Attorney-Approved Quitclaim Deed Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the title. |

| Governing Law | In Texas, quitclaim deeds are governed by the Texas Property Code, specifically Chapter 5. |

| Use Cases | Commonly used in situations like transferring property between family members, clearing up title issues, or during divorce settlements. |

| No Warranty | This type of deed does not guarantee that the property is free from liens or other claims. The grantee accepts the property "as is." |

| Execution Requirements | The deed must be signed by the grantor (the person transferring the property) in front of a notary public. |

| Recording | To protect the new owner's rights, the quitclaim deed should be recorded with the county clerk's office in the county where the property is located. |

| Consideration | While a nominal consideration (like $1) is often stated, it is not required for the validity of the deed. |

| Tax Implications | Property transfers using a quitclaim deed may have tax implications, so consulting a tax advisor is recommended. |

| Limitations | Quitclaim deeds are not suitable for all situations, especially when warranties of title are needed, such as in traditional sales. |

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here are five essential dos and don’ts to consider:

- Do provide complete and accurate information about the grantor and grantee.

- Do include a legal description of the property being transferred.

- Do sign the form in the presence of a notary public.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't forget to check local recording requirements before submission.

Create Popular Quitclaim Deed Forms for Different States

How Much Does a Deed Cost - Property owners must clearly list the grantor and grantee on the form.

In navigating the complexities of trailer ownership transfer, it is essential to utilize the appropriate documentation, such as the Washington Trailer Bill of Sale form, which can be found through resources like Forms Washington. This legal document not only facilitates the transfer of ownership but also provides vital information needed for a seamless transaction.

Quick Deed Ohio - It is important to understand that this deed does not protect against future claims.

Common mistakes

-

Incorrect Property Description: A common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the property address or using vague terms that do not clearly identify the property boundaries.

-

Missing Signatures: All parties involved must sign the Quitclaim Deed. Omitting a signature can lead to the document being deemed invalid. Ensure that all grantors and grantees have signed the form.

-

Not Notarizing the Document: A Quitclaim Deed must be notarized to be legally binding. Failing to have the document notarized can result in issues during the recording process.

-

Incorrectly Identifying Parties: It is essential to accurately identify all parties involved in the transaction. Mistakes in names, such as misspellings or using incorrect legal names, can create complications.

-

Failure to Record the Deed: After completing the Quitclaim Deed, it must be filed with the county clerk's office in the appropriate county. Neglecting to record the deed can lead to disputes over property ownership.

Documents used along the form

When completing a property transfer in Texas using a Quitclaim Deed, several other forms and documents may be necessary to ensure a smooth transaction. Here’s a list of commonly used documents that can accompany the Quitclaim Deed.

- Property Transfer Tax Form: This form is required to report the transfer of property and assess any applicable taxes. It ensures compliance with state tax laws.

- Title Search Report: A title search report provides information about the property's title history. It reveals any liens, encumbrances, or claims against the property.

- Affidavit of Heirship: This document is used when property is inherited. It establishes the heirs' rights to the property, especially when no formal will exists.

- Closing Statement: A closing statement outlines the financial details of the property transaction. It includes costs, fees, and any adjustments that need to be made at closing.

- Warranty Deed (if applicable): While a Quitclaim Deed transfers ownership without guarantees, a Warranty Deed provides a guarantee that the title is clear. It may be used if additional assurances are needed.

- Power of Attorney: If the property owner cannot be present to sign documents, a Power of Attorney allows another person to act on their behalf during the transaction.

- Notice of Ownership Change: This document informs local authorities of the change in property ownership. It may be required for tax records and other administrative purposes.

Utilizing these documents alongside the Texas Quitclaim Deed can facilitate a more efficient property transfer process. Ensure that all necessary paperwork is completed accurately to avoid any complications down the line.

Misconceptions

Understanding the Texas Quitclaim Deed is essential for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this legal document.

- It transfers ownership of the property. A quitclaim deed does not guarantee that the grantor has any ownership rights. It simply transfers whatever interest the grantor may have, if any.

- It is the same as a warranty deed. Unlike a warranty deed, which provides guarantees about the title, a quitclaim deed offers no such assurances. The recipient assumes the risk regarding the title.

- It can be used to settle debts. A quitclaim deed cannot be used to settle debts or obligations. It merely transfers property interests and does not affect financial liabilities.

