Attorney-Approved Tractor Bill of Sale Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Texas Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by Texas state law, specifically the Texas Business and Commerce Code. |

| Essential Information | The form typically includes details such as the buyer's and seller's names, addresses, and contact information. |

| Tractor Details | Information about the tractor, including make, model, year, and Vehicle Identification Number (VIN), should be included. |

| Purchase Price | The agreed-upon purchase price must be clearly stated in the bill of sale. |

| Signatures | Both the buyer and seller must sign the document to make it legally binding. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed bill of sale for their records. |

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it's essential to approach the task with care. Here are six important do's and don'ts to consider:

- Do ensure all information is accurate and complete. Double-check names, addresses, and vehicle details.

- Do include the sale price clearly. This helps avoid future disputes over the transaction.

- Do sign and date the form. Both the buyer and seller should provide their signatures to validate the sale.

- Do keep a copy for your records. This serves as proof of the transaction for both parties.

- Don't leave any fields blank. Incomplete forms can lead to complications later on.

- Don't use incorrect or outdated forms. Always use the latest version of the Texas Tractor Bill of Sale.

Create Popular Tractor Bill of Sale Forms for Different States

Florida Bill of Sale Requirements - Legally binding document for the sale of a used tractor.

When dealing with the transfer of a trailer's ownership in Ohio, utilizing the Ohio Trailer Bill of Sale form is crucial for a seamless transaction. This essential document not only safeguards both parties involved but also aids in the registration process. For those looking for efficient solutions, Ohio PDF Forms can provide the necessary templates needed to complete this task accurately.

Bill of Sale for Tractor - Necessary for registering the tractor under new ownership.

Bill of Sale for Tractor - Provides details about any equipment included in the sale.

Does a Tractor Have a Title - Standardizes the sale process, making it easier for all parties involved.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Ensure that both the buyer's and seller's names, addresses, and contact information are clearly stated.

-

Incorrect Vehicle Identification Number (VIN): The VIN must be accurate. Double-check that you have entered the correct number, as even a single digit error can lead to issues with registration.

-

Missing Signatures: Both parties must sign the document. Neglecting to obtain a signature from either the buyer or the seller can render the bill of sale invalid.

-

Omitting the Sale Price: Clearly state the sale price of the tractor. Leaving this field blank can create confusion and may affect tax obligations.

-

Not Including Date of Sale: The date when the transaction occurs is crucial. Without it, you may face complications in future dealings or disputes.

-

Failure to Provide Additional Details: Including information such as the tractor's make, model, year, and condition can help clarify the transaction. This additional context can protect both parties in case of disputes later on.

Documents used along the form

When purchasing or selling a tractor in Texas, the Tractor Bill of Sale is a crucial document. However, several other forms and documents may accompany it to ensure a smooth transaction and proper record-keeping. Below is a list of commonly used documents that may be relevant in such transactions.

- Title Transfer Document: This form is essential for transferring ownership of the tractor from the seller to the buyer. It includes details such as the vehicle identification number (VIN) and the names of both parties.

- Application for Texas Title: Buyers must complete this application to obtain a new title in their name. It is typically submitted to the Texas Department of Motor Vehicles (TxDMV).

- Vehicle Registration Form: This document registers the tractor for use on public roads. It includes information about the owner and the vehicle, ensuring compliance with state regulations.

- Affidavit of Motor Vehicle Gift Transfer: If the tractor is given as a gift, this affidavit serves as proof of the transaction. It helps avoid taxes that may apply to sales transactions.

- Sales Tax Exemption Certificate: This form is used if the buyer qualifies for a sales tax exemption, providing necessary documentation to avoid paying sales tax on the purchase.

- Durable Power of Attorney Form: Completing this form allows an individual to designate someone to manage their financial affairs, even if they become incapacitated. For more information, visit formsillinois.com.

- Inspection Certificate: Depending on the age and condition of the tractor, an inspection certificate may be required to confirm that the vehicle meets safety and operational standards.

- Power of Attorney: If the seller cannot be present for the transaction, a power of attorney allows another person to sign the necessary documents on their behalf.

- Bill of Sale for Equipment: This document may be used for additional equipment sold alongside the tractor. It details the items included in the sale, ensuring clarity for both parties.

- Warranty or Guarantee: If applicable, this document outlines any warranties or guarantees provided by the seller regarding the condition or functionality of the tractor.

