Attorney-Approved Operating Agreement Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The Texas Operating Agreement outlines the management structure and operational procedures of a limited liability company (LLC) in Texas. |

| Governing Law | This agreement is governed by the Texas Business Organizations Code. |

| Member Rights | It specifies the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Flexibility | The Operating Agreement allows for flexibility, enabling members to customize their LLC’s operations according to their needs. |

| Importance | Having a written Operating Agreement is crucial, as it helps prevent disputes and provides a clear framework for the LLC’s operations. |

Dos and Don'ts

When filling out the Texas Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about your business.

- Do include the names and addresses of all members involved.

- Do specify the management structure clearly, whether it’s member-managed or manager-managed.

- Do consult with a legal professional if you have any questions.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't use vague language; be specific in your descriptions and terms.

- Don't rush through the process; take your time to ensure everything is correct.

- Don't forget to sign and date the form where required.

By adhering to these guidelines, you can help ensure that your Texas Operating Agreement is completed properly and serves your business needs effectively.

Create Popular Operating Agreement Forms for Different States

Is an Operating Agreement Required for an Llc - The document can be revised as needed to reflect changes in the business structure.

When purchasing a trailer, it is important to utilize the Washington Trailer Bill of Sale form to formalize the transaction. This legal document not only verifies the ownership transfer but also provides necessary details, such as the trailer's identification and purchase price. For those looking to create this essential form, templates can be found at Forms Washington, ensuring that all required information is accurately recorded to comply with state regulations.

Ohio Llc Operating Agreement Pdf - The Operating Agreement may discuss tax treatment preferences of the LLC.

Common mistakes

-

Failing to include all members' names and addresses. Each member's information is crucial for the agreement's validity.

-

Not specifying the ownership percentages. Clearly defining each member's share helps prevent disputes later.

-

Omitting the purpose of the business. A clear statement of purpose establishes the company's goals and objectives.

-

Using vague language. Specific terms and conditions provide clarity and reduce the potential for misunderstandings.

-

Neglecting to outline management structure. Defining roles and responsibilities ensures smooth operations and decision-making.

-

Not including procedures for adding or removing members. This is essential for adapting to future changes in the business.

-

Failing to address profit and loss distribution. Clearly stating how profits and losses will be shared can prevent conflicts.

-

Overlooking dispute resolution methods. Establishing a process for resolving conflicts can save time and resources.

-

Not having the document signed and dated. Signatures are necessary to validate the agreement and make it legally binding.

-

Forgetting to review and update the agreement regularly. Regular reviews help ensure that the agreement remains relevant and accurate.

Documents used along the form

The Texas Operating Agreement is a crucial document for limited liability companies (LLCs) in Texas, outlining the management structure and operational procedures of the company. Several other forms and documents are commonly used in conjunction with the Operating Agreement to ensure compliance and clarity in business operations. Below is a list of these documents, each serving a specific purpose.

- Articles of Organization: This document is filed with the Texas Secretary of State to officially create the LLC. It includes basic information such as the company name, registered agent, and purpose of the business.

- Member Resolution: This is a formal document that records decisions made by the members of the LLC. It can address various matters, such as approving new members or authorizing significant business transactions.

- Bylaws: While not always required for LLCs, bylaws outline the internal rules and procedures for managing the company. They can cover topics like voting rights and meeting protocols.

- Operating Procedures: This document details the day-to-day operational processes of the LLC. It can include guidelines for financial management, employee responsibilities, and customer interactions.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

- Tax Election Forms: LLCs may need to file forms with the IRS to elect how they will be taxed, such as choosing between partnership or corporate taxation.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared among members or between the LLC and third parties. This document helps maintain business secrets and proprietary information.

- Employment Agreements: These contracts outline the terms of employment for individuals working for the LLC. They can specify job responsibilities, compensation, and termination conditions.

- Annual Reports: Many states, including Texas, require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the company and its members.

Using these documents in conjunction with the Texas Operating Agreement helps ensure that the LLC operates smoothly and complies with state regulations. Each document plays a vital role in defining the structure and functioning of the business, contributing to its long-term success.

Misconceptions

The Texas Operating Agreement form is an essential document for limited liability companies (LLCs) in Texas. However, several misconceptions surround its purpose and requirements. Below is a list of ten common misconceptions, along with clarifications to help understand the importance of this form.

- It is not necessary for all LLCs. Some believe that an Operating Agreement is optional. In Texas, while not required by law, it is highly recommended to outline the management structure and operational guidelines.

