Attorney-Approved Loan Agreement Template for the State of Texas

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Texas Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Texas. |

| Parties Involved | The form includes spaces for the names and contact information of both the lender and the borrower. |

| Loan Amount | The specific amount of money being loaned must be clearly stated in the agreement. |

| Interest Rate | The interest rate applicable to the loan should be specified, including whether it is fixed or variable. |

| Repayment Terms | The agreement must outline the repayment schedule, including due dates and payment amounts. |

| Default Terms | Conditions under which the borrower may be considered in default should be clearly defined. |

| Signatures | Both parties must sign and date the agreement to make it legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Dos and Don'ts

When filling out the Texas Loan Agreement form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here are seven things to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate personal and financial information.

- Do ensure that all signatures are included where required.

- Do double-check the loan amount and terms for correctness.

- Don't leave any sections blank unless instructed.

- Don't rush through the process; take your time to avoid mistakes.

- Don't ignore any additional documentation requirements specified in the form.

Following these guidelines can help streamline the process and prevent delays in your loan application.

Create Popular Loan Agreement Forms for Different States

New York Promissory Note - Clarifies the transferability of the loan agreement.

It is crucial for defendants to understand the implications of the Illinois 20A form, as it triggers essential legal procedures in the recovery of real estate possession, and detailed guidance can be found on formsillinois.com, where users can obtain and fill out the necessary documentation to ensure compliance with the court's requirements.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out essential details. Make sure to fill in all required fields, including names, addresses, and loan amounts. Missing information can delay processing.

-

Incorrect Loan Amount: Double-check the loan amount you are requesting. Entering an incorrect figure can lead to confusion and may result in a denial of your application.

-

Not Reading the Terms: Failing to read and understand the terms of the agreement can lead to unexpected obligations. Take the time to review the interest rates, repayment schedule, and any fees associated with the loan.

-

Signature Errors: Ensure that all required signatures are present. Missing or incorrect signatures can invalidate the agreement, causing delays in processing your loan.

-

Providing Outdated Information: Using old or incorrect personal information can create issues. Always verify that your contact details and financial information are current before submission.

-

Failure to Attach Necessary Documentation: Not including required documents, such as proof of income or identification, can lead to immediate rejection. Make sure to gather and attach all necessary paperwork to support your application.

Documents used along the form

In the context of a Texas Loan Agreement, several other forms and documents are commonly utilized to ensure clarity and legality in the lending process. Each of these documents serves a specific purpose, contributing to the overall structure of the loan transaction.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount under specified terms, including interest rates and payment schedules.

- Security Agreement: This agreement details the collateral that secures the loan, providing the lender with a claim to the asset in case of default.

- Disclosure Statement: Lenders are often required to provide a disclosure statement that includes important information about the loan, such as fees and terms, ensuring transparency for the borrower.

- Loan Application: The borrower typically submits a loan application, which includes personal and financial information necessary for the lender to assess creditworthiness.

- Credit Report Authorization: This document allows the lender to obtain the borrower’s credit report, which is crucial for evaluating their financial history and ability to repay the loan.

- Personal Guarantee: In some cases, a personal guarantee may be required, where an individual agrees to be personally liable for the loan if the borrowing entity defaults.

- Loan Closing Statement: This statement summarizes the final terms of the loan, including any adjustments and fees, and is typically reviewed and signed at the closing of the loan.

- California LLC-1 Form: When establishing a Limited Liability Company (LLC) in California, it is essential to complete the californiadocsonline.com/california-llc-1-form/ to facilitate communication with the Secretary of State's office and ensure efficient processing of your submission.

- Amortization Schedule: This document provides a detailed breakdown of each payment over the life of the loan, showing how much goes toward principal and interest.

- Release of Lien: Once the loan is fully repaid, a release of lien is issued, which formally removes the lender's claim on the collateral used to secure the loan.

Understanding these accompanying documents is essential for both borrowers and lenders, as they collectively define the terms and conditions of the loan, ensuring that all parties are aware of their rights and obligations throughout the lending process.

