Valid Transfer-on-Death Deed Form

State-specific Transfer-on-Death Deed Documents

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows property owners to designate beneficiaries who will receive the property upon the owner's death, avoiding probate. |

| Governing Law | In the United States, the laws governing Transfer-on-Death Deeds vary by state. For example, in California, it is governed by California Probate Code Section 5600. |

| Revocation | The deed can be revoked or modified at any time before the owner’s death, ensuring flexibility in estate planning. |

| Limitations | Not all types of property are eligible for a Transfer-on-Death Deed. For instance, some states restrict it to residential real estate only. |

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it is crucial to follow specific guidelines to ensure the document is valid and effective. Here is a list of things you should and shouldn't do:

- Do ensure that you are eligible to create a Transfer-on-Death Deed.

- Do clearly identify the property being transferred.

- Do include the names and details of the beneficiaries.

- Do sign the deed in the presence of a notary public.

- Don't use vague language when describing the property.

- Don't forget to record the deed with the appropriate county office.

- Don't leave out the date of signing.

- Don't assume that verbal agreements will suffice; written documentation is essential.

Create Popular Types of Transfer-on-Death Deed Documents

Deed in Lieu of Foreclosure Meaning - Understanding state-specific laws and lender requirements is crucial in this process.

New Jersey Quitclaim Deed Form - A formal method to transfer rights without a sale transaction.

A Washington Cease and Desist Letter form is a legal document used to formally request that an individual or organization stop certain actions that are believed to be harmful or unlawful. For those seeking guidance on this process, resources such as Forms Washington can provide valuable templates and information. This letter serves as a warning and can help resolve disputes without resorting to litigation. Understanding how to properly utilize this form is essential for protecting one's rights and interests.

Free Lady Bird Deed Form - The Lady Bird Deed is named after former First Lady Lady Bird Johnson, reflecting its unique approach to property transfer.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. It's essential to include the correct legal description, which can usually be found on the property deed. A vague description may lead to confusion or disputes later on.

-

Not Naming Beneficiaries: Some individuals forget to name beneficiaries or list them incorrectly. It's crucial to specify who will receive the property upon the owner's death. Omitting this information can result in the property being distributed according to state laws, which may not align with the owner's wishes.

-

Failure to Sign and Date: A Transfer-on-Death Deed must be signed and dated by the property owner. Neglecting this step renders the deed invalid. Always ensure that the deed is signed in the presence of a notary, if required by state law.

-

Not Recording the Deed: After completing the deed, some people forget to record it with the appropriate local government office. Recording the deed is essential to make the transfer official and to protect the beneficiaries' rights. Without recording, the deed may not be recognized after the owner's death.

-

Ignoring State Laws: Each state has specific laws governing Transfer-on-Death Deeds. Failing to understand these laws can lead to mistakes in the deed's execution or validity. It's important to research state-specific requirements to ensure compliance.

-

Not Updating the Deed: Life changes, such as marriage, divorce, or the death of a beneficiary, can affect the validity of the deed. Some people neglect to update their Transfer-on-Death Deed after such events. Regularly reviewing and updating the deed is essential to reflect current intentions.

Documents used along the form

A Transfer-on-Death Deed (TOD Deed) allows property owners to designate beneficiaries who will receive the property upon the owner's death, without the need for probate. This deed is a straightforward way to transfer ownership while retaining control during the owner's lifetime. Several other documents may be used in conjunction with the TOD Deed to ensure a smooth transfer process and to clarify the intentions of the property owner. Below is a list of related forms and documents.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can include specific bequests and appoint an executor to manage the estate.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. This can help avoid probate and provide for the management of assets if the individual becomes incapacitated.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance policies or retirement accounts to specify who will receive the benefits upon the account holder's death. They are crucial for ensuring that assets pass directly to the intended beneficiaries.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal or financial matters. It can be useful if the property owner becomes incapacitated and needs someone to manage their affairs.

- California LLC-1 Form: To officially establish a Limited Liability Company (LLC) in California, it is essential to file the californiadocsonline.com/california-llc-1-form, which serves as a submission cover sheet and facilitates the processing of your Articles of Organization.

- Property Title Documents: These documents establish ownership of the property and may need to be updated to reflect the transfer outlined in the TOD Deed. They serve as proof of ownership and are essential for any future transactions involving the property.

Understanding these documents and their roles can help property owners make informed decisions regarding their estate planning. Each document serves a specific purpose and can work together to facilitate a seamless transition of assets to beneficiaries.

Misconceptions

Transfer-on-Death Deeds (TOD Deeds) are a useful estate planning tool, but several misconceptions can lead to confusion. Understanding these misconceptions is crucial for effective planning.

- Misconception 1: A Transfer-on-Death Deed avoids probate entirely.

- Misconception 2: The property can be sold by the beneficiary before the owner's death.

- Misconception 3: A Transfer-on-Death Deed is the same as a will.

- Misconception 4: A Transfer-on-Death Deed can be easily revoked without formalities.

This is partially true. While a TOD Deed allows the property to pass directly to the named beneficiary upon the owner's death, it does not eliminate the need for probate for other assets or if there are disputes regarding the deed.

This is incorrect. The beneficiary named in a TOD Deed does not have any rights to the property until the owner's death. The owner retains full control over the property during their lifetime.

This is misleading. A TOD Deed specifically transfers real estate directly to a beneficiary upon death, while a will distributes all assets, including personal property, and requires probate.

While a TOD Deed can be revoked, it must be done following specific legal procedures. This typically involves executing a new deed or a formal revocation document, ensuring that the original deed is properly canceled.

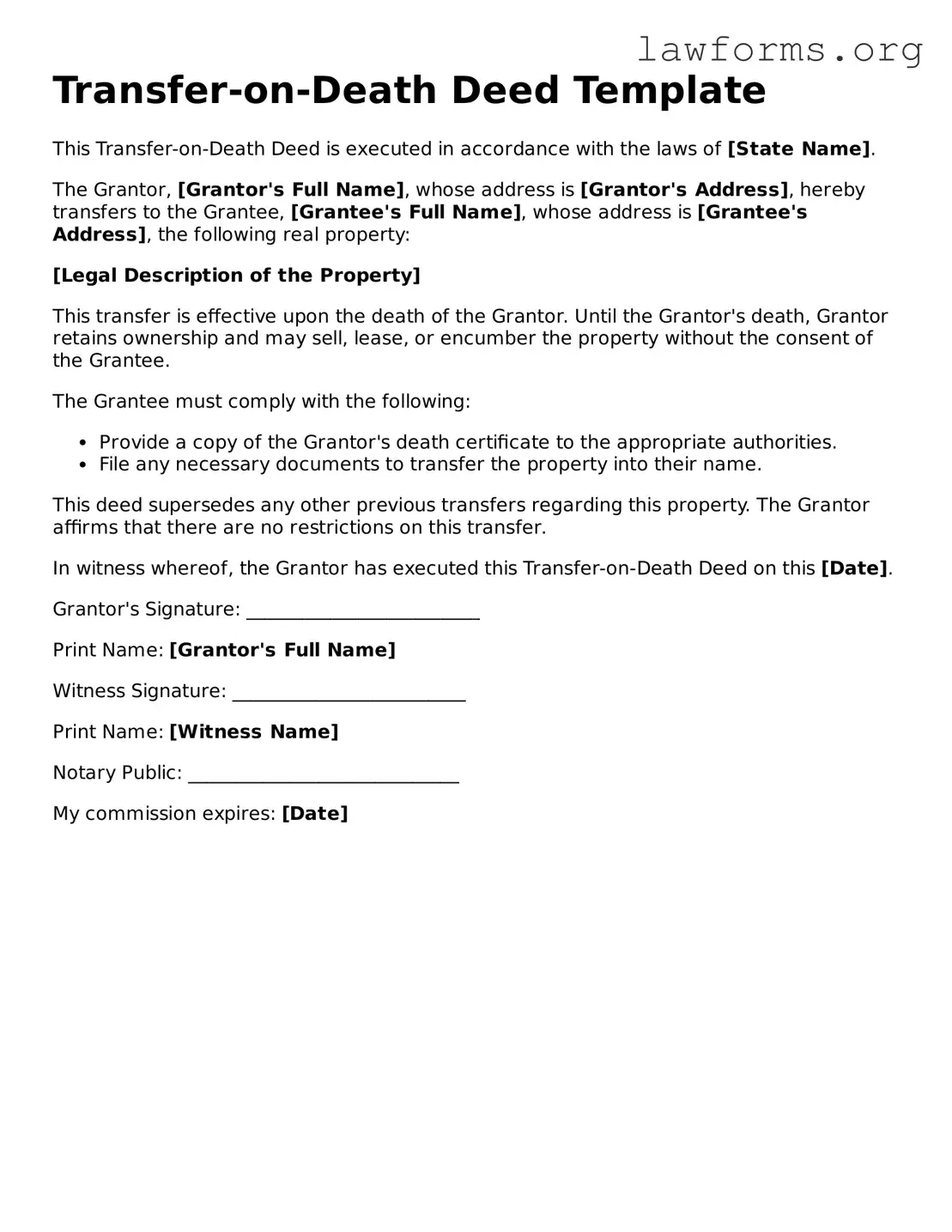

Preview - Transfer-on-Death Deed Form

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of [State Name].

The Grantor, [Grantor's Full Name], whose address is [Grantor's Address], hereby transfers to the Grantee, [Grantee's Full Name], whose address is [Grantee's Address], the following real property:

[Legal Description of the Property]

This transfer is effective upon the death of the Grantor. Until the Grantor's death, Grantor retains ownership and may sell, lease, or encumber the property without the consent of the Grantee.

The Grantee must comply with the following:

- Provide a copy of the Grantor's death certificate to the appropriate authorities.

- File any necessary documents to transfer the property into their name.

This deed supersedes any other previous transfers regarding this property. The Grantor affirms that there are no restrictions on this transfer.

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on this [Date].

Grantor's Signature: _________________________

Print Name: [Grantor's Full Name]

Witness Signature: _________________________

Print Name: [Witness Name]

Notary Public: _____________________________

My commission expires: [Date]

Key takeaways

When considering a Transfer-on-Death (TOD) Deed, there are several important points to keep in mind. This type of deed allows property owners to pass their real estate directly to beneficiaries without going through probate. Below are key takeaways regarding the form and its use.

- Understand the Purpose: A Transfer-on-Death Deed is designed to allow the transfer of real estate to designated beneficiaries upon the owner's death, simplifying the process of inheritance.

- Eligibility: Not all properties qualify for a TOD Deed. Generally, it must be real estate, and some states have specific requirements regarding the type of property that can be transferred.

- Filling Out the Form: The form requires accurate information about the property and the beneficiaries. It is crucial to include full legal names and details to avoid confusion later.

- Revocation: A Transfer-on-Death Deed can be revoked at any time before the owner's death. This allows for flexibility if circumstances change, such as a change in beneficiaries or property ownership.

- State Laws Vary: The rules governing Transfer-on-Death Deeds can differ significantly from state to state. It is advisable to consult local laws or seek legal advice to ensure compliance.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries for their property. However, a will must go through probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how those assets are to be managed after death. Similar to a Transfer-on-Death Deed, it allows for the direct transfer of property without going through probate.

- Payable-on-Death (POD) Account: This type of bank account allows the account holder to designate a beneficiary who will receive the funds upon the account holder's death. Like the Transfer-on-Death Deed, it facilitates a direct transfer of assets without the need for probate.

- Do Not Resuscitate Order: For those considering end-of-life care options, the comprehensive Do Not Resuscitate Order guide provides vital insights and access to necessary forms.

- Beneficiary Designation: Certain financial accounts, such as retirement accounts and insurance policies, allow account holders to name beneficiaries. This is similar to a Transfer-on-Death Deed, as both documents ensure that assets pass directly to the designated person upon death.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more people to own property together. When one owner dies, their share automatically passes to the surviving owner(s). This is akin to a Transfer-on-Death Deed in that it avoids probate and ensures a smooth transfer of ownership.