- It must be filed with the state. Many think the Operating Agreement needs to be submitted to the Texas Secretary of State. In reality, this document is kept internally and is not filed with any state agency.

- It can only be created at the formation of the LLC. Some individuals assume that the Operating Agreement must be established when the LLC is formed. However, it can be created or amended at any time during the life of the company.

- All members must sign the agreement. There is a belief that every member of the LLC must sign the Operating Agreement for it to be valid. While it is best practice to have all members sign, the agreement can still be enforceable even without every signature.

- It does not need to be updated. Some people think that once the Operating Agreement is created, it does not require updates. Changes in membership, business structure, or state laws may necessitate revisions to the document.

- It can be a verbal agreement. There is a misconception that a verbal agreement is sufficient. An Operating Agreement should be in writing to provide clarity and legal protection for the members.

- It is only for multi-member LLCs. Many believe that Operating Agreements are only necessary for LLCs with multiple members. However, single-member LLCs also benefit from having an Operating Agreement to define their operations.

- It can be overly complex. Some individuals think that Operating Agreements must be complicated legal documents. In fact, they can be straightforward and tailored to the specific needs of the LLC.

- It is only about profit distribution. A common misconception is that the Operating Agreement only addresses how profits are shared. In truth, it covers various aspects, including management roles, decision-making processes, and member responsibilities.

- It is not enforceable in court. There is a belief that an Operating Agreement lacks legal weight. However, this document is legally binding and can be enforced in court, provided it is properly executed.

Understanding these misconceptions can help ensure that LLC owners in Texas recognize the significance of the Operating Agreement and its role in effective business management.