Misconceptions

Many people have misunderstandings about the Texas Loan Agreement form. Here are four common misconceptions:

- It is only for large loans. Many believe this form is only applicable for substantial amounts of money. In reality, it can be used for loans of various sizes, making it versatile for personal and business needs.

- It requires a lawyer to complete. Some think that a lawyer must draft or review the agreement. While legal advice can be beneficial, individuals can fill out the form themselves, provided they understand the terms involved.

- It is the same as a promissory note. There is a belief that the Texas Loan Agreement form is identical to a promissory note. However, while both documents relate to loans, the agreement typically outlines the terms of the loan in more detail, including repayment schedules and interest rates.

- It is not enforceable in court. Some people think that this form holds no legal weight. This is incorrect; when properly completed and signed, it is a legally binding document that can be enforced in court if necessary.

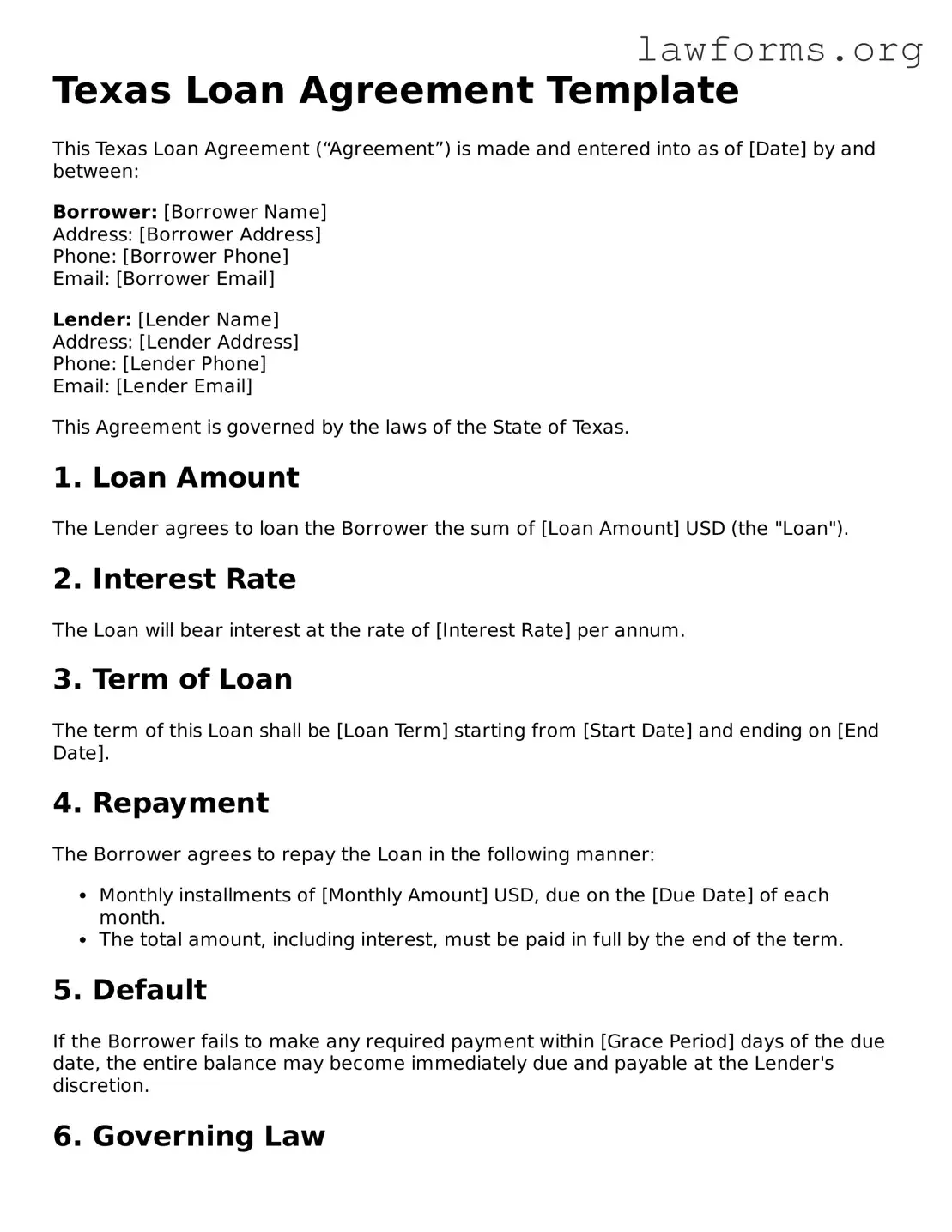

Preview - Texas Loan Agreement Form

Texas Loan Agreement Template

This Texas Loan Agreement (“Agreement”) is made and entered into as of [Date] by and between:

