Fill Out a Valid Texas residential property affidavit T-47 Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Texas residential property affidavit T-47 form is used to affirm the ownership of a property and confirm specific details about it. |

| Governing Law | This form is governed by Texas Property Code, specifically Section 12.001. |

| Who Uses It | Homeowners, buyers, and lenders commonly use the T-47 form during real estate transactions. |

| Signature Requirement | The form must be signed by the property owner or authorized representative to be valid. |

| Filing Process | The completed T-47 form is typically filed with the county clerk's office where the property is located. |

Dos and Don'ts

When filling out the Texas residential property affidavit T-47 form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information regarding the property.

- Do double-check all entries for spelling and numerical errors.

- Do sign and date the form in the designated areas.

- Don't leave any required fields blank.

- Don't use abbreviations unless specified in the instructions.

- Don't submit the form without reviewing it for completeness.

- Don't forget to keep a copy of the completed form for your records.

Other PDF Documents

Wage and Tax Statement - The layout of the W-2 includes boxes designating specific information such as year-to-date wages.

Make Your Own Gift Card - Both the donor and recipient benefit from having a clear, written record of the gift through this form.

When dealing with the transfer of ownership for vehicles or vessels in California, it's important to familiarize yourself with the California Form REG 262. This essential document not only accompanies the title or application for a duplicate title but also plays a crucial role in ensuring that both buyers and sellers are protected during the transaction process. More information about the requirements and details can be found at https://californiadocsonline.com/california-fotm-reg-262-form.

Miscellaneous Information - Taxpayers should track their income to ensure all earnings are reported via 1099-MISC.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details on the form. Missing signatures, dates, or property descriptions can lead to processing delays.

-

Incorrect Property Description: A common error involves inaccuracies in the legal description of the property. It is crucial to ensure that the description matches the records to avoid complications.

-

Failure to Sign: Some applicants neglect to sign the affidavit. An unsigned form is not valid and will be rejected, requiring resubmission.

-

Not Notarizing the Document: The T-47 form requires notarization. Failing to have the affidavit notarized can render it ineffective.

-

Using Outdated Versions: Submitting an outdated version of the form can lead to rejection. Always verify that the most current version is being used.

-

Ignoring Instructions: Applicants often overlook specific instructions provided with the form. Following these guidelines is essential for proper completion.

-

Providing Inaccurate Contact Information: Incorrect or outdated contact details can hinder communication. Ensure that all information is current to facilitate any necessary follow-up.

Documents used along the form

The Texas Residential Property Affidavit T-47 form serves as a crucial document in real estate transactions, particularly when dealing with property ownership and title issues. In conjunction with this form, several other documents may be necessary to ensure a smooth and legally sound transaction. Below is a list of commonly used forms and documents that often accompany the T-47.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the loan is repaid. It outlines the terms of the loan and the obligations of the borrower.

- Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This document protects the buyer from any future claims against the property.

- Title Commitment: Issued by a title company, this document outlines the terms under which a title insurance policy will be issued. It details any liens, encumbrances, or defects that may affect the property title.

- Property Disclosure Statement: This statement is often required by law and provides information about the property's condition. Sellers must disclose any known issues, which helps buyers make informed decisions.

- Closing Disclosure: This document outlines the final terms and costs of the mortgage. It must be provided to the buyer at least three days before closing, allowing them to review all financial details.

- Ohio Residential Lease Agreement: This crucial document outlines the terms between a landlord and tenant for renting residential property, ensuring clarity and protection of rights. For a comprehensive understanding, refer to the Ohio PDF Forms.

- Affidavit of Heirship: Used when property is inherited, this affidavit establishes the heirs of a deceased property owner. It can help clarify ownership when formal probate is not pursued.

Understanding these documents can significantly enhance the clarity and effectiveness of your real estate transactions. Each serves a unique purpose, working together to facilitate a secure and transparent property transfer process.

Misconceptions

The Texas residential property affidavit T-47 form is often misunderstood. Here are nine common misconceptions about this form, along with explanations to clarify them.

-

Misconception 1: The T-47 form is only for sellers.

This form can be used by both sellers and buyers. It serves as an affidavit regarding the property’s condition and ownership, which is relevant to all parties involved in a real estate transaction.

-

Misconception 2: The T-47 form guarantees clear title.

While the T-47 form provides important information, it does not guarantee that the title is free of liens or other encumbrances. A title search is still necessary to confirm the property's title status.

-

Misconception 3: The T-47 form is optional.

In many transactions, especially those involving a lender, the T-47 form is required. It helps provide assurance about the property’s condition and ownership history.

-

Misconception 4: The T-47 form can be filled out after closing.

This form must be completed before closing. It is used to inform all parties about the property’s condition at the time of sale, making timely submission crucial.

