Attorney-Approved Lady Bird Deed Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of transfer on death deed that allows property owners in Texas to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, specifically Section 113.001 and Section 113.002. |

| Benefits | This deed allows property owners to retain control over their property during their lifetime while also ensuring a smooth transfer to heirs. |

| Tax Implications | Using a Lady Bird Deed can help beneficiaries avoid certain tax implications that might arise from a traditional inheritance. |

| Revocability | The deed can be revoked or modified by the property owner at any time before their death, providing flexibility. |

| Eligibility | Only individuals who own real property in Texas can create a Lady Bird Deed. |

| Recording Requirement | To be effective, the Lady Bird Deed must be recorded in the county where the property is located. |

| Beneficiary Designation | Property owners can designate multiple beneficiaries, allowing for shared ownership among heirs. |

| Impact on Medicaid | A Lady Bird Deed can protect the property from being counted as an asset for Medicaid eligibility, under certain conditions. |

| Legal Assistance | While it is possible to create a Lady Bird Deed without an attorney, consulting with a legal professional is advisable to ensure it meets all legal requirements. |

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, it’s important to approach the process with care. Here are some guidelines to help you navigate the form effectively.

- Do ensure that all property details are accurate and complete.

- Do clearly identify the beneficiaries to avoid confusion later.

- Do consult with a legal professional if you have any questions about the form.

- Do keep a copy of the completed deed for your records.

- Don't rush through the form; take your time to review each section.

- Don't leave any sections blank unless instructed to do so.

- Don't forget to sign the deed in the presence of a notary.

- Don't overlook the importance of recording the deed with the county clerk.

Create Popular Lady Bird Deed Forms for Different States

Lady Bird Deed South Carolina - It is recognized in several states and has specific legal requirements for validity.

For those looking to understand the significance of a Do Not Resuscitate Order that is critical for end-of-life care decisions, exploring available resources is vital. This legal document is essential for ensuring that patients receive the level of medical intervention they desire in critical situations.

Transfer on Death Deed Florida Form - The deed facilitates a smoother transfer of property with minimal legal hurdles.

Common mistakes

-

Incorrect Property Description: Many individuals fail to provide a clear and accurate description of the property being transferred. This can lead to confusion or disputes later on.

-

Missing Signatures: It's crucial to ensure that all required parties sign the deed. Omitting a signature can render the document invalid.

-

Not Using the Correct Form: People sometimes use outdated or incorrect versions of the Lady Bird Deed form. Always check for the most current version to avoid issues.

-

Failure to Notarize: A common mistake is neglecting to have the deed notarized. Without notarization, the deed may not be legally recognized.

-

Ignoring Local Laws: Each county may have specific requirements for property transfers. Failing to comply with local regulations can complicate the process.

Documents used along the form

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. When preparing this deed, several other forms and documents may be needed to ensure a smooth process. Below is a list of common documents that often accompany the Lady Bird Deed.

- General Warranty Deed: This document provides a guarantee that the property is free from any liens or claims. It transfers ownership from one party to another and ensures that the seller has the right to sell the property.

- Affidavit of Heirship: Used to establish the heirs of a deceased person, this affidavit helps clarify who inherits property when someone passes away without a will.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. It can be useful if the property owner wishes to delegate authority regarding the Lady Bird Deed.

- Will: A legal document that outlines how a person wishes their assets to be distributed after their death. A will can complement the Lady Bird Deed by addressing other assets not covered by the deed.

- Transfer on Death Deed: Similar to a Lady Bird Deed, this document allows for the transfer of property upon the owner’s death without going through probate. It is important to understand the differences between the two.

- Title Insurance Policy: This policy protects against potential disputes over property ownership. It ensures that the title is clear and can help prevent issues after the Lady Bird Deed is executed.

- Cease and Desist Letter: This legal document can be critical for individuals looking to halt potentially damaging actions by others, ensuring a formal request is made. For more detailed guidance, refer to the Forms Washington template.

- Property Tax Exemption Forms: If the property qualifies for certain tax exemptions, these forms can help maintain those benefits after the transfer of ownership through the Lady Bird Deed.