- It requires a notary to be valid. While having a notary can help, a quitclaim deed can still be valid without one, provided it meets the necessary legal requirements.

- It must be filed with the county clerk immediately. While it is advisable to file the deed promptly for public record, there is no strict deadline for doing so.

- It can only be used between family members. Although quitclaim deeds are often used in family transactions, they can be used in any situation where property interests are being transferred.

- It is a complicated legal document. The quitclaim deed is relatively straightforward compared to other legal documents. Its simplicity can be an advantage for many transactions.

- It is irrevocable once signed. While a quitclaim deed transfers ownership, it can be revoked or altered through a subsequent deed, provided all parties agree.

- It eliminates the need for title insurance. Because a quitclaim deed does not guarantee title, obtaining title insurance is still recommended to protect against potential claims.

- It is only valid in Texas. While this discussion focuses on Texas, quitclaim deeds are recognized in many states, though their implications may vary.

Being informed about these misconceptions can empower individuals to make better decisions regarding property transactions. Understanding the nature of a quitclaim deed is crucial for navigating the complexities of real estate law.

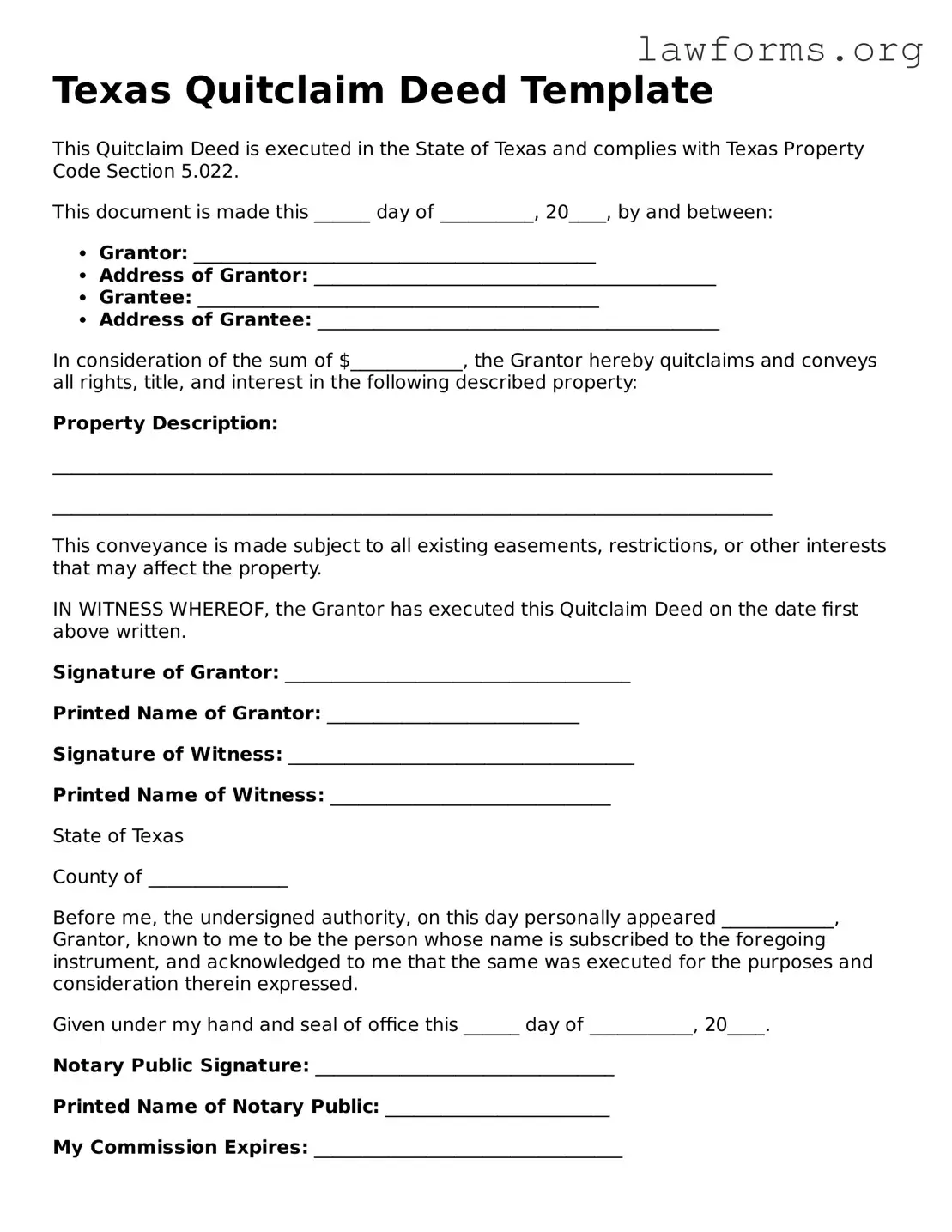

Preview - Texas Quitclaim Deed Form

Texas Quitclaim Deed Template

This Quitclaim Deed is executed in the State of Texas and complies with Texas Property Code Section 5.022.

This document is made this ______ day of __________, 20____, by and between:

- Grantor: ___________________________________________

- Address of Grantor: ___________________________________________

- Grantee: ___________________________________________

- Address of Grantee: ___________________________________________

In consideration of the sum of $____________, the Grantor hereby quitclaims and conveys all rights, title, and interest in the following described property:

Property Description:

_____________________________________________________________________________

_____________________________________________________________________________

This conveyance is made subject to all existing easements, restrictions, or other interests that may affect the property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the date first above written.

Signature of Grantor: _____________________________________

Printed Name of Grantor: ___________________________

Signature of Witness: _____________________________________

Printed Name of Witness: ______________________________

State of Texas

County of _______________

Before me, the undersigned authority, on this day personally appeared ____________, Grantor, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that the same was executed for the purposes and consideration therein expressed.

Given under my hand and seal of office this ______ day of ___________, 20____.

Notary Public Signature: ________________________________

Printed Name of Notary Public: ________________________

My Commission Expires: _________________________________

Key takeaways

When filling out and using the Texas Quitclaim Deed form, it is essential to understand several key aspects. Here are ten important takeaways:

- Purpose: A quitclaim deed transfers ownership of property from one party to another without guaranteeing the property's title.

- Parties Involved: The form requires the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: A clear and accurate description of the property is necessary. This includes the address and any legal descriptions.

- Consideration: This refers to the value exchanged for the property. It can be nominal, such as $10, or reflect the actual sale price.

- Signature Requirement: The grantor must sign the deed in the presence of a notary public for it to be valid.

- Notarization: The notary public must complete their section, confirming the identity of the grantor and witnessing the signature.

- Filing: After completion, the deed should be filed with the county clerk's office in the county where the property is located.

- Record Keeping: Keep a copy of the quitclaim deed for personal records after it has been filed.

- Limitations: A quitclaim deed does not clear any liens or encumbrances on the property; it simply transfers the ownership interest.

- Legal Advice: It is advisable to consult with a legal professional if there are any uncertainties about the process or implications of using a quitclaim deed.

Understanding these key points will help ensure a smooth transaction when using the Texas Quitclaim Deed form.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of property from one party to another without any warranties or guarantees. While it serves a unique purpose, it shares similarities with several other legal documents. Here are nine documents that are similar to a Quitclaim Deed:

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. However, both documents facilitate the transfer of property ownership.

- Grant Deed: A Grant Deed also conveys property ownership and includes certain warranties, though not as comprehensive as those in a Warranty Deed. Both documents are used in real estate transactions.

- Special Purpose Deed: This type of deed is used for specific situations, such as transferring property into a trust. Like a Quitclaim Deed, it can be executed without extensive legal formalities.

- Transfer on Death Deed: This deed allows property owners to designate beneficiaries who will inherit the property upon their death. Both documents facilitate the transfer of property but operate under different circumstances.

- Deed of Trust: While primarily used to secure a loan with real property, a Deed of Trust involves the transfer of property interest. Both documents are essential in real estate transactions.

- Lease Agreement: A Lease Agreement grants temporary possession of property, similar to how a Quitclaim Deed transfers ownership. Both documents establish rights concerning property use.

- Affidavit of Title: This document provides a sworn statement regarding the ownership of property, similar to the assurances made in a Warranty Deed. Both are used to clarify property ownership.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including property transactions. Both documents can facilitate property transfers, albeit in different contexts.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it does not transfer ownership itself, it sets the stage for deeds like the Quitclaim Deed to be executed.