-

Misconception 5: Only licensed professionals can complete the T-47 form.

Homeowners can fill out the T-47 form themselves. However, it is advisable to consult with a real estate professional to ensure accuracy and completeness.

-

Misconception 6: The T-47 form is only relevant for older homes.

The T-47 form applies to all residential properties, regardless of age. New constructions can also have issues that need to be disclosed.

-

Misconception 7: The T-47 form is the same as a property disclosure statement.

While both documents provide information about the property, the T-47 form specifically addresses ownership and condition at the time of sale, while a property disclosure statement may cover a broader range of issues.

-

Misconception 8: Completing the T-47 form is a quick process.

While the form itself is straightforward, gathering the necessary information can take time. Homeowners should prepare in advance to ensure they can provide accurate details.

-

Misconception 9: The T-47 form is only needed for single-family homes.

The T-47 form is applicable to various types of residential properties, including townhomes, condominiums, and multi-family units. It is not limited to single-family homes.

Understanding these misconceptions can help individuals navigate the real estate process more effectively and ensure compliance with Texas regulations.

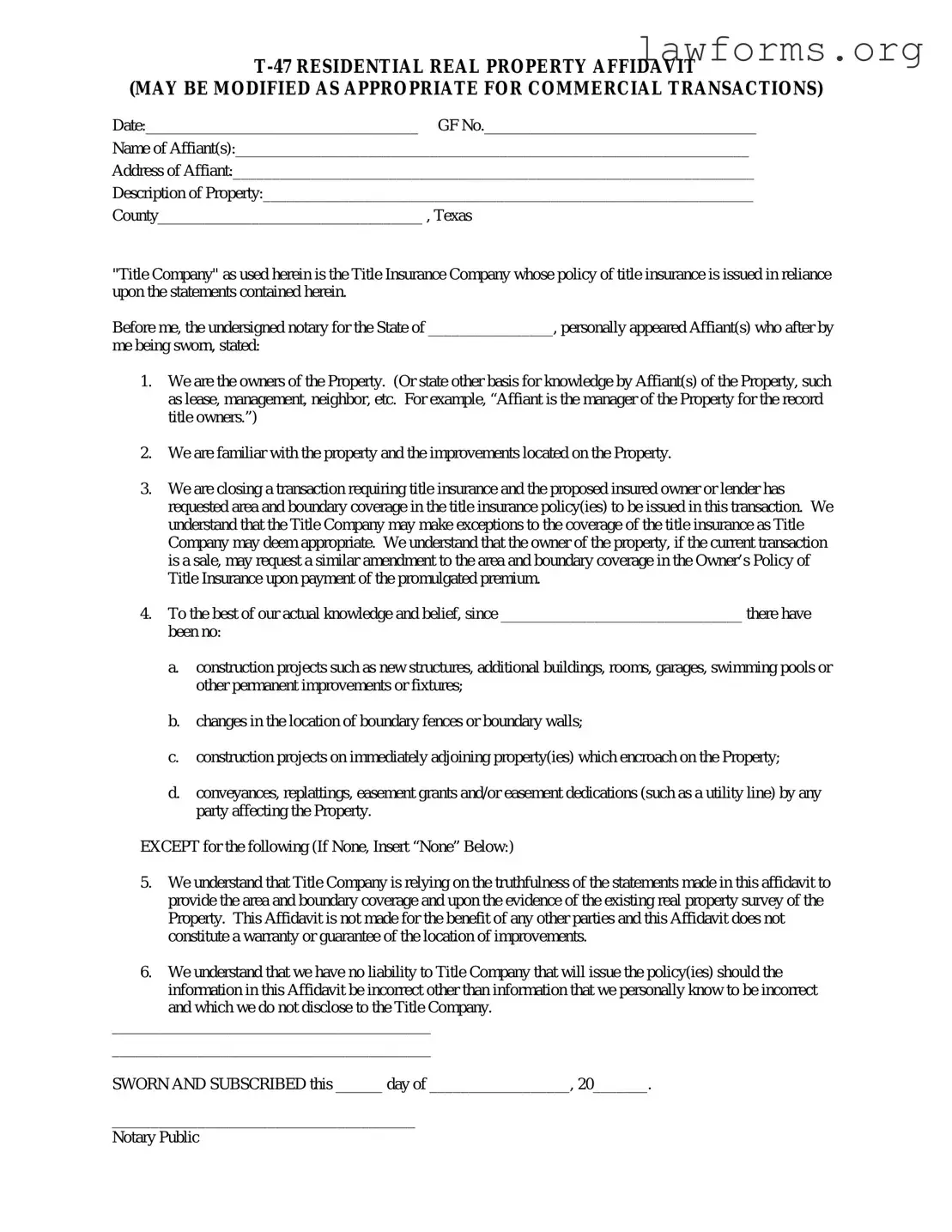

Preview - Texas residential property affidavit T-47 Form

(MAY BE MODIFIED AS APPROPRIATE FOR COMMERCIAL TRANSACTIONS)

Date:___________________________________ GF No.___________________________________

Name of Affiant(s):__________________________________________________________________

Address of Affiant:___________________________________________________________________

Description of Property:_______________________________________________________________

County__________________________________ , Texas

"Title Company" as used herein is the Title Insurance Company whose policy of title insurance is issued in reliance upon the statements contained herein.