Utilizing these documents alongside the Texas Tractor Bill of Sale can facilitate a more transparent and legally sound transaction. Each form serves a specific purpose, contributing to the overall integrity of the sale process. It is advisable for both buyers and sellers to familiarize themselves with these documents to ensure a smooth and compliant exchange.

Misconceptions

The Texas Tractor Bill of Sale form is often misunderstood. Below are four common misconceptions:

- It is not legally required. Many believe that a bill of sale is optional for tractor transactions. However, having this document is crucial for proving ownership and protecting both the buyer and seller.

- It can be handwritten. Some think that a simple handwritten note suffices. While a handwritten document may be valid, using a standardized form ensures all necessary details are included and recognized by authorities.

- It only needs to be signed by the seller. There is a misconception that only the seller's signature is necessary. In reality, both parties should sign the document to confirm the transaction and protect their interests.

- It is only for new tractors. Many assume that this form applies only to new purchases. However, it is equally important for used tractors, as it establishes a clear record of the sale and transfer of ownership.

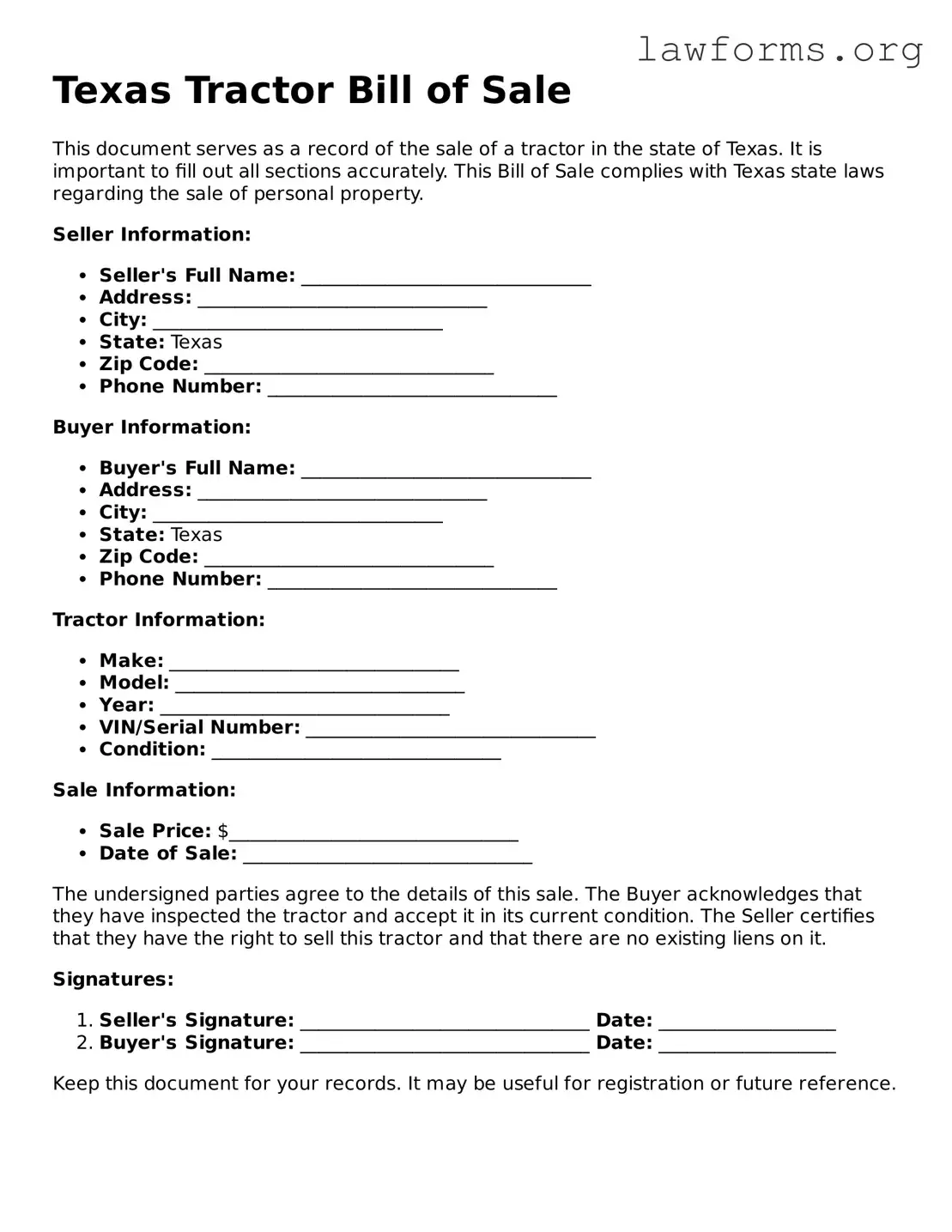

Preview - Texas Tractor Bill of Sale Form

Texas Tractor Bill of Sale

This document serves as a record of the sale of a tractor in the state of Texas. It is important to fill out all sections accurately. This Bill of Sale complies with Texas state laws regarding the sale of personal property.