Understanding these documents can help facilitate the transfer of property and ensure that your wishes are honored. It is always advisable to consult with a legal professional to ensure that all necessary forms are completed accurately and in compliance with Texas law.

Misconceptions

Understanding the Texas Lady Bird Deed can be challenging. Here are six common misconceptions about this legal document.

-

The Lady Bird Deed is only for married couples.

This is not true. The Lady Bird Deed can be utilized by any individual or group of individuals, regardless of marital status, to transfer property while retaining certain rights.

-

Using a Lady Bird Deed avoids all taxes.

While this deed can help avoid probate, it does not exempt the property from property taxes or capital gains taxes. Tax implications still apply.

-

A Lady Bird Deed is the same as a regular transfer on death deed.

While both deeds allow for the transfer of property upon death, the Lady Bird Deed provides additional rights to the grantor, such as the ability to sell or mortgage the property without needing consent from the beneficiaries.

-

The Lady Bird Deed is irrevocable.

This misconception is misleading. The grantor retains the right to revoke or change the deed at any time during their lifetime, allowing for flexibility.

-

All states recognize the Lady Bird Deed.

This is incorrect. The Lady Bird Deed is specific to Texas and may not be valid or recognized in other states.

-

A Lady Bird Deed eliminates the need for a will.

While it can simplify the transfer of certain properties, it does not replace the need for a will. A comprehensive estate plan should include both a will and any necessary deeds.