Before me, the undersigned notary for the State of ________________, personally appeared Affiant(s) who after by

me being sworn, stated:

1.We are the owners of the Property. (Or state other basis for knowledge by Affiant(s) of the Property, such as lease, management, neighbor, etc. For example, “Affiant is the manager of the Property for the record title owners.”)

2.We are familiar with the property and the improvements located on the Property.

3.We are closing a transaction requiring title insurance and the proposed insured owner or lender has requested area and boundary coverage in the title insurance policy(ies) to be issued in this transaction. We understand that the Title Company may make exceptions to the coverage of the title insurance as Title Company may deem appropriate. We understand that the owner of the property, if the current transaction is a sale, may request a similar amendment to the area and boundary coverage in the Owner’s Policy of Title Insurance upon payment of the promulgated premium.

4.To the best of our actual knowledge and belief, since _______________________________ there have been no:

a.construction projects such as new structures, additional buildings, rooms, garages, swimming pools or other permanent improvements or fixtures;

b.changes in the location of boundary fences or boundary walls;

c.construction projects on immediately adjoining property(ies) which encroach on the Property;

d.conveyances, replattings, easement grants and/or easement dedications (such as a utility line) by any party affecting the Property.

EXCEPT for the following (If None, Insert “None” Below:)

5.We understand that Title Company is relying on the truthfulness of the statements made in this affidavit to provide the area and boundary coverage and upon the evidence of the existing real property survey of the Property. This Affidavit is not made for the benefit of any other parties and this Affidavit does not constitute a warranty or guarantee of the location of improvements.

6.We understand that we have no liability to Title Company that will issue the policy(ies) should the

information in this Affidavit be incorrect other than information that we personally know to be incorrect and which we do not disclose to the Title Company.

_________________________________________

_________________________________________

SWORN AND SUBSCRIBED this ______ day of __________________, 20_______.

_______________________________________

Notary Public

Key takeaways

When dealing with the Texas residential property affidavit T-47 form, it is essential to understand its purpose and how to complete it correctly. Here are some key takeaways to keep in mind:

- The T-47 form is used to confirm the location and boundaries of a residential property. It provides important information to lenders and title companies.

- Accuracy is crucial. Ensure that all details regarding the property, such as legal descriptions and owner information, are filled out precisely to avoid complications.

- This form must be signed by the property owner in the presence of a notary public. Notarization adds a layer of authenticity and helps validate the information provided.

- Submitting the T-47 form is often a requirement for obtaining title insurance, making it an important step in real estate transactions.

By keeping these points in mind, you can navigate the process of filling out and utilizing the T-47 form more effectively.

Similar forms

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. Like the T-47, it provides clarity regarding ownership and can assist in the transfer of property without formal probate.

- Warranty Deed: A warranty deed guarantees that the seller has clear title to the property and the right to sell it. This is similar to the T-47 in that both documents confirm ownership and address potential claims.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in the property without any guarantees. It serves a similar purpose to the T-47 in establishing ownership, though it does not provide the same level of protection.

- Title Insurance Policy: This document protects against losses from disputes over property ownership. Like the T-47, it aims to clarify ownership and prevent future claims on the property.

- Property Transfer Disclosure Statement: This statement informs buyers of any known issues with the property. It shares the goal of transparency with the T-47, ensuring that all parties are aware of the property’s status.

- Lease Agreement: A lease outlines the terms under which a property is rented. While primarily focused on rental terms, it also establishes the rights of the parties involved, similar to the ownership clarifications in the T-47.

- North Carolina Motor Vehicle Bill of Sale: This document is essential for transferring ownership of a vehicle, ensuring that all transaction details are clearly recorded. To begin the process, open the form.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can be similar to the T-47 in that it deals with the transfer of property rights.

- Deed of Trust: A deed of trust secures a loan with real property as collateral. It relates to the T-47 by clarifying ownership interests and responsibilities associated with the property.

- Real Estate Purchase Agreement: This agreement outlines the terms of a property sale. It is similar to the T-47 in that it establishes the intentions and rights of the parties involved in the transaction.

- Affidavit of Title: This document confirms the seller's ownership and the absence of liens or claims against the property. Like the T-47, it serves to affirm the legitimacy of the ownership being transferred.