Valid Vehicle Repayment Agreement Form

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves the borrower and the lender, which can be a financial institution or a private party. |

| Loan Amount | The form specifies the total amount borrowed for the vehicle purchase, including any applicable fees. |

| Interest Rate | The agreement includes the interest rate applicable to the loan, which can be fixed or variable. |

| Payment Schedule | A clear payment schedule is outlined, detailing the frequency and amount of each payment. |

| Governing Law | The agreement is governed by state law, which varies by jurisdiction. For example, California’s Vehicle Code may apply. |

| Default Terms | It specifies the conditions under which the borrower is considered in default and the lender's rights in such cases. |

| Signatures Required | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

| Amendments | The form may include provisions for amendments, allowing changes to the agreement with mutual consent. |

| Legal Recourse | In case of disputes, the agreement may outline the legal recourse available to both parties, including mediation or arbitration. |

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is important to approach the process with care. Here are some guidelines to follow:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information.

- Do: Double-check your calculations for any payment amounts.

- Do: Sign and date the form where required.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any required fields blank.

- Don't: Use white-out or erase any mistakes; instead, draw a line through errors and initial them.

Following these steps can help ensure that your Vehicle Repayment Agreement is processed smoothly.

Popular Templates:

Free Direct Deposit Authorization Form - Submitting incorrect routing numbers can lead to lost funds or delays.

Army Da 31 - Personnel and finance must note charges for leave in the designated section.

For those who are navigating the investment landscape, an effective Investment Letter of Intent template can simplify the process of outlining key agreements and intentions. This document is vital for establishing the groundwork for any potential investment discussion, ensuring clarity and alignment between parties.

Bol Meaning Shipping - Clarity in the Bill of Lading helps establish trust between shippers, carriers, and consignees.

Common mistakes

-

Not reading the instructions carefully. Many people skip the instructions, which can lead to mistakes. Each section of the form has specific requirements that must be followed.

-

Providing inaccurate personal information. Double-check names, addresses, and contact details. A simple typo can cause significant delays in processing.

-

Failing to include all required documentation. Missing documents can result in the rejection of your application. Make sure to attach everything listed in the instructions.

-

Not signing the form. It may seem obvious, but forgetting to sign can halt the entire process. Always check for a signature before submitting.

-

Overlooking the repayment terms. Carefully review the repayment schedule and interest rates. Misunderstanding these terms can lead to financial difficulties later on.

-

Using incorrect payment methods. Ensure you know what forms of payment are accepted. Using an unsupported method could delay your agreement.

-

Not keeping copies of submitted documents. Always make copies of everything you send. This can be crucial if there are any disputes or issues later on.

-

Ignoring deadlines. Submitting the form late can result in penalties or denial. Mark important dates on your calendar to stay on track.

-

Failing to follow up. After submitting, check the status of your agreement. It’s important to ensure that everything is being processed as expected.

Documents used along the form

The Vehicle Repayment Agreement form is a crucial document in the context of vehicle financing. It outlines the terms under which a borrower agrees to repay a loan for a vehicle. Alongside this form, several other documents are often utilized to ensure a clear understanding of the financial obligations and the legal rights involved. Below is a list of related forms and documents that complement the Vehicle Repayment Agreement.

- Loan Application Form: This document collects personal and financial information from the borrower. It helps lenders assess the borrower's creditworthiness and ability to repay the loan.

- Credit Report Authorization: Borrowers sign this form to give lenders permission to access their credit history. This report plays a significant role in determining loan eligibility and terms.

- Promissory Note: This is a legal document in which the borrower promises to repay the loan amount. It includes details such as the principal, interest rate, and repayment schedule.

- Title Transfer Document: When a vehicle is financed, the lender often holds the title until the loan is paid off. This document facilitates the transfer of ownership and ensures the lender's interest is protected.

- Motor Vehicle Bill of Sale: This essential document verifies the sale and ownership transfer of the vehicle, ensuring both the buyer and seller have proper protection and can easily register the vehicle with the Department of Licensing. For a template, visit Forms Washington.

- Insurance Verification Form: Lenders typically require proof of insurance before finalizing a loan. This form confirms that the borrower has adequate coverage for the vehicle.

- Payment Schedule: This document outlines the timeline for payments, including due dates and amounts. It helps borrowers stay organized and ensures timely repayments.