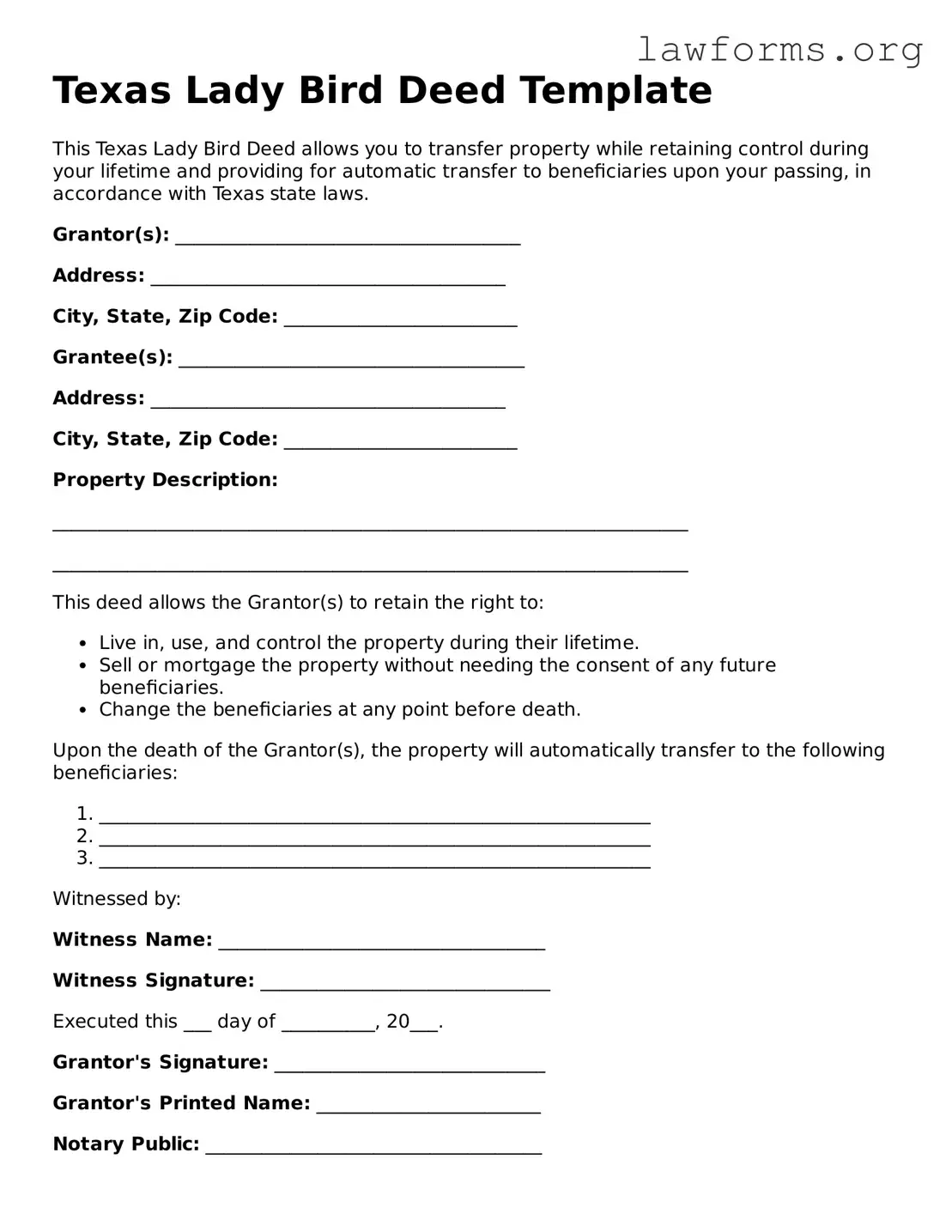

Preview - Texas Lady Bird Deed Form

Texas Lady Bird Deed Template

This Texas Lady Bird Deed allows you to transfer property while retaining control during your lifetime and providing for automatic transfer to beneficiaries upon your passing, in accordance with Texas state laws.

Grantor(s): _____________________________________

Address: ______________________________________

City, State, Zip Code: _________________________

Grantee(s): _____________________________________

Address: ______________________________________

City, State, Zip Code: _________________________

Property Description:

____________________________________________________________________

____________________________________________________________________

This deed allows the Grantor(s) to retain the right to:

- Live in, use, and control the property during their lifetime.

- Sell or mortgage the property without needing the consent of any future beneficiaries.

- Change the beneficiaries at any point before death.

Upon the death of the Grantor(s), the property will automatically transfer to the following beneficiaries:

- ___________________________________________________________

- ___________________________________________________________

- ___________________________________________________________

Witnessed by:

Witness Name: ___________________________________

Witness Signature: _______________________________

Executed this ___ day of __________, 20___.

Grantor's Signature: _____________________________

Grantor's Printed Name: ________________________

Notary Public: ____________________________________

My commission expires: ________________________________

Key takeaways

- The Texas Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining the right to use the property during their lifetime.

- This deed is particularly beneficial for avoiding probate, as the property automatically transfers to the designated beneficiaries upon the owner's death.

- Filling out the form requires accurate information about the property, including its legal description and the names of the grantor and grantee.

- It is essential to include a clear statement of intent to create a Lady Bird Deed, which distinguishes it from other types of deeds.

- Property owners can revoke or change the deed at any time during their lifetime, providing flexibility in estate planning.

- The deed must be signed by the grantor in the presence of a notary public to ensure its validity.

- Once completed, the deed should be filed with the county clerk’s office where the property is located to be effective.

- Beneficiaries named in the deed do not have any rights to the property until the owner's death, which helps maintain control over the property during the owner's lifetime.

- Consulting with a legal professional is advisable to ensure that the deed meets all legal requirements and accurately reflects the owner's intentions.

Similar forms

- Transfer on Death Deed (TODD): This document allows property owners to transfer their real estate to beneficiaries upon their death, similar to how a Lady Bird Deed functions. It avoids probate and provides a straightforward method for passing property to heirs.

- Life Estate Deed: A Life Estate Deed grants a person the right to live in or use a property for their lifetime. After their death, the property automatically transfers to the designated beneficiaries, much like the Lady Bird Deed.

- Revocable Living Trust: This trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. It provides flexibility and avoids probate, similar to the benefits of a Lady Bird Deed.

- Will: A Will outlines how a person's assets will be distributed upon their death. While it does go through probate, it serves a similar purpose in designating beneficiaries for property, akin to the Lady Bird Deed.

- California LLC-1 form: The californiadocsonline.com/california-llc-1-form is essential for filing the Articles of Organization for an LLC in California, ensuring efficient processing and communication with the Secretary of State's office.

- Quitclaim Deed: This document transfers ownership interest in a property without warranties. While it does not specifically address death, it can be used to transfer property between parties, similar to how a Lady Bird Deed designates future ownership.