Attorney-Approved Motor Vehicle Bill of Sale Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by the Texas Transportation Code, specifically Section 501.007. |

| Required Information | The form must include details such as the vehicle identification number (VIN), make, model, year, and the sale price. |

| Signatures | Both the seller and buyer must sign the document to validate the sale. |

| Notarization | While notarization is not required, it can provide additional security and legitimacy to the transaction. |

| Use for Title Transfer | The Bill of Sale can be used as a supporting document when applying for a new title with the Texas Department of Motor Vehicles. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

| Sales Tax | Sales tax is typically due at the time of title transfer based on the sale price recorded in the Bill of Sale. |

| Online Availability | The Texas Motor Vehicle Bill of Sale form can often be found online through various state and legal websites. |

| Dispute Resolution | In case of disputes, the Bill of Sale serves as a legal document that can support claims regarding the terms of the sale. |

Dos and Don'ts

When filling out the Texas Motor Vehicle Bill of Sale form, it's essential to ensure accuracy and completeness. Here are some key dos and don'ts to keep in mind:

- Do provide accurate vehicle information, including the make, model, year, and VIN.

- Don't leave any sections blank; incomplete forms can lead to issues later.

- Do include the full names and addresses of both the buyer and seller.

- Don't forget to sign and date the form; both parties must provide their signatures.

- Do indicate the sale price clearly to avoid confusion.

- Don't use white-out or make alterations; this can invalidate the document.

- Do keep a copy of the completed form for your records.

Following these guidelines will help ensure a smooth transaction and protect both parties involved.

Create Popular Motor Vehicle Bill of Sale Forms for Different States

Bill of Sale Requirements - A simple document for transferring ownership of a vehicle between a seller and a buyer.

The Employee Handbook form is an important document that outlines a company's policies, procedures, and expectations for its employees. This form serves as a resource to help employees understand their rights and responsibilities within the workplace. For a comprehensive guide on creating effective employee handbooks, consider visiting Top Document Templates. Ensure you're informed—fill out the form by clicking the button below.

Bill of Sale for a Car - It can also provide clarification on the payment method used in the sale.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Every section, including buyer and seller details, vehicle information, and sale price, must be completed to ensure the document is valid.

-

Incorrect Vehicle Identification Number (VIN): The VIN is crucial for identifying the vehicle. Errors in this number can lead to complications in registration and ownership transfer.

-

Missing Signatures: Both the buyer and seller must sign the document. Omitting signatures can render the bill of sale ineffective.

-

Not Dated: Failing to include the date of the transaction can create confusion regarding the timeline of ownership and responsibilities.

-

Inaccurate Sale Price: Listing an incorrect sale price can lead to issues with taxes and future transactions. Always ensure that the price reflects the agreed-upon amount.

-

Not Including Odometer Reading: The odometer reading is a critical piece of information. It should be accurately recorded to prevent disputes about the vehicle’s condition and mileage.

-

Failure to Provide a Copy: After completing the bill of sale, both parties should retain a copy. Not doing so can lead to misunderstandings later on.

-

Ignoring State Requirements: Each state may have specific requirements for a bill of sale. Failing to adhere to Texas regulations can result in legal complications.

-

Not Notarizing When Necessary: While notarization is not always required, some transactions may benefit from it. Notarizing can provide an extra layer of protection for both parties.

-

Assuming the Form is Standard: Using a generic bill of sale form without ensuring it meets Texas requirements can lead to issues. Always use the appropriate form for the state.

Documents used along the form

When buying or selling a vehicle in Texas, the Motor Vehicle Bill of Sale form is just one piece of the puzzle. There are several other important documents that often accompany this form to ensure a smooth transaction. Understanding these documents can help both buyers and sellers navigate the process with confidence.

- Texas Title Application (Form 130-U): This form is used to apply for a new title after a vehicle purchase. It contains information about the buyer, seller, and the vehicle itself.

- Vehicle Title: This is the official document that proves ownership of the vehicle. It must be transferred from the seller to the buyer during the sale.

- Odometer Disclosure Statement: Required for vehicles less than 10 years old, this document verifies the vehicle's mileage at the time of sale, helping to prevent fraud.

- Application for Texas Certificate of Title (Form 130-U): This form is used to apply for a title for a vehicle that does not currently have one, such as a homemade trailer.

- Vehicle Registration: After purchasing a vehicle, the new owner must register it with the Texas Department of Motor Vehicles (DMV) to legally drive it on public roads.

- Proof of Insurance: Before registering the vehicle, the buyer must provide proof of insurance, demonstrating that the vehicle is covered in case of an accident.

- Sales Tax Receipt: When a vehicle is purchased, sales tax is typically due. This receipt serves as proof that the tax has been paid.

- Affidavit of Motor Vehicle Gift Transfer: If the vehicle is being given as a gift, this document is necessary to establish that no money was exchanged.

