Attorney-Approved Promissory Note Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time. |

| Governing Law | The Texas Business and Commerce Code governs promissory notes in Texas. |

| Parties Involved | The note typically involves a borrower (maker) and a lender (payee). |

| Interest Rate | Interest rates can be fixed or variable, but must comply with Texas usury laws. |

| Payment Terms | Payment terms, including due dates and installment amounts, should be clearly outlined in the note. |

| Default Provisions | The note may include terms that specify what happens if the borrower fails to make payments. |

| Signature Requirement | For the note to be enforceable, it must be signed by the borrower. |

Dos and Don'ts

When filling out the Texas Promissory Note form, it's essential to approach the task with care and attention to detail. Here’s a list of things to do and avoid, ensuring a smooth process.

- Do read the entire form carefully before starting to fill it out.

- Don't leave any required fields blank; incomplete forms can lead to issues.

- Do write clearly and legibly to ensure that all information is easily readable.

- Don't use abbreviations or shorthand; clarity is key.

- Do double-check all numerical figures for accuracy, especially the loan amount and interest rate.

- Don't forget to include the date of the agreement; this is crucial for legal purposes.

- Do ensure that both parties sign the document in the designated areas.

- Don't use a pencil; always use a blue or black ink pen for permanence.

- Do keep a copy of the completed form for your records.

- Don't rush through the process; take your time to avoid mistakes.

Create Popular Promissory Note Forms for Different States

Promissory Note Template Ohio - Promissory notes can provide a sense of security for lenders, knowing there's a formal commitment to repay.

Create Promissory Note - A Promissory Note is a written promise to pay a specified sum of money to a designated person or entity.

The California Dog Bill of Sale form is an essential legal document for anyone looking to transfer ownership of a dog. By detailing important information such as breed, age, and health status, this form ensures both the seller and buyer maintain clarity and accountability in the transaction. For more information on how to properly complete this form, visit https://californiadocsonline.com/dog-bill-of-sale-form/.

Promissory Note New York - Lenders can stipulate the use of the borrowed funds, ensuring the money is used as intended.

Common mistakes

-

Failing to include all required information. Every section of the form must be completed. Missing details can lead to confusion or disputes later.

-

Not clearly stating the loan amount. It is essential to write the amount both in numbers and words to avoid any misunderstandings.

-

Omitting the interest rate. Clearly specifying the interest rate is crucial. Without it, the terms of repayment may be unclear.

-

Not defining the repayment schedule. Indicate when payments are due and how often they will occur. This helps both parties understand their obligations.

-

Neglecting to include late fees or penalties. If payments are missed, it’s important to outline any fees that may apply.

-

Forgetting to sign the document. Both the borrower and lender must sign the note for it to be legally binding.

-

Not dating the document. The date of signing is important for tracking the timeline of the loan.

-

Using vague language. Be specific and clear in all terms. Ambiguity can lead to disputes in the future.

-

Ignoring state-specific requirements. Texas may have specific laws that affect the promissory note. Familiarizing oneself with these is essential.

Documents used along the form

When dealing with a Texas Promissory Note, several other forms and documents may be needed to ensure a smooth transaction. Each of these documents serves a specific purpose and can help clarify the terms of the agreement or protect the interests of the parties involved.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule. It provides a comprehensive overview of the agreement between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document specifies what the collateral is and the rights of the lender if the borrower defaults.

- Disclosure Statement: This form provides important information about the loan, including fees, interest rates, and other terms. It ensures that the borrower understands the costs associated with the loan.

- Payment Schedule: A detailed outline of when payments are due, how much each payment will be, and the total length of the loan. This helps both parties keep track of payment obligations.

- Default Notice: This document is used to inform the borrower that they have failed to meet the terms of the promissory note. It typically outlines the steps that may be taken if the default is not resolved.

- Amendment Agreement: If any terms of the original promissory note need to be changed, this document is used to formally modify the agreement, ensuring both parties agree to the new terms.

- Horse Bill of Sale Form: When facilitating horse ownership transfers, utilize the detailed horse bill of sale form requirements to ensure proper documentation and compliance.

- Release of Liability: Once the loan is paid off, this document releases the borrower from any further obligations under the promissory note, providing peace of mind.

- Guaranty Agreement: If a third party agrees to back the loan, this document outlines their responsibility to pay if the borrower defaults. It adds an extra layer of security for the lender.

- Notice of Assignment: If the lender sells the promissory note to another party, this document notifies the borrower of the change in ownership and who to make payments to.

