Attorney-Approved Transfer-on-Death Deed Template for the State of Texas

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Texas to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Estates Code, Title 2, Chapter 114. |

| Eligibility | Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time by the property owner, as long as they are alive. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them. |

| Filing Requirement | The deed must be filed with the county clerk's office where the property is located to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not affect the property owner's tax status during their lifetime. |

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do ensure you are eligible to use a Transfer-on-Death Deed.

- Do accurately complete all required fields on the form.

- Do include the legal description of the property.

- Do sign the deed in the presence of a notary public.

- Do file the completed deed with the county clerk's office.

- Don't leave any required fields blank.

- Don't forget to provide your contact information.

- Don't use vague descriptions for the property.

- Don't attempt to alter the form after it has been notarized.

- Don't neglect to check for any county-specific filing requirements.

Following these guidelines can help prevent delays or complications in the transfer of property. Take the time to review your form carefully before submission.

Create Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Florida Form - A Transfer-on-Death Deed can help avoid family disputes over property by clearly stating the intended beneficiary in advance.

In addition to its importance in recording a transaction, utilizing a template can simplify the process of creating a Motorcycle Bill of Sale. For those looking for a reliable resource, Forms Washington offers a comprehensive template that ensures all necessary details are included, making the transfer of ownership clearer and more efficient.

Where Can I Get a Tod Form - Filing the Transfer-on-Death Deed with the appropriate county office is essential for validity.

Problems With Transfer on Death Deeds Ohio - The Transfer-on-Death Deed can serve as a reliable solution for future property ownership kinship.

Tod Deed California - Beneficiaries do not have ownership rights until the original owner has passed away, ensuring the owner's control over the property.

Common mistakes

-

Incomplete Information: Failing to provide all required details about the property can lead to issues. Ensure that the legal description of the property is accurate and complete.

-

Incorrect Signatures: All necessary parties must sign the deed. If a required signature is missing, the deed may be invalid.

-

Not Notarizing the Document: The Texas Transfer-on-Death Deed must be notarized to be valid. Skipping this step can render the deed ineffective.

-

Improper Witnesses: In Texas, witnesses are not required for a Transfer-on-Death Deed. However, if you choose to have witnesses, ensure they are eligible and meet legal requirements.

-

Filing the Deed Incorrectly: After completing the deed, it must be filed with the county clerk's office. Failing to file it correctly or within the required timeframe can lead to complications.

-

Not Updating the Deed: If circumstances change, such as the death of a beneficiary or changes in property ownership, it's essential to update the deed. Neglecting to do so can cause confusion later.

-

Ignoring State-Specific Rules: Each state has specific laws regarding Transfer-on-Death Deeds. Not being aware of Texas-specific requirements can lead to mistakes.

Documents used along the form

When considering the Texas Transfer-on-Death Deed, it’s important to understand that this document often works in conjunction with several other forms and documents. Each of these plays a crucial role in ensuring that property transfers are handled smoothly and according to the law. Below are four key documents commonly associated with the Transfer-on-Death Deed.

- Will: A will outlines how a person’s assets should be distributed upon their death. While the Transfer-on-Death Deed allows for direct transfer of property to a beneficiary, a will can provide additional instructions for other assets and may name guardians for minor children.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person when there is no will. It can help clarify who is entitled to inherit property and may be necessary if there are disputes among potential heirs.

- Hold Harmless Agreement: This crucial document provides protection against liability in various transactions, including real estate dealings. For more information, visit https://californiadocsonline.com/hold-harmless-agreement-form/.

- Beneficiary Designation Forms: These forms are often used for financial accounts and insurance policies. They allow individuals to name beneficiaries who will receive assets directly upon death, similar to the function of a Transfer-on-Death Deed for real estate.

- Power of Attorney: A power of attorney allows an individual to designate someone else to make decisions on their behalf, particularly in financial or legal matters. This can be important for managing property during a person’s lifetime, especially if they become incapacitated.

Each of these documents serves a unique purpose in estate planning and property transfer. By understanding their roles, individuals can better navigate the complexities of transferring property and ensure that their wishes are honored after their passing.

Misconceptions

Understanding the Texas Transfer-on-Death Deed (TODD) can help individuals plan for the future and manage their estates effectively. However, several misconceptions surround this legal tool. Here are nine common misunderstandings:

-

It automatically transfers property upon death.