- Temporary Tag Application: If immediate registration is not possible, this form allows the buyer to obtain a temporary tag to legally drive the vehicle until full registration is completed.

Being informed about these documents can significantly ease the process of buying or selling a vehicle in Texas. Each document plays a crucial role in ensuring that the transaction is legal and that both parties are protected. Always consider consulting with a professional if you have any questions or uncertainties during the process.

Misconceptions

The Texas Motor Vehicle Bill of Sale form is an important document for anyone buying or selling a vehicle in the state. However, several misconceptions surround its use. Here are five common misunderstandings:

-

It is not necessary to use a Bill of Sale in Texas.

Many people believe that a Bill of Sale is optional when transferring ownership of a vehicle. In reality, while not always legally required, it serves as a crucial record of the transaction, providing proof of sale for both parties.

-

All sales must be notarized.

Some individuals think that every Bill of Sale must be notarized to be valid. This is not true. In Texas, notarization is not required, although it can add an extra layer of security and authenticity to the document.

-

A Bill of Sale is the same as a title transfer.

This misconception can lead to confusion. A Bill of Sale documents the transaction, while a title transfer officially changes ownership with the Texas Department of Motor Vehicles. Both are important but serve different purposes.

-

Only the seller needs to sign the Bill of Sale.

Many believe that only the seller's signature is necessary. In fact, both the buyer and the seller should sign the Bill of Sale to ensure that both parties acknowledge and agree to the terms of the sale.

-

Once the Bill of Sale is completed, no further action is needed.

Some think that completing the Bill of Sale is the end of the process. However, the buyer must also apply for a new title and registration with the local DMV, which is a crucial step in finalizing the ownership transfer.

Understanding these misconceptions can help ensure a smoother vehicle transaction process in Texas. Always take the time to familiarize yourself with the requirements and best practices when buying or selling a vehicle.