Having these documents ready can help facilitate a clear understanding between the lender and borrower. They provide essential details that protect both parties and ensure a smooth lending process.

Misconceptions

Understanding the Texas Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise. Below is a list of common misunderstandings about this legal document.

- All Promissory Notes Are the Same: Many believe that all promissory notes are interchangeable. In reality, each state has specific requirements and formats, making the Texas version unique.

- Only Written Notes Are Valid: Some think that verbal agreements can never be enforced. While written notes are stronger, verbal agreements can still be legally binding under certain conditions.

- A Promissory Note Guarantees Payment: There is a misconception that signing a promissory note guarantees that the borrower will repay the loan. It is a promise to repay, but it does not eliminate the risk of default.

- Interest Rates Are Fixed: Many assume that all promissory notes have a fixed interest rate. In fact, the terms can be negotiated, and variable rates are also permissible.

- Signing a Note Means You Can’t Change Terms: Some borrowers think that once they sign a note, the terms are set in stone. Modifications can be made, but both parties must agree to any changes in writing.

- Promissory Notes Only Apply to Personal Loans: A common belief is that promissory notes are only for personal loans. However, they can also be used in business transactions, real estate deals, and more.

- Collateral Is Always Required: Many people think that a promissory note must always be secured by collateral. While collateral can be included, it is not a requirement for all notes.

- Legal Action Is Immediate Upon Default: Some believe that lenders can take immediate legal action if a borrower defaults. In reality, lenders often must follow specific procedures before pursuing legal remedies.

Clarifying these misconceptions can help individuals navigate the complexities of financial agreements more effectively. Understanding the Texas Promissory Note form is crucial for both lenders and borrowers.

