Attorney-Approved Last Will and Testament Template for the State of Texas

Form Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The Texas Last Will and Testament is governed by the Texas Estates Code. |

| Age Requirement | The testator must be at least 18 years old to create a valid will in Texas. |

| Witness Requirement | At least two witnesses must sign the will for it to be valid. |

| Holographic Will | A handwritten will, known as a holographic will, is valid if it is signed by the testator. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original. |

| Self-Proving Affidavit | A self-proving affidavit can simplify the probate process by affirming the validity of the will. |

| Executor Appointment | The testator can appoint an executor to manage the estate and ensure the will is followed. |

| Distribution of Assets | The will outlines how the testator’s assets will be distributed among beneficiaries. |

| Filing Requirement | The will must be filed with the probate court after the testator's death for it to be enforced. |

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it is crucial to approach the process with care. Here are six important dos and don'ts to keep in mind:

- Do ensure that you are of sound mind and at least 18 years old when creating your will.

- Do clearly identify yourself and state that the document is your last will and testament.

- Do list your beneficiaries clearly, specifying who will inherit your assets.

- Do sign the will in the presence of at least two witnesses who are not beneficiaries.

- Don't use ambiguous language that could lead to confusion about your wishes.

- Don't forget to review and update your will periodically, especially after major life events.

Create Popular Last Will and Testament Forms for Different States

New Jersey Will Template - Allows individuals to name an executor to manage their estate after passing.

A Motor Vehicle Bill of Sale form is not only crucial for documenting the transfer of ownership between the seller and buyer, but it also provides vital information such as the vehicle's make, model, year, and VIN. By using this form, both parties can ensure a smooth transaction process and avoid potential disputes in the future. For a helpful resource, you can obtain a template from Formaid Org, which makes it easier to create this important document.

Simple Will Florida - Can help reduce stress for your loved ones during a difficult time.

Common mistakes

-

Not Clearly Identifying the Testator

One common mistake is failing to clearly state who the will belongs to. It’s essential to include your full name and address at the beginning of the document. This helps to avoid any confusion about the identity of the person making the will.

-

Omitting Witness Signatures

In Texas, you need at least two witnesses to sign your will. People often forget this step, which can lead to complications later. Ensure that your witnesses are not beneficiaries of the will to avoid any potential conflicts of interest.

-

Failing to Update the Will

Life changes, and so should your will. Many individuals neglect to update their wills after significant life events, such as marriage, divorce, or the birth of a child. Regularly reviewing and revising your will can ensure that it accurately reflects your current wishes.

-

Not Being Specific with Assets

Vague language can lead to misunderstandings. When listing assets, be as specific as possible. Instead of saying “my car,” specify the make, model, and year. This clarity helps ensure that your wishes are carried out exactly as you intend.

-

Ignoring the Self-Proving Affidavit

Many people overlook the self-proving affidavit, which can simplify the probate process. This affidavit, signed by the witnesses at the same time as the will, can help verify the authenticity of the will and reduce the need for witnesses to testify in court later.

Documents used along the form

When preparing a Texas Last Will and Testament, several other forms and documents may be necessary to ensure that your wishes are clearly expressed and legally binding. Each of these documents serves a unique purpose in the estate planning process.

- Durable Power of Attorney: This document allows you to designate someone to make financial and legal decisions on your behalf if you become unable to do so yourself.

- Medical Power of Attorney: Similar to the durable power of attorney, this form lets you appoint someone to make healthcare decisions for you when you cannot communicate your wishes.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you are unable to express your wishes, particularly at the end of life.

- Beneficiary Designations: These forms are used to specify who will receive certain assets, like life insurance policies or retirement accounts, outside of the will.

- Trusts: A trust can be established to manage your assets during your lifetime and after your death, providing more control over how and when your assets are distributed.

- Affidavit of Heirship: This document can help establish the heirs of a deceased person, especially when there is no will, aiding in the transfer of property.

- Guardianship Designation: If you have minor children, this document allows you to name a guardian who will care for them in the event of your passing.

- Codicil: A codicil is a legal document that modifies an existing will. It can add, remove, or change provisions without creating a new will.