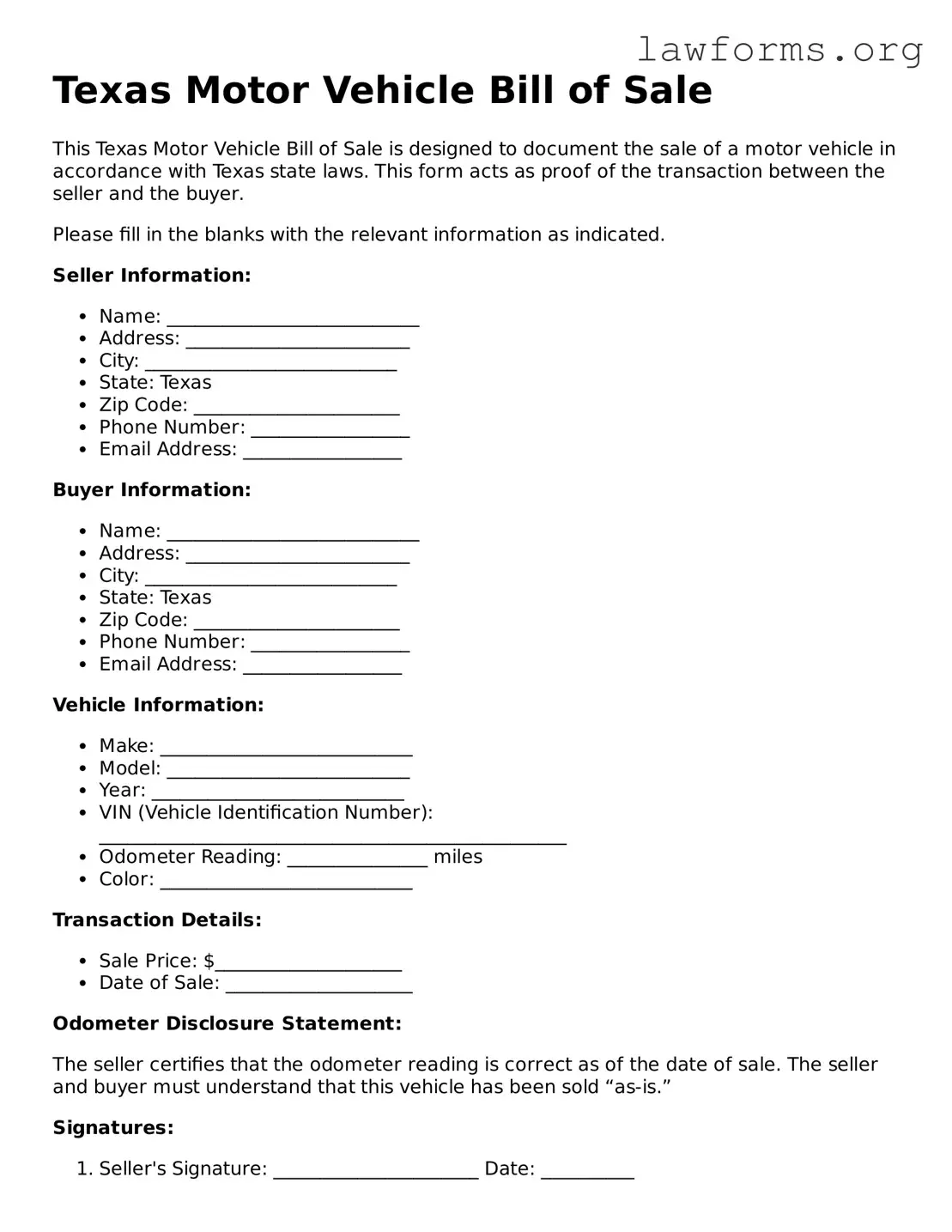

Preview - Texas Motor Vehicle Bill of Sale Form

Texas Motor Vehicle Bill of Sale

This Texas Motor Vehicle Bill of Sale is designed to document the sale of a motor vehicle in accordance with Texas state laws. This form acts as proof of the transaction between the seller and the buyer.

Please fill in the blanks with the relevant information as indicated.

Seller Information:

- Name: ___________________________

- Address: ________________________

- City: ___________________________

- State: Texas

- Zip Code: ______________________

- Phone Number: _________________

- Email Address: _________________

Buyer Information:

- Name: ___________________________

- Address: ________________________

- City: ___________________________

- State: Texas

- Zip Code: ______________________

- Phone Number: _________________

- Email Address: _________________

Vehicle Information:

- Make: ___________________________

- Model: __________________________

- Year: ___________________________

- VIN (Vehicle Identification Number): __________________________________________________

- Odometer Reading: _______________ miles

- Color: ___________________________

Transaction Details:

- Sale Price: $____________________

- Date of Sale: ____________________

Odometer Disclosure Statement:

The seller certifies that the odometer reading is correct as of the date of sale. The seller and buyer must understand that this vehicle has been sold “as-is.”

Signatures:

- Seller's Signature: ______________________ Date: __________

- Buyer's Signature: ______________________ Date: __________

This document is to be used for record-keeping purposes. It is recommended to keep a copy of this Bill of Sale for your records.

Key takeaways

When filling out and using the Texas Motor Vehicle Bill of Sale form, there are several important points to keep in mind. This document serves as proof of the transaction between the buyer and the seller. Here are some key takeaways:

- Accurate Information: Ensure that all details, including the vehicle identification number (VIN), make, model, and year of the vehicle, are entered accurately. Mistakes can lead to issues with registration.

- Signatures Required: Both the seller and the buyer must sign the form. This signature confirms that both parties agree to the terms of the sale.

- Notarization: While notarization is not mandatory for the Bill of Sale in Texas, having it notarized can add an extra layer of security and legitimacy to the transaction.

- Keep Copies: After completing the form, both the buyer and seller should keep copies for their records. This documentation can be helpful in case of future disputes or for tax purposes.

- Use for Registration: The completed Bill of Sale is often required when registering the vehicle in the buyer's name. It serves as proof of ownership and can facilitate a smoother registration process.

By following these guidelines, individuals can ensure a more seamless transaction when buying or selling a vehicle in Texas.

Similar forms

- Boat Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this document serves as proof of ownership transfer for a boat. It includes details about the vessel, the buyer, and the seller.

- Motorcycle Bill of Sale: This form is used to document the sale of a motorcycle. It captures essential information such as the vehicle identification number (VIN), sale price, and the parties involved.

- ATV Bill of Sale: Just like the Motor Vehicle Bill of Sale, this document facilitates the transfer of ownership for all-terrain vehicles. It ensures both parties have a record of the transaction.

- Trailer Bill of Sale: This document is used for the sale of trailers. It outlines the specifics of the trailer and provides a legal record of the ownership change.

- Mobile Home Bill of Sale: This form is similar in purpose, as it transfers ownership of a mobile home. It includes details about the home and the sale agreement between the buyer and seller.

- Aircraft Bill of Sale: Used for the transfer of ownership of an aircraft, this document contains information about the aircraft and the parties involved, much like the Motor Vehicle Bill of Sale.

- Equipment Bill of Sale: This document is utilized for the sale of various types of equipment, ensuring that both the buyer and seller have a record of the transaction.

- Real Estate Purchase Agreement: While primarily for property, this agreement outlines the terms of a sale, similar to how a Motor Vehicle Bill of Sale details the terms of a vehicle sale.

- Personal Property Bill of Sale: This form is used for the sale of personal items, providing a record of ownership transfer, akin to the Motor Vehicle Bill of Sale.

- Gift Receipt: When a vehicle is given as a gift, this document can serve a similar purpose to a Bill of Sale by documenting the transfer of ownership without a monetary exchange.