Borrower: [Borrower Name]

Address: [Borrower Address]

Phone: [Borrower Phone]

Email: [Borrower Email]

Lender: [Lender Name]

Address: [Lender Address]

Phone: [Lender Phone]

Email: [Lender Email]

This Agreement is governed by the laws of the State of Texas.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of [Loan Amount] USD (the "Loan").

2. Interest Rate

The Loan will bear interest at the rate of [Interest Rate] per annum.

3. Term of Loan

The term of this Loan shall be [Loan Term] starting from [Start Date] and ending on [End Date].

4. Repayment

The Borrower agrees to repay the Loan in the following manner:

- Monthly installments of [Monthly Amount] USD, due on the [Due Date] of each month.

- The total amount, including interest, must be paid in full by the end of the term.

5. Default

If the Borrower fails to make any required payment within [Grace Period] days of the due date, the entire balance may become immediately due and payable at the Lender's discretion.

6. Governing Law

This Agreement shall be interpreted and enforced in accordance with the laws of the State of Texas.

7. Amendments

No amendment or modification of this Agreement shall be valid unless made in writing and signed by both parties.

8. Acceptance

By signing below, the parties acknowledge and agree to the terms of this Loan Agreement.

Borrower Signature: ___________________________

Date: _______________

Lender Signature: ___________________________

Date: _______________

Key takeaways

When filling out and using the Texas Loan Agreement form, there are several important points to keep in mind. Here are key takeaways to consider:

- Ensure that all parties involved in the loan are clearly identified. This includes the lender and the borrower.

- Clearly state the loan amount. This figure should reflect the total amount being borrowed.

- Specify the interest rate. If applicable, indicate whether it is fixed or variable.

- Outline the repayment terms. Include details such as the schedule for payments and the duration of the loan.

- Include any collateral details if the loan is secured. This provides assurance to the lender.

- Be aware of any fees associated with the loan. Clearly list these to avoid misunderstandings later.

- Both parties should sign and date the agreement. This formalizes the contract and makes it legally binding.

- Keep a copy of the signed agreement for your records. This is crucial for future reference and clarity.

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a specific amount of money to a lender. Like a loan agreement, it includes details such as the loan amount, interest rate, and repayment terms, but it is generally simpler and focuses primarily on the borrower's commitment.

-

Mortgage Agreement: When a loan is secured by real estate, a mortgage agreement is used. This document details the terms of the loan and the property involved. Similar to a loan agreement, it specifies the amount borrowed, interest rates, and consequences of default, but it also includes information about the property being used as collateral.

- Cease and Desist Letter: This legal document is critical in addressing harmful actions by formally requesting their cessation. For additional guidance on drafting this letter, consider the template provided by Forms Washington.

-

Security Agreement: This document is used when a borrower offers collateral to secure a loan. It outlines the rights of the lender regarding the collateral, much like a loan agreement does with the terms of the loan itself. Both documents protect the lender's interests in case of default.

-

Line of Credit Agreement: A line of credit agreement allows borrowers to access funds up to a specified limit. Similar to a loan agreement, it details the terms of borrowing, interest rates, and repayment schedules, but it offers more flexibility in how and when the borrower can use the funds.

-

Loan Modification Agreement: This document is used to change the terms of an existing loan. Like a loan agreement, it includes details about the loan amount and terms, but it specifically addresses modifications such as changes in interest rates or repayment schedules.

-

Personal Loan Agreement: This type of agreement is used for unsecured loans between individuals or businesses. It shares many characteristics with a loan agreement, including the loan amount, interest rates, and repayment terms, but it often has fewer formalities since it may not involve a financial institution.