- Default Notice: If a borrower misses payments, this document serves as a formal notification of default. It outlines the consequences and potential actions the lender may take.

- Release of Lien: Once the loan is fully paid, this document is issued to the borrower. It confirms that the lender no longer has a financial interest in the vehicle and releases the title back to the borrower.

Understanding these documents is essential for anyone involved in vehicle financing. They provide clarity on the responsibilities and rights of both the borrower and the lender, ensuring a smoother transaction process.

Misconceptions

When it comes to the Vehicle Repayment Agreement form, several misconceptions can lead to confusion. Understanding the truth behind these misunderstandings is essential for anyone involved in a vehicle financing situation.

- Misconception 1: The Vehicle Repayment Agreement is only for those who have defaulted on their loans.

- Misconception 2: Signing the agreement means you are giving up your rights.

- Misconception 3: The form is overly complicated and difficult to understand.

- Misconception 4: You cannot negotiate the terms of the agreement.

- Misconception 5: The agreement is only necessary for traditional loans.

This is not true. The agreement can be utilized by anyone who is financing a vehicle and wants to establish clear terms for repayment, regardless of their current payment status.

In reality, signing the Vehicle Repayment Agreement does not mean you relinquish your rights. It simply outlines the terms of your repayment and protects both parties involved.

While legal documents can seem daunting, the Vehicle Repayment Agreement is designed to be straightforward. It outlines key information in a clear manner, making it accessible for all parties.

This is a common misunderstanding. Terms can often be negotiated to better suit the needs of both the borrower and the lender, fostering a more cooperative relationship.

Many people think this form applies only to traditional financing. However, it can also be relevant for lease agreements or other financing arrangements related to vehicles.