Using these documents in conjunction with a Texas Last Will and Testament can help ensure that your wishes are honored and that your loved ones are cared for according to your preferences. It is always advisable to consult with a professional to ensure that all documents are completed correctly and meet your specific needs.

Misconceptions

Understanding the Texas Last Will and Testament form is crucial for anyone planning their estate. Here are six common misconceptions that people often have:

- Only wealthy people need a will. Many believe that wills are only for the wealthy. In reality, anyone with assets or dependents should have a will to ensure their wishes are honored.

- A will can be verbal. Some think that a verbal agreement is enough. However, Texas law requires a written document to be legally binding.

- Wills are only for after death. While wills do take effect after death, they can also help manage your affairs if you become incapacitated.

- Just having a will is enough. A will is important, but it may not cover all aspects of your estate. Trusts and other documents can also be necessary.

- Any will is valid in Texas. Wills must meet specific legal requirements to be valid in Texas. It’s important to use the correct form and follow state laws.

- Wills are set in stone. Many people think a will cannot be changed. In Texas, you can update or revoke your will at any time, as long as you follow the proper procedures.

Being informed about these misconceptions can help you make better decisions regarding your estate planning.

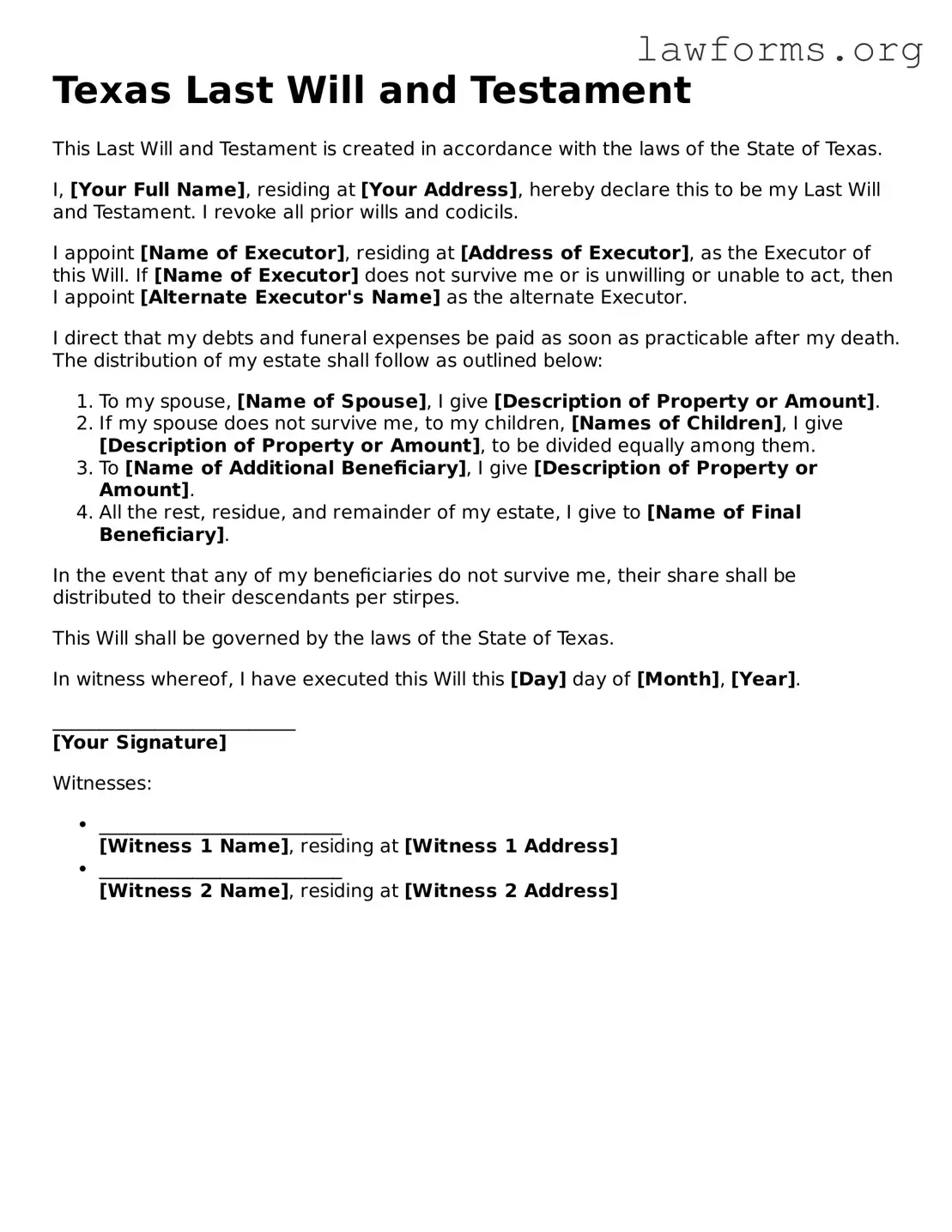

Preview - Texas Last Will and Testament Form

Texas Last Will and Testament

This Last Will and Testament is created in accordance with the laws of the State of Texas.

I, [Your Full Name], residing at [Your Address], hereby declare this to be my Last Will and Testament. I revoke all prior wills and codicils.

I appoint [Name of Executor], residing at [Address of Executor], as the Executor of this Will. If [Name of Executor] does not survive me or is unwilling or unable to act, then I appoint [Alternate Executor's Name] as the alternate Executor.

I direct that my debts and funeral expenses be paid as soon as practicable after my death. The distribution of my estate shall follow as outlined below:

- To my spouse, [Name of Spouse], I give [Description of Property or Amount].

- If my spouse does not survive me, to my children, [Names of Children], I give [Description of Property or Amount], to be divided equally among them.

- To [Name of Additional Beneficiary], I give [Description of Property or Amount].

- All the rest, residue, and remainder of my estate, I give to [Name of Final Beneficiary].

In the event that any of my beneficiaries do not survive me, their share shall be distributed to their descendants per stirpes.

This Will shall be governed by the laws of the State of Texas.

In witness whereof, I have executed this Will this [Day] day of [Month], [Year].