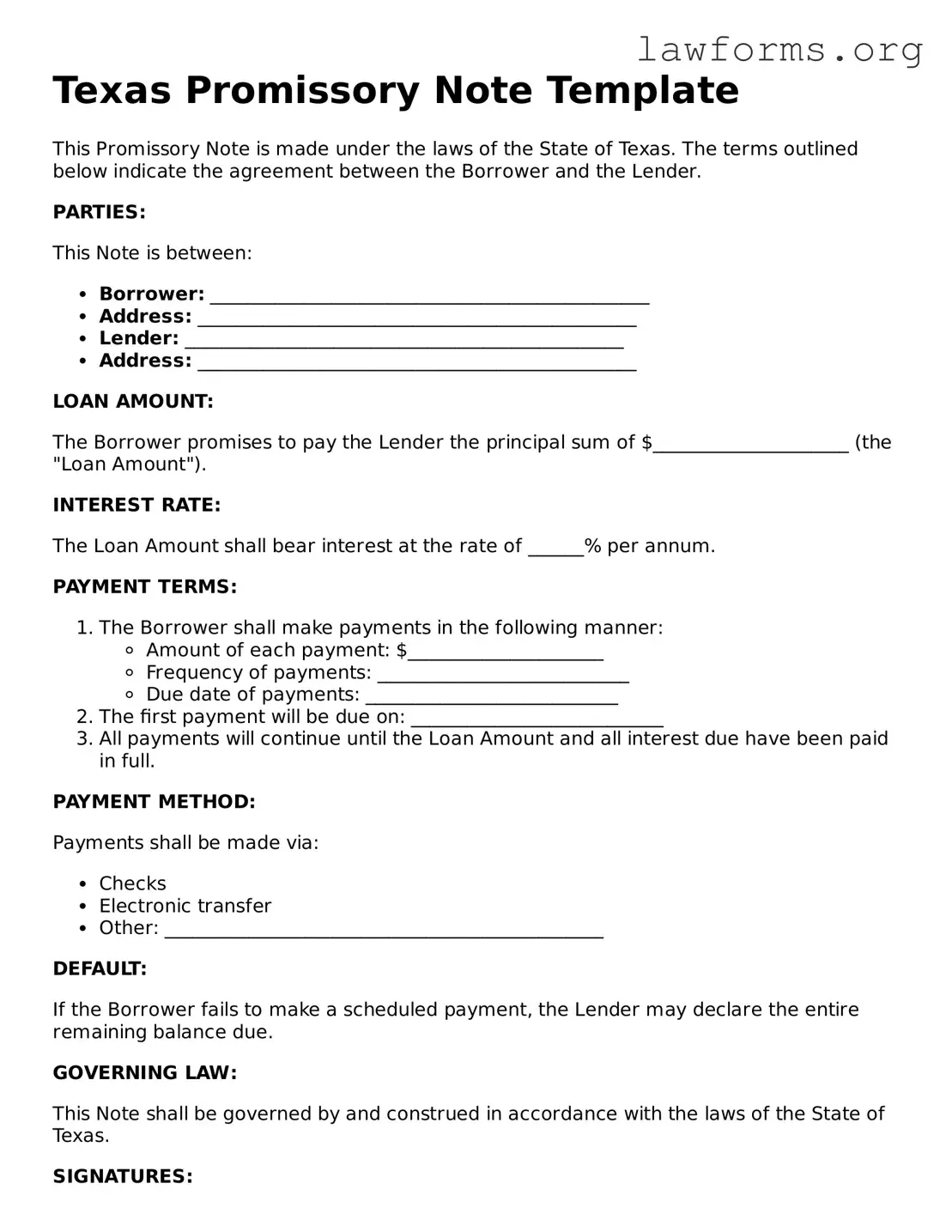

Preview - Texas Promissory Note Form

Texas Promissory Note Template

This Promissory Note is made under the laws of the State of Texas. The terms outlined below indicate the agreement between the Borrower and the Lender.

PARTIES:

This Note is between:

- Borrower: _______________________________________________

- Address: _______________________________________________

- Lender: _______________________________________________

- Address: _______________________________________________

LOAN AMOUNT:

The Borrower promises to pay the Lender the principal sum of $_____________________ (the "Loan Amount").

INTEREST RATE:

The Loan Amount shall bear interest at the rate of ______% per annum.

PAYMENT TERMS:

- The Borrower shall make payments in the following manner:

- Amount of each payment: $_____________________

- Frequency of payments: ___________________________

- Due date of payments: ___________________________

- The first payment will be due on: ___________________________

- All payments will continue until the Loan Amount and all interest due have been paid in full.

PAYMENT METHOD:

Payments shall be made via:

- Checks

- Electronic transfer

- Other: _______________________________________________

DEFAULT:

If the Borrower fails to make a scheduled payment, the Lender may declare the entire remaining balance due.

GOVERNING LAW:

This Note shall be governed by and construed in accordance with the laws of the State of Texas.

SIGNATURES:

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the ____ day of _______________, 20___.

Borrower's Signature: ______________________________________

Date: ____________________

Lender's Signature: ______________________________________

Date: ____________________

Key takeaways

- Understand the purpose: A Texas Promissory Note serves as a written promise to repay borrowed money under specific terms.

- Identify the parties: Clearly list the lender and borrower’s names and contact information to avoid confusion.

- Specify the loan amount: Clearly state the principal amount being borrowed. This figure should be accurate and easy to locate.

- Outline repayment terms: Include details about the repayment schedule, such as due dates and frequency of payments.

- Interest rate: Clearly indicate the interest rate, if applicable. Ensure it complies with Texas usury laws.

- Include default terms: Specify what happens if the borrower fails to make payments. This may include late fees or acceleration of the loan.

- Signatures: Both parties must sign and date the document. Consider having it notarized for added legal validity.

Similar forms

- Loan Agreement: A loan agreement outlines the terms of a loan, including the amount, interest rate, and repayment schedule. Like a promissory note, it serves as a legal commitment to repay borrowed money.

- Mortgage: A mortgage is a specific type of loan secured by real property. It details the borrower's promise to repay the loan, similar to a promissory note, but also includes the terms of the property as collateral.

- Durable Power of Attorney: A Durable Power of Attorney enables you to designate someone to make decisions for you if you're unable to, ensuring your preferences are honored. For more information, you can refer to Forms Washington.

- Installment Agreement: This document lays out a plan for repaying a debt in regular installments. It shares similarities with a promissory note in that it defines the payment structure and obligations of the borrower.

- Credit Agreement: A credit agreement governs the terms of a line of credit. It includes repayment terms and conditions, much like a promissory note, but often covers a broader range of borrowing options.

- Personal Guarantee: This document involves a person agreeing to repay a debt if the primary borrower defaults. It functions similarly to a promissory note by establishing a legal obligation to pay.

- Secured Note: A secured note is a promissory note backed by collateral. It shares the same basic structure as a promissory note but adds an extra layer of security for the lender.

- Business Loan Agreement: This is a contract between a lender and a business for a loan. It specifies the loan amount, interest rate, and repayment terms, paralleling the commitments found in a promissory note.