Seller Information:

- Seller's Full Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: Texas

- Zip Code: _______________________________

- Phone Number: _______________________________

Buyer Information:

- Buyer's Full Name: _______________________________

- Address: _______________________________

- City: _______________________________

- State: Texas

- Zip Code: _______________________________

- Phone Number: _______________________________

Tractor Information:

- Make: _______________________________

- Model: _______________________________

- Year: _______________________________

- VIN/Serial Number: _______________________________

- Condition: _______________________________

Sale Information:

- Sale Price: $_______________________________

- Date of Sale: _______________________________

The undersigned parties agree to the details of this sale. The Buyer acknowledges that they have inspected the tractor and accept it in its current condition. The Seller certifies that they have the right to sell this tractor and that there are no existing liens on it.

Signatures:

- Seller's Signature: _______________________________ Date: ___________________

- Buyer's Signature: _______________________________ Date: ___________________

Keep this document for your records. It may be useful for registration or future reference.

Key takeaways

When filling out and using the Texas Tractor Bill of Sale form, it’s essential to keep several key points in mind. This document serves as a legal record of the sale and transfer of ownership of a tractor, ensuring both parties are protected. Here are ten important takeaways:

- Accurate Information: Ensure that all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are filled out correctly.

- Seller and Buyer Details: Include full names, addresses, and contact information for both the seller and the buyer to avoid any disputes later.

- Purchase Price: Clearly state the agreed-upon purchase price. This amount should reflect the fair market value of the tractor.

- Date of Sale: Document the date when the transaction takes place. This helps establish a timeline for ownership transfer.

- Signatures Required: Both the seller and buyer must sign the bill of sale. This indicates agreement to the terms outlined in the document.

- Notarization: While not always required, having the bill of sale notarized can add an extra layer of authenticity and protection.

- Condition of the Tractor: It’s wise to include a description of the tractor’s condition. This can help clarify expectations and responsibilities.

- Disclosure of Liens: If there are any liens on the tractor, the seller must disclose this information to the buyer to avoid legal complications.

- Keep Copies: Both parties should retain a copy of the signed bill of sale for their records. This document may be needed for future reference.

- State Regulations: Familiarize yourself with any specific state regulations regarding tractor sales in Texas to ensure compliance.

By following these guidelines, you can ensure a smooth transaction and protect the interests of both the buyer and the seller in the sale of a tractor in Texas.

Similar forms

- Vehicle Bill of Sale: This document serves a similar purpose by transferring ownership of a vehicle from one party to another. It includes details like the vehicle identification number (VIN), sale price, and buyer and seller information.

- Boat Bill of Sale: Just like the Tractor Bill of Sale, this form facilitates the transfer of ownership for a boat. It outlines the boat's specifications, sale price, and parties involved.

- California Judicial Council Form: This standardized document is essential in California courts, designed to streamline legal processes. It ensures all required details are included for court filings, and can be attached to other court papers. For more information, visit californiadocsonline.com/california-judicial-council-form.

- Motorcycle Bill of Sale: This document is used for the sale of a motorcycle, detailing the motorcycle's make, model, and condition, along with buyer and seller details.

- Equipment Bill of Sale: Similar to the Tractor Bill of Sale, this form is used for transferring ownership of various types of equipment, including construction or agricultural machinery. It includes specifics about the equipment and the terms of sale.

- Aircraft Bill of Sale: This document facilitates the sale of an aircraft, detailing its specifications and registration information, much like the Tractor Bill of Sale does for tractors.

- Real Estate Purchase Agreement: While not a bill of sale, this document also formalizes the transfer of ownership. It includes terms of sale, property details, and buyer and seller information, similar to the way a Tractor Bill of Sale does.

- Personal Property Bill of Sale: This general form can be used for various personal items, similar to the Tractor Bill of Sale. It outlines the item being sold, sale price, and the parties involved in the transaction.