__________________________

[Your Signature]

Witnesses:

- __________________________

[Witness 1 Name], residing at [Witness 1 Address] - __________________________

[Witness 2 Name], residing at [Witness 2 Address]

Key takeaways

When filling out and using the Texas Last Will and Testament form, it’s important to keep several key points in mind. These takeaways can help ensure that your will is valid and reflects your wishes.

- Understand the Requirements: In Texas, you must be at least 18 years old and of sound mind to create a valid will.

- Choose Your Executor Wisely: Select a trusted individual to act as the executor of your estate. This person will be responsible for carrying out your wishes as outlined in the will.

- Be Clear and Specific: Clearly state your wishes regarding asset distribution. Ambiguities can lead to disputes among heirs.

- Sign and Date the Will: To make your will legally binding, you must sign and date it in the presence of at least two witnesses who are not beneficiaries.

- Store Your Will Safely: Keep the original document in a secure location, such as a safe deposit box or with your attorney, and inform your executor where it is stored.

- Review and Update Regularly: Life changes, such as marriage, divorce, or the birth of children, may necessitate updates to your will. Regularly review it to ensure it remains current.

Similar forms

The Last Will and Testament is a crucial document for anyone looking to outline their wishes regarding the distribution of their assets after passing. Several other documents serve similar purposes in estate planning and management. Here are six documents that share similarities with a Last Will and Testament:

- Living Trust: A living trust allows individuals to transfer their assets into a trust during their lifetime. Like a will, it specifies how assets should be distributed upon death but can also help avoid probate.

- Power of Attorney: This document grants someone the authority to make decisions on your behalf if you become incapacitated. It complements a will by ensuring your financial and medical wishes are honored while you are still alive.

- Advance Healthcare Directive: Also known as a living will, this document outlines your healthcare preferences in case you cannot communicate them. It works alongside a will by addressing medical decisions separately from asset distribution.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. This document functions similarly to a will by designating who receives specific assets upon your death.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes without creating an entirely new document, ensuring your last wishes remain current and accurate.

- Revocable Trust: Similar to a living trust, a revocable trust can be altered or dissolved during your lifetime. It provides flexibility in asset management and distribution, much like a will, but can also help streamline the probate process.