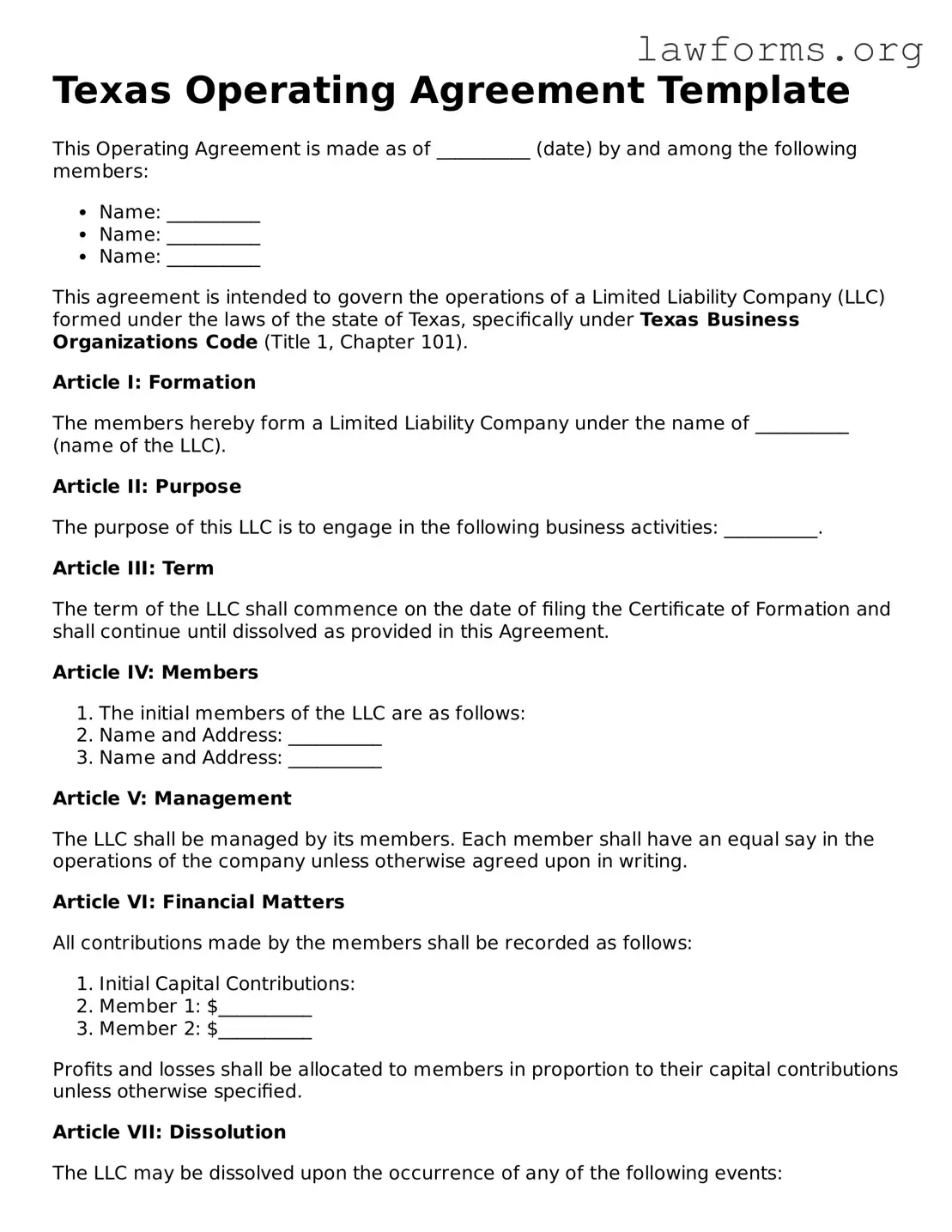

Preview - Texas Operating Agreement Form

Texas Operating Agreement Template

This Operating Agreement is made as of __________ (date) by and among the following members:

- Name: __________

- Name: __________

- Name: __________

This agreement is intended to govern the operations of a Limited Liability Company (LLC) formed under the laws of the state of Texas, specifically under Texas Business Organizations Code (Title 1, Chapter 101).

Article I: Formation

The members hereby form a Limited Liability Company under the name of __________ (name of the LLC).

Article II: Purpose

The purpose of this LLC is to engage in the following business activities: __________.

Article III: Term

The term of the LLC shall commence on the date of filing the Certificate of Formation and shall continue until dissolved as provided in this Agreement.

Article IV: Members

- The initial members of the LLC are as follows:

- Name and Address: __________

- Name and Address: __________

Article V: Management

The LLC shall be managed by its members. Each member shall have an equal say in the operations of the company unless otherwise agreed upon in writing.

Article VI: Financial Matters

All contributions made by the members shall be recorded as follows:

- Initial Capital Contributions:

- Member 1: $__________

- Member 2: $__________

Profits and losses shall be allocated to members in proportion to their capital contributions unless otherwise specified.

Article VII: Dissolution

The LLC may be dissolved upon the occurrence of any of the following events:

- By the unanimous agreement of the members.

- Upon the death, resignation, or expulsion of a member.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by all members.

IN WITNESS WHEREOF, the members have executed this Operating Agreement as of the date first above written.

Signature: ____________________ Date: __________

Signature: ____________________ Date: __________

Key takeaways

When filling out and using the Texas Operating Agreement form, keep these key takeaways in mind:

- Purpose of the Agreement: The Operating Agreement outlines the management structure and operational procedures for your LLC. It serves as a foundational document that guides the business's internal workings.

- Member Information: Clearly list all members of the LLC. Include their names, addresses, and ownership percentages to avoid any future disputes regarding ownership and responsibilities.

- Management Structure: Decide whether the LLC will be member-managed or manager-managed. This decision affects how decisions are made and who has authority over the business.

- Voting Rights: Specify how voting will occur among members. Outline the voting process, including what constitutes a quorum and how decisions will be made.

- Profit Distribution: Clearly state how profits and losses will be distributed among members. This can be based on ownership percentages or another agreed-upon method.

- Amendments: Include a section on how the Operating Agreement can be amended in the future. This ensures that the document can evolve as the business grows.

- Legal Compliance: Ensure that the agreement complies with Texas laws. It’s important to keep the document in line with state regulations to maintain your LLC's good standing.

Similar forms

- Partnership Agreement: Like an Operating Agreement, a Partnership Agreement outlines the responsibilities, rights, and obligations of each partner within a business. It serves to clarify how profits and losses will be shared and provides a framework for decision-making processes.

- Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they specify the roles of directors and officers, how meetings are conducted, and the procedures for making important decisions. Both documents aim to establish clear guidelines for governance.

- Shareholders Agreement: This document is relevant for corporations and outlines the rights and responsibilities of shareholders. Much like an Operating Agreement, it addresses issues such as the transfer of shares, voting rights, and how disputes among shareholders will be resolved.

- Business Plan: While a Business Plan primarily focuses on the strategic direction and financial projections of a business, it shares similarities with an Operating Agreement in that both documents provide a roadmap for the organization. They help stakeholders understand the objectives and operational structure of the business.