The TODD does not transfer property immediately. The transfer occurs only after the property owner's death, and the deed must be recorded before that time.

-

It replaces a will.

A TODD does not replace a will. It is a separate document that only addresses specific real estate, while a will covers all assets and personal wishes.

-

All property types can be transferred using a TODD.

Not all properties qualify. A TODD can only be used for real estate and cannot be applied to personal property like vehicles or bank accounts.

-

There are no requirements for a TODD.

A TODD must meet specific legal requirements to be valid, including being signed and notarized. Failure to comply with these requirements can invalidate the deed.

-

It eliminates the need for probate.

While a TODD can simplify the transfer of real estate, it does not eliminate the need for probate for other assets or in cases where the estate is contested.

-

Beneficiaries cannot be changed.

Beneficiaries can be changed at any time before the property owner's death. A new TODD must be executed and recorded to reflect any changes.

-

It is only for individuals with large estates.

A TODD can be beneficial for anyone who owns real estate, regardless of the size of their estate. It provides a straightforward way to transfer property.

-

All heirs will automatically receive equal shares.

The property is transferred according to the terms specified in the TODD. If no specific shares are designated, the distribution may not be equal.

-

Using a TODD is always the best option.

A TODD may not be suitable for everyone. Individual circumstances vary, and it is essential to consider all estate planning options and consult with a professional.

By clarifying these misconceptions, individuals can make informed decisions regarding their estate planning and the use of Transfer-on-Death Deeds in Texas.

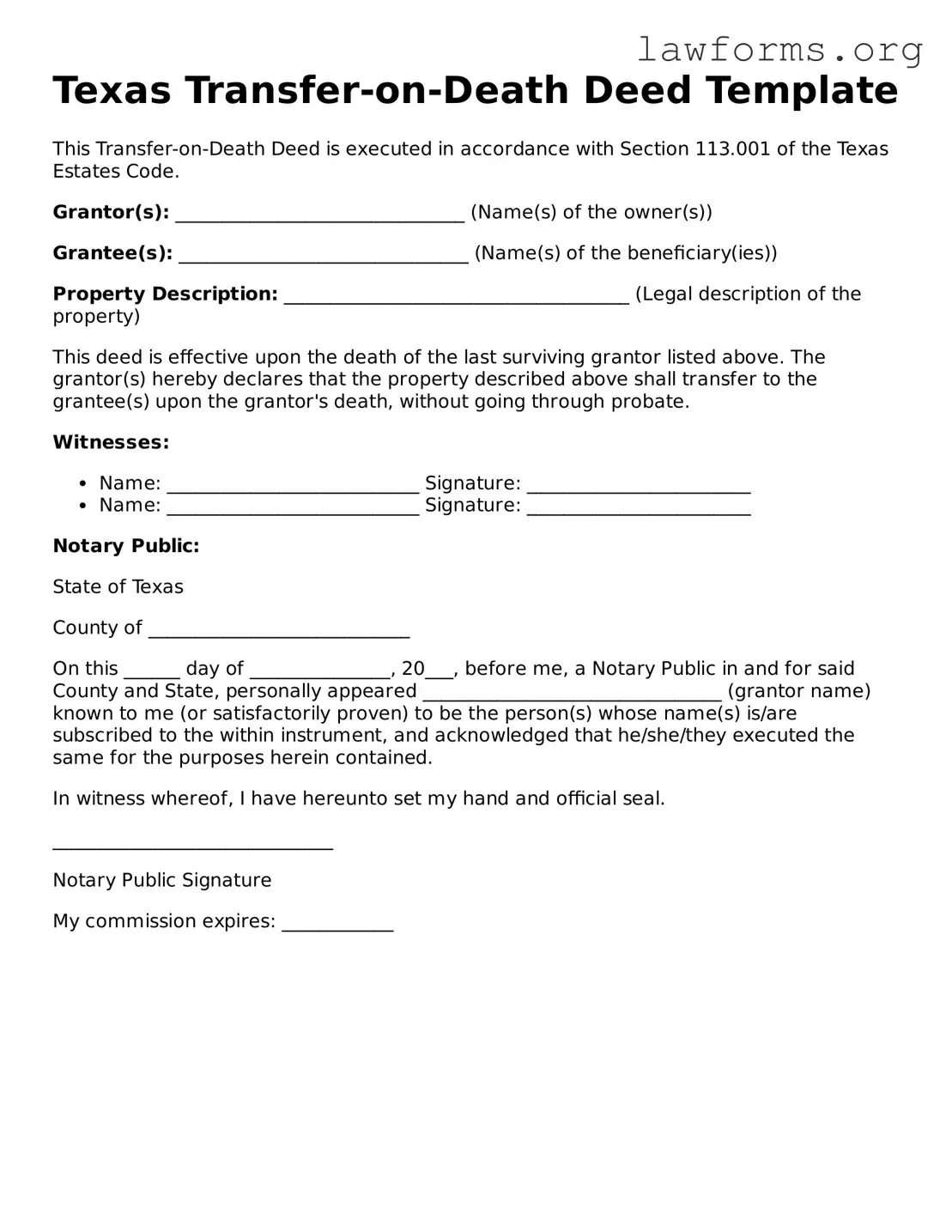

Preview - Texas Transfer-on-Death Deed Form

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Section 113.001 of the Texas Estates Code.

Grantor(s): _______________________________ (Name(s) of the owner(s))

Grantee(s): _______________________________ (Name(s) of the beneficiary(ies))

Property Description: _____________________________________ (Legal description of the property)

This deed is effective upon the death of the last surviving grantor listed above. The grantor(s) hereby declares that the property described above shall transfer to the grantee(s) upon the grantor's death, without going through probate.

Witnesses:

- Name: ___________________________ Signature: ________________________

- Name: ___________________________ Signature: ________________________

Notary Public:

State of Texas

County of ____________________________

On this ______ day of _______________, 20___, before me, a Notary Public in and for said County and State, personally appeared ________________________________ (grantor name) known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes herein contained.

In witness whereof, I have hereunto set my hand and official seal.

______________________________

Notary Public Signature

My commission expires: ____________

Key takeaways

When considering a Texas Transfer-on-Death Deed, it's essential to understand its purpose and implications. Here are some key takeaways to keep in mind:

- Definition: A Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit their property automatically upon their death, avoiding probate.

- Eligibility: This deed can be used for various types of real estate, including single-family homes and vacant land, but not for properties with a mortgage that is not assumable.

- Form Requirements: The deed must be in writing, signed by the property owner, and should clearly identify the property and the beneficiaries.

- Recording: To be effective, the deed must be recorded in the county where the property is located before the owner’s death.

- Revocation: The property owner retains the right to revoke or change the deed at any time before their death, providing flexibility in estate planning.

- Beneficiary Designation: It’s crucial to clearly list the beneficiaries. If no beneficiaries are named, the property may revert to the owner's estate.

- Tax Implications: Beneficiaries may face tax responsibilities upon inheriting the property, so it’s wise to consult a tax professional.

- Legal Advice: While the form is straightforward, seeking legal advice can help ensure that the deed meets all legal requirements and aligns with the owner’s overall estate plan.

Understanding these key points can make the process of using a Transfer-on-Death Deed smoother and more effective for property owners in Texas.

Similar forms

- Last Will and Testament: Like a Transfer-on-Death Deed, a Last Will specifies how a person's assets should be distributed after their death. However, a will goes through probate, while a Transfer-on-Death Deed allows for direct transfer without probate.

- Living Trust: A Living Trust holds assets during a person's lifetime and specifies their distribution after death. Both documents avoid probate, but a Living Trust may require more management during the grantor's life.

- Beneficiary Designation: Similar to a Transfer-on-Death Deed, beneficiary designations on accounts (like life insurance or retirement accounts) allow assets to pass directly to a named person upon death, bypassing probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows property to pass directly to the surviving owner upon death. Like a Transfer-on-Death Deed, it avoids probate but can create complications if one owner wishes to sell.

- Notary Acknowledgement: To ensure the authenticity of signatures, review the essential Notary Acknowledgement document guidelines for a smooth verification process.

- Payable-on-Death (POD) Accounts: These accounts allow the account holder to designate a beneficiary who will receive the funds upon their death. Similar to a Transfer-on-Death Deed, POD accounts avoid the probate process.

- Life Estate Deed: A Life Estate Deed allows a person to live in a property for their lifetime while designating a remainder beneficiary to receive the property after their death. Both documents facilitate a transfer of property outside of probate.