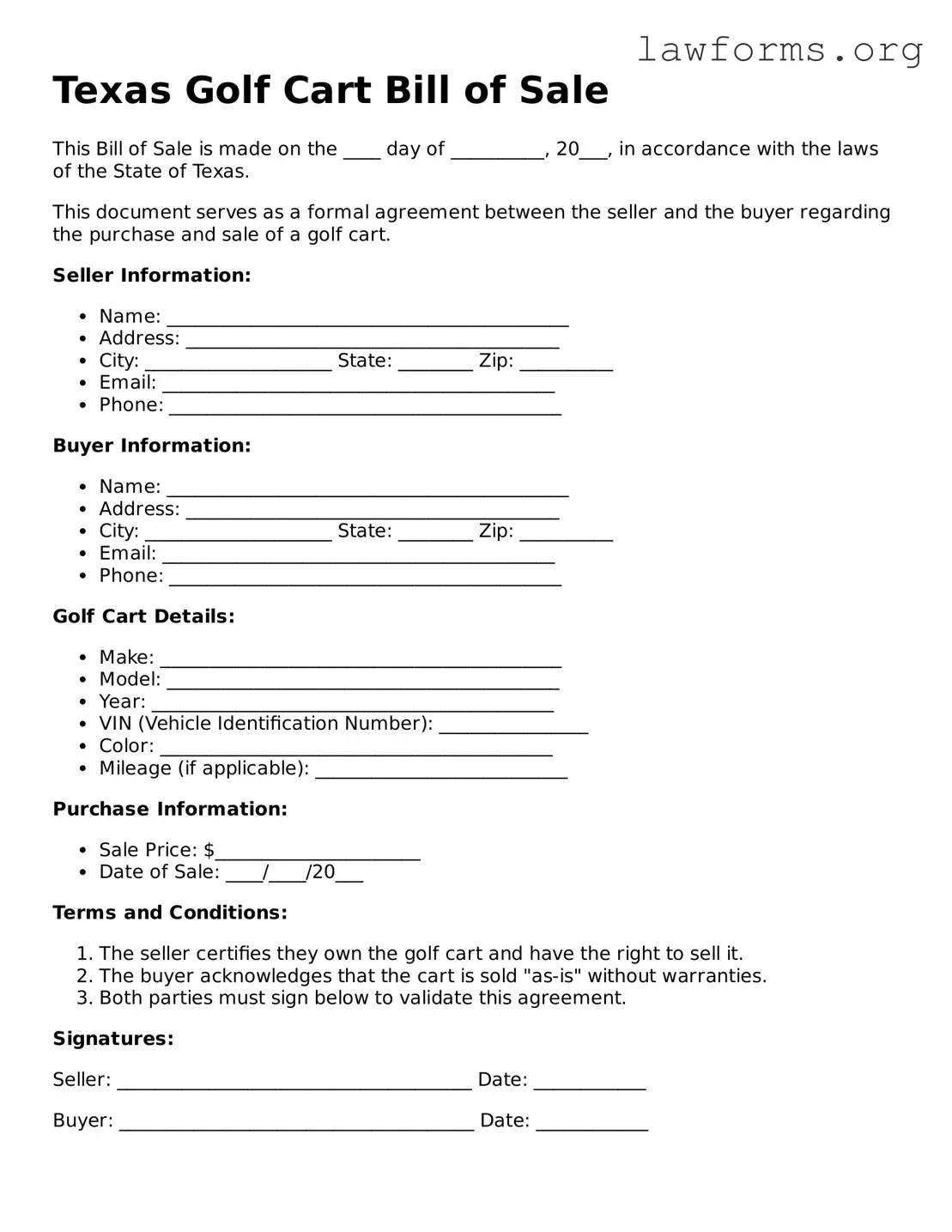

Texas Golf Cart Bill of Sale

This Bill of Sale is made on the ____ day of __________, 20___, in accordance with the laws of the State of Texas.

This document serves as a formal agreement between the seller and the buyer regarding the purchase and sale of a golf cart.

Seller Information:

- Name: ___________________________________________

- Address: ________________________________________

- City: ____________________ State: ________ Zip: __________

- Email: __________________________________________

- Phone: __________________________________________

Buyer Information:

- Name: ___________________________________________

- Address: ________________________________________

- City: ____________________ State: ________ Zip: __________

- Email: __________________________________________

- Phone: __________________________________________

Golf Cart Details:

- Make: ___________________________________________

- Model: __________________________________________

- Year: ___________________________________________

- VIN (Vehicle Identification Number): ________________

- Color: __________________________________________

- Mileage (if applicable): ___________________________

Purchase Information:

- Sale Price: $______________________

- Date of Sale: ____/____/20___

Terms and Conditions:

- The seller certifies they own the golf cart and have the right to sell it.

- The buyer acknowledges that the cart is sold "as-is" without warranties.

- Both parties must sign below to validate this agreement.

Signatures:

Seller: ______________________________________ Date: ____________

Buyer: ______________________________________ Date: ____________

Key takeaways

When dealing with the Texas Golf Cart Bill of Sale form, there are several important aspects to keep in mind. Here are key takeaways to consider:

- Accurate Information: Ensure that all information is filled out accurately. This includes the names and addresses of both the buyer and seller, as well as the golf cart's make, model, and Vehicle Identification Number (VIN).

- Signatures Required: Both the buyer and seller must sign the document. This signature validates the transaction and confirms that both parties agree to the terms outlined in the bill of sale.

- Consider a Notary: While not required, having the bill of sale notarized can provide an extra layer of protection and legitimacy to the transaction.

- Keep Copies: Both the buyer and seller should retain a copy of the completed bill of sale for their records. This can be helpful for future reference or in case of any disputes.

- Registration Requirements: Be aware of any local or state registration requirements for golf carts. In some areas, you may need to register the cart after the sale is complete.

Similar forms

-

Vehicle Bill of Sale: This document serves a similar purpose by transferring ownership of a motor vehicle. It includes details like the buyer and seller's information, vehicle identification number, and sale price.

-

Boat Bill of Sale: Like the Golf Cart Bill of Sale, this document is used to finalize the sale of a boat. It outlines the terms of the sale and includes important details about the vessel.

-

ATV Bill of Sale: This document is specifically for the sale of all-terrain vehicles. It captures the same essential information as a golf cart bill of sale, ensuring a legal transfer of ownership.

-

Motorcycle Bill of Sale: Similar to the Golf Cart Bill of Sale, this form facilitates the transfer of ownership for motorcycles, detailing the buyer, seller, and motorcycle specifics.

- Ohio Trailer Bill of Sale: This essential form facilitates the transfer of ownership for trailers in Ohio, ensuring a documented and recognized transaction. For more information and to obtain the form, visit Ohio PDF Forms.

-

Trailer Bill of Sale: This document is used when selling a trailer. It includes necessary information about the trailer and both parties involved, mirroring the structure of a golf cart sale.

-

Personal Property Bill of Sale: This generic form can be used for various items, including golf carts. It ensures a clear transfer of ownership for personal property.

-

Mobile Home Bill of Sale: This document is used for the sale of mobile homes. It captures the essential details needed for a legal transfer, similar to a golf cart bill of sale.

-

Farm Equipment Bill of Sale: When selling agricultural machinery, this document outlines the sale details and is structured similarly to the golf cart bill of sale.

-

Livestock Bill of Sale: This document is used to transfer ownership of livestock. It includes details about the animals being sold, much like the specifics included in a golf cart sale.

-

Business Asset Bill of Sale: When selling business assets, this document formalizes the transfer of ownership and includes relevant details about the assets, similar to a golf cart bill of sale.