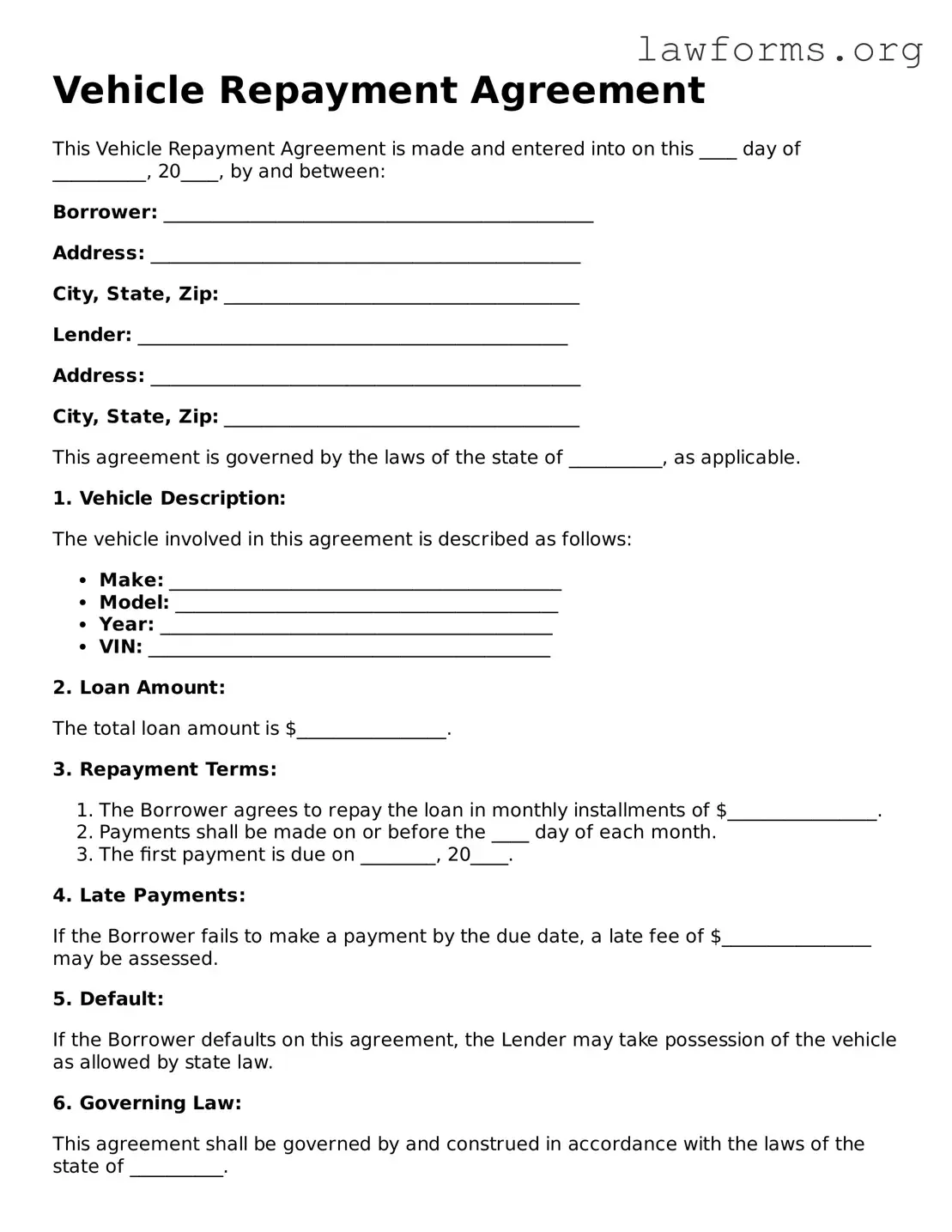

Preview - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made and entered into on this ____ day of __________, 20____, by and between:

Borrower: ______________________________________________

Address: ______________________________________________

City, State, Zip: ______________________________________

Lender: ______________________________________________

Address: ______________________________________________

City, State, Zip: ______________________________________

This agreement is governed by the laws of the state of __________, as applicable.

1. Vehicle Description:

The vehicle involved in this agreement is described as follows:

- Make: __________________________________________

- Model: _________________________________________

- Year: __________________________________________

- VIN: ___________________________________________

2. Loan Amount:

The total loan amount is $________________.

3. Repayment Terms:

- The Borrower agrees to repay the loan in monthly installments of $________________.

- Payments shall be made on or before the ____ day of each month.

- The first payment is due on ________, 20____.

4. Late Payments:

If the Borrower fails to make a payment by the due date, a late fee of $________________ may be assessed.

5. Default:

If the Borrower defaults on this agreement, the Lender may take possession of the vehicle as allowed by state law.

6. Governing Law:

This agreement shall be governed by and construed in accordance with the laws of the state of __________.

7. Signatures:

By signing below, both parties agree to the terms of this Vehicle Repayment Agreement.

Borrower Signature: _____________________________ Date: ______________

Lender Signature: ______________________________ Date: ______________

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, keep these key takeaways in mind:

- Ensure all personal information is accurate. Double-check names, addresses, and contact details.

- Clearly outline the repayment terms. Specify the amount, due dates, and payment methods.

- Include a section for signatures. Both parties must sign to validate the agreement.

- Keep a copy for your records. Documenting the agreement helps in case of future disputes.

- Review the agreement periodically. Adjust terms if circumstances change for either party.

- Consult a professional if needed. If you have questions, getting expert advice can clarify any uncertainties.

Similar forms

The Vehicle Repayment Agreement form is an important document that outlines the terms and conditions under which a borrower agrees to repay a loan for a vehicle. Several other documents share similarities with this form, as they also govern financial agreements and repayment terms. Below are four such documents:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Like the Vehicle Repayment Agreement, it binds both parties to specific obligations and outlines consequences for non-compliance.

- Promissory Note: A promissory note is a written promise to pay a specific amount of money at a certain time. It is similar to the Vehicle Repayment Agreement in that it provides clear terms regarding repayment and can be used as evidence in case of a dispute.

General Bill of Sale: This essential document records the transfer of ownership for personal property, ensuring that both the seller and buyer have a clear understanding of the transaction. For more information, you can refer to legalformspdf.com/.

- Lease Agreement: When leasing a vehicle, a lease agreement sets forth the terms under which the lessee can use the vehicle. This document is akin to the Vehicle Repayment Agreement as both involve payment obligations and conditions for use of the vehicle.

- Retail Installment Sales Contract: This contract is used when purchasing a vehicle on an installment plan. It outlines the sales price, down payment, and payment schedule, much like the Vehicle Repayment Agreement, ensuring both parties understand their financial responsibilities.

Understanding these documents can help borrowers navigate their financial commitments more effectively, ensuring clarity and